Prostock-Studio

Earnings season is a good time to have dry powder on hand, as market reactions to quarterly results can lead to great buying opportunities. This could be due to perceived weaknesses in the near term that causes short-term investors to bail, thereby creating “time arbitrage” opportunities for those with a longer investment horizon.

This brings me to Discover Financial Services (NYSE:DFS), which has seen a material drop in its share price since it released its Q2 results. In this article, I highlight what makes DFS an attractive stock to buy on the drop, so let’s get started.

Why DFS?

Discover Financial Services is a digital banking and payment services company that was founded in 1986. It pioneered credit card cash rewards that are ubiquitous with most credit cards today. Its offerings include its widely used namesake card, and PULSE, which is America’s leading ATM/debit network. In addition, DFS also provides personal and business lines of credit and banking, and is the home of Diners Club International.

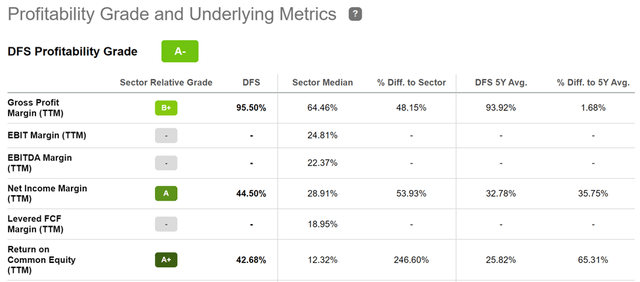

Unlike some banks, such as Bank of America (BAC), that have a credit card business on the side, Discover generates most of its revenue (around 70%) from credit cards. This highly focused approach results in efficiencies for the company, as it’s able to devote its energy and resources towards a more singular focus. This is reflected by Discover’s A- grade for profitability with a sector leading net income margin of 44.5%, sitting well above the 29% sector median.

DFS Profitability (Seeking Alpha)

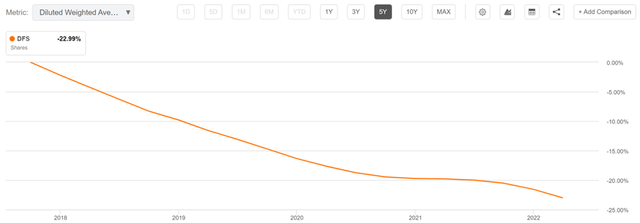

Moreover, DFS generates a stellar 42.7% return on equity, due to its aggressive share repurchases. As shown below, DFS has retired an astounding 23% of its outstanding float over the past 5 years alone.

DFS Shares Outstanding (Seeking Alpha)

DFS recently reported Q2 earnings that topped Wall Street expectations, with EPS of $3.96 compared to $3.77 consensus. Its non-interest income also improved to $614 million, up from $423 million in the prior-year period, and net interest income grew by a respectable 14% YoY to $311 million.

These results were driven by robust growth in total loans, which ended Q2 at $99 billion, a 13% YoY increase and up 6% sequentially. This was led by credit card loan growth of 15% YoY, followed by personal and private student loan growth of 4% and 2%, respectively.

Not all is rosy, however, as the current macroeconomic conditions have resulted in losses rising modestly, while delinquencies are stable, reflecting slower than expected credit normalization. The net charge-off rate of 1.8% is 19 basis points higher compared to last year, and management upped the provision for credit losses to $549 million, up from just $154 million in the prior quarter.

Clearly, DFS is setting aside a substantial amount of capital to buffer against a potential economic downturn. In addition, management just announced a suspension of its share repurchase program due to an internal investigation conducted by a Board appointed independent special committee on student loan servicing matters.

Nonetheless, I don’t see these factors as being a deal breaker for the stock, and the robust loan growth has resulted in a larger credit card receivables base on which it can spread its losses. Plus, Discover continues to differentiate itself from the pack with award-winning customer service that generates customer loyalty. This was highlighted by management during the recent conference call:

In our Digital Banking segment, our combination of industry-leading customer service and compelling products continues to differentiate us in the marketplace. We were recently awarded the highest ranking in customer satisfaction by J.D. Power among mobile, credit card apps, and websites.

We also achieved J.D. Power’s top customer satisfaction and checking accounts for direct retail banks. This recognition underscores our customer service model, which combined with our compelling Cashback rewards and no fee products, create a value proposition that we believe others will struggle to match.

For this reason, we’re confident that we are well-positioned to generate substantial growth and shareholder value over the long-term. Notwithstanding our strong performance, we continue to closely monitor today’s evolving economic environment.

Meanwhile, DFS maintains a BBB- investment grade rated balance sheet, and pays a 2.4% dividend yield that comes with a very low 15% payout ratio (based on Q2 EPS of $3.96). The dividend also comes with a respectable 5-year CAGR of 11.8%.

I see value in the stock at $100 with a forward P/E of just 6.8, sitting well below its normal P/E of 10.9 over the past decade. Sell side analysts have a consensus Buy rating on the stock with an average price target of $128.58, implying a potential one-year 31% total return including dividends.

Investor Takeaway

With shares of Discover Financial Services down significantly after its Q2 earnings release, I believe the stock presents an attractive entry point for long-term investors. The company is a well-oiled operation that continues to generate solid loan growth with industry-leading customer service. While there is some uncertainty surrounding its near-term outlook, I believe the stock is a bargain at current levels for long-term investors.

Be the first to comment