Black_Kira

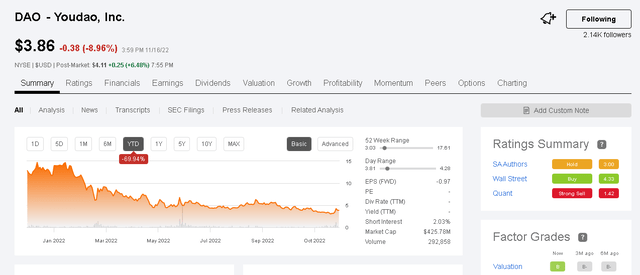

I am a loyalist of the parent company of Youdao (NYSE:DAO). I am endorsing DAO as a buy for growth investors. This contradicts the “strong sell” rating of Seeking Alpha Quant AI for Youdao. This company reported its Q3 2022 ER earlier today. It is a big beat that might boost the stock later. The Q3 Non-GAAP EPADS of $0.19 beats estimates by $0.43.

Q3 Non-GAAP EPADS of $0.19 beats by $0.43. The revenue of $197.25 million beats by $9.75 million and is +35% YoY. This impressive third-quarter performance might help DAO recover from yesterday’s -9% performance.

Seeking Alpha.com

Youdao has been beating EPS estimates. It deserves to be covered more often here at Seeking Alpha. My buy thesis for DAO is due to its –69.94% YTD gain. The stock price is now less than $4, significantly lower than its 52-week high of $17.61. DAO is a money losing but affordable growth stock.

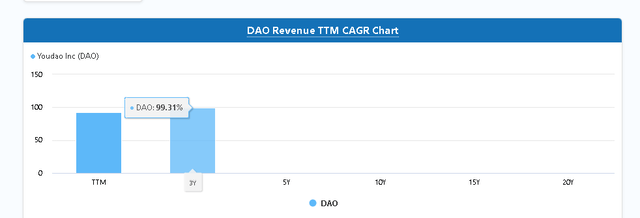

NetEase (NTES) did the Youdao IPO only in 2019. DAO’s 3-year revenue average CAGR is greater than 90%. I opine that any company that books a revenue CAGR greater than 18% is already a decent growth stock.

Financecharts.com

Growth Story Has More Chapters

Youdao has a solid tailwind from China’s 257.3 billion yuan ($36.3 billion) online education industry. This niche business is growing at 17.5% CAGR. The zero-COVID policy of China is still in effect. Youdao will experience slower growth as restrictions ease.

I opine Youdao can still achieve a 20% or higher sales CAGR. Youdao made it clear that it has global expansion plans. Aside from the top-line boost, the $200 billion global online education business might accelerate DAO’s climb to profitability.

Youdao will only get stronger. As a parent, I concluded two years ago that online learning is the safer way to educate my only child. The Philippines has enforced face-to-face classes, but the government isn’t banning online learning for private schools. The point is that online education is here to stay.

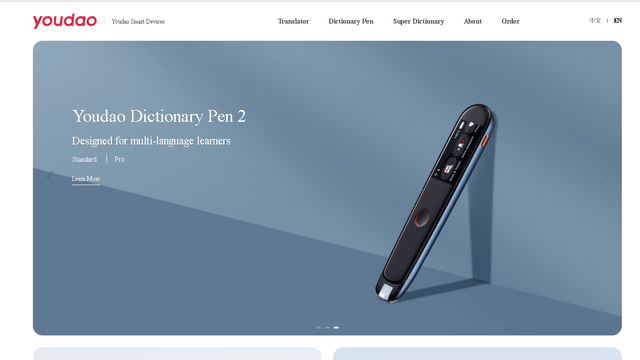

The other growth driver for DAO would be its smart devices. These products are useful for kids and adults. I want the AI-powered Youdao Translator when I go back to Europe. My buy thesis for DAO is largely due to its AI products, like the Smart Learning Pad X10. Youdao is not only an online education/marketing company. It is an AI hardware vendor.

Youdao.com

Go long on Youdao. It has a tailwind from the fast-growing $422.37 billion global AI market. This particular industry is growing at 39.4% CAGR. Youdao is an AI company serving 120 million active monthly users. There are now 8 billion people on the planet who could potentially use Youdao smart devices.

I want a Youdao AI laptop that can self-learn my articles here at Seeking Alpha. After machine learning my 844 SA articles, the Youdao laptop should be able to autonomously write investing ideas that can get Editor’s Pick badges from SA editors.

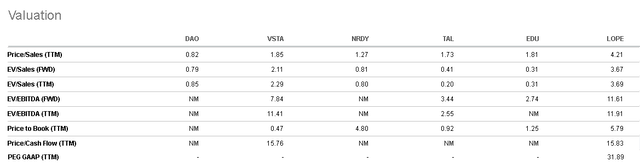

Massive Price Decline Made DAO Relatively Undervalued

Compared to its education sector peers, DAO’s TTM price/sales valuation of 0.82x is much lower than Tal Education’s (TA) 1.73x. Refer to the chart below to understand why DAO is relatively undervalued. Seeking Alpha Quant AI has many NM (no meaningful) ratios for DAO. The AI has difficulty sourcing out important numbers for DAO.

Seeking Alpha

We can blame this relative undervaluation and large price decline on a universal fear of Youdao’s worsening net losses. This is the downside risk of Youdao. Persistent losses could panic shareholders/traders. A disappointing Q3 EPS and/or revenue figure could further scare investors.

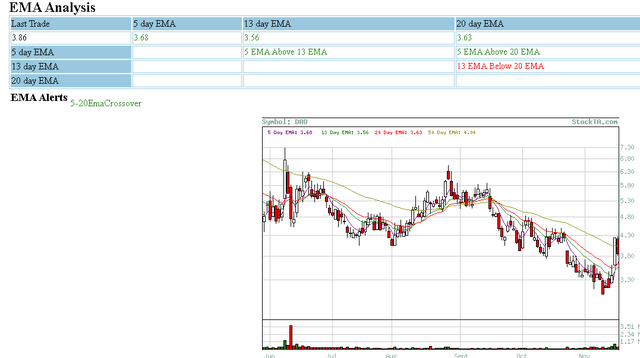

Fear is just another market emotion that can quickly change. The near-term Exponential Moving Average indicator is now bullish on DAO. The 5-20 EMA Crossover alert is a short-term bullish trade signal.

StockTa.com

My Verdict

DAO is a buy because its Q3 numbers showed it can be profitable while posting YoY revenue growth greater than 35%. A post-ER bull run could happen because DAO is really undervalued. The management should put more emphasis on the AI hardware/software solutions that Youdao offers.

Less emphasis should be put on its online education segment. The global AI market is growing faster than China’s online education market: 39.4% CAGR vs. 17.5% CAGR. Optimistic guidance for Q4 and F2022 is also highly desirable.

Youdao is a legit growth stock. DAO has a little-discussed but massive catalyst in the 39.4% CAGR of the $422.37 global AI industry.

Everything in this thesis is just my opinion. Exercise your own critical thinking. I made it clear that my buy rating is the kryptonite of the strong sell warning of Seeking Alpha Quant AI. Place your bets at your own peril.

Be the first to comment