mikdam

This article was co-produced with Cappuccino Finance.

The sentiment toward tobacco companies has been bad for a couple of decades. Lawsuits and heavy government regulation have just killed interest in the companies. The general public perception of the tobacco industry is that it’s declining or already dead.

But that is not actually true.

People continue to smoke and use tobacco products, and the market just keeps steadily growing.

In fact, the heavy government regulation and lack of enthusiasm toward the industry has served the existing companies quite well. It has built a wide economic around the current tobacco giants like Philip Morris International Inc. (PM), British American Tobacco p.l.c. (BTI), and Altria Group, Inc. (MO).

There simply are no young aspiring entrepreneurs that want to enter the industry and become the next tobacco mogul.

The result – companies like Philip Morris, British American Tobacco, and Altria make tons of money and pay a healthy dividend to their shareholders. Investors who love a stable dividend income should consider these tobacco giants.

Philip Morris International

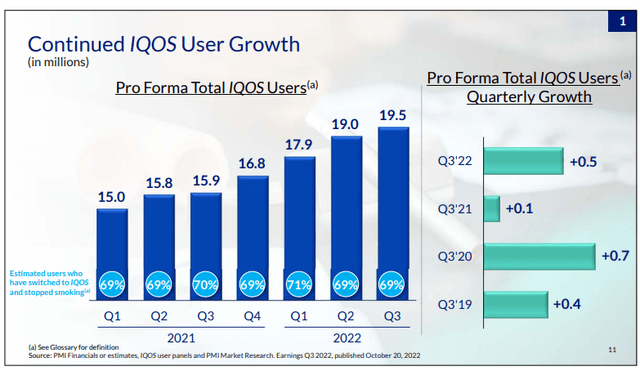

Philip Morris International is a leading international tobacco company, and their portfolio consists of cigarettes, reduced-risk products (e.g., heat-not-burn), vapor and nicotine products. Since 2008, they have invested more than $9 B to develop safer and more innovative smoke-free products for adults.

Their products are sold in approximately 180 different markets around the world, and have a prominent number one or two place in the market.

Recently, Philip Morris and Altria agreed to a deal in which Altria will receive cash payments of $2.7 B in exchange for assigning exclusive U.S. commercialization rights to the IQOS Tobacco Heating System effective April of 2024. Philip Morris has ambitious plans to maximize profit through a full-scale launch and rapid expansion of IQOS in the U.S. market.

PM Investor Relations

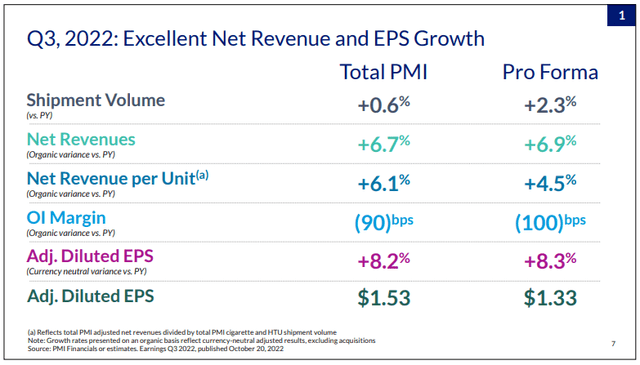

Philip Morris’ profitability is outstanding, demonstrating their competitive advantage and strong operations. The gross profit margin, EBIT margin, and net income margin are at 65.95%, 39.43%, and 27.57%, respectively, and these numbers are substantially higher than the sector medians.

PM Investor Relations

Not surprisingly, they generate strong operating cash flow. They generated more than $11.7 B of operating cash flow in the past twelve months.

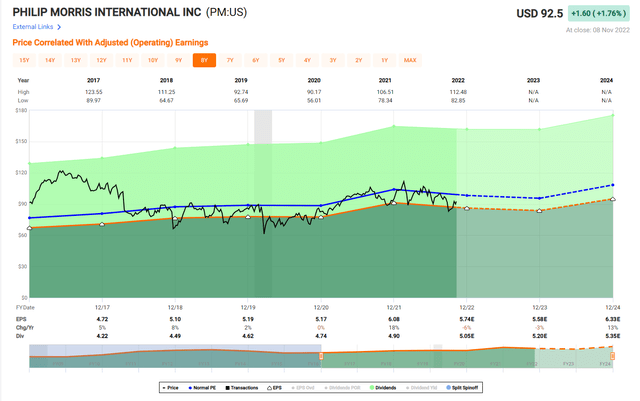

And as the cash comes flowing in and the business keeps growing, they have been raising their dividend consistently. The dividend growth rate in the past 10 years has been 4.74% per year. Their dividend payout is safe at this point, with the payout ratio at 72.66%. Their dividend may be the lowest of these three companies, but is still a generous 5.5% dividend yield.

Right now, their stock price is slightly undervalued compared to their historical average. The current P/E ratio of 16.01x and EV/EBITDA of 11.91x are about 10% lower than the historical average, making this a good time to pick up some shares.

FAST Graphs

British American Tobacco

British American Tobacco is a global tobacco and nicotine product company. They offer combustible, vapor, tobacco heating, and modern oral nicotine products. British American Tobacco owns many well-known brands such as Kent, Dunhill, Lucky Strike, Pall Mall, and Camel.

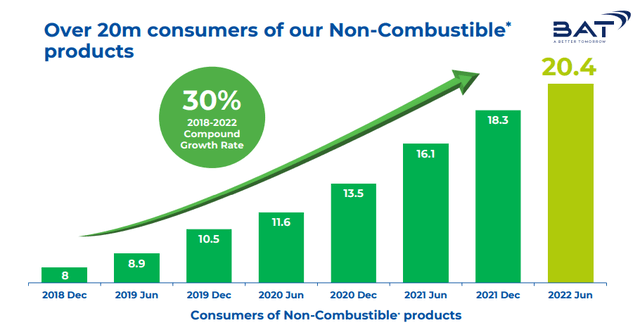

Recently, they have been focusing their resources on developing and marketing new product lines like glo, VUSE, and VELO, and these new products are performing very well. The revenues from VUSE, glo, and VELO increased more than 35% compared to last year, and volumes also rose substantially.

These products have captured a substantial market share, which are 34.7% for VUSE, 19.6% for glo, and 31.4% for VELO in the last quarter. Additionally, for H1 2022, new category revenue growth for Europe, APME, AMSSA, and USA regions were 49.8%, 15.9%, 71.5%, and 59.2%, respectively.

BTI Investor Relations

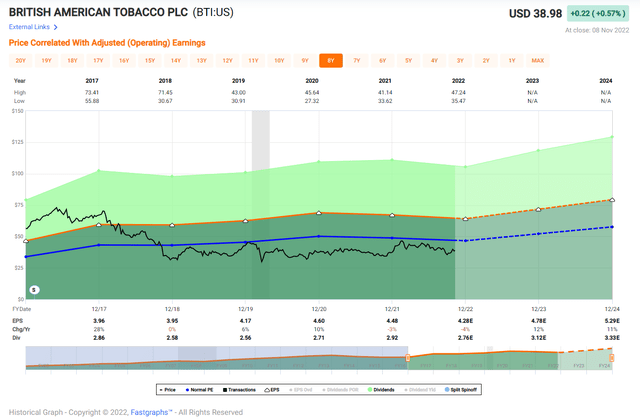

The valuation metrics show that British American Tobacco is undervalued at this point. The P/E ratio of 8.88x and EV/EBITDA of 9.14x are very favorable. These values are lower than the 5-year average of British American Tobacco, and also below sector medians.

The profitability of British American Tobacco is amazing. Their gross profit margin, EBIT margin, and net income margin are 82.47%, 41.35%, and 20.51%, respectively.

Their ability to generate operating cash flow is great as well. The operating cash flow for the past several years has been $13.1 B (2018), $11.9 B (2019), $13.4 B (2020), $13.1 B (2021), and $13.0 (TTM). Given their new product line’s growth, I expect the trend will continue well into the future.

Currently, British American Tobacco is paying a juicy dividend with a yield of 7.3%. Their dividend is safe at this point. The cash dividend payout ratio is at 48.5%, which shows the substantial cushion that exists between the cash flow and the dividend payout.

FAST Graphs

Altria

Altria is a leading tobacco company, and their vision (Altria’s Vision by 2030) is to responsibly lead the transition of adult smokers to less harmful tobacco products. Altria’s wholly owned subsidiaries include Philip Morris USA, John Middleton Co., UST, Smokeless Tobacco Company, and Helix Innovations.

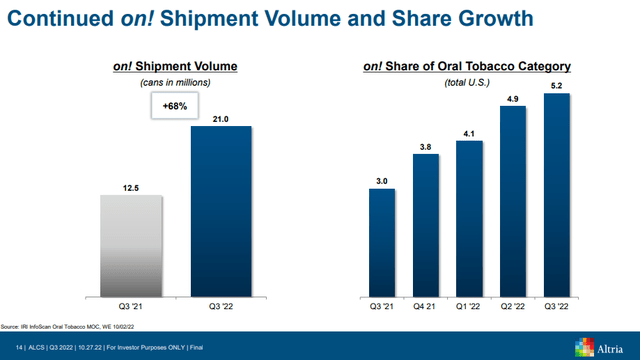

Adhering to their vision statement, Altria has been busy expanding their product lines, either by organically developing or acquiring new companies. Their smoke-free platforms (oral tobacco – smokeless, oral tobacco- nicotine pouches, E-vapor, and heated tobacco products) have been performing very well in the market. I expect the growth of smoke-free platforms to continue well into the future.

MO Investor Relations

Altria had a very good quarter, and the first nine months of 2020 has been strong. They returned a total of $6.4 B of cash to shareholders ($1.5 B via share repurchases and $4.9 B via dividend). Management is expecting to deliver EPS in a range of $4.81 to $4.89 for full year of 2022, which represents a growth rate of 4.5% to 6% from 2021.

The cash generating ability of Altria has been great. Operating cash flow has been $7.8 B, $8.4 B, $8.4 B, and $8.3 B in 2019, 2020, 2021, and the past twelve months. This strong cash flow allows them to invest in new products and reward shareholders with dividends or buybacks.

With their solid economic moat, I expect their profitability to remain strong in the future, and their cash generation to stay robust as well.

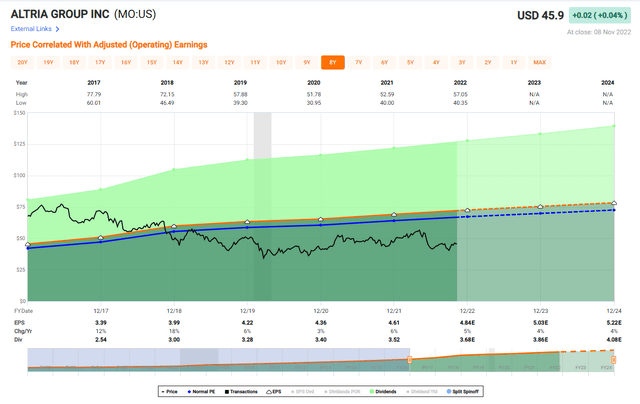

Altria’s dividend growth has been strong in the past 10 years. The current dividend yield is 8.2%, and the dividend growth rate over the past 10 years has been 8.1%. Their dividend is safe and well covered, shown by the cash dividend payout ratio of 81.2%.

Altria’s valuation is very favorable at this point. The P/E ratio (FWD) of 13.17x and EV/ EBITDA (FWD) of 8.44x are lower than sector median and their historical average.

I believe Altria is undervalued at this point. Given their strong economic moat and cash generating ability, I believe their stock price will appreciate in the long run and find the right value.

Fast Graphs

Risks…

As inflation persists and the Federal Reserve maintains a high interest rate, many people are expecting a recession to come soon. Even though the consumption of tobacco will likely be robust compared to other goods, a recession will still have a negative impact on the sales of tobacco products. Tobacco is more of a recession-resistant habit, but not a completely recession-proof good.

The tobacco industry also has large exposure to changes in government regulations. New taxes or regulations can have a large impact on the sales of Philip Morris, British American Tobacco, and Altria, and these companies don’t have too much leverage against government regulation changes.

Negative perception of the public and pressure from healthcare related entities could have a large impact on the future growth of their businesses.

Conclusion

Highly publicized lawsuits and healthcare related pressure has created a lot of negative sentiment around investing in tobacco companies.

Despite this, the sales of tobacco related products have remained robust, and the tobacco giants like Philip Morris, British American Tobacco, and Altria are generating tons of cash.

The shareholders of the companies have been enjoying eye-catching dividends. I expect that will be the case in the foreseeable future. I believe tobacco is here to stay.

While a recession may challenge sales in the short term, their strong cash generating ability and economic moat will allow them to weather the tougher times. It is just hard to give up certain habits. With the transition to smoke-less and less harmful products, I believe these tobacco companies to continue their profitable track record well into the future.

And right now, all three companies are trading below their historical averages, making it a great time to take a closer look at them.

Be the first to comment