Bet_Noire

Introduction

It’s time to take a deep dive into the oil industry and the many (related) problems facing consumers all over the world. Oil and gas supply has been the cornerstone of my macro research since 2020, and it’s the reason why I have close to 19% of my entire net worth in oil and gas stocks. In this article, I will do two things. First, I will guide you through my thoughts on oil and gas supply using the fundamental issues facing the industry as well as new developments that honestly worry me (meaning bullish inflation). Then, I will explain the bull case for Exxon Mobil (NYSE:XOM), which is my second-largest investment for a reason. The company offers a steady and high dividend and a future-proof business model, and I believe there’s a lot of upside for shareholder distributions.

So, let’s get to it!

Supply Is A Total And Utter Mess

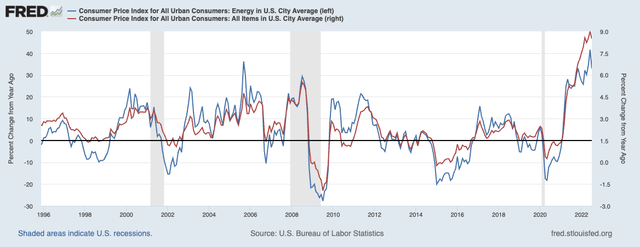

Energy and agriculture are two related subjects that I’ve covered intensely since the end of the COVID 2020 lockdowns. They are also the only subjects where I combine words like “worried”, “bad news”, and “bullish” as good news for energy is currently bad news for the (global) consumer, given the impact of high energy prices on inflation.

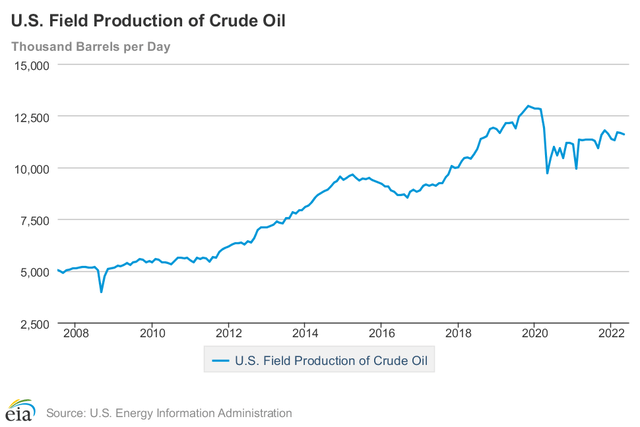

Essentially, what we are dealing with here is a mix of factors that have caused oil production to remain low. If we go back to the start of the US shale revolution, we see that the post-pandemic period is the first period where oil companies refrain from boosting production. US field production of crude oil is roughly 1.2 million barrels per day below the 2020 highs.

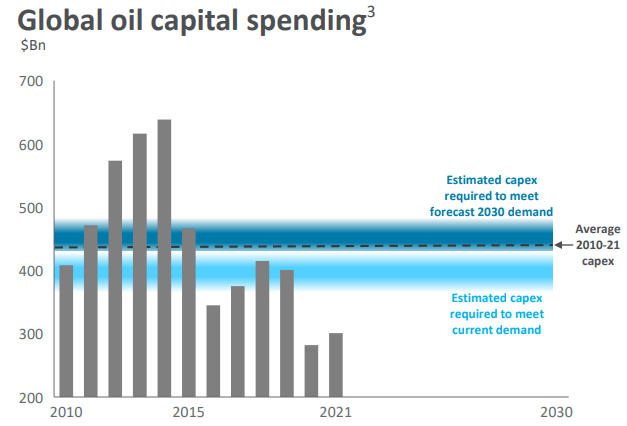

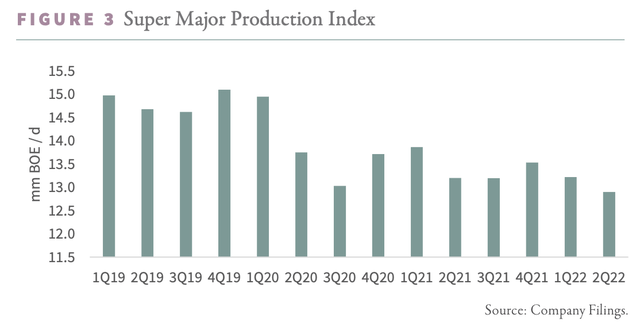

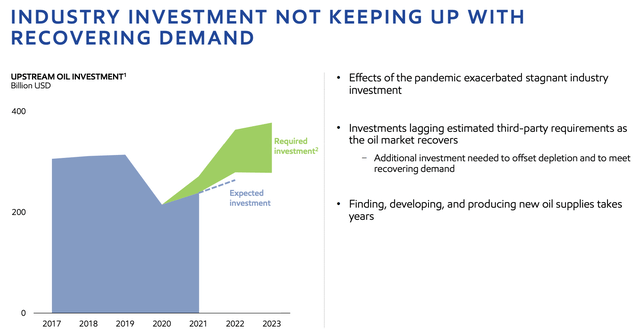

This has obviously to do with spending on production, which has come down significantly since the shale peak of 2014. Back then, global oil capital spending (“CapEx”) was roughly $640 billion. In early 2021, it was less than half that number.

Seeking Alpha

Using more recent data, focused on the largest oil companies (super majors), we see that nothing has changed. If anything, CapEx plans have gone down in 2Q22 – to the lowest levels since 3Q20.

Exxon Mobil believes that this will remain a big problem:

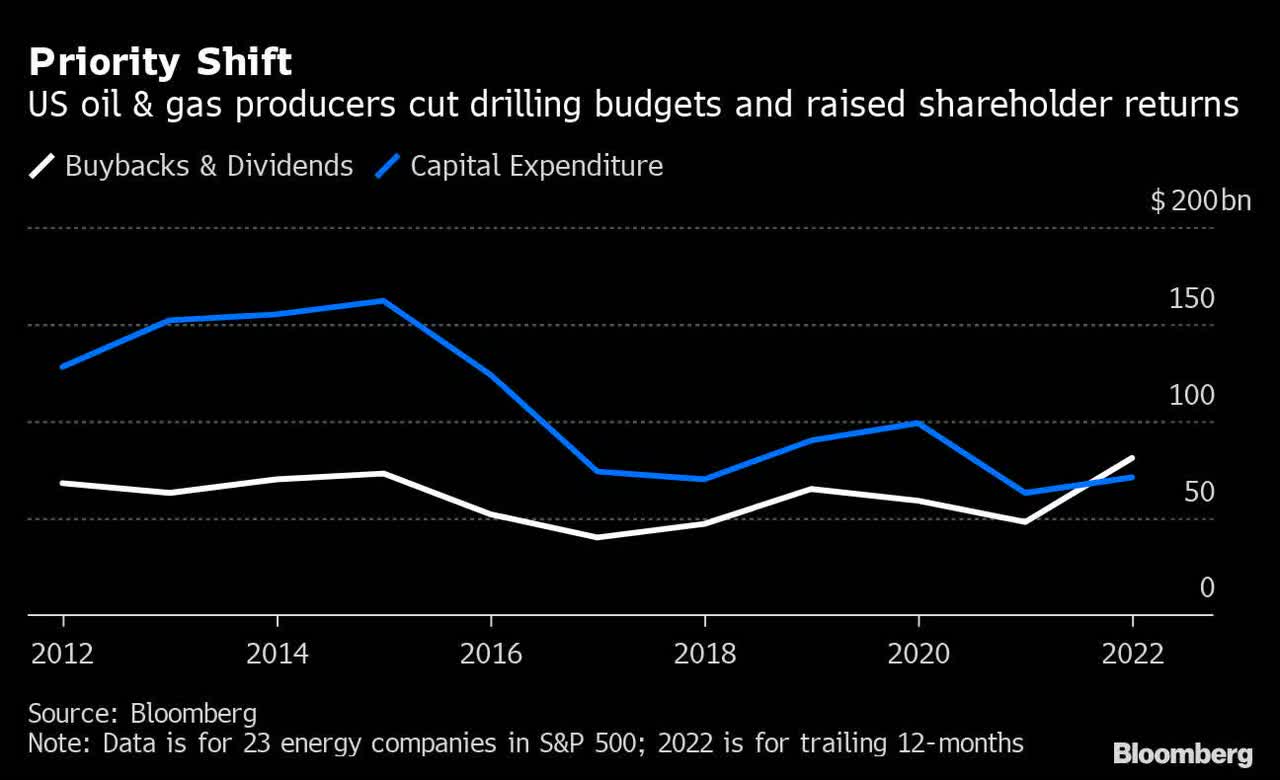

Going into this year, oil and gas shareholder distributions were higher than CapEx, which is truly remarkable.

Bloomberg

There are multiple reasons for this, and I believe that the most important reasons are politically motivated. For example, the push for renewables that follows Paris Climate Agreement guidelines (net zero in 2050) is adopted in almost all western countries, leading to stricter investment guidelines and the overall view that oil and gas companies are the “bad guys”.

One thing I like to incorporate in most of my articles is a July interview with Biden’s personal advisor Brian Deese, who was asked by CNN (as reported by the New York Post) what he thinks of sky-high gas inflation:

“What do you say to those families who say, ‘Listen, we can’t afford to pay $4.85 a gallon for months, if not years. This is just not sustainable?”

He answered:

“What you heard from the president today was a clear articulation of the stakes,” Deese answered. “This is about the future of the liberal world order and we have to stand firm.”

In a recent Ovintiv (OVV) article, I added comments from the IEA (do not confuse this with the US-based EIA).

Headquartered in Paris, France, the International Energy Agency is what they call an autonomous intergovernmental organization that provides policy recommendations, analyses and data, and coverage of global energy markets.

For example, the IEA is working with the European Union on challenging energy problems in times of the Russia/Ukraine war.

Earlier this year, the organization asked a key question in one of its many reports.

A key question is what today’s energy crisis means for fossil fuel investments if we are still to achieve our collective climate goals. Are today’s sky-high fossil fuel prices a signal to invest in additional supply or a further reason to invest in alternatives?

The answer is exactly why I am bullish on fossil fuels as the answer – according to the IEA – is accelerating investments in renewables.

In the IEA’s landmark Roadmap to Net Zero Emission by 2050 published in May 2021, the analysis indicated that a massive surge in investment in renewables, energy efficiency and other clean energy technologies could drive declines in global demand for fossil fuels on a scale that would as a result require no investment in new oil and gas fields.

The need for this clean energy investment surge is greater than ever today. As the IEA has repeatedly stated, the key solution to today’s energy crisis – and to get on track for net zero emissions – is a dramatic scaling up of energy efficiency and clean energy.

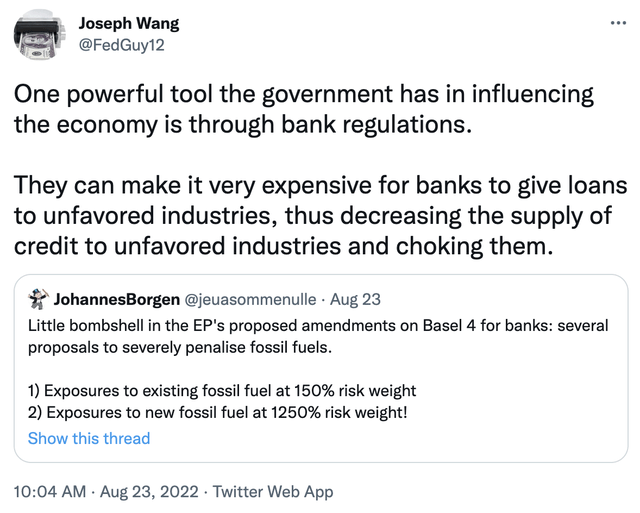

In other words, the solution to this supply problem is to push even harder for renewables. This is devastating as it gives producers even more uncertainty. Let’s assume oil companies were to boost production. Supply would come back. If the current economic environment sees more weakness, demand would come down. The result could be very weak oil prices. At that point, weaker oil companies would struggle to survive, finding it hard to get funding. After all, we’re now seeing that even banks are making it much harder for fossil fuel companies to get funding as the tweet from financial markets expert Joseph Wang:

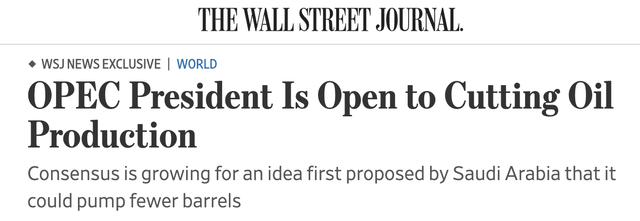

With all of this in mind, things are getting way more serious – which is why I wanted to write this article in the first place. For example, OPEC is open to cutting oil production. Yes, you read that right. CUTTING production.

According to the Wall Street Journal:

OPEC’s rotating president told The Wall Street Journal that the Saudi energy minister’s proposal to consider a reduction in light of market volatility was “in line with our views and objectives.”

This includes the (potential) return of Iranian barrels. OPEC is not going to let that increase supply if its own comments are any indication. This takes away a major bearish force.

Moreover:

OPEC is next set to meet on Sept. 5, but there is no plan at this stage to discuss production cuts at the gathering. Several OPEC members have told the Journal that they might back a reduction in output, particularly if a global recession materializes.

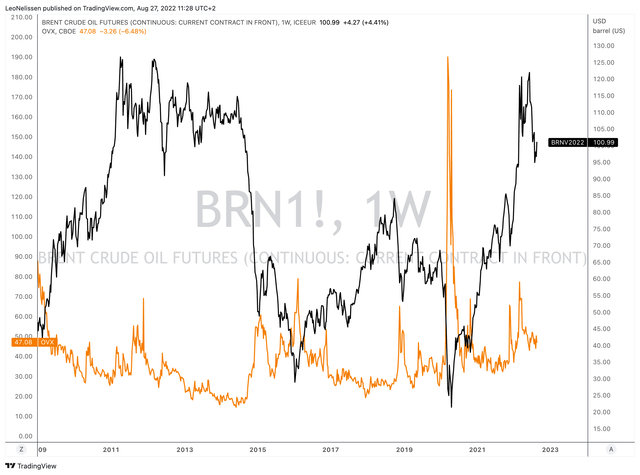

With that in mind, it’s important to look at the bigger picture. Oil prices (using Brent in the chart below) have risen to $100 again. Yes, that’s below recent highs close to $125, but well above the average of the past 7 years. Moreover, it’s once again at $100 despite global recession fears. Meanwhile, oil volatility as displayed by the orange line below is at 47. That’s elevated, but nothing that should worry producers too much. Yet, it’s enough for OPEC to consider cutting production. I am sure OPEC is playing a political game here.

TradingView (Black = Brent Oil, Orange = Oil Volatility)

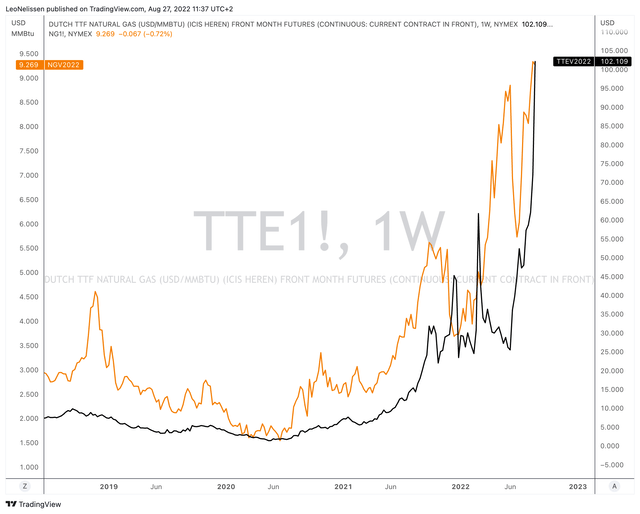

And that’s still not everything. As almost everyone knows by now, we’re in a global energy crisis that is so much worse in other places of the world than in the US. Gas prices in the US (Henry Hub) are trading at $9.3 per MMBtu. That’s one of the highest levels ever. However, in Europe, gas prices are at $102 per MMBtu. More than 10x higher than in the US (as displayed by TTE in the chart below)!

TradingView (Black = TTE, Orange = Henry Hub)

European nations are highly dependent on Russian natural gas imports, which gives Russia leverage. Gas flows through Nord Stream 1 have fallen to less than 20%, causing doubts about whether Germany, Europe’s industrial heart, can survive the winter economically.

Hence, the US is now more important than ever in its role to export LNG (liquid natural gas) and pretty much everything that is liquid and flammable.

Morgan Stanley

I’m not only bringing this up because it underlines the importance of fossil fuels, but also because we’re seeing new developments on this front.

The other day, Energy Secretary Jennifer Granholm implored major US refiners to reduce exports to protect US supply.

That’s the message Energy Secretary Jennifer Granholm sent last week in a letter imploring seven major refiners to limit fuel exports. We obtained a copy of the letter, which the Administration didn’t release publicly. Ms. Granholm warns that gasoline inventories on the East Coast are at a near-decade low, and diesel stocks are nearly 50% below the five-year average across the region.

This means that the energy situation overseas could become even worse and also that a lot of issues in North America are caused by regulatory issues. According to the same Wall Street Journal article:

But the problem isn’t U.S. exports. It’s the political and regulatory assault on U.S. production and refining. One culprit is the 2019 closure of the Philadelphia Energy Solutions refinery, which removed about 335,000 barrels a day of refining capacity from the Northeast. This made the region more dependent on Gulf Coast and overseas refineries.

Everything mentioned in this article, so far, is tremendously good news for Exxon Mobil and its investors.

Why Exxon Is My 2nd-Largest Investment

While there are a lot of good energy companies in the US, Exxon is my largest investment because of its high and consistent yield as well as its ability to benefit from every single trend in global energy markets.

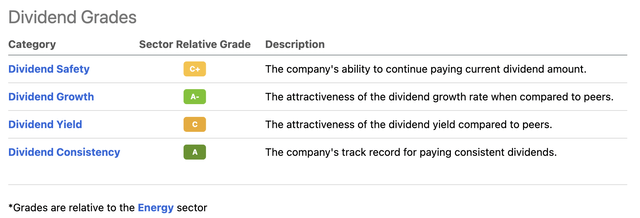

The Seeking Alpha dividend scorecard shows low scores on dividend safety and dividend yield. I’m going to dive into dividend safety in this article, as we’re seeing tremendous improvements on that front that are set to increase the company’s yield as well. The yield is currently scoring a C as a lot of peers (mainly onshore oil drillers) have adopted very aggressive dividend policies, leading to dividend yields of more than 10% in a lot of cases. These dividends are variable (more often than not), which means Exxon doesn’t score high on its yield, but it scores very high on consistency.

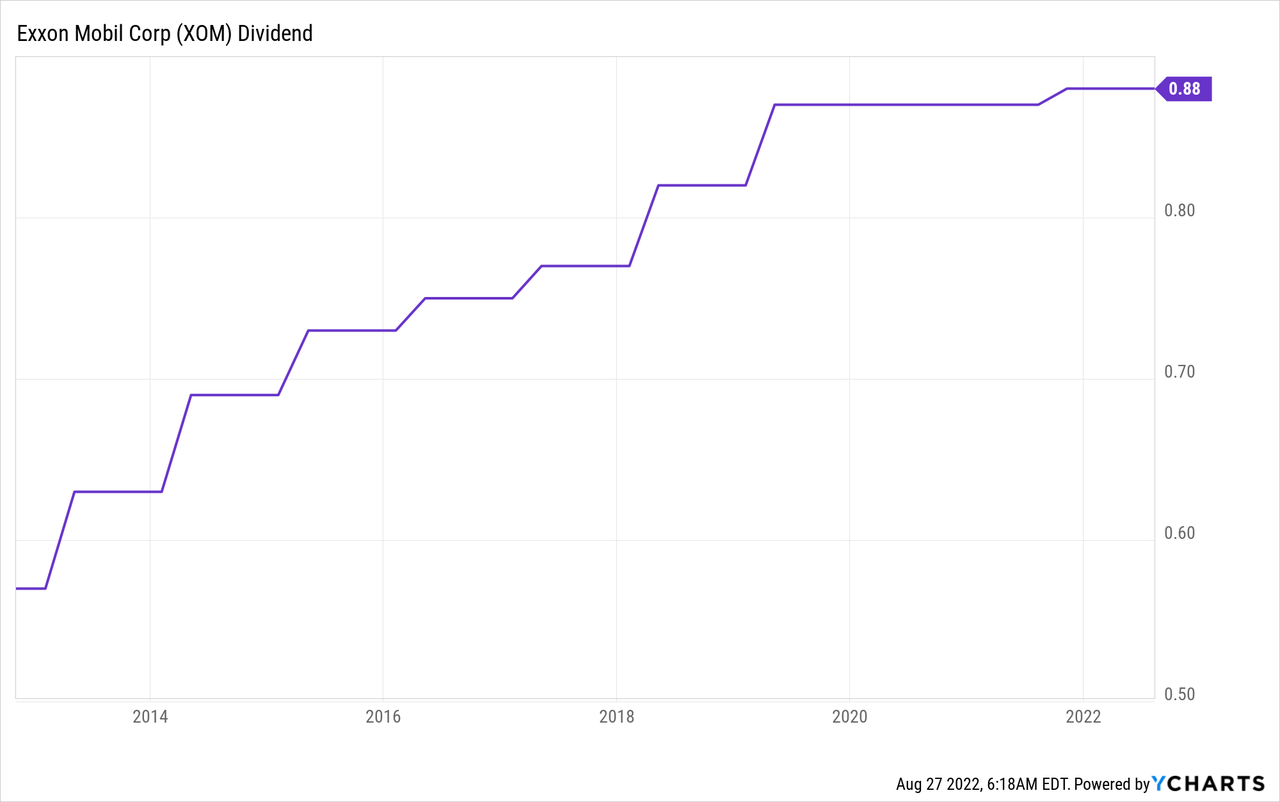

Currently, Exxon pays a $0.88 per share per quarter dividend. That’s $3.52 per share per year, or 3.6% of its stock price, the dividend yield.

Exxon’s dividend consistency score makes sense as the company is a dividend aristocrat. The company has raised its dividend for at least 25 straight years, which makes it one of 65 S&P 500 companies that have accomplished this.

With that said, the 10-year average dividend growth rate is 5.4%. The 5-year average is now below 3.0%. These numbers are disappointing and causing the stock to yield less than 4.0% now.

The most recent hike was announced in October of 2021 when the company hiked by a mere 1.1%.

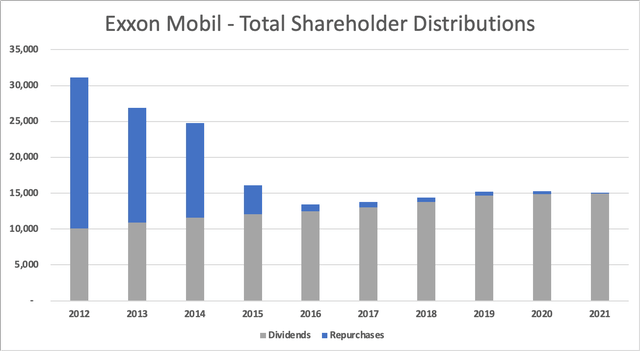

Moreover, stock buybacks have completely dried up as the company seized bringing down the number of shares outstanding after the 2014/2015 oil price crash.

I believe these times of weak hikes and buybacks are over. Let me show you why.

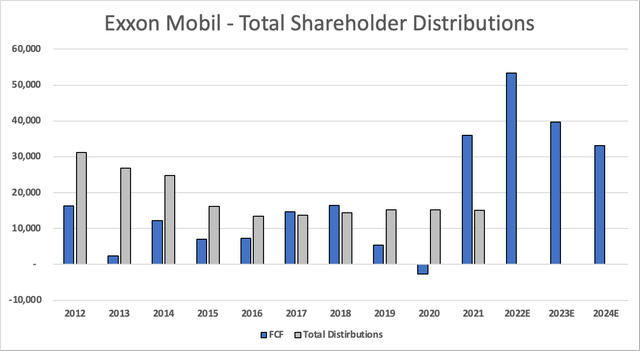

When overlaying total shareholder distributions (buybacks and dividends) and free cash flow, we see that the company was indeed in a bad spot in the past as it didn’t have enough cash to maintain its distributions without having to increase borrowing. Free cash flow, which is operating cash flow minus capital expenditures, is cash a company can spend on distributions. As the chart below shows, the company did not have sufficient FCF in the past.

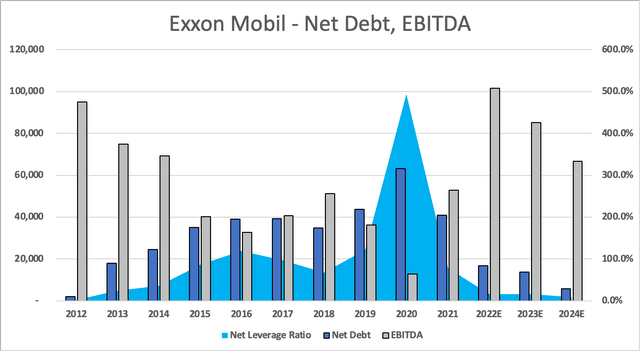

The result was higher net debt as external funding was needed to fund distribute dividends. The good news is that the company had a balance sheet to support high dividends – even during the pandemic. While net debt rose to more than $40 billion prior to the pandemic, the leverage ratio remained close to 1.0x EBITDA.

With that said, as the free cash flow chart in this article shows, FCF is expected to come in close to $55 billion this year. Even if oil prices normalize in 2023, FCF is still set to remain close to $40 billion and roughly $33 billion in 2024, which I believe the company will easily beat.

What this means is that there’s a lot of room for higher dividends on top of debt reduction. If the outlook is any indication, the company is set to lower its net debt load to the lowest levels since 2013 between now and the end of 2024.

Moreover, with regard to production, Exxon is one of the few companies actually boosting production. Between 2017 and 2022E, crude oil production is growing by 20% per year. The average peer had 10% growth during this period. Between 1Q22 and 2Q22, oil production improved from 3.68 million barrels per day to 3.73 million barrels per day, as production growth of 100 thousand barrels per day more than offset a 30 thousand barrels per day decline due to the war in Ukraine (Russia curtailment).

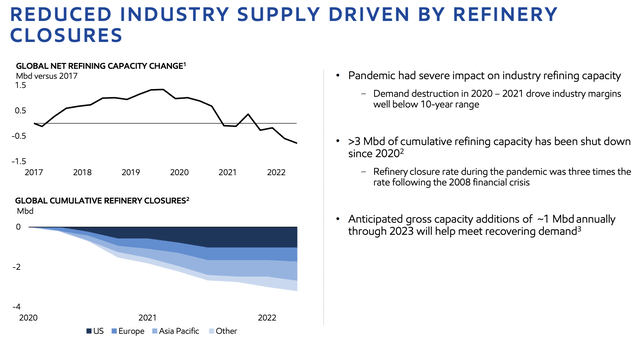

Not only that, but Exxon is one of the world’s largest refiners. Refinery margins are currently sky-high as supply has faded due to the pandemic. Since 2020, more than 3 million barrels per day of refining capacity has been shut down. On a side note, Exxon is the only company expanding refinery capacity in its Beaumont, Texas, refinery, adding 250 thousand barrels per day in 1Q23.

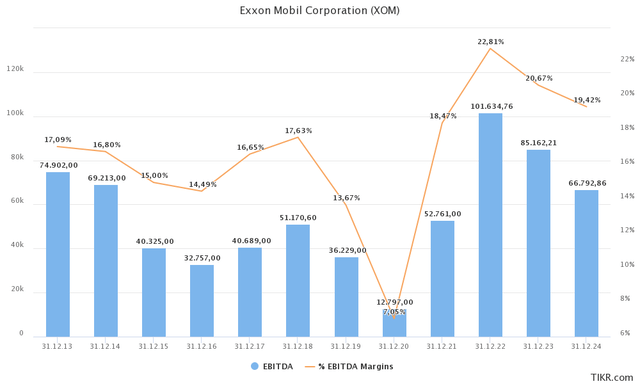

The result is high margins. The company is expected to maintain adjusted EBITDA margins close to 20% in the years ahead, almost 300 basis points above prior peaks.

This brings me to the valuation.

Valuation

Exxon Mobil has an enterprise value of $446.2 billion. That’s based on its $408.0 billion market cap, $13.6 billion in expected 2023 net debt, $17.4 billion in current pension-related liabilities, and $7.2 billion in minority interest. This enterprise value is 5.2x 2023E EBITDA of $85.2 billion.

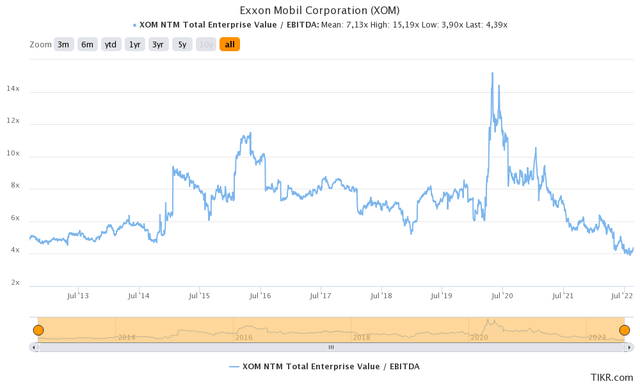

During “normal” years, the company trades at roughly 7x NTM EBITDA, which I believe is fair.

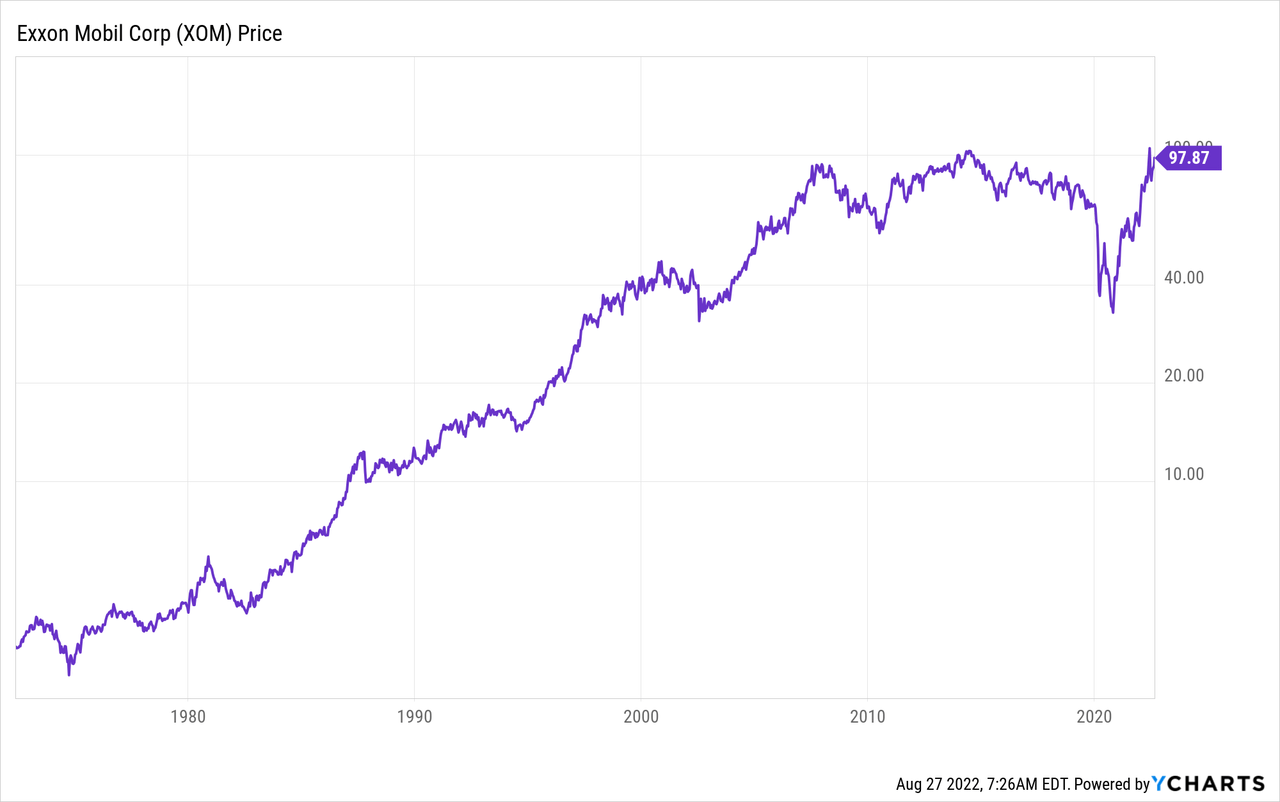

This would imply that the company has roughly 37% upside potential to its “fair” value. On a long-term basis, I believe that Exxon will outperform the market. Free cash flow is high, debt is quickly being reduced, and shareholder distributions are expected to accelerate.

Note that the chart above excludes dividends.

Takeaway

This may not be the biggest bull case “ever”, yet it’s the most serious bull case for sure. I made the decision to go overweight energy because it added some much-needed yield given my focus on dividend growth over high-yield investments.

Little did I know in 2020 that energy would be among the biggest dividend growth winners of the post-pandemic world. Energy supply has become a serious issue, drillers aren’t focusing on production growth anymore due to political and related risk-management issues.

On top of that, we’re now dealing with significant energy shortages in i.e., Europe as Russia is using its energy leverage. While the US is going to be a leading provider of much-needed energy supply, it is currently struggling itself, causing politicians to call for lower exports.

Moreover, it looks like OPEC wants to cut oil. Even if that is still unlikely, the odds of OPEC boosting output are close to zero right now.

Exxon Mobil is in a fantastic place to benefit from all of this. The company is increasing production, benefiting from both higher output and strong prices. Additionally, it is one of the world’s largest refinery companies, with more output on the way in 1Q23.

The valuation is great and the odds are in favor of aggressive growth in shareholder distributions. Free cash flow is set to remain high for years to come while net debt is back at levels where it doesn’t make too much sense to prioritize balance sheet health over shareholder distributions.

So, long story short, I am extremely happy that I own Exxon and believe that it deserves a place in every dividend portfolio. Regardless of whether it’s a high-yield or dividend growth portfolio.

(Dis)agree? Let me know in the comments!

Be the first to comment