JHVEPhoto

(Note: This was in the newsletter October 28, 2022.)

Back in fiscal year 2020 when Exxon Mobil (NYSE:XOM) was about the only company in the industry going “full blast” and racking up debt to the consternation of a whole lot of observers, there was a consensus that it was not sustainable. Then, of course, came the full year loss for the first time in a very long time (in fiscal year 2020). But the company had long planned to fix things before that loss ever happened. It just takes a lot of time when you are the size of Exxon Mobil. Now, it appears the results are becoming apparent to the market. What may not be apparent to the market is the new lean and mean Exxon Mobil has growth ahead for the first time in a very long time. That growth is just beginning.

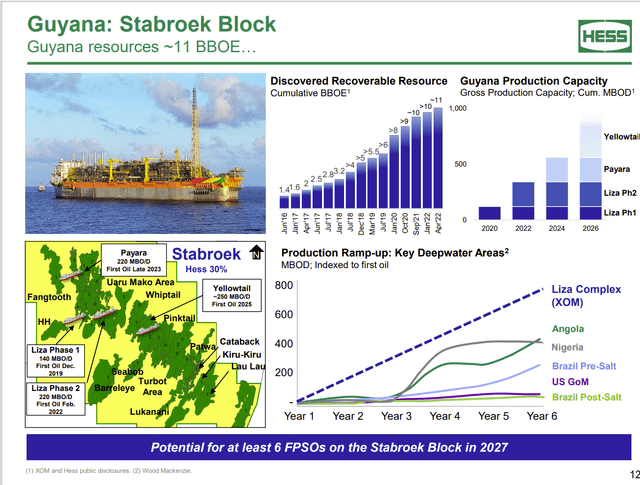

Hess Presentation Of Guyana Partnership Near Term Potential (Hess Presentation At Barclays CEO Energy-Power Conference September 2022)

Hess (HES) presented some of the near-term plans for the Guyana Partnership that Exxon Mobil operates. Exxon Mobil reported two more discoveries while mentioning they expect this partnership to produce 1 million barrels of oil per day by the end of the decade. That kind of discovery is significant for a company the size of Exxon Mobil.

There is considerable upside for this project not only on the current block but also on the blocks where little exploration has so far been done.

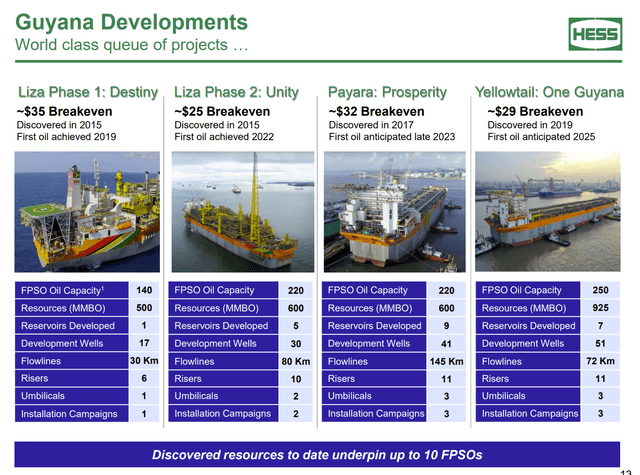

Hess Presentation Of FPSO’s Operating And Planned (Hess Presentation At Barclays CEO Energy-Power Conference September 2022)

By far, the largest advantage of continuing to work through the pandemic (and the industry downturn in general) was the rock-bottom prices that the company got in the first two FPSOs that are now producing. The high prices of commodities have enabled an unexpectedly fast repayment of capital costs for a project that usually measures payback in years instead of months.

Nothing is more important than a lot of cash flow in the early part of a project that produces unexpectedly fast repayment of early capital costs. Since the discounted cash flow models used by management emphasize the importance of more cash now rather than later, currently, strong commodity prices have likely improved the project profitability materially.

Currently, strong commodity prices have also allowed a level of partnership self-financing that was not imaginable back in fiscal year 2020 when the long-term debt levels were climbing. There was some pressure for faster development of the reserves. That pressure can be met with more activity thanks to the planning that enabled the partnership to take advantage of the currently strong commodity prices.

The lower costs of the first FPSOs will likely maintain a cost advantage throughout the basin that will last a decade or two because these wells are long-lived. Estimates on the fourth platform vary as high as 50% more now that the offshore business is beginning to recover. Then there is the higher cost of services and equipment as well. Despite the additional debt necessary in fiscal year 2020, this company ended up with a very profitable proposition for the first 3 FPSOs that competitors in the basin will likely not be able to match.

Earnings Planning

The company grew other production as well. This company operates in the Permian, where it likewise was drilling and completing wells right through the industry downturn. Management reported overall growth in earnings of less than two percent over the previous quarter. But the projects are in place for more growth in the future. It just takes time to get those projects going to the point where they are significant to a company the size of Exxon Mobil.

When one listens to a Warner Bros. Discovery (WBD) transcript, the most frequent comment from management is that the earnings reported now are from decisions made roughly 3 years ago. Management has often made that comment to remind investors what it takes to turn a large acquisition around. Management has to plan for market conditions way ahead of time to succeed when you are large. That is a very hard concept to get across to the market.

Exxon Mobil is still larger than that combination that came to be Warner Bros. Discovery. The progress that investors see now revolves around a decision made probably when the new CEO took over to get the company growing. Now that the profits and production growth show some progress, there is probably more on the way.

Earnings Results

The result of this planning for a recovery the market never saw coming was financial results that the market never thought possible.

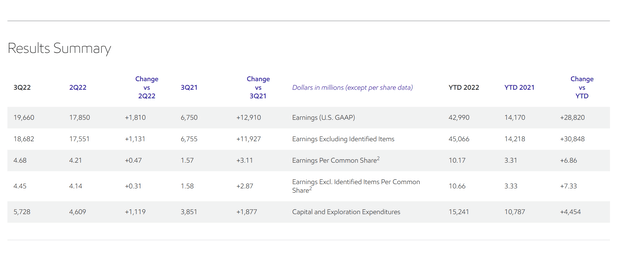

Exxon Mobil Summary Of Third Quarter 2022, Profits (Exxon Mobil Third Quarter 2022, Earnings Press Release)

The third quarter actually came in better than the second quarter. This is a result that few observers expected. But those long-term followers of Exxon Mobil know that management long ago promised to reduce the corporate breakeven. That process took years. But it is now apparent that the process to reduce the corporate breakeven point is well underway and producing results. Exxon Mobil is well on its way to a record year.

But what is more important is that the loss year in fiscal year 2020 that so concerned the market as the debt was increasing now turns out to be offset by one-quarter of earnings in current conditions.

Management reported that long-term debt is now under the original goal. That means there is plenty of room for more debt should management find profitable projects to develop during a downturn. This company has long been a counter-cyclical company. As a result, management often obtains long-term cost advantages that few can match by developing projects when the rest of the industry is largely idle. It has been that way for as long as I can remember. The countercyclical strategy is likely to continue well into the future.

Up Next For Management

Management has some other giant projects as they have a huge natural gas find in Papua New Guinea that plays a profit role that few imagined back when the company began that project. Back in 2016, The company acquired InterOil for about $2.5 billion. Current natural gas prices are likely to allow the company to make that cost back many times over. That acquisition is looking more and more like a steal.

Management is also partnered with other companies I follow in Brazil. A discovery off the coast of Brazil is likely to further enhance future growth projects.

In the meantime, there is a lot more upside potential to Guyana on other leases owned with different partnerships. This company has a lot of growth possibilities that are very unusual for a company the size of Exxon Mobil

In the near term, growth is likely to accelerate into the mid-single digits. That would provide earnings and cash flow to keep raising the dividend while providing a total return in the low teens. Few large companies this size with the sky-high financial strength have the growth prospects lined up like Exxon Mobil.

As a result, this company can be considered for both income and appreciation investors. The safety of the company due to the high financial strength ratings makes the lower returns competitive with riskier companies on a risk-adjusted basis.

Management just raised the dividend by $.03 per quarter. There is likely to be more raises where that came from in the future. This company is a dividend king where both vertical and horizontal diversification provide an unusual amount of investment safety. Strategic execution is also among the best in the industry as well.

Be the first to comment