Aranga87

Kandi Technologies Group, Inc. (NASDAQ:KNDI) receives tax benefits from the government in China and appears to receive demand for its electric vehicles (“EVs”). Keep in mind that pollution in some cities in China is at its highest levels. Management also counts with distributors in the U.S. and may launch an aggressive internationalization campaign as soon as KNDI’s airbag safety standards are enhanced. In any case, under my own financial models, I obtained a fair valuation that is higher than the current stock price.

Kandi Technologies

Listed on the Nasdaq Stock Exchange, Kandi Technologies Group develops, manufactures, and commercializes electric vehicles, power electric motors, and lithium batteries, among other items for the auto industry.

Considering that KNDI appears to be selling cars in the United States, it is a great time to study the stock. In 2022, Kandi America introduced a new all-wheel-drive EV model in the U.S. Besides, I could review a significant number of new models on the website of the exclusive distributor for Kandi electric vehicles in the U.S.

kandiamerica.com

In my view, if KNDI really becomes a global seller of EVs, revenue growth could grow significantly, as the target market will likely multiply. Let’s hope that KNDI manufacturers continue to offer new models that are finally approved in the United States and the EU. In the last quarterly earnings call, KNDI noted that new models could be approved by authorities in the United States once KNDI’s airbag safety standards are enhanced:

But as we mentioned in the past question, the requirements of the airbag safety standard is much higher than those in China and even EU, because well in China and EU, basically we have that similar standards. Source: KNDI’s Earnings Call

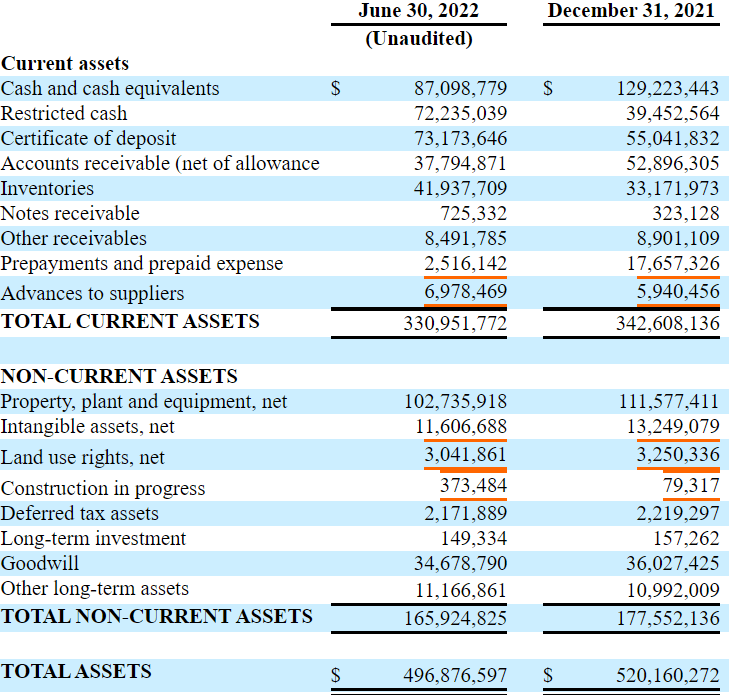

Healthy Balance Sheet

As of June 30, 2022, KNDI reported cash and cash equivalents of $87 million, in addition to a restricted cash of $72 million. With a certificate of deposit of $73 million, accounts receivables worth $37 million, and an inventory of $41 million, the total current assets stand at $330 million.

Regarding the non-current assets, property, plant, and equipment was worth $102 million, and intangible assets were worth $11 million with land use rights of $3 million. KNDI also appears to have expertise in the M&A markets, which investors may appreciate. Keep in mind that goodwill stands at $34 million. Finally, total assets stand at $496 million. In my view, with an asset/liability of 6x, the balance sheet stands in good shape.

Source: 10-Q

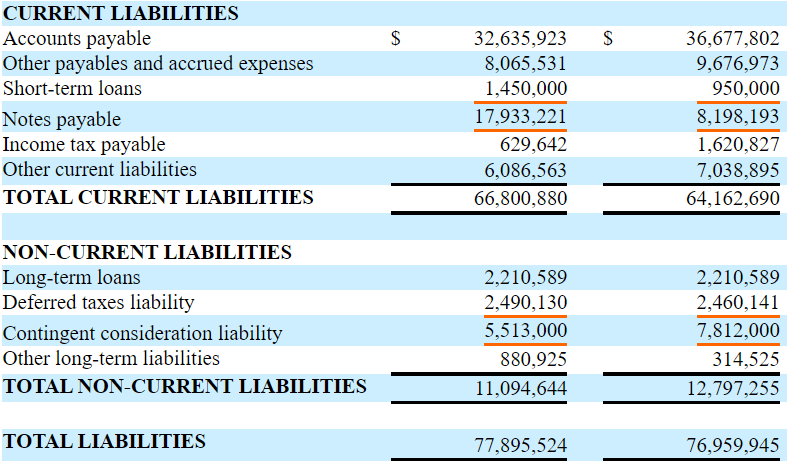

Regarding the current liabilities, the company reported accounts payable of $32 million, other payables and accrued expenses of $8 million, and short-term loans of $1.45 million. Notes were equal to $17 million, and other current liabilities stand at $6 million. Finally, total current liabilities stand at $66.8 million.

Turning to non-current liabilities, long-term loans were worth $2.2 million, with deferred tax liability of $2.4 million, in addition to a contingent consideration liability of $5.5 million. Finally, the total non-current liabilities were equal to $11 million, with total liabilities of $77 million.

Source: 10-Q

Under Normal Conditions, In My View, The Stock Price Is Worth $4.56 Per Share

In my view, KNDI will most likely experience significant demand for EVs because pollution is already affecting many cities in China. With this in mind, I don’t see why the government in China would stop tax subsidies. In this regard, management came with the following commentary in the annual report:

Cities in China face four critical challenges in the traffic environment, including pollution, traffic congestion, insufficient parking availability and growing scarcity of energy supplies, which are mainly the result of ever growing volume of gas-powered private cars. Source: 10-K

I also believe that internationalization of the business could bring KNDI significant revenue growth. Investors out there were very concerned about potential tariffs on products from China, however, I don’t see a major problem. KNDI will likely sell its products at a bit higher price, so that EBITDA margins remain the same. Management gave the following explanation in a recent earnings call.

For shipping to the U.S., the U.S. government charges a 10% tariff on all imports. So, under the existing conditions, our sales price in the U.S. market is determined according to the existing tariff, the tax rate. If there are any future adjustments down the road, our sales price will also be adjusted accordingly. So, basically there is no such a significant impact to that company’s revenue upon the change or adjustments of the tariff tax rate. Source: Source: KNDI’s Earnings Call

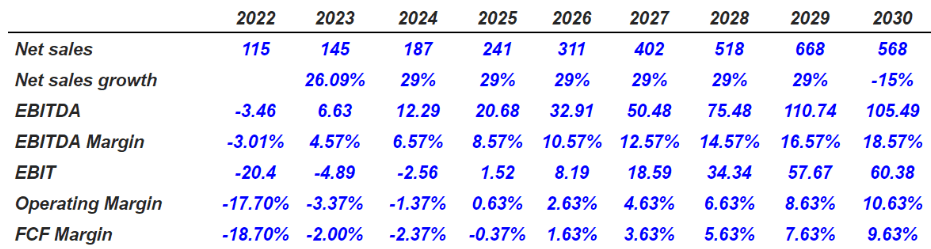

Market experts believe that the Chinese electric vehicles market could grow at a CAGR of over 30% from 2022 to 2027. Under this base-case scenario, I assumed that the company’s revenue growth would be close to that of the market. In my view, it is a conservative assumption because the internationalization of the brand could bring even more sales growth.

The Chinese electric vehicles market was valued at USD 124.2 billion in 2021, and it is expected to reach USD 799 billion by 2027 by registering a CAGR of over 30.1% during the forecast period (2022-2027). Source: China Electric Vehicles Market Report, Size, Growth | 2022 – 27 | Industry Analysis

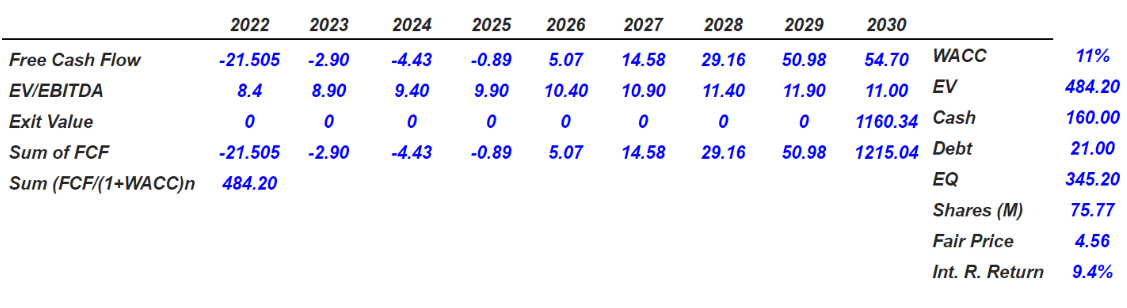

By 2030, I forecast net sales of $568 million, with net sales growth of -15%. I expect EBITDA of $105.49 million, with an EBITDA margin of 18.57%. I expect EBIT to be $60.38 million, with an operating margin of 10.63%. FCF (free cash flow) margin would stand at 9.63% along with a free cash flow of $54.70 million.

My DCF Model

With an EV/EBITDA multiple of 11x, I obtained an exit value of $1160 million, together with a sum of FCF of $1215 million. If we discount everything with a WACC of 11%, the implied valuation would be $484.20 million. With cash of $160 million and debt of $21 million, I obtained an equity valuation of $345.20 million. Finally, the fair price would be $4.56 million with an IRR of 9.4%.

My DCF Model

Most Unlikely Case Scenario Results In A Valuation Of $0.9 Per Share

I believe that new technologies, competition, and changes in regulation may affect the company’s business model. Management clearly noted in the last annual report that the industry may not evolve as expected.

According to the Announcement, purchases of new energy vehicles that occur between January 1, 2023, and December 31, 2023, will continuously be exempted from vehicle purchase tax. Source: China Considers Extending its EV Subsidies to 2023.

If the market for EVs and pure electric off-road vehicles in China does not develop as we expect or develops more slowly than we expect, our business, prospects, financial condition and operating results will be harmed. Source: 10-K

I also believe that failed development of new technologies could be quite detrimental for the company’s future revenue generation. Changes in current technologies, lower investments in research and development, or changes in drivers’ tastes may push the revenue growth down. In the worst-case scenario, if journalists disclose KNDI’s lack of competitiveness, the stock price could decline.

Any failure by us to develop new or enhanced technologies or processes, or to react to changes in existing technologies, could materially delay our development and introduction of new and enhanced EV products and Pure Electric off-road vehicles, which could result in the loss of competitiveness of our vehicles, decreased revenue and a loss of market share to competitors. Source: 10-K

The company notes a significant concentration of clients, which is a relevant risk. If relevant clients decide to stop buying vehicles from KNDI, in my view, the decline in sales growth could be very significant. Management disclosed this risk in the last annual report:

As of December 31, 2021 and 2020, our operating subsidiaries’ major customers, in the aggregate, accounted for 29% and 38%, respectively, of their sales. Due to the concentration of sales to relatively few customers including the Affiliate Company, loss of one or more of these customers will have relatively high impact on their operational results. Source: 10-K

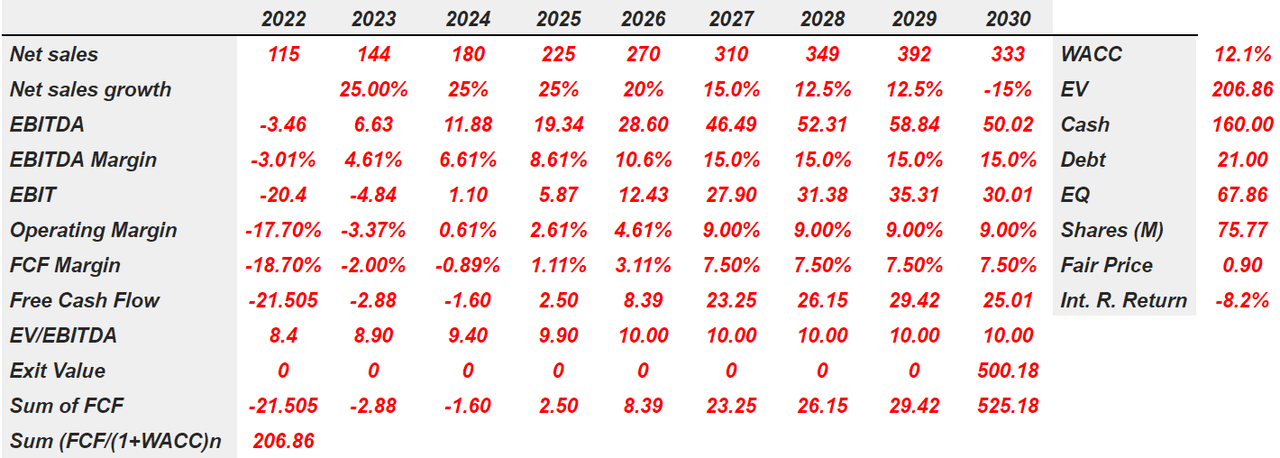

Under the previous conditions, in my view, 2030 will likely bring net sales of $333 million and net sales growth of -15%. I obtained EBITDA of $50.02 million, with an EBITDA margin of 15%. The EBIT would be close to $30 million, with an operating margin of 9%. Regarding the FCF margin, I would foresee 7.5%, together with free cash flow of $25.01 million.

If we use, in this case, an EV/EBITDA of 10x, the exit value would stand at around $500 million. The sum of FCF would be around $525 million, and the discounted sum of free cash flow would be $206 million. I also obtained an equity valuation of $67.86 million. Shares will be around $75.77 million. Finally, my results included a fair price of $0.90 per share and an IRR of -8.2%.

My DCF Model

Takeaway

KNDI benefits from the recent demand for EVs in China. The company also benefits from tax benefits offered by the government in that country. It is worth considering that there is already a direct distributor of KNDI products in the United States. In my view, once KNDI’s airbag safety standards are enhanced, the company will most likely be able to sell products in both the EU and the U.S. As a result, the target market may increase significantly, which would push the company’s revenue growth up.

In any case, I do believe that the current stock price is significantly undervalued. Like other EV manufacturers, free cash flow will most likely appear sooner or later and may justify higher stock valuations.

Be the first to comment