JHVEPhoto

Time and time again, the management team at Exxon Mobil (NYSE:XOM) proves that the company is one of the best players in the energy sector on the planet. The latest case in which the company has provided proof of this was on October 28th when the firm announced financial results covering the third quarter of its 2022 fiscal year. Not only did the company perform well, it generated profits that exceeded any other quarter in the company’s entire history. While it is probable that some recent performance will not be permanent because of the unusually high energy prices it has benefited from, the company should still be an affordable prospect in almost any environment. Given these considerations, I view the company as an attractive prospect still worthy of the ‘buy’ rating I gave it when I last wrote about it in May of 2020.

Stellar performance by Exxon Mobil in Q3

Back in May of 2020, I wrote a rather bullish article about Exxon Mobil. In that article, I was covering results from the first quarter of the company’s 2020 fiscal year. At that time, it was suffering from a fundamental perspective. But even so, there were some aspects of the business that were shining through, causing me to take a positive view of its prospects in the long run. Ultimately, I concluded that the company served as a paragon of quality during difficult times. And this led me to rate the firm a ‘buy’, reflecting my belief at that time that shares should outperform the broader market moving forward. That truly was a great call-in retrospect. You see, while the S&P 500 is up by 37% since then, shares of Exxon Mobil have generated upside for investors of 193.3%.

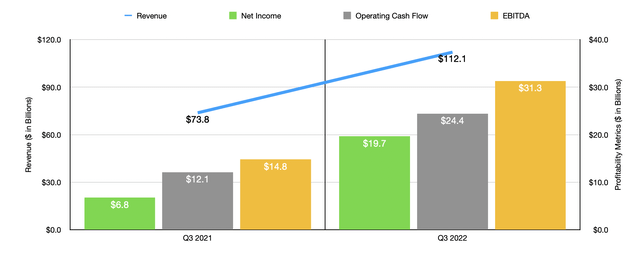

Although I could cover data for the rest of the 2020 and 2021 fiscal years, I think it would make the most sense to cover what is happening this year. Most specifically, I would like to focus on the quarter for which the firm just announced financial results. This is the third quarter of 2022. During that quarter, revenue for the company came in strong at $112.1 billion. This represents an increase of 51.9% over the $73.8 billion generated one year earlier. This managed to beat analysts’ expectations by over $9.1 billion. For this particular firm, it’s worth noting that management focuses a lot more on bottom line results than top line results. Although this may seem peculiar to some, it’s also important to note that what causes the bottom-line results for the company would also reflect on what top line results ended up being.

On the bottom line for the quarter, net income came in at $19.7 billion. This represents an increase of 191.3% over the $6.8 billion in profits generated in the third quarter of 2021. On a per-share basis, we are looking at profits of $4.45, beating the expectations of analysts by $0.65 per share. Another important profitability metric to pay attention to is operating cash flow. This more than doubled, shooting up from $12.1 billion to $24.4 billion. In addition to this, we should also pay attention to EBITDA, which ended up rising from $14.8 billion in the third quarter of the company’s 2021 fiscal year to $31.3 billion the same time this year.

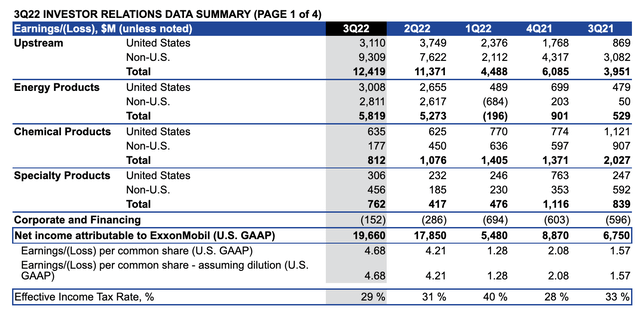

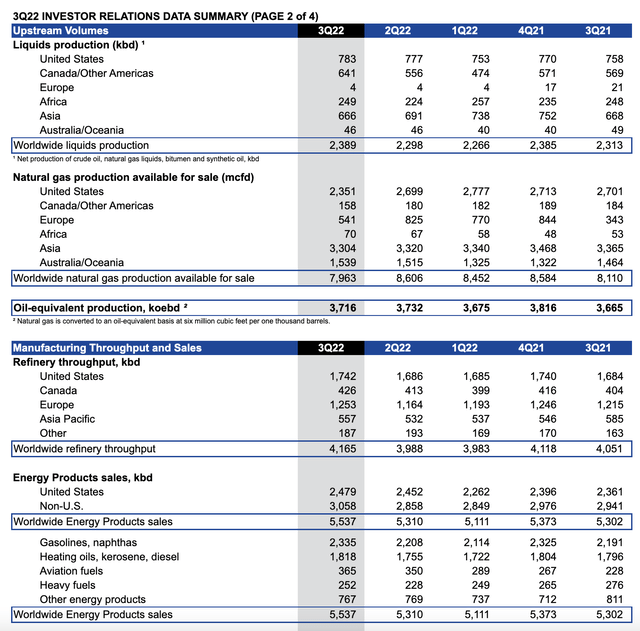

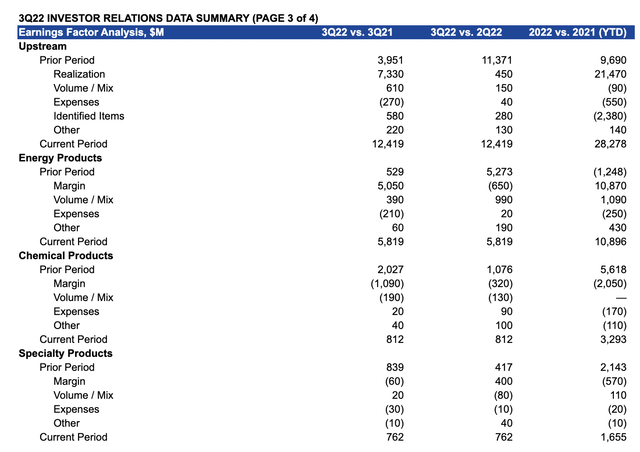

To really understand what’s going on, we should touch on individual portions of the company. When digging into the numbers, you come to realize that there were two key operating segments that were instrumental in pushing the company’s profits up year over year. The first of these is the Upstream segment, which reported earnings of $12.4 billion. To put this in perspective, earnings just one year earlier came in at less than $4 billion. Some of this increase was driven by higher production. For instance, total output for the company averaged 3.716 million boe (barrels of oil equivalent) per day in the latest quarter. That’s 1.4% higher than the 3.665 million boe per day achieved the same time last year. At the end of the day, higher volume and a mix in products sold was responsible for $610 million of the $8.5 billion increase in earnings the segment experienced. There were other factors as well. But the single largest contributor to the increase was higher pricing, which added $7.3 billion to the company’s bottom line. In the US, realized pricing for crude oil came out to $91.69 per barrel compared to the $67.62 per barrel generated one year earlier. Meanwhile, natural gas realized pricing rose from $3.33 per Mcf to $8.38 per Mcf. Similar price increases could be seen when it came to the company’s international operations. In particular, the company benefited tremendously from a 244.5% rise in realized pricing associated with natural gas operations in Europe. When you consider what is going on in Europe, particularly centered around Russia and Ukraine, this makes a lot of sense.

The other strong area for the enterprise involved its Energy Products segment. This is the part of the company responsible for the production and sale of high-value products such as heating oils, kerosene, aviation fuels, heavy fuels, and more. Is also responsible for certain licensing activities. Profits under this segment totaled $5.8 billion during the quarter. That compares to the $529 million it generated only one year earlier. This stark increase came only partially because of higher sales, with 5.537 million boe per day coming in only 4.4% higher than the 5.302 million boe per day that was generated last year. This improvement in volume and product mix added $390 million to the company stop line. But the real driver was improved margin, adding nearly $5.1 billion to the company’s top line results. Simply put, the margin is the spread between what it costs the company for the inputs and what it can sell the outputs for.

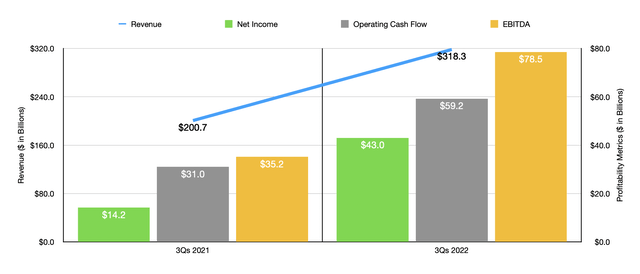

This strong result for the third quarter was helpful in achieving strong results for the 2022 fiscal year so far as a whole. In the first three quarters of the year, revenue came in at $318.3 billion. That’s up from the $200.7 billion generated only one year ago. Net income for the company shot up from $14.2 billion to $43 billion. Operating cash flow also rose, nearly doubling from $31 billion to $59.2 billion. And finally, EBITDA for the company jumped from $35.2 billion to $78.5 billion. Strong financial performance on the bottom line was also helpful in improving the company’s balance sheet. At the end of the firm’s 2021 fiscal year, it had $40.9 billion in net debt. Today, that number is lower than $15 billion, with $30.5 billion in cash on the company’s books. Management is doing more than just reducing debt though.

During the latest quarter alone, the company allocated $3.7 billion to dividends. And they also purchased $4.5 billion worth of shares. Year to date, total share buybacks came out to $10.5 billion, which is consistent with the company’s plan to purchase up to $30 billion worth of stock through the 2023 fiscal year. Management also continues to make investments dedicated to growing the enterprise. Most recently, for instance, the firm announced two additional discoveries in Guyana. During the third quarter, the firm was already producing 360,000 boe per day from the country. And their goal is to ultimately increase this to 1 million boe per day by 2030. To illustrate just how committed the company is to not only maintaining production but growing it, consider that this year they are still planning to spend between $21 billion and $24 billion on capital expenditures.

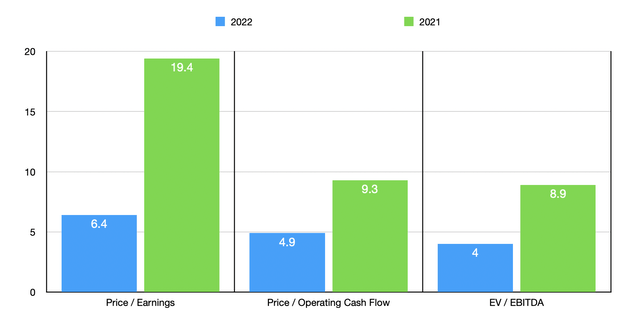

While all of these results are great, it is rather difficult to know how to value the business. We don’t have much in the way of guidance and we should also know that the current energy situation will not last forever. The simple path is to annualize results experienced for the current fiscal year but then to assume that financial performance in the future might look weaker in a different scenario. For instance, annualizing results would give us net income this year of $69.8 billion, operating cash flow of $91.8 billion, and EBITDA of $117.8 billion. This would imply that the company is trading at a forward price to earnings multiple of 6.4, a forward price to operating cash flow multiple of 4.9, and a forward EV to EBITDA multiple of 4. But if we assume that financial performance might revert back to what the company saw in 2021, these multiples would be higher at 19.4, 9.3, and 8.9, respectively. Also, as part of my analysis, I compared the firm to three other big energy companies. On a price-to-earnings basis, these firms ranged from a low of 5.9 to a high of 13.5. Using the EV to EBITDA approach, the range was between 3 and 7.8. In the first case, only one of the three companies was cheaper than our prospect, while two were cheaper in the second case. Meanwhile, using the price to operating cash flow approach, the range was between 3.5 and 6.3, with two of the three being cheaper.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Exxon Mobil | 6.4 | 4.9 | 4.0 |

| Chevron (CVX) | 8.1 | 6.3 | 4.8 |

| Shell plc (SHEL) | 5.9 | 3.7 | 3.0 |

| BP p.l.c. (BP) | 13.5 | 3.5 | 7.8 |

Takeaway

Pretty much no matter how you look at it, the picture for Exxon Mobil looks amazing. This was certainly a memorable quarter that demonstrates just how high quality the enterprise remains. Admittedly, energy conditions today will not last forever. And when the picture does change, we can expect weakness in financial data to form. But even if financial performance reverts back to the kind of level that we saw last year, shares would still look very affordable, especially given the quality of its underlying operations.

Be the first to comment