Sean Gallup

Overview

Match Group, Inc. (NASDAQ:MTCH) is a technology company and owner of a portfolio of dating applications. The company’s holdings include market leader Tinder along with lesser-known apps such as Hinge, OkCupid, and Plenty of Fish. Its total portfolio includes over 40 companies.

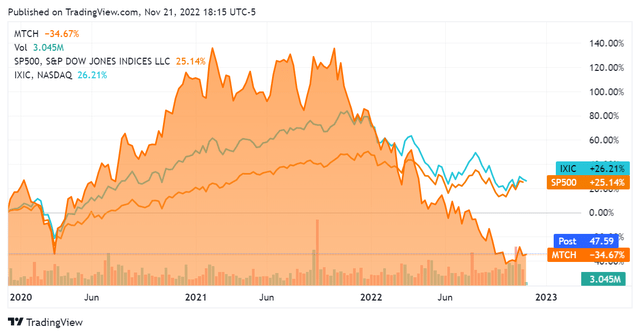

Match Group was previously a part of media conglomerate IAC but was spun out in Q2 2020. It appreciated (sensibly so) during the pandemic but has lost value since then, now underperforming the S&P 500 (SP500) as well as the NASDAQ Composite (COMP.IND).

SeekingAlpha.com MTCH 11.21.22

Match Group is a unique player in that it is the largest entity within the e-dating market while also owning the leading brand. It is situated between two distinct secular trends: the overall proliferation of online activity as well as online dating, and the emerging post-pandemic context. While these two act contrary to each other, they are both worth keeping in mind. This article will review Match Group’s financials to determine if it may constitute a good investment at its current price point.

Financials

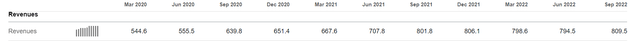

Match Group’s latest earnings report beat consensus expectations marginally, with an EPS of $0.58 exceeding consensus by $0.01 and a quarterly revenue of $809.55M beating consensus by $16.33M. It’s fair to call these numbers in-line performance overall. We will review the firm’s financial results for the last 11 quarters, inclusive of Q1 2020 prior to its Q2 2020 spin-out from IAC.

Revenue growth has been solid during that time, with quarterly revenues having increased 49% between Q1 2020 and Q3 2022. The rate of growth of its revenues, however, has slowed materially. While displaying an accelerating trendline throughout the pandemic, this momentum appears to have come to a standstill over the last 2 quarters; first halving, and then dropping to less than 1% YoY for its latest quarterly result. I think it’s fair to say that the company’s favorable secular positioning during the pandemic has come to a hard stop.

SeekingAlpha.com MTCH 11.21.22 SeekingAlpha.com MTCH 11.21.22

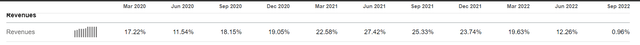

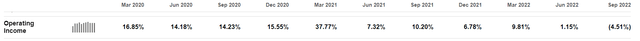

Match Group has also faced an increasing cost structure throughout this time, reflected in its operating income trendline. While correlating with its revenue growth YoY, the numbers are generally a significant portion of what it was able to generate in increased revenues. The notable exception to this is Q1 2021, but that appears to be a one-off. Operating income actually decreased in its latest filing, notably so for the first time in the last 2 fiscal years.

SeekingAlpha.com MTCH 11.21.22 SeekingAlpha.com MTCH 11.21.22

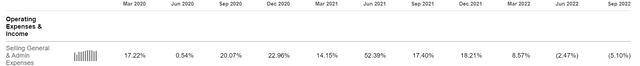

The implication here is clear: Match Group’s growth came along with a decreased level of capital efficiency. The company had significant and consistently growing expenditures as to selling and marketing its services throughout this period. While this has dropped off somewhat for the last 2 quarters, it’s fair to say that it needed to conduct this in order to generate the revenue growth that it was seeing. With slowing marketing spend, we saw slowing growth in revenues; the question any investor should now be asking is how sticky its revenue base really is. I am not able to render a judgement on this as of yet.

SeekingAlpha.com MTCH 11.21.22

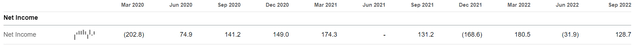

Looking at net income to get the final word on profitability, we see that Match Group is generally a profitable enterprise – albeit with notable levels of volatility. Given its ongoing acquisition spree, its sensible to conclude that these non-operating costs are being directed towards that, which is a fair usage of capital. I am not overly concerned with these numbers, as the company was able to exceed its peak quarterly profitability each year running – note the March 2022 results.

SeekingAlpha.com MTCH 11.21.22

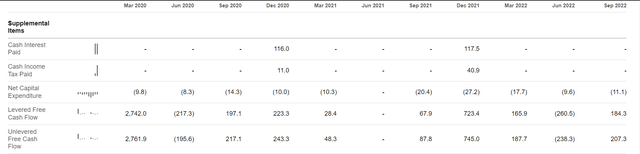

The company’s cash flow situation also looks amenable. The statistically abnormal result in Q1 2020 was due to a cash injection from its parent company prior to being spun out. While not being overly neat as to trendline, this company clearly generates positive free cash flow – and often puts that right into acquisitions. While it does not appear that the firm paid cash on interest for 2022, the disparity between unlevered and levered cash flow indicates that it is indeed doing so.

SeekingAlpha.com MTCH 11.21.22

Overall I have comfort in Match Group’s ability to generate free cash flow.

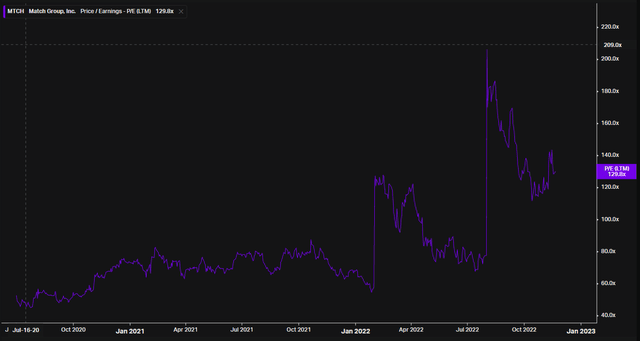

Looking over at the company’s valuation, we see that Match Group is trading at a 130x P/E multiple. This is exceptionally high, even for today’s technology sector. One would have to presume a very significant level of earnings growth over the next several years to make this sensible. Notably, the trailing twelve months’ P/E ratio seems to spike and then decrease over the next several quarters – this effect is visible in Q1 2022 as well as Q3 2022. This means that the company’s earnings are not keeping up with its valuation and that it is getting sold off as a result. This is certainly a negative indicator from a technical perspective.

Conclusion

While Match Group is a mature technology company and dominant player in the online dating space, it just doesn’t look like a very good stock. It seems to have a “grow no matter what” mentality, evidenced by its acquisitive habits and significant spend on sales & marketing. Just like its parent before it, it is a conglomerate.

This strategy appears to have resulted in Match Group trading at extremely high multiples while staring down a dead stop in its revenue growth. While there are obvious economics inherent in combining entities of this nature, there are also many associated costs and an overall diffusion as to corporate strategy that come along with this. This is why many conglomerates, historically speaking, have actually ended up underperforming expectations on the basis of the sum of their parts. It’s unclear if this is what will occur with Match Group, but the stop in revenue growth and a dip in overall operating profits are red flags as to this.

While it can make cash just continuing to operate, the company has not issued a dividend in order to pay this back to shareholders. It will likely continue to acquire – if there is anything left to acquire. The prudent investor should ask themselves if Match Group can actually scale revenues organically with its portfolio. This would require peeling back the complex onion that is this company, and at first glance I am frankly skeptical – otherwise the YoY performance this past quarter would not have been so poor.

The online dating space is a competitive and fickle one, with low switching costs for users going across different apps. Additionally, the pandemic era has ended, and that has been made apparent with the financials underlying this security. The jury is still out on this stock, but I am going to go with my gut and call Match Group a sell.

Be the first to comment