akinbostanci/iStock via Getty Images

Online travel agencies (OTAs) revolutionised and digitalised the travel and lodging industry. Expedia Group, Inc. (NASDAQ:EXPE) is one of the OTA giants that disrupted the fragmented industry and grew into a multibillion-dollar business quickly by providing a hybrid solution acting as a merchant, travel agency and advertising platform. Long-term shareholders have been rewarded with returns of 349.32%.

Stock Trend since IPO in 1999 (SeekingAlpha.com)

Today things are not looking as rosy for this stock. Expert groups such as Wolfe Research advise investors to stay away from online travel stocks, downgrading their ratings from a Hold to Sell status. Solid Q3 results last month did nothing to improve the negative sentiment, and we have seen the stock drop 48.43% in value since the start of the year. Although cautious of the implications of a forecasted macroeconomic slowdown, if we compare EXPE to its fellow peers, Booking (BKNG) and Airbnb (ABNB), there is value in maintaining a Hold status for this stock for the time being at a price well below its target estimate of $128.96.

Overview

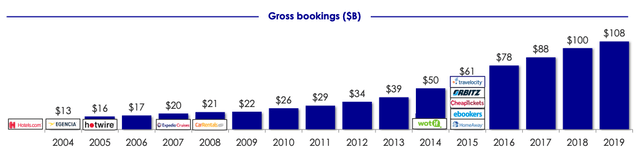

EXPE has a short but eventful history. Starting as an online travel booking website by Microsoft (MSFT) in 1996, it has grown its travel portfolio through acquisitions. A successful IPO in 1999 began the growth journey, but until recently, the company focused on expanding rather than unifying the different entities and, thus, not benefiting from scaling up.

Acquisitions (Investor Presentation 2022)

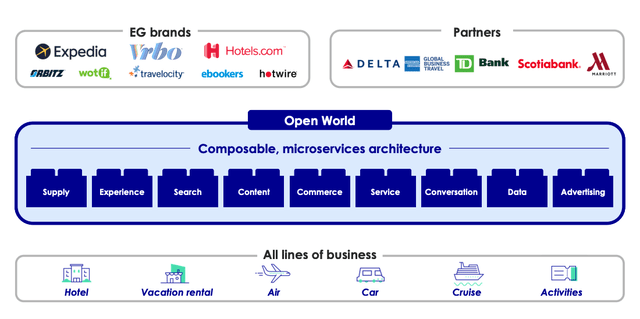

During the financial crisis of 2008, EXPE’s performance was immediately impacted. However, online travel reached record numbers shortly after the economic downturn. In 2011 Tripadvisor was spun-off from EXPE and became its entity and competitor. Below we can see the brands that the company has today and the diversified lines of business that the company is part of.

Brands and Business Segments (Investor Presentation 2022)

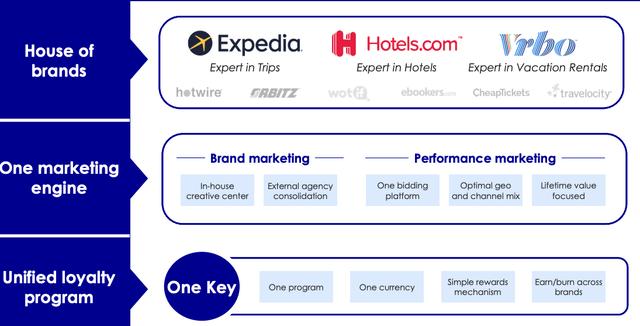

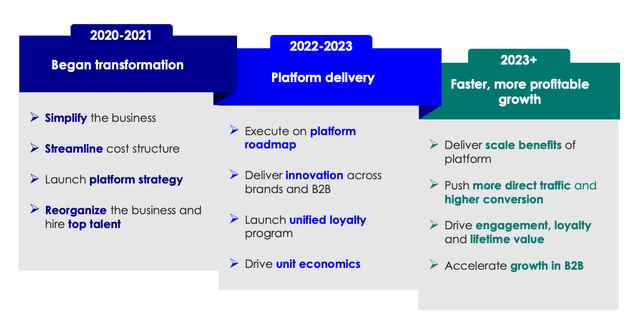

Since 2021 it has moved from a company with many separate businesses working to a more unified approach through one platform, one marketing engine, and a unified loyalty program focused on increasing customer lifetime value, for which I believe the benefits will be seen in the coming future.

Unified Platform (Investor Presentation 2022)

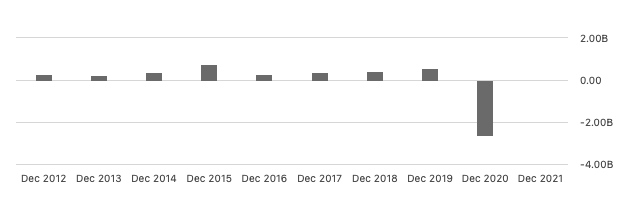

After many consecutively profitable years, the company made significant losses of $2.61 billion in the COVID pandemic filled 2020.

Annual net income (SeekingAlpha.com)

Its main revenue streams are from Retail which contributed 79% to total revenue in 2021; B2B, which contributed 17% and Trivago, the European headquartered majority-owned hotel metasearch, which accounted for 4% of its total revenue in 2021. The company works as a merchant (64% of revenue in 2021), an agent (27% of revenue in 2021) and an advertiser (27% of revenue in 2021).

Financials and Valuation

The company produced positive top and bottom-line results this year and in its most recent third-quarter financial performance. However, we have also seen the company lose market share and maintain smaller profit margins. Last quarter EXPE produced revenue of $3.62 billion, a year-on-year increase of 22.3%. This was mainly due to the rise in revenue from Trivago, Retail and B2B business segments. The adjusted EBITDA increased by 18% compared to 2019 to $1.1 billion.

The third quarter showed that customers booked 81.6 million room nights versus an actual 93.2 million stayed room nights. The gross bookings were worth $23.99 billion, an increase of 28% compared to Q3 2021. The reason for this is the recovery the industry has experienced regarding travel products, especially lodging, air, and other demand has recovered.

The company had a negative free cash flow of $1.2 billion, which means it could not cover expenses from operating revenues alone. However, this was an improvement year on year by $200 million and was influenced by the seasonality of the business. There is a positive cash flow of $3.1 billion, double what it was in 2019.

If we look at the balance sheet, the company has a healthy liquidity of $7.1 billion for future business operations. The company has also paid off $3.4 billion in debt in the last eighteen months. Due to the increased flexibility, the company purchased $200 million worth of shares in October and an availability of 21 million more shares for future repurchases.

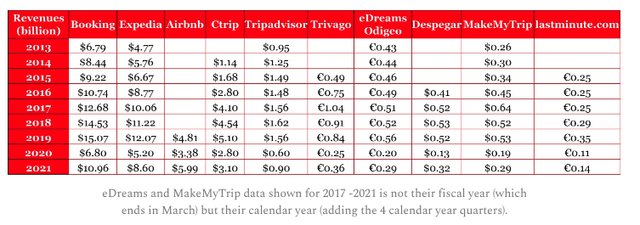

It is interesting to compare EXPE to two other giants, BKNG and ABNB, which account for 82% of revenue in a study of 10 publicly traded online travel agencies.

10 Companies annual revenue (traveltechessentialist.substack.com)

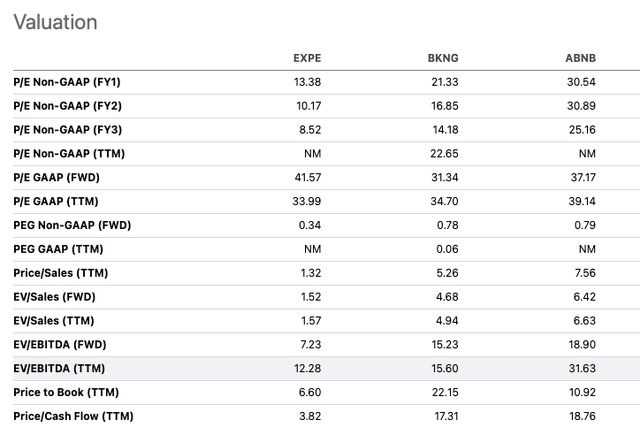

If we look at the relative valuation between the companies, we can see that EXPE is undervalued on several ratios. What keeps EXPE attractive is that its stock price is well below BKNG, which is valued at $2,048.96 per share and is underrated if you compare it to ABNB, has a Seeking Alpha Quant rating of D, compared to an A- for EXPE and a much lower price to equity ratio of 13.38 versus that of BKNG at 21.33 and ABNB at 30.54.

Relative Valuation (SeekingAlpha.com)

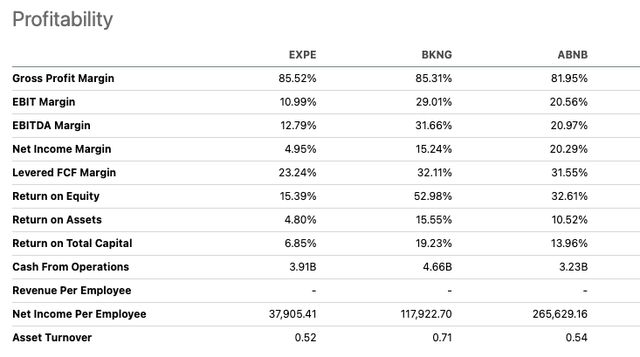

If we zoom in on the profitability, we can see that EXPE has a much lower EBITDA margin of 12.79%, a very low-income margin rate which could be better if we compare it to the higher rates produced by its peers. However, the company has invested in unifying its platform, which should improve costs and efficiencies.

Profitability comparison (SeekingAlpha.com)

Final thoughts

The Great Recession heavily impacted EXPE; however, the pain was short-lived, and it came out of the experience with record bookings once the economy started to recover. We have yet to feel the full force of a macroeconomic slowdown forecasted for 2023. However, negative sentiment is already taking over the market. The company is also losing market share, decreasing margins and not growing as quickly as its peers, BKNG and ABNB. Although EXPE may lack innovation and is slower in growth, on a relative peer valuation, EXPE is well positioned and undervalued. Furthermore, it is addressing increasing its profit margin through its unified approach to the platform, advertising and increasing customer value through a unified loyalty program. For this reason, I recommend a Hold status.

Be the first to comment