imaginima

(Note: This article appeared in the newsletter on August 13, 2022 and has been updated as needed.)

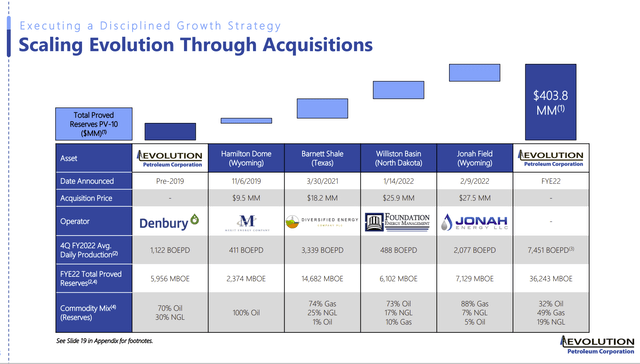

Evolution Petroleum (NYSE:EPM) has been on a shopping spree since about 2019. That shopping spree accelerated when the operator of the main asset, Denbury (DEN), ended its own financial challenges by emerging from bankruptcy.

The latest shopping spree diversified the company to lessen the dependence upon the main asset. It also raised fears of the riskiness of expanding two rapidly. The coming annual report should put an end to such concerns. Management already gave an update showing a much better net debt picture than expected. That net debt picture will continue to improve materially.

Preliminary Results

The biggest risk avoidance strategy was the purchase of interests in projects by established operators. Rapid growth is far less risky when the only work expanding is in the accounting department.

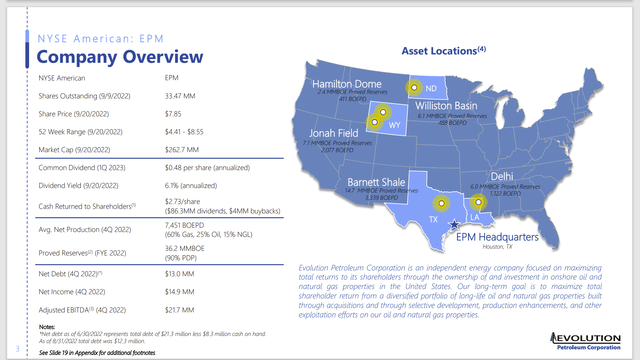

Evolution Petroleum Map Of Operations And Net Debt Update (Evolution Petroleum September 2022, Corporate Presentation)

The net debt figure was definitely a big positive surprise for any investor following the announcements about interests acquired. Some of this was due to the acquisition timing. Clearly the acquisition of the Hamilton Dome in 2019 and the Barnett Shale not long after provided quite an earnings boost compared to the assumptions at the time of the purchase. Short of a major malfunction on the part of management, those two purchases had to be “home-runs” in the current environment.

The other consideration is that management has long made a very strong financial position a priority. It should therefore be no surprise at all that management will likely eliminate the debt as fast as possible. This is a relatively high-cost operator. Therefore, no debt is probably the “way to go” just in case production needs to be shut-in while waiting for a commodity price recovery in the future.

This points out that one of the best times to grow a cyclical business is at times when the outlook is the worst because it is very hard to overpay during those time periods. The Barnett Shale, for example is known for its natural gas production. There is absolutely no way anyone saw the current level of natural gas prices at the time of the purchase.

Purchase Details

This is a business where one should diversify purchases because it is so hard to tell which purchase will pay off quickly in the future.

Evolution Petroleum Schedule Of Acquisitions Made (Evolution Petroleum September 2022, Corporate Presentation)

Purchasing non-operated minority interests is a good way to build cash flow because the market for these interests is limited. Therefore, even in good times the prices are usually below (sometimes far below) a controlling interest. Normally the only entity interested in these types of interest is the operator and that is not real often.

So, trading or selling these interests eventually is probably not a real good strategy. Instead, this type of purchase is good for building cash flow to get the company to a size where it may either attract a buyer or decide at some point to operate its own project.

As far as successes go, clearly the first two acquisitions made after 2018, are very likely to be long-lived assets that have paid back. That is very unusual for this type of purchase even though it is often a goal.

The market will worry that production has climbed well past 100% increase. But the non-operated nature of the purchases combined with the high predictability of secondary recovery operations (relatively speaking) both reduce the risk. That means that Evolution Petroleum continues to engage in projects that are not personnel intensive as it is not the operator of any of these projects.

Net Debt

One of the big keys that this program of acquisitions will prove successful is the unexpectedly low figure of net debt shown above compared to the amount spent on purchases. This was a debt free company with a decent cash balance before all the purchases. It is very clear that management is heading towards a negative net debt position as fast as possible.

Management noted that they paid another $9 million of debt after the fiscal year end to get to a net debt figure of about $12 million. That makes the goal to repay the outstanding debt fast very realistic. This management used financial leverage at the right time (the beginning of the industry recovery cycle) and is now deleveraging fast.

The oil and gas industry has very low visibility. Evolution Petroleum engages in production that has relatively high costs. The regular upstream crowd has the lowest average production costs. Companies like Evolution Petroleum endure higher costs to make a profit after the “regular” companies no longer achieve sufficient profitability.

Therefore, many secondary recovery operations have no debt to offset the higher operating costs. This kind of operation may have to shut down during periods of weak commodity prices to reduce losses. The company then lives off hedges (if any) and its cash balance until that cyclical recovery arrives. This situation describes a far more volatile profit situation than is the case for much of the upstream. Still, conservative operators often can make “a good living” from the higher cost operations with a higher level of care and focus.

The Future

Evolution Petroleum has been through a lot of tough times for such a small company. The issues with Denbury before it finally filed for bankruptcy alone would have been tough on many managements. Making matters more challenging is the fact that for years, the Denbury operated asset was the only asset in the portfolio. Overcoming those kinds of challenges is the sign of darn good management.

The management made the Hamilton Dome and Barnett Shale acquisitions at would appear to be darn good times in the industry cycle. The ability to repay the debt associated with the acquisitions is a huge plus because secondary operations tend to be high cost.

The overall profitability of each purchase will be evaluated in the future because there really has not yet been enough time to grade management on all of them. But it is apparent that both the Hamilton Dome and the Barnett Shale acquisitions have excellent recent histories compared to the purchase price. The ones made after that are mostly opinions until there is a few more years of history since the purchase.

This particular operator is risky because of the debt as well as the small size of the operation. The focus on secondary recovery probably makes this small operator less likely to be acquired. The key person is likely to be one of the founders who is Chairman of the Board. Missing him for any reason is likely to prove crucial to the future of the company.

Management did report record earnings for the fiscal year and a big jump in cash flow. However, this same management is getting ready for the next cyclical downturn by repaying debt and rebuilding the cash balance.

But the actual operations as they are now, are low risk highly predictable operations run by established operators. The main risk is the productivity of decisions made by the climbing cash flow combined with any financial leverage. As was previously discussed, the best financial leverage for a secondary operator is probably zero combined with a decent cash balance.

Evolution Petroleum has a very good chance to repay all the debt in the current industry environment. But this is a low visibility industry. So, there is some risk to that assumption.

Nonetheless, for those who can afford the risk, this small operator has some very experienced people in management. Those employees have overcome some challenges that would have proved daunting to other managers. So, this issue can be considered by those willing to accept a company situation like this one as it is likely to prove rewarding on a risk adjusted basis.

Be the first to comment