gorodenkoff/iStock via Getty Images

In his recent paid newsletter, Mr. Pancake of Pancake Worldwide Capital Strategic Investment Solutions advises clients of a burgeoning risk of surging dividend yields due to falling stock prices. We are sitting here today with Mr. Pancake to get his take on current market conditions.

Interviewer: Thank you for being here with us today, Mr. Pancake.

I.P.: Thank you. It’s a pleasure to be here.

Interviewer: As you are probably aware, global equities markets have been in a steady downward trend since the beginning of the year. With the Dow Jones now in bear market territory and dropping, what would you say investors should be most worried about today?

I.P.: I’m glad you asked because the problems we starting to see in the stock market today are almost guaranteed to get far, far, far worse in the years to come. Why? I can answer that with just one word: compounding.

Interviewer: can you explain that for us?

I.P.: Yes. What we are starting to see today is that falling stock prices are resulting in rapidly rising dividend yields. What that means is that investors who reinvest dividends or add new capital to their portfolios today are increasing the risk that they could end up earning far greater portfolio income in the future.

Interviewer: So you are saying that now is a particularly dangerous environment for investors to navigate?

I.P.: Absolutely. You see, in today’s market, investors need to wage the battle against rising income on at least two separate fronts. First off, many stock investors continue to experience an onslaught of dividend increases even in spite of falling stock prices. Look at Microsoft (MSFT), for example. Here we have a company that just announced a plan that is going to saddle their investors with a dividend that is almost 10% HIGHER than it was only last year! That means MSFT investors now are caught between a rock and a hard place. On the one hand, they are getting paid MORE dividend money to reinvest back into MSFT stock while on the other hand, they’ll be doing so at today’s lower stock prices. And you can see the problem with that, right?

Interviewer: you mean higher dividend yields?

I.P.: EXACTLY. Higher yields today multiply the risk of exponentially higher portfolio income in the future. And the further out in the future we’re talking about, the worse it gets. We call this sort of income death spiral “runaway portfolio income growth” risk… or “runaway P.I.G. risk” for short.

Interviewer: That sounds ominous.

I.P.: ummm hmmmm.

Interviewer: Is MSFT the only “Runaway P.I.G.” that your firm is tracking?

I.P.: I wish. Unfortunately, our fund has been hammered particularly hard this month with multiple dividend increases. For instance, Starbucks (SBUX) just hiked dividends by over 8%. Then we have Honeywell (HON) with a 5% increase announcement, and Lockheed Martin (LMT) just this past week with a 7% increase. And with the stock prices for these names dropping this month, we are not willfully blind to the risk of exacerbating those dividend increases by reinvesting savings into even more shares.

Interviewer: So how do you limit your exposure to “Runaway P.I.G.” risk? Any tips for our audience?

I.P.: Well, the first step is obviously the easy step. Never reinvest dividends, or at least keep your dividend reinvestments to a minimum if possible. Second, avoid owning dividend-paying stocks in the first place. Third, be on the lookout for stocks that could pay dividends in the future. Most important of all: avoid any “dividend red flag” companies.

Interviewer: Can you give an example of a “dividend red flag?”

I.P.: Certainly. One example of a classic dividend red flag could include a corporate history of consistent and rising dividend payments. If they’ve paid a dividend once, it’s probably delusional to hope that they won’t do it again.

Let me come back to MSFT as an example. Here we have all the classic signs of a dividend red flag. First of all, the company has AAA rated debt, so unfortunately, we’re talking about a company that is even more creditworthy than the government United States of America. You know that lower debt payments mean more money for equity investors, which is a glaring dividend red flag right there.

Then you have to look at their dividend track record. 18 years without one single reprieve from dividend payments according to Seeking Alpha and worse still, the company only pays out 27.84% of their earnings as dividends. The pressure to raise dividends can become so severe that dividend increases become almost inevitable.

Interviewer: So you think MSFT is a potential “Runaway P.I.G.” situation?

I.P.: Ha ha. Yeah, well the one thing MSFT does have going for it is a relatively low yield of 1.15%, so I guess you could call it maybe a risk of becoming a “Runaway PIGlet.” Even so, investors who are risk-averse when it comes to income growth should be extremely cautious about owning a company like MSFT for the long-term. Especially at today’s prices. But don’t ignore the big picture because if the stock market drops further… which it might… the income growth risk is only going to keep going up due to the higher dividend yields.

Interviewer: Good point. So you want to avoid reinvesting dividends and also avoid owning companies with both high current yields and high dividend growth. Do you have any tools to help investors visualize their dividend growth risk?

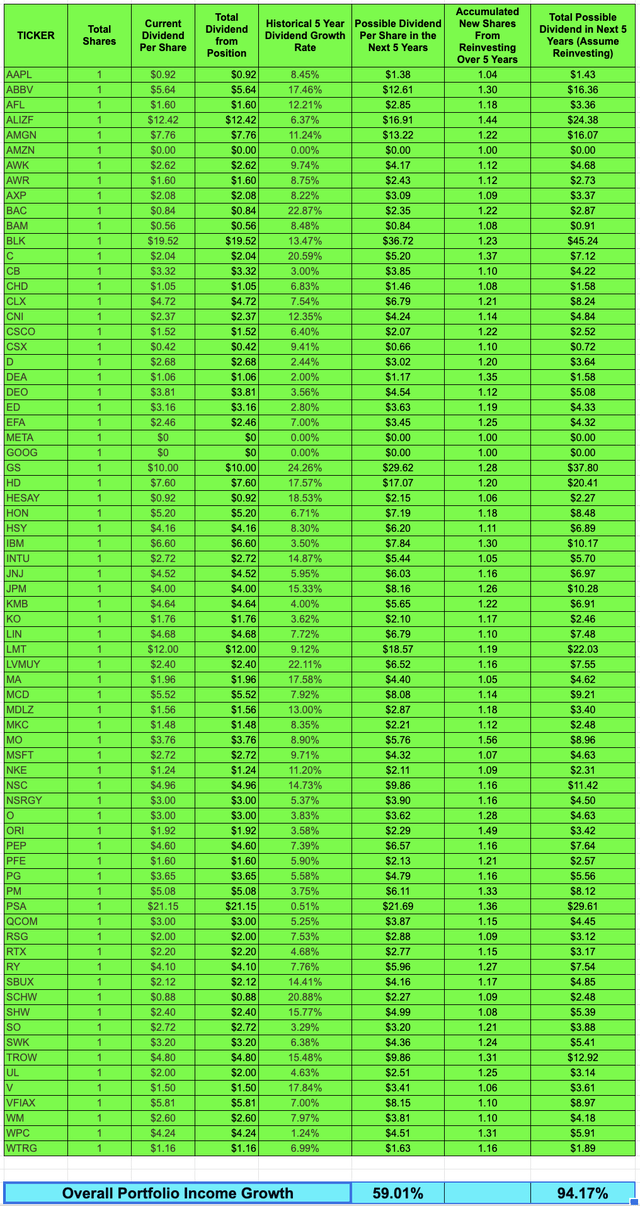

I.P.: Sure! Here is a spreadsheet that lists all the companies that I currently own. I input the ticker symbols, my total shares, the current dividends per share and the historical dividend growth rate for each company (which I can find on Seeking Alpha). The spreadsheet then calculates what my future portfolio income could be in 5 years if companies raise dividends at the growth rates I’m assuming.

You can see here that if I owned just one share of each company, my future portfolio income in five years would be 59% higher than it is today. So that’s something I’m obviously very worried about.

Author’s Stock Positions (Google Finance)

But you can also see what would happen if I were to reinvest all dividends from each company back into more shares over a five-year period, assuming today’s stock prices (which the spreadsheet automatically updates). In that case, my portfolio income would grow by over 94%!!! Obviously, the further down the market crashes today, the worse and worse that income growth risk gets in the future.

Interviewer: That’s a sobering thought.

I.P.: … It sure is. The ephemeral day-to-day noise and hubbub of the stock market can really distract investors from the longer-term risks that they’re facing when it comes to portfolio income growth – especially if they’re reinvesting dividends or otherwise adding capital to their portfolios today. That’s why I created a free spreadsheet that investors can use to input their own portfolio data and measure the “Runaway P.I.G.” risk lurking in their portfolios. If that doesn’t convince you that the real risk of falling stock prices is out-of-control future portfolio income, maybe nothing will.

Interviewer: There certainly are a lot of reasons why investors should be nervous about stock prices in this bear market. Thanks for coming into the studio today.

I.P.: It’s always a pleasure.

Interviewer: … and now, back to local weather after a short commercial break.

Be the first to comment