GaudiLab/iStock via Getty Images

Investment Thesis

ZoomInfo (NASDAQ:ZI) sees the stock slide after hours as investors didn’t welcome the fact that ZoomInfo’s growth rates are slowing down to approximately 30% CAGR.

That being said, I strongly believe that the market has overreacted here to what is more likely than not some measure of being conservative with its guidance.

Also, keep in mind that ZoomInfo’s balance sheet has a net debt position of $800 million. But given that it’s so highly profitable, this means that its balance sheet still has ample flexibility. Particularly given that its debt’s maturity isn’t due for several years.

I maintain my buy rating on this name. Paying 35x earnings for a company that is already so profitable and still growing at such a fast clip, even in this macro environment, is a very fair valuation.

What’s Happening Right Now?

The theme that has been happening throughout this earnings season is that companies either have to impress against analysts’ expectations and will get a pass. Or otherwise, they fail to impress investors’ and analysts’ expectations, and the stock gets hit hard.

And that’s exactly what happened here with ZI.

ZoomInfo now bolsters more than 235 million business-to-business (”B2B”) professional profiles. A substantial proportion of ZoomInfo’s customers are large enterprises. In fact, it’s worth highlighting that one new customer in the quarter signed up for a $1 million contract.

This shows, beyond doubt, that ZoomInfo’s platform of contacts, prospects, sales engagement, and account-based marketing are evidently worthwhile paying for.

Revenue Growth Rates Slow Down

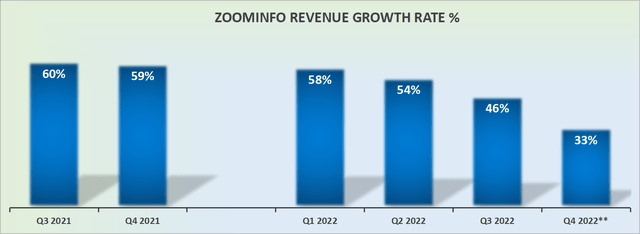

ZI revenue growth rates

Now onto some bad news. ZoomInfo is yet another company that is rapidly decelerating its revenue growth rates into the Q4 quarter.

This is the same theme that has been percolating throughout the market for several weeks now.

The market is rapidly bifurcating between companies that are now perceived to have ”over earned” last year and those that are going to remain resilient as the economic environment slows down.

What companies are still thriving? And what companies are seeing sales cycles elongate?

I ponder, could tech take a back seat to energy in the coming year too?

The Crown Jewel, EPS Figures Get Downwards Revised 15%

The bull case for ZoomInfo zeroes in on its profitability profile.

Indeed, for Q4 2022, ZoomInfo’s non-GAAP operating margins are expected to reach 41%, a 200 basis points increase compared with Q4 of last year.

Also, ZoomInfo upwards revises its midpoint Q4 EPS figures by approximately $0.04.

Yet, investors wanted more.

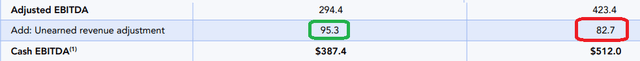

ZI Q3 2022

If I were to be particularly attentive, I would make the case that unearned revenues are down for the trailing twelve months (red box for 2022, compared with the green box for 2021).

When questioned on the call about billings or unearned revenues, this is what ZoomInfo’s CFO Cameron Hyzer stated on the call,

I think particularly if you’re looking at bookings growth and billings growth for that matter, you need to adjust for the acquired RPO [remaining performance obligations] and acquired unearned revenue in Q3 of last year. RPO as an example, was close to $24 million of acquired those acquired in Q3 of 2021, it needs to be adjusted for. And billing similarly, I get a number that’s closer to 30% when I adjust for those things overall.

However, I don’t believe that’s a thesis breaker. Yes, ZoomInfo isn’t going to be growing much faster than 30% CAGR for now, but the stock isn’t that expensive when all this is considered.

ZI Stock Valuation – 35x Next Year EPS

If we take analysts’ EPS estimates at face value, the stock is now priced at 35x next year’s EPS.

That being said, we know that in 2022, ZoomInfo is likely to make approximately $0.84 per share.

Hence, even if we factor in the total number of shares outstanding increasing by 15% y/y in 2023, next year ZoomInfo’s EPS figures should reach approximately $1 of EPS, with ease.

Altogether, I believe that it’s very likely that ZoomInfo’s 2023 EPS reaches more than $1.00.

If we consider that not only the business is growing at a rapid clip on the top line, but that it’s clearly profitable, I don’t view paying 35x forward EPS as all that expensive.

The Bottom Line

The stock isn’t that expensive, with investors overreacting to its lackluster guidance. If were to surmise investors’ reaction here I would have to say that investors are now coming to the realization that despite the illusion that many companies in tech were secular growth stories, it turns out that the secular growth companies are fewer and farther between than we all previously realized.

That being said, I don’t believe that it’s justified that ZoomInfo’s stock is presently hovering around $35.

The worst outlook here is that ZoomInfo is ”only” going to be growing at 30% CAGR. That isn’t so bad.

Be the first to comment