Drew Angerer

EVgo, Inc. (NASDAQ:EVGO) is one of the leading DC fast charging network operators in the US. As of Q3 ‘22, it operates 2,115 DC stalls in the US, up 32% year over year on a comparative basis. Although it is still losing money, the company’s revenue increase appears to be sustainable, as seen by its expanding Active E&C Stall Development Pipeline. This puts EVGO in a good position to benefit from the ongoing adoption of electric cars.

EVGO ended the quarter with growing revenue and new commercial partnerships. It continues to provide convenience that translates to its growing customer base. EVGO is trading around its logical support and below my estimated fair value, making it an appealing long-term prospect.

Company Overview

EVgo completed the quarter with $10.5 million in revenue, up from $6.2 million in the same quarter last year. Charging revenue from retail customers remains the bread and butter of the company which generates $5.176 million, up from its $3.203 million recorded in Q3 ‘21.

The company will continue to benefit from its long-term tailwinds from growing the Mobility as a Service (MaaS) market and from the Inflation Reduction Act (IRA) of 2022, which is aimed to accelerate EV adoption in the US. There is no wonder why the management remains confident, providing a total revenue outlook of between $48 million and $55 million, up from the $22.2 million recorded in FY ‘21.

EVGO has nearly hit another milestone, with over 498,000 customers, up from 340,000 in Q4 ’21, thanks to its growing DC fast charging stall and improving services such as its newly launched Autocharge+ which enhances customer experience. Additionally, the company remains attractive, particularly given its expanding operating footprint and its growing charging stalls target, as shown below.

Additionally, we expanded our existing site footprint at several large grocery chains, including Kroger, Safeway and WinCo. We also energized the first of many sites in development at Target, which are now available on the EVgo app and PlugShare.

The addition of new national retail site host partners in the home improvement, grocery and restaurant sectors, complemented by deepening engagements with a number of our existing portfolio partners has significantly increased EVgo’s pipeline for station locations at every corner of the U.S.

In fact, when we overlay specific store locations of these well-known brands with EVgo’s own proprietary network planning tool that accounts for the numerous vectors that make charging infrastructure pencil, we’ve added nearly 10,000 potential charging stalls that pass our internal investment hurdles today and could be added to EVgo’s development pipeline. Source: Q3 ‘22 Earnings Call Transcript

According to the management’s 2023 target, they intend to have between 2,800 and 3,100 DC fast charging stalls in operation or under construction.

Electrifying America

Another point of interest is EVGO’s partnership with MHX, LLC, a logistics operator in California, which aims to electrify its electric heavy-duty trucks. They have a new commercial partnership, as quoted below.

The key to winning the land grab for charging infrastructure is site control, where we secured multiple new agreements with national brand names, which will provide EVgo with access to high-quality properties in prime locations across the U.S. among these is our agreement with Home Improvement powerhouse Lowe’s. Source: Q3 ‘22 Earnings Call Transcript

On top of this, EVGO started to benefit from its General Motors LLC (GM) and Pilot Travel Centers LLC (“Pilot Company”) partnership, which brings its active E&C stall development pipeline to 4,534 stalls, up from 2,494 recorded in Q3 ‘21. EVGO is trying to strengthen its competitive advantage with its new Connect the Watts™ program which aims to bring awareness and speed up EV adoption. This could further enhance the company’s Ancillary revenue, EVGO’s digital software-driven solutions, which totaled $2.777 million this quarter, up from $1.104 million in Q3 ’21.

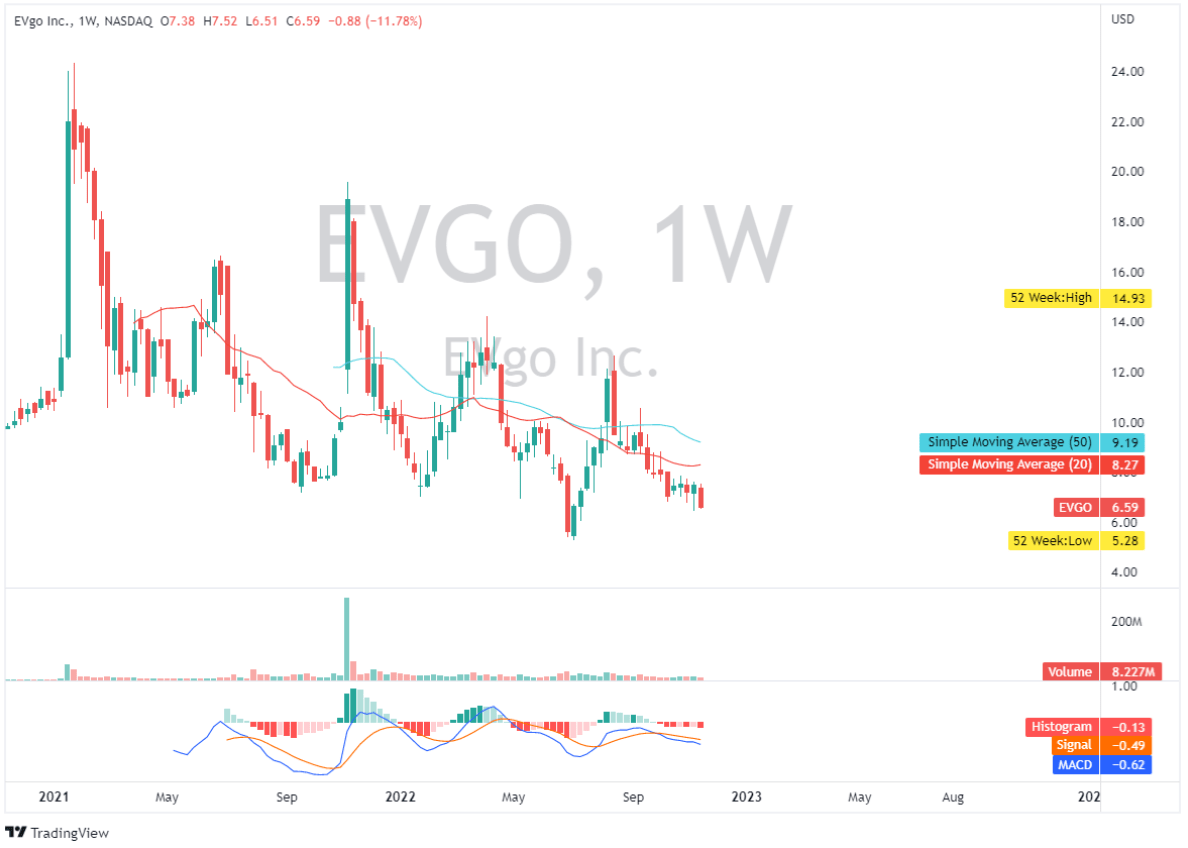

Trading Near Potential Support

EVGO: Weekly Chart (Source: Author’s TradingView)

EVGO is trading below its simple moving averages at the moment. Observing its MACD indicator, which is now below the zero line and below its -0.49 Signal Line, we may anticipate the presence of bearish pressure. If this occurs, its last swing low at $5.30 might serve as support. A breach of its 20-day simple moving average might indicate that bears have been exhausted and that the price is about to record an upward momentum move. A probable crossing of its MACD will also attract the attention of prospective bulls.

Attractive Upside Potential

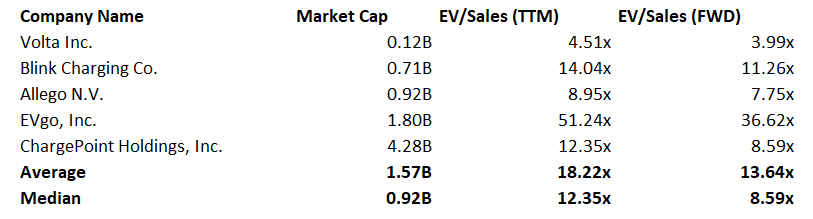

EVGO: Relative Valuation (Source: Data from Seeking Alpha. Prepared by the Author)

Volta Inc. (NYSE:VLTA), Blink Charging Co. (NASDAQ:BLNK), Allego N.V. (NYSE:ALLG), ChargePoint Holdings, Inc. (NYSE:CHPT)

Since EVGO does not yet have positive EBITDA and net income, I will only utilize the EV/Sales multiple to value the company. As seen in the image above, its multiple is larger than that of its competitors. It trades at a trailing multiple of 51.24x, which is much higher than the average peer multiple of 18.22x. Considering its 67.2x 2-year average and its forward EV/Sales of 36.62x, it offers an appealing discount.

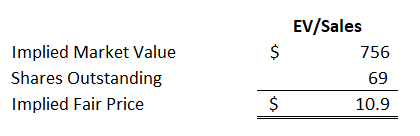

EVGO: Relative Valuation (Source: Prepared by the Author. Amounts are in Millions, except fair price)

To quantify our valuation, using an implied 13.6x EV/Sales and estimated revenue amounting to $48.14 million in FY ‘22, we can arrive at a fair price of $10.9, implying 65% upside potential as of this writing.

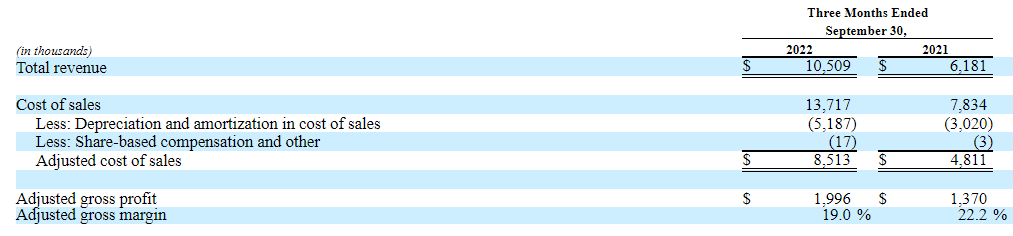

Pressured Margin

EVGO: Declining Gross Margin (Source: Q3 ‘22 report)

This quarter, EVGO had $1.996 million in its adjusted gross profit, down from $1.370 million on a percentage of revenue basis. According to the management, this is due to a seasonal impact of lower LCFS credit prices this year. Diesel costs are also expected to remain high in FY ’23, placing additional pressure on today’s LCFS credit pricing and, eventually, EVGO’s gross margin.

Additionally, uncertainties continue as the management provided negative adjusted EBITDA outlook amounting to -$85 million to -$80 million in FY ‘22. This outlook remains unfavorable compared to its -$51.37 million recorded in FY ‘21. According to the management, this decline will come from an increased labor force as they continue to expand and lower network throughput outlook of 42 gigawatt to 45 gigawatt hours compared to last guidance of 50 gigawatt to 60 gigawatt hours.

Conclusive Thoughts

Despite today’s margin pressure, the management remains confident that they will hit profitability at the right service volume. I believe that the long-term perspective of EVGO remains compelling due to its growing charging stalls and competitive digital presence.

EVGO has dilution risk; however, on the bright side, expanding further at this early stage of the EV charging market is reasonable.

With this in mind, after we file our third quarter 10-Q, EVgo is planning to file a prospective supplement to our recently filed S-3 in order to facilitate at-the-market sales of up to $200 million of our common stock. We plan to use the proceeds of this ATM program to opportunistically raise additional capital in order to take advantage of this robust and accelerating EV infrastructure sector.

Lastly, EVGO remains attractive due to its increasing total deferred revenue of $23.097 million, up from $3.982 million in FY ’21, showing a boost in demand, making this company an appealing long candidate.

Thank you for reading and good luck!

Be the first to comment