da-kuk/E+ via Getty Images

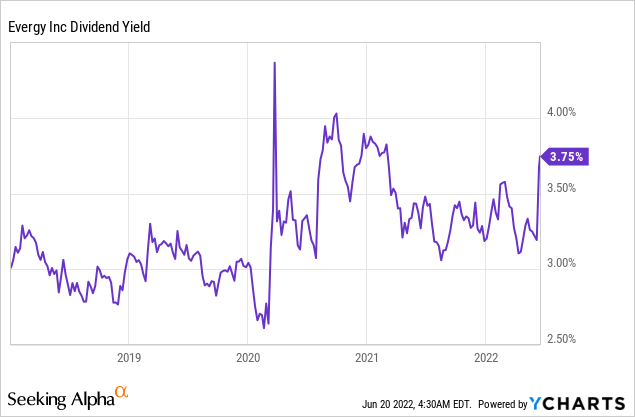

The stock market has entered into bear market territory this year due to the surge of inflation to a 40-year high and fears of an upcoming recession due to the aggressive interest rate hikes of the Fed. While this phase is painful for most investors, they should realize that it provides an ideal opportunity to initiate long-term positions in reliable dividend growth stocks at attractive entry points. Evergy (NYSE:EVRG) certainly fits this description. This high-quality utility, which enjoys a wide business moat and has raised its dividend for 17 consecutive years, is currently offering a nearly 10-year high dividend yield of 3.8%.

Business overview

Evergy is an electric utility holding company, headquartered in Kansas City, Missouri. Through its subsidiaries Evergy Kansas, Evergy Metro and Evergy Missouri West, it serves approximately 1.4 million residential customers, nearly 200,000 commercial customers and about 7,000 industrial customers and municipalities in Kansas and Missouri. The utility generates about half of its energy from clean energy sources and thus offers reliable energy, with less impact to the environment.

The subsidiaries of Evergy are fully regulated retail utilities in Kansas and Missouri and hence they enjoy one of the widest business moats investors can hope for. Moreover, thanks to the nature of its business, Evergy has proved rock-solid throughout the coronavirus crisis. While many companies saw their earnings plunge due to the pandemic in 2020, Evergy proved immune to the crisis. It was negatively affected by mild winter in both the winter and summer of that year, but it offset that effect with a drastic reduction of operating and maintenance expenses. As a result, it grew its adjusted earnings per share 7% in 2020, to a new all-time high.

Even better, Evergy has maintained its strong business momentum. In 2021, it grew its earnings per share by another 14%, to a new all-time high, primarily thanks to favorable weather and some tax credits. Moreover, in the first quarter of 2022, the utility enjoyed improved transmission margins and lower credit loss costs and thus it grew its earnings per share 6% over last year’s quarter, from $0.55 to $0.58, thus exceeding the analysts’ estimates by $0.03.

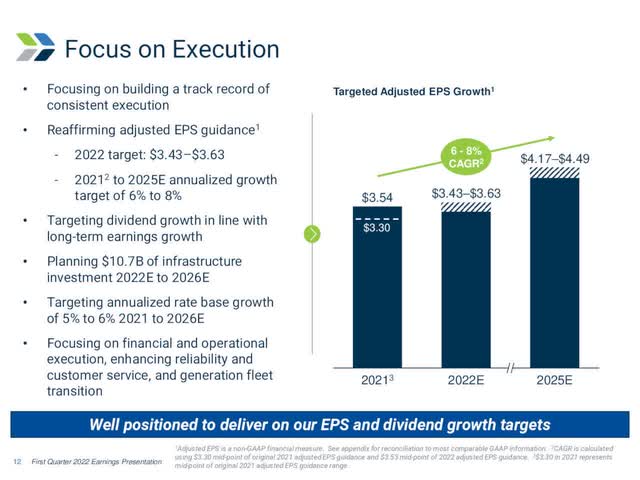

As management reiterated its guidance for earnings per share of $3.43-$3.63 this year, it is reasonable to expect the company to post essentially flat (record) earnings per share. On the other hand, the utility has exceeded the analysts’ earnings-per-share estimates in 6 of the last 7 quarters and hence one can reasonably expect the company to exceed the mid-point of its guidance. Analysts expect flat earnings per share of $3.54 this year.

Growth prospects

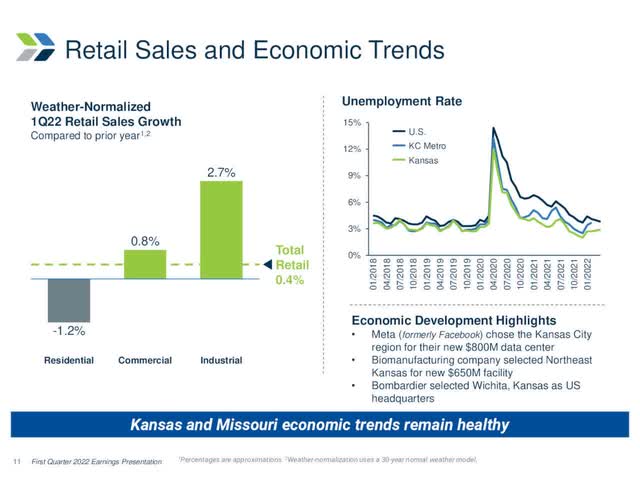

Evergy has exhibited consistent customer growth over the last decade. To be sure, the company has increased its customer count in almost every single quarter during this period. In addition, it benefits from the superior economic growth of Kansas, which has posted a lower unemployment rate than the average U.S. rate for several quarters in a row.

Evergy business model (Investor Presentation)

Thanks to the wide business moat it enjoys as a utility and the favorable economic characteristics of its markets, Evergy has consistently grown its earnings per share over the last decade, with growth in 8 of the last 10 years. During this period, the company has grown its earnings per share by 5.7% per year on average.

Even better, Evergy has accelerated its growth strategy in the last few years. According to its business plan, the utility intends to invest $10.7 billion in infrastructure until the end of 2026.

Evergy Growth Of Earnings And Dividend (Investor Presentation)

As this amount is 78% of the market capitalization of the stock, it is a clear signal that Evergy is heavily investing in its future growth. Thanks to this capital plan, Evergy expects to grow its rate base by 5%-6% per year and its adjusted earnings per share by 6%-8% per year until 2026. This is an undoubtedly attractive growth rate for a reliable stock, with a rock-solid business model in place. It is also important to note that management targets dividend growth in line with earnings growth.

Valuation

The surge of inflation to a 40-year high this year has imparted a double hit on several stocks. First of all, high inflation greatly increases the cost base of many companies and thus it exerts pressure on their profit margins. In addition, high inflation greatly reduces the present value of future cash flows and hence it exerts pressure on the valuation of stocks, especially high-growth stocks.

Fortunately for the shareholders of Evergy, inflation does not affect the earnings of the company, which can easily pass its increased costs to its customers, given the nature of its business. Consequently, the only effect of inflation on Evergy is on its valuation. However, the decline of this high-quality stock seems to be overdone.

Evergy is currently trading at a price-to-earnings ratio of 16.9, which is lower than its 10-year average price-to-earnings ratio of 18.2. On one hand, a lower price-to-earnings ratio than the historical average is reasonable, given high inflation. On the other hand, inflation will almost certainly revert towards the 2% target of the Fed in the upcoming years thanks to the aggressive interest rate hikes of the central bank. When that happens, the stock will probably be rewarded by the market with an expansion of its price-to-earnings ratio. It is also worth noting that the stock is trading at only 14.2 times its expected earnings in 2025.

Moreover, the current valuation of Evergy is attractive, given the reliable growth trajectory of the company. It is really hard to identify stocks with such a wide business moat, such reliable earnings growth and a price-to-earnings ratio of 16.9. Overall, those who purchase the stock at its current price are likely to be highly rewarded in the long run.

Dividend

Evergy has raised its dividend for 17 consecutive years and is currently offering a nearly 10-year high dividend yield of 3.8%.

The utility has a payout ratio of 63% and expects to grow its earnings per share by 6%-8% until at least 2026. In addition, it has a healthy balance sheet, with a BBB+ credit rating from S&P and Baa2 from Moody’s. As interest expense consumes only 30% of operating income and Evergy enjoys a wide business moat, it is obvious that the utility can easily deliver on its promise for 6%-8% average annual dividend growth until at least 2026.

To cut a long story short, investors are given a rare opportunity to lock in a nearly 10-year high dividend yield and enjoy meaningful dividend hikes for the next five years. Evergy has grown its dividend by 7.4% per year on average over the last five years and can easily continue raising its dividend at a similar rate for many more years. The next dividend hike is expected in November.

Final Thoughts

Most investors have been panicked by the onset of a bear market. However, this is an ideal period for them to purchase high-quality stocks at prices that are highly attractive from a long-term point of view. Evergy is offering a nearly 10-year high dividend and expects to raise its dividend by 6%-8% until at least 2026. Given also its rock-solid business model, which is as resilient to recessions as investors can hope for, Evergy has become a great bargain for value and income-oriented investors.

Be the first to comment