Guido Mieth/DigitalVision via Getty Images

Evercore (NYSE:EVR) is the world’s best independent investment bank. In the last decade, the financial sector has trailed the performance of the broad market. Economy-wide changes should lift class returns. As that happens, Evercore is well-placed to do well. Evercore’s business model is asset light. Growth is driven by human capital and Evercore has invested in its human capital, driving revenue growth and profitability. The company enjoys network effects, as its success with deals and its growing stature attracts more customers, with the company finding it easier to attract the marginal customer. The bigger Evercore gets, the easier it is to grow even bigger and more profitable. In addition, the company benefits from long-standing shifts in the industry that are driving customers to independent, focused firms. As with many financial firms, the company is deeply undervalued. The combination of these factors results in a large margin of safety for a wonderful company that investors should buy.

A New Era for Financials

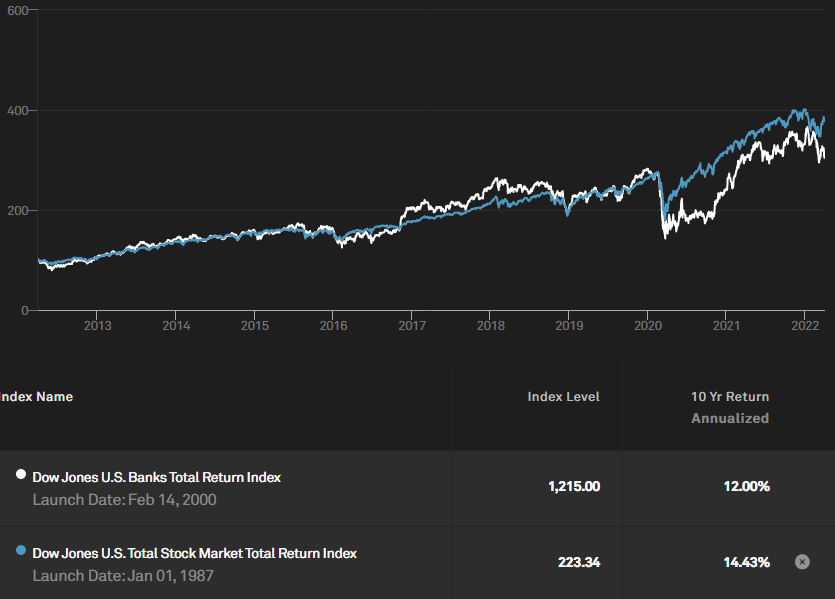

The last decade has been a period of significant underperformance by financials. In that time, the Dow Jones U.S. Banks Total Return Index gave investors an annualized total return of 12% compared to 14.43%. Much of that underperformance can be ascribed to the pandemic era, in which the shift to digital benefited tech companies, who dominate broad market indices.

Source: S&P Dow Jones Indices

Financials have struggled as interest rates have declined, bank regulations have enforced conservatism, banks themselves have worried that interest rates may rise -causing them to keep their powder dry, and financial disintermediation has made non-bank sources of capital even more attractive.

2021 is a momentous year. Inflation is back, and interest rates may, in the short run, defy an eight-century long trend toward declining real interest rates. Valuations of many banks are attractive in terms of potential rewards. Conditions are primed to see financials do better going forward.

An Asset-Light Business

Evercore operates through two business segments: Investment Banking and Investment Management. The Investment Banking segment comprises the global advisory business, and institutional equities services. The Investment Management segment conducts wealth management and trust services through Evercore Wealth Management L.L.C. and Evercore Casa de Bolsa, S.A. de C.V. in Mexico, along with investments in private equity firms. investment management in Mexico through., as well as private equity through investments in entities that manage private equity funds.

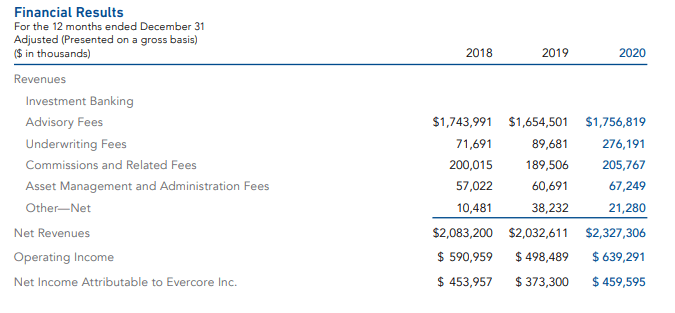

According to Evercore’s 2020 annual report, over the last 3 years, advisory fees made up an average of 80% of the company’s revenue.

Source: Evercore 2020 Annual Report

Advisory services require no significant outlay of capital to generate. Advisory fees are driven by relationships and consequently, the deeper the relationships, the higher the fees and as the network of relationships thickens and widens, so too do fees. All without a significant outlay of capital.

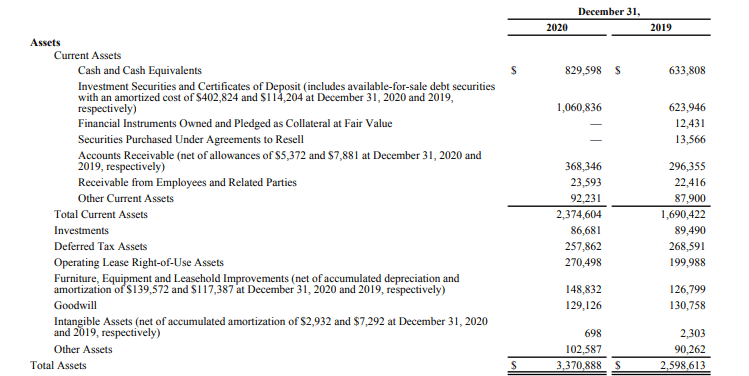

Source: 2020 Annual Report

Evercore’s Investment in Top Talent is Driving Future Profitability

Evercore’s key investments are in its people. Co-chairman and chief executive officer (CEO) Ralph Schlosstein executed an aggressive strategy of expanding his staff during the Great Recession, at a time when bulge-bracket firms were largely in retrenchment and diversifying due to regulatory pressure. Since then, Evercore’s focus on growing its brain trust has continued. In the 2017 to 2019 period, Evercore grew its staff by nearly 20%, or 300 employees. Evercore’s employees are some of the best in the business. Whereas a rival such as Moelis & Company (MC) focuses on hiring junior bankers, Evercore chose to hire the very best investment bankers.

This strategy has worked out, with revenue per senior managing director topping $15 million, the best figures in the industry. However, the consequence of that is that Evercore’s bankers enjoy stratospheric salaries. This year, the company gave its 1,950 staff members a 35% pay raise, which works out to just under $1 million each. Compensation is over 60% of revenues.

However, it must be noted that as recruitment continues, the company banks additional earnings capacity: as the company acknowledged last year, there is a lag between hiring and getting a new hire profitable, so we should expect last year’s hires to help the company achieve even greater profitability.

Getting Bigger Makes it Easier for Evercore to Get Even Bigger

The Banker named Evercore the best investment bank of Q3 2021. Global Finance has also named the New York firm as the world’s best boutique investment bank. The company has received similar praise in Asia. Evercore was also recognized by The Deal in its 2021 Deals of the Year Awards, being selected as Consumer, Retail Food & Beverage

Investment Bank of the Year, with three deals the firm advised on selected as winners, including for Deal of the Year.

What is the effect of this? Typically, investors tend to think of network effects in terms of tech firms, but the concept predates the tech boom and applies beyond tech. As Evercore’s reputation grows, it draws in more customers for its advisory services, as its success acts as a signal to potential customers.. The marginal customer becomes easier and easier to attract, at a diminishing cost to the firm. In other words, the bigger and more successful Evercore becomes, the easier it is to become bigger and more successful.

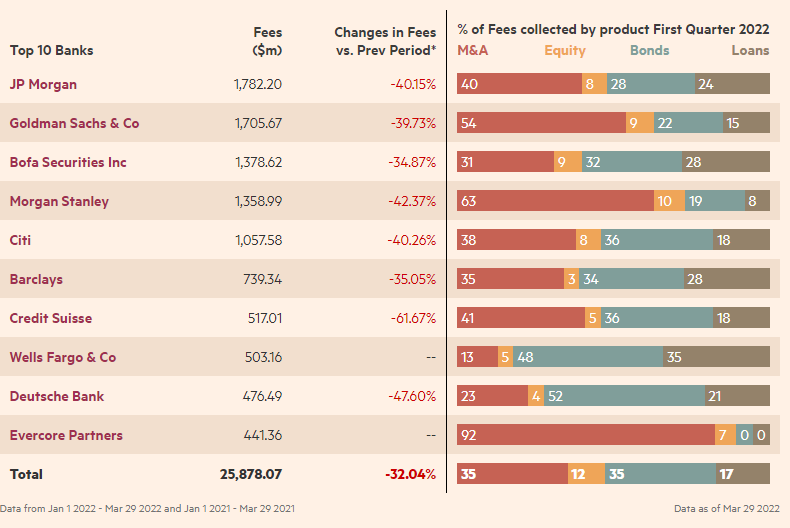

Evercore has been a success in drumming up business. According to the Financial Times, globally, the investment bank is the 10th largest in terms of advisory fees, behind such giants peers, J.P. Morgan (JPM), Goldman Sachs & Co (GS), Bofa Securities Inc, Morgan Stanley (MS), Citi (C), Barclays (BCS), Credit Suisse (CS), Wells Fargo & Co (WFC), and Deutsche Bank (DB).

Source: Financial Times

Throughout its life, Evercore has already advised on M&A deals worth over $2 trillion, with 1.7% of deal fees in the year-to-date.

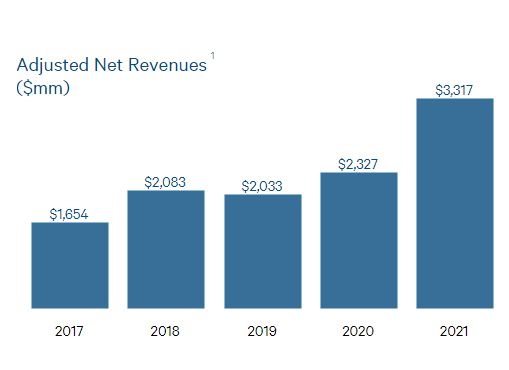

Size has only made Evercore stronger, and this is reflected in revenue growth from over $1.6 billion in 2017 to more than $3.3 billion in 2021, for a 5-year revenue compound annual growth rate (CAGR) of 14.93%.

Source: Evercore

Indeed, Evercore’s ability to grow sustainably is long-run. Since 2010, Evercore has grown revenues by a CAGR of 22%; grown net income from more than $8.9 million to over $840 million for a CAGR of 46%; grown earnings per share (EPS) from $0.94 in 2010 to $17.50 in 2021, for a CAGR of nearly 28%; grown adjusted operating margin from 17% to 34.3%.

Customers Are Looking for Independent, Focused Advisors

In addition, as major banks diversify their operations, for regulatory and financial reasons, they lose the specialization that clients need when looking for investment banks to help them with mergers & acquisitions (M&A), restructuring, and other issues. Furthermore, large, diversified banks still present risks to clients seeking investment banking services, risks in the form of agency problems and conflicts of interest. Indeed, when the company was founded in 1995 by Senior Chairman, Roger C. Altman, it was on the premise that clients would be best served having as their investment advisor, a company free of such conflicts of interest.

Valuation

Evercore offers such a large margin of safety that an investor does not have to think of a very complex model to value it. The best investments are those that are trading for such a discount to the market that a crude valuation is enough. The more precise a valuation needs to be, the bigger the risk that an investor has no margin of safety.

The company’s price-earnings (P/E) multiple is at 1.48, compared to its 5-year average of 2. The S&P 500’s P/E ratio is 26.02. Indeed, it can be argued that as a class, financials are so cheap that relative valuations are meaningless. The investor has to balance the obvious relative underpricing with firm qualities. In Evercore’s case, the firm has great firm qualities.

Conclusion

The company’s combination of asset-light business model, investments in human capital, network effects, and cheap valuation, makes for a very attractive proposition. The chance to invest in a firm that over a decade has grown at rates that tech firms, without paying the elevated prices of tech firms, is one that investors cannot pass up.

Be the first to comment