FreezeFrames

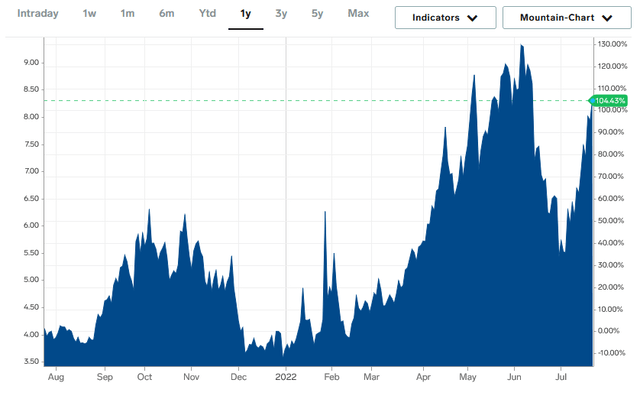

EQT Corporation (NYSE:EQT) is the largest producer of natural gas in the incredibly wealthy Appalachian region. This is overall a very good place to be as the demand for natural gas is likely to surge over the coming few decades, which may bring especially large benefits to American shale gas companies if the Western nations continue their sanctions against Russia. We have already seen the early stages of this rapidly emerging opportunity by looking at the increase in natural gas prices over the past twelve months. EQT’s investors have certainly benefited from this as the stock price is up a phenomenal 103.52% over the past year. The best may be yet to come though as the stock still looks to be dramatically undervalued at its present level. EQT has been benefiting from the high natural gas prices in other ways too as the company has been working quite hard to strengthen its balance sheet and reward the shareholders through share buybacks. Overall, there may be some very good reasons to add EQT to your portfolio today.

About EQT Corporation

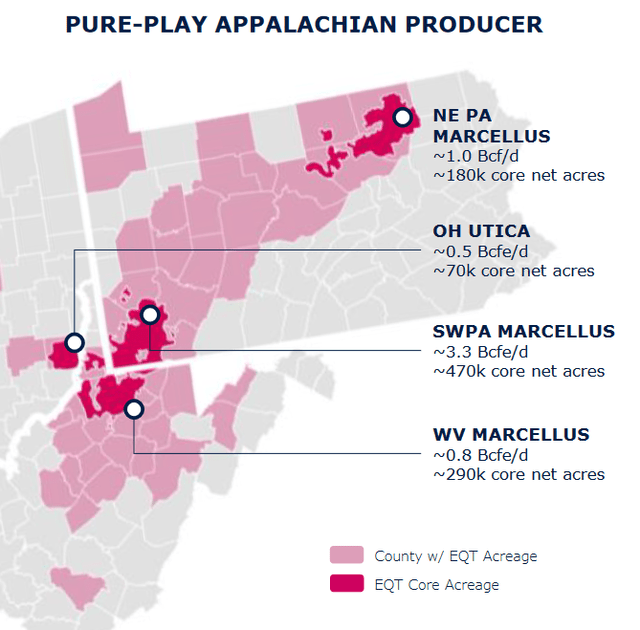

As stated in the introduction, EQT Corporation is an independent exploration and production company that produces natural gas and natural gas liquids in the Appalachian basins. In fact, EQT is the largest operator in the region, boasting 940,000 core net acres in West Virginia, Pennsylvania, and Ohio:

This is a very good place for a natural gas-focused company to operate as the Marcellus Shale is one of the wealthiest natural gas deposits in the world. According to the United States Energy Information Administration, the Marcellus Shale contained proved reserves of 148.7 trillion cubic feet of natural gas in 2015. As proved reserves only include the natural gas that can be economically recovered, there may be reasons to believe that the basin has higher reserves today as prices are higher now.

The incredible mineral wealth of the Marcellus Shale is reflected in EQT’s reserves. An energy company’s reserves are frequently overlooked by investors but they are critically important. This is because the production of crude oil and natural gas is an extractive industry. After all, a company like EQT literally obtains its products by pulling them out of reservoirs in the ground. As these reservoirs only contain a finite quantity of resources, the company must continually discover or otherwise acquire new sources of oil and natural gas or it will eventually run out of products to sell. As success of this task is by no means guaranteed, the company’s reserves essentially dictate the length of time that it can operate without enjoying success at acquiring new resources. As of December 31, 2021, EQT had proved reserves of 25.0 trillion cubic feet of natural gas equivalents. As the company expects to produce an average of 5.5 billion cubic feet of natural gas equivalents per day in 2022, EQT has sufficient reserves to operate for about 12.5 years without discovering or otherwise acquiring new sources of natural gas. This is a reasonable reserve life and it is quite a bit longer than many of the major oil producers possess so we can be fairly comfortable that EQT is built for the long term.

It is unlikely to be a surprise to anyone reading this that natural gas prices have increased substantially over the past year. Over the past twelve months, the price of natural gas at Henry Hub is up 104.43%:

This has certainly benefited EQT Corporation. As we can see here, the company’s free cash flow has generally increased dramatically over the past few quarters, especially relative to the levels that the company had prior to mid-2021:

| Q1 2022 | Q4 2021 | Q3 2021 | Q2 2021 | Q1 2021 | Q4 2020 | Q3 2020 | Q2 2020 | Q1 2020 | |

| Levered Free Cash Flow | 1,123.8 | (111.4) | 1,016.7 | 362.7 | 171.3 | 245.9 | 80.8 | 343.3 | 173.4 |

(all figures in millions of US dollars)

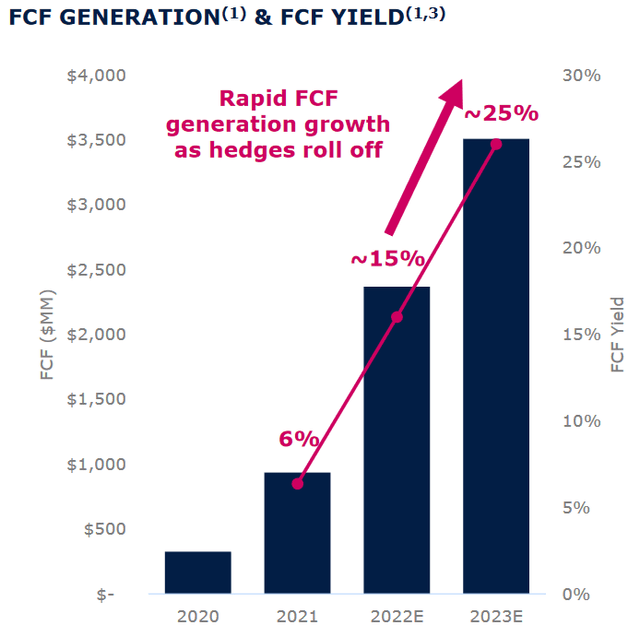

Unfortunately for EQT, these cash flows over the past few quarters are nowhere near as high as they could have been. This is because of the company’s hedging program. As is the case with many energy companies, EQT uses a variety of hedges (such as forward and futures contracts) to essentially lock in the prices that it obtains for its production. The company does this in order to aid its financial planning and manage its commodity price risk. However, many of its current hedges are actually set at prices well below the current market price for natural gas. We see proof of this in the fact that EQT only realized an average price of $3.18 per thousand cubic feet of natural gas equivalents in the most recent quarter, which was substantially below the average market price at that time. These hedges will likely continue to result in the company receiving a below-market price for the next several quarters since EQT has 45% of its projected 2023 production hedged at similarly low prices. The proportion of its production that EQT has to sell for these low prices will be decreasing over time though, which should allow it to grow its free cash flow over the next several years, assuming that natural gas prices remain static:

As we will see later in this article, the fundamentals for natural gas point to gas prices either staying around today’s levels or increasing going forward so there may be some reasons to believe that the above-outlined scenario will actually play out. Fortunately, though, EQT does not need natural gas prices to remain at today’s levels. This is because it only costs the company about $2.30 per thousand cubic feet of natural gas equivalents to produce the natural gas that it sells so even if prices were to decline by quite a lot, the company would still be able to operate profitably.

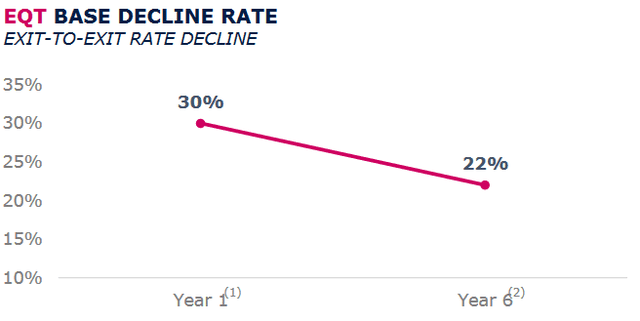

EQT has not been relying solely on natural gas price increases to drive its free cash flow growth. It has also been working hard to lower its costs, which will help it address one of the biggest problems with American shale resource production. That problem is an incredibly high decline rate. As I discussed in a previous article, it is not uncommon for a shale well’s production to be only 10% of its level when it was first drilled by the end of its second year. This problem essentially forces shale producers to continually drill new wells in order to simply maintain, let alone grow, their production. This is an expensive proposition. Fortunately, the decline rates of wells in the Marcellus Shale are not nearly that high, particularly in the core areas of Southwestern Pennsylvania and West Virginia. As we can see here, EQT’s wells see a much lower decline rate and are still producing a noticeable amount of natural gas even by the end of the sixth year:

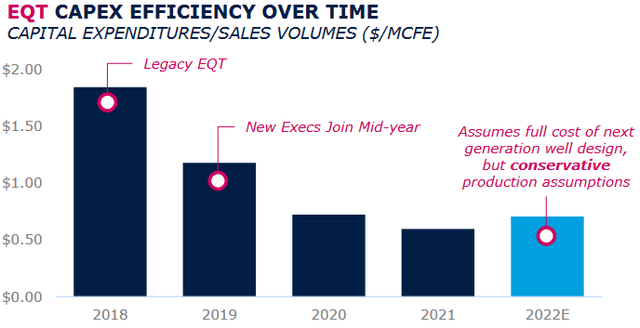

This is one very big factor that helps EQT keep its costs down because it allows the company to maintain its production with much less need to drill new wells than some of its peers. This is not the only thing that has helped EQT keep its costs down and thus allow for higher free cash flows than the company could otherwise generate. One of these is using new technologies to improve its drilling efficiency along with focusing on the most promising drilling locations. As we can see here, the company has been reducing its cost of producing every thousand cubic feet of natural gas equivalent since 2018:

At this point, there may be a few readers that point out that EQT’s production costs are actually expected to go up this year. This is something that every upstream producer is being forced to deal with since it is caused by higher steel and diesel prices, which are needed items in order to drill a well. Fortunately, the fact that natural gas prices are substantially higher this year than they were in 2021 more than offsets this. Overall, EQT should see growing free cash flow going forward as its hedges expire, just as we discussed earlier.

Fundamentals Of Natural Gas

As 95% of EQT’s production consists of natural gas, it is a good idea to look at the fundamentals of this fuel source. Fortunately, the fundamentals are very good, as I have hinted at over the course of this article. This is something that may be surprising to some readers considering that many governments in the developed world have been attempting to decrease the consumption of fossil fuels in favor of renewable sources of energy within their borders. However, it is exactly this push to increase the use of renewables that is causing the strong fundamentals for natural gas. This is because most renewable sources of energy are not reliable enough to support the needs of modern society. After all, solar power does not work when the sun is not shining and wind power does not work when the air is still. The common solution to this problem is to supplement renewables with natural gas turbines. This is because natural gas is reliable enough to keep the grid operational when renewables alone cannot and it burns cleaner than any other fossil fuel so it still serves to reduce carbon emissions.

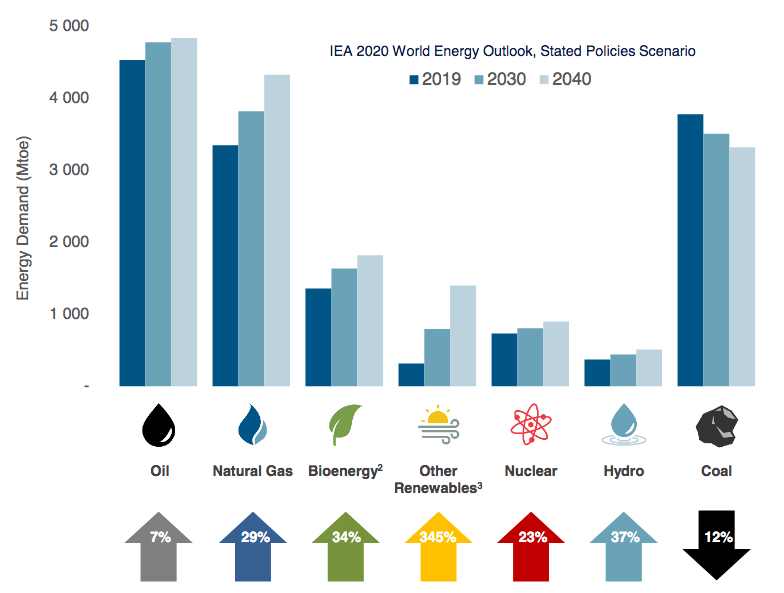

According to the International Energy Agency, this will cause the global demand for natural gas to increase by 29% over the next twenty years:

Pembina Pipeline/Data from IEA 2021 World Energy Outlook

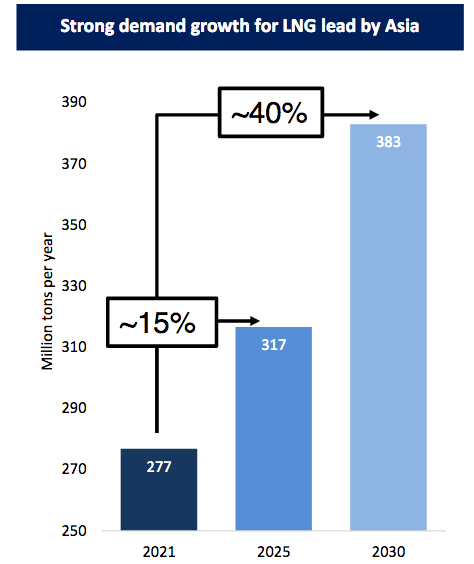

This is one of the big factors that is driving the rapid expansion of the American liquefied natural gas industry. This is because a significant amount of the demand growth is coming from the various Asian countries. In response to the Russian sanctions, Europe is also increasingly hungry for natural gas, especially since there are very real concerns that the continent does not have sufficient supplies to make it through the coming winter. In a previous article, I pointed out that the global demand for liquefied natural gas will increase by 40% by 2030:

Golar LNG Investor Presentation

The United States is one of the few nations that can increase its production sufficiently to satisfy this demand due to the wealth of areas like the Marcellus Shale. This is why the United States is on par to quadruple its production of liquefied natural gas by 2030 in order to supply these foreign nations. This will of course require the country’s natural gas producers to increase their production to supply feedstock to the new liquefaction plants. As EQT is the largest producer of natural gas in the United States, it should be easy to see how the company will benefit.

Earlier in this article, I stated that the fundamentals pointed to high natural gas prices going forward. This is because it is unlikely that production will increase sufficiently to satisfy the demand growth. As I pointed out in a previous article, there are several companies that are content to simply maintain their production instead of growing it. In addition to this, the energy industry has been chronically underinvesting in production capacity and midstream infrastructure since the 2015 crude oil bear market. The Appalachian region, for example, is plagued with a lack of sufficient takeaway capacity to accommodate production growth. The overall situation is so bad that Moody’s stated that the oil and gas industry needs to immediately increase upstream spending by $542 billion annually, in addition to the necessary spending increases in midstream spending to transport all incremental resources. It is highly unlikely that the industry will actually do this. After all, it is under tremendous pressure from politicians and activists to improve the sustainability of its operations and from investors to improve returns. Thus, we have a situation in which demand is likely to grow much more than supply. According to the laws of economics, that causes prices to increase. Naturally, EQT will also benefit from rising natural gas prices so this is certainly not a bad thing for investors in the company.

Financial Considerations

It is always important to look at the way that a company finances itself before investing in it. This is because debt is a riskier way to finance a business because debt must be repaid at maturity. As this is usually accomplished by issuing new debt to pay off the maturing debt, this can cause the company’s interest costs to increase following the rollover depending on the market conditions. In addition, a company must make regular payments on its debt if it is to remain solvent. Thus, an event that causes a decline in cash flows could push a company into financial distress if it has too much debt. This could be an especially big concern for a company like EQT because of the volatility of commodity prices.

One measure that we commonly use to measure the debt load of a company like EQT is the leverage ratio, which in this case is defined as net debt-to-adjusted EBITDA. This ratio essentially tells us how many years it would take the company to completely pay off its debt if it were to devote all of its pre-tax cash flow to that task. As of right now, EQT’s leverage ratio is 1.9x based on the company’s trailing twelve-month adjusted EBITDA for the period ended March 31, 2022. This is admittedly a bit high for my liking, although it is a substantial improvement over the 2.3x that the company had at the start of the year. The company states that it intends to have this down to 1.0x to 1.5x by the end of the year, which would put it in line with the strongest independent exploration and production companies in the industry. As long as natural gas prices remain high, it should be able to accomplish this but we will want to watch and make sure that it does.

Valuation

It is critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to earn a suboptimal return on that asset. In the case of an independent upstream company like EQT, one metric that we can use to measure it is the price-to-earnings growth ratio. This is a modified version of the familiar price-to-earnings ratio that takes a company’s earnings per share growth into account. A price-to-earnings growth ratio below 1.0 is a sign that the stock may be undervalued relative to its forward earnings per share growth and vice versa.

According to Zacks Investment Research, EQT Corporation will grow its earnings per share at a 48.87% rate over the next three to five years. This gives the company a price-to-earnings growth ratio of 0.24 at the current price, which is an obvious sign that the company may be substantially undervalued at the current price. However, as I pointed out in numerous previous articles, pretty much the entire energy industry is quite a bit undervalued today. Thus, it may make sense to compare EQT’s valuation with that of a few of its peers to see which company offers the most attractive relative valuation:

| Company | PEG Ratio |

| EQT Corporation | 0.24 |

| Range Resources (RRC) | 0.20 |

| Pioneer Natural Resources (PXD) | 0.72 |

| Continental Resources (CLR) | 0.14 |

| Chesapeake Energy (CHK) | 1.01 |

| Diamondback Energy (FANG) | 0.20 |

Admittedly, EQT Corporation does not have the most attractive valuation here but that does not necessarily mean that it is a bad investment today. This table confirms my statement that pretty much the entire industry is substantially undervalued today. Thus, anyone buying EQT today is getting a very good deal when we consider that the company is the largest natural gas producer in the United States and that the fundamentals for natural gas are incredibly strong, much stronger than the fundamentals for crude oil. EQT has a much higher proportion of its production as natural gas than any of its peers, which could actually make it the best way to play this trend even if it does not have the absolute lowest valuation.

Conclusion

In conclusion, there are a lot of reasons to be interested in EQT Corporation today. It is the largest natural gas producer in the United States and one of the only pure-plays on this commodity. The company is very well positioned to substantially grow its free cash flow over the next few years if natural gas prices remain high, which seems quite likely based on the fundamentals. The company also boasts a reasonably attractive balance sheet and an attractive valuation. Overall, this one could be worth purchasing today.

Be the first to comment