JLco – Julia Amaral/iStock via Getty Images

A Quick Take On EverCommerce

EverCommerce (NASDAQ:EVCM) went public in July 2021, raising approximately $325 million in gross proceeds from an IPO that priced at $17.00 per share.

The firm provides business management SaaS software to service-based businesses in a variety of industry verticals.

Given a possible ‘stagflation’ economy with increasing interest rates, companies like EVCM that cannot make a significant move toward operating breakeven may remain at a discount.

I’m, therefore, on Hold for EVCM in the near term.

EverCommerce Overview

Denver, Colorado-based EverCommerce was founded to develop a platform providing vertically integrated software to small and midsize firms in the healthcare, wellness and other home service sectors.

Management is headed by founder and CEO Eric Remer, who was previously co-founder and CEO of PaySimple, now part of EverCommerce.

The company’s primary offerings include:

-

Marketing technology solutions

-

Customer engagement applications

-

Billing & payment solutions

-

Business management

The firm’s primary verticals are:

-

Home services

-

Health services

-

Fitness & Wellness

-

Other

The firm pursues a ‘land and expand’ marketing strategy for its prospective customers and places a strong emphasis on cross-selling its offerings to gain maximum share of wallet and customer buy-in.

EverCommerce’s Market & Competition

According to a 2020 market research report, the global market for SMB IT spending was an estimated $610 billion in 2020 and is expected to reach $824 billion by 2027.

This represents a forecast CAGR of 7% from 2020 to 2027.

Also, China is expected to continue as the fastest growing region in percentage terms during the period.

Major competitive or other industry participants include:

-

Salesforce (CRM)

-

Intuit (INTU)

-

Square (SQ)

-

HubSpot (HUBS)

-

Manual processes

-

Vertically-focused competitors

EverCommerce’s Recent Financial Performance

-

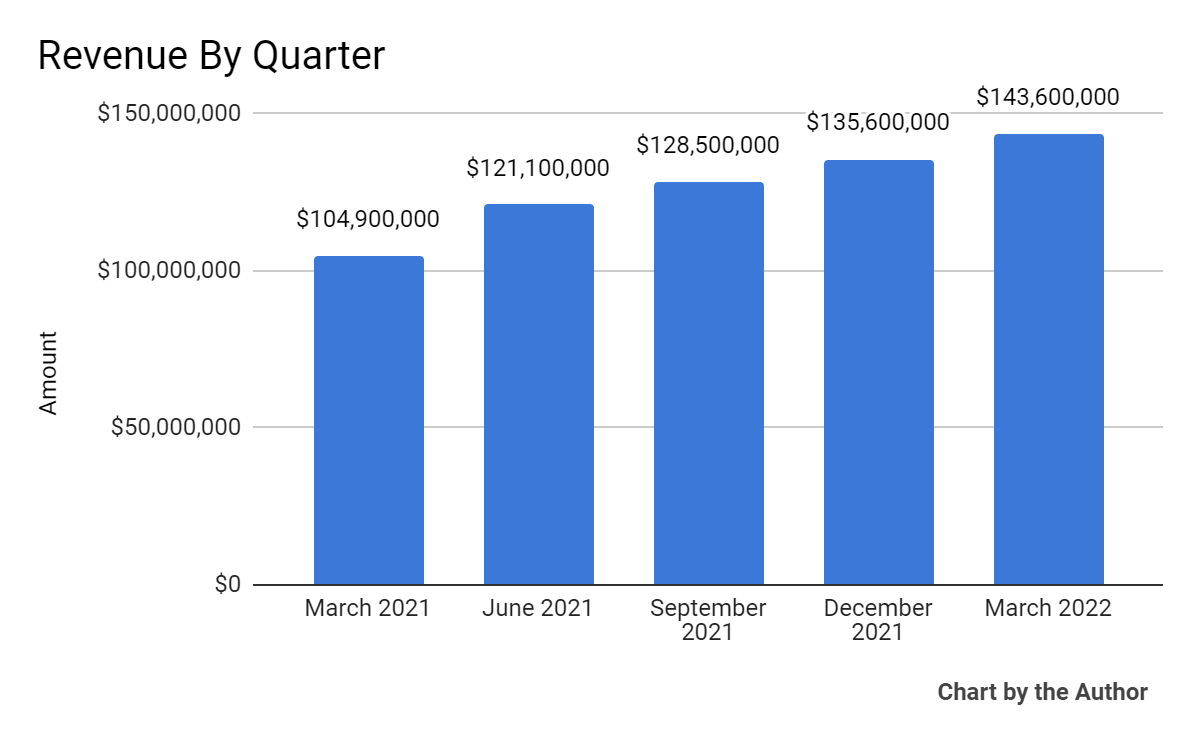

Total revenue by quarter has grown steadily:

5 Quarter Total Revenue (Seeking Alpha)

-

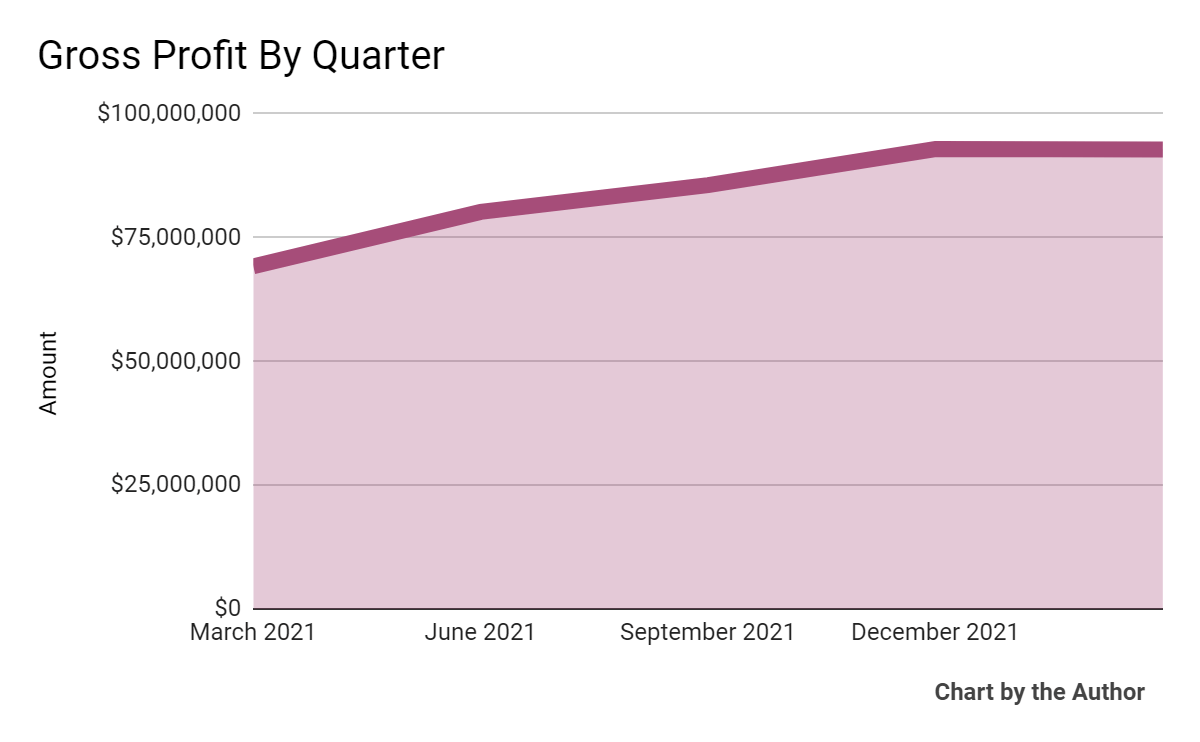

Gross profit by quarter has plateaued in the most recent quarter:

5 Quarter Gross Profit (Seeking Alpha)

-

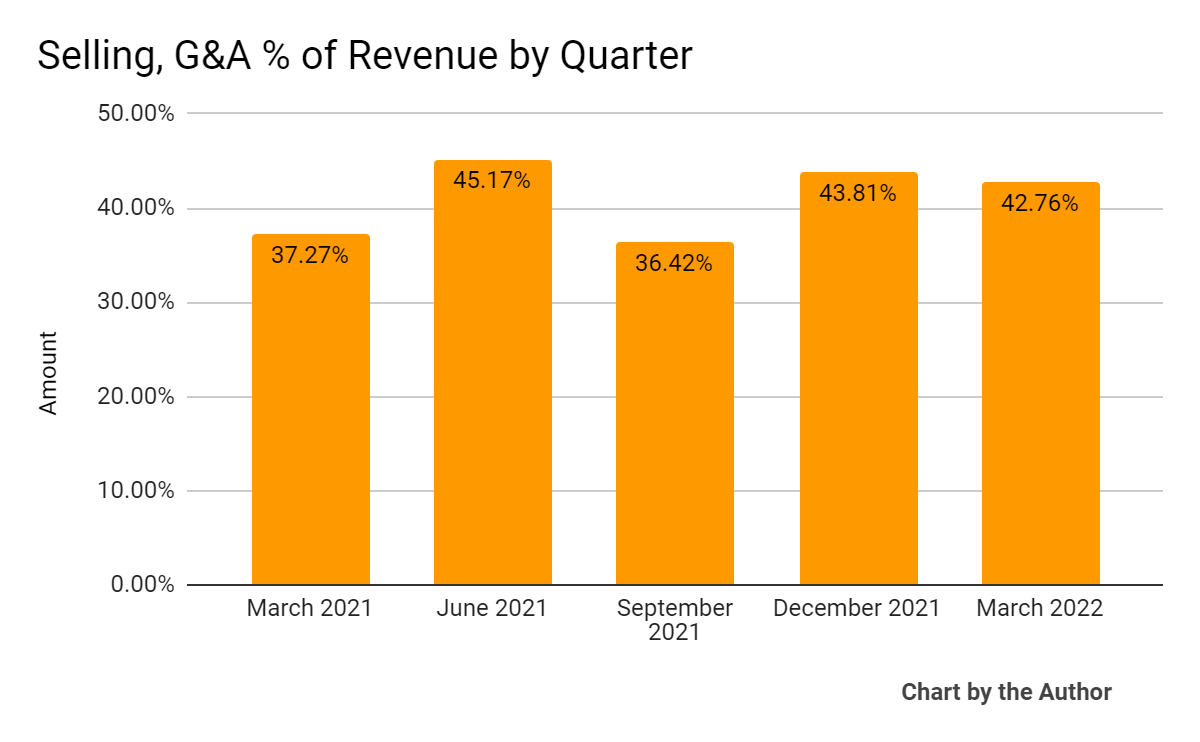

Selling, G&A expenses as a percentage of total revenue by quarter have performed according to the following chart:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

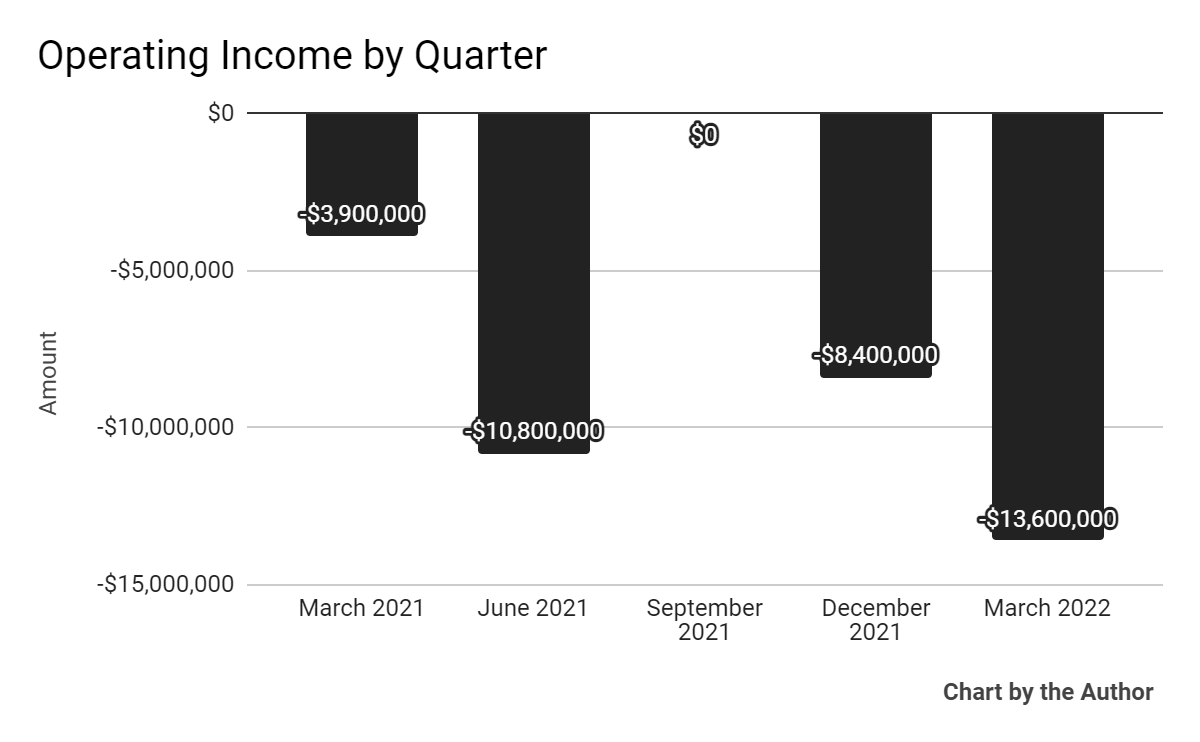

Operating losses by quarter have worsened in the most recent reporting period:

5 Quarter Operating Income (Seeking Alpha)

-

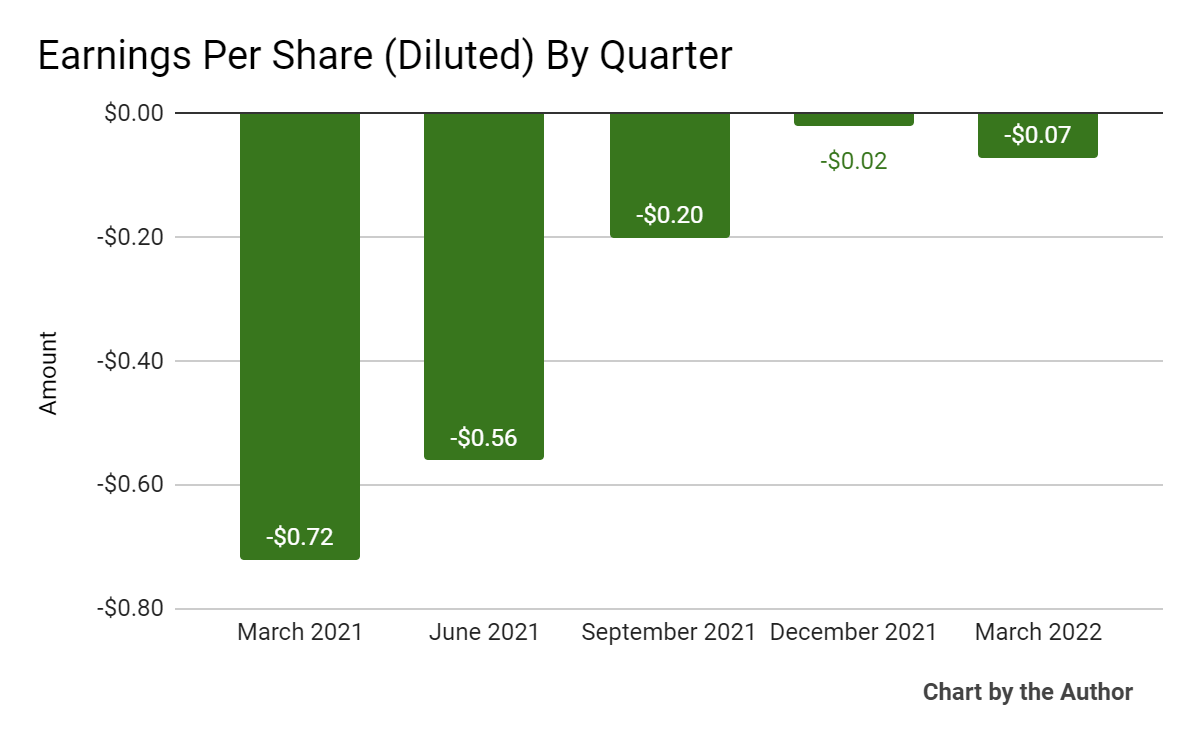

Earnings per share (Diluted) have made progress toward breakeven:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

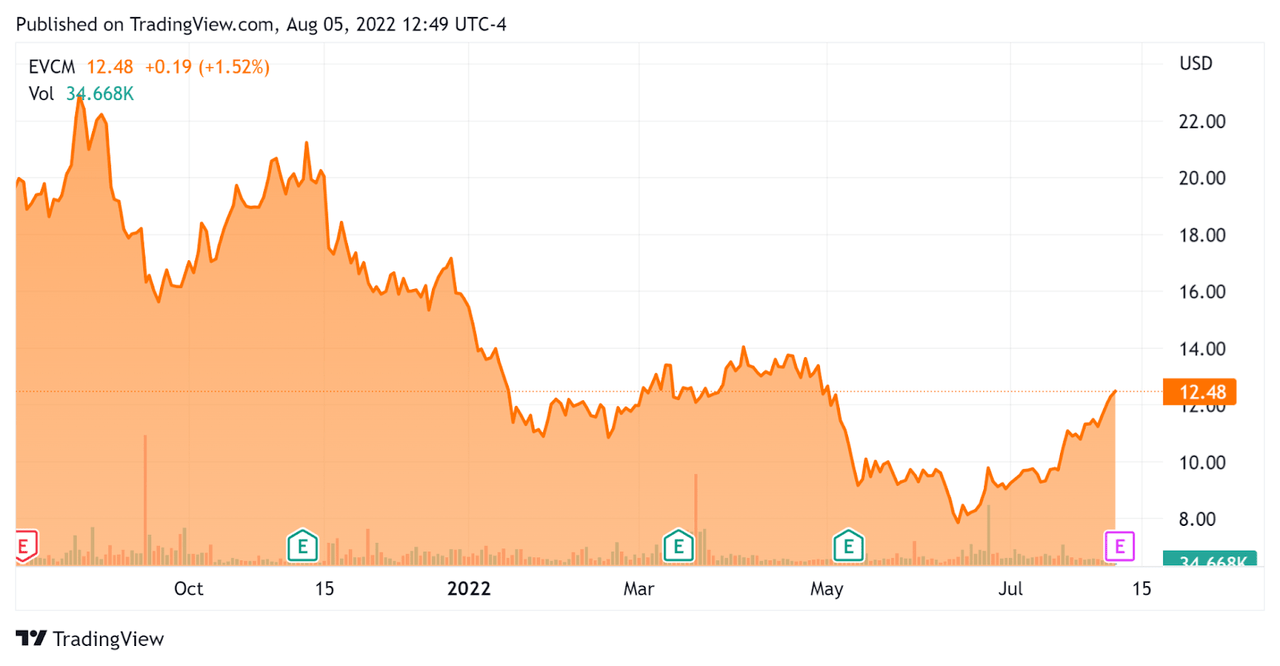

In the past 12 months, EVCM’s stock price has fallen 36.1% vs. the U.S. S&P 500 index’ drop of around 6.8%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For EverCommerce

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Enterprise Value |

$2,850,000,000 |

|

Market Capitalization |

$2,400,000,000 |

|

Enterprise Value / Sales [TTM] |

5.39 |

|

Revenue Growth Rate [TTM] |

44.72% |

|

Operating Cash Flow [TTM] |

$55,740,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.85 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be HubSpot (HUBA); shown below is a comparison of their primary valuation metrics:

|

Metric |

HubSpot |

EverCommerce |

Variance |

|

Enterprise Value / Sales [TTM] |

11.65 |

5.39 |

-53.7% |

|

Operating Cash Flow [TTM] |

$258,250,000 |

$55,740,000 |

-78.4% |

|

Revenue Growth Rate |

46.6% |

44.7% |

-4.0% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

EVCM’s most recent GAAP Rule of 40 calculation was 57% as of Q1 2022, so the firm has performed impressively in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

45% |

|

GAAP EBITDA % |

13% |

|

Total |

57% |

(Source – Seeking Alpha)

Commentary On EverCommerce

In its last earnings call (Source – Seeking Alpha), covering Q1 2022’s results, management highlighted its revenue and adjusted EBITDA results exceeding the top end of its previous guidance range.

Founder and CEO Eric Remer also reiterated management’s previous ‘long-term strategy of balancing growth with profitability’, however, given its increasing GAAP operating losses, it is difficult to see this occurring.

Of course, many firms like to point to ‘adjusted’ numbers, which are more favorable to their definition of profitability.

The company is focused on three primary industry verticals, home services, health services and fitness and wellness services, seeking to automate and optimize small businesses which are frequently underserved with IT options.

Management reported an ‘average annualized net revenue retention’ of more than 100%, which means negative net churn. This is an impressive result given the company’s large customer base of over 617,000 customers at the end of 2021.

As to its financial results, topline revenue grew 37% year-over-year, mostly from organic growth, although the company does continue to make ‘selective’ acquisitions as desired.

Q1 adjusted EBITDA margin was 16%, double that of the previous year’s same period.

However, GAAP operating loss was the highest in the last 5 quarters, driven by higher expenses for SG&A and R&D.

For the balance sheet, the company ended the quarter with $101 million in cash and equivalents plus $190 million capacity on its revolving line of credit. EVCM generated $12.0 million in free cash flow during the quarter.

Looking ahead, management raised its full year 2022 topline revenue and adjusted EBITDA guidance slightly and does not take into account any potential M&A activity for the remainder of 2022.

Regarding valuation, the market is valuing EVCM at an EV/Sales multiple of around 5.4x.

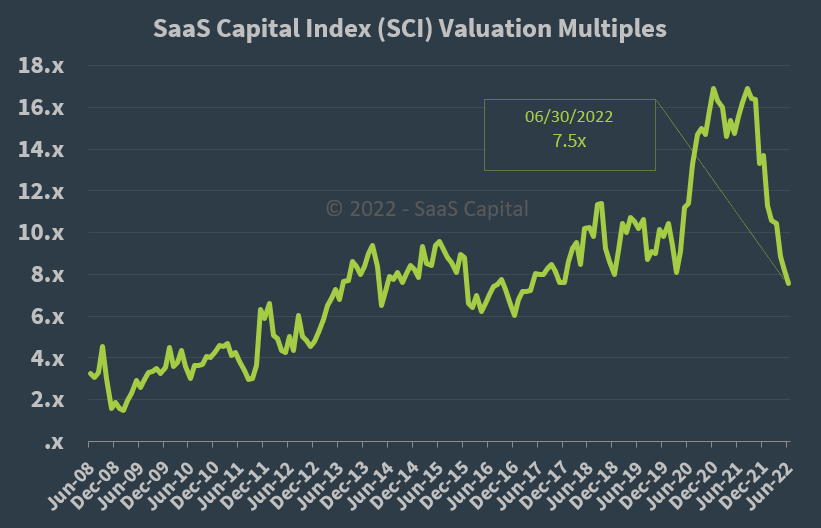

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 7.5x on June 30, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, EVCM is currently valued by the market at a discount to the SaaS Capital Index, at least as of June 30, 2022.

The primary risk to the company’s outlook is a potential macroeconomic slowdown or recession, which may slow sales cycles and reduce its revenue growth estimates.

A potential upside catalyst to the stock could include continued success upselling its customer base to its payment services functionalities.

With the market valuing EVCM at a discount to its peers, interested and patient investors may see the possibility of a bargain buy at its current stock price.

However, the firm is producing growing operating losses which continue to be punished by the market due to a rising cost of capital environment, which lowers valuation multiples accordingly.

Given a possible ‘stagflation’ economy with increasing interest rates, companies like EVCM that cannot make a significant move toward operating breakeven may remain at a discount.

I’m, therefore, on Hold for EVCM in the near term until it can produce growth while materially reducing operating losses.

Be the first to comment