400tmax/iStock Unreleased via Getty Images

When Was Google’s Stock Split Approved?

Included in the fourth-quarter 2021 earnings release of advertising giant Alphabet Inc (NASDAQ:GOOG)(NASDAQ:GOOGL) was the announcement of a 20-for-1 stock split “in the form of a one-time special stock dividend” on each of the company’s Class A, Class B, and Class C stock. Shareholders of Alphabet Inc approved the stock split at the company’s annual meeting on June 1. Each shareholder at the market close as of July 1 will receive, on July 15, 19 additional shares for each share of the same class of stock they own.

The aim of this article is not to debate the merits of the stock split to GOOG stock (unlike the piece I wrote last year titled Tesla Stock Split: Will It Happen Again) but to discuss the share price outlook following the split. Hence, I will briefly list the likely vital motivations for the executives of Alphabet to implement a stock split:

- Having been traded in the four-digit price handle for the last couple of years (and $2370.76 for GOOG as of the market close on 24 June 2022), the high price tag has prevented some investors from being able to afford to buy entire, rather than fractional, shares of the parent of Google.

- Although most brokerage firms now enable the trading of fractional shares, from the psychological perspective of an individual investor, it is more palatable to own a whole share of a company’s stock rather than a fraction of one share of it. A retail investor gets to proudly declare to the uninitiated he owns one share of GOOG stock, rather than having to say he owns 0.05 share of GOOG stock.

- Investors who choose to or can only buy whole shares would do so after the stock split, providing a lift to the share price. Those who manage their investments based on whole shares would also find it easier to add GOOG without skewing their portfolios, serving as another pool of buyers post-split.

- As typical of tech companies, Alphabet Inc issues stock-based compensation to its employees. A stock split to the low triple-digit price level enables Alphabet to issue smaller-ticket stock compensation to more employees than previously feasible.

- It’s a reminder to market players that Alphabet shares have done so well that they need to do a split to get the price back to triple digits.

- The stock split removes the inhibition of the index committee that GOOG’s high share price would overwhelm the price-weighted Dow. After the stock split, GOOG would trade at $118.54, assuming it is done at the same on 24 June 2022, putting it behind Apple Inc’s (AAPL) $140.81, an existing Dow member.

How Did Google Stock Do After Its Last Stock Split?

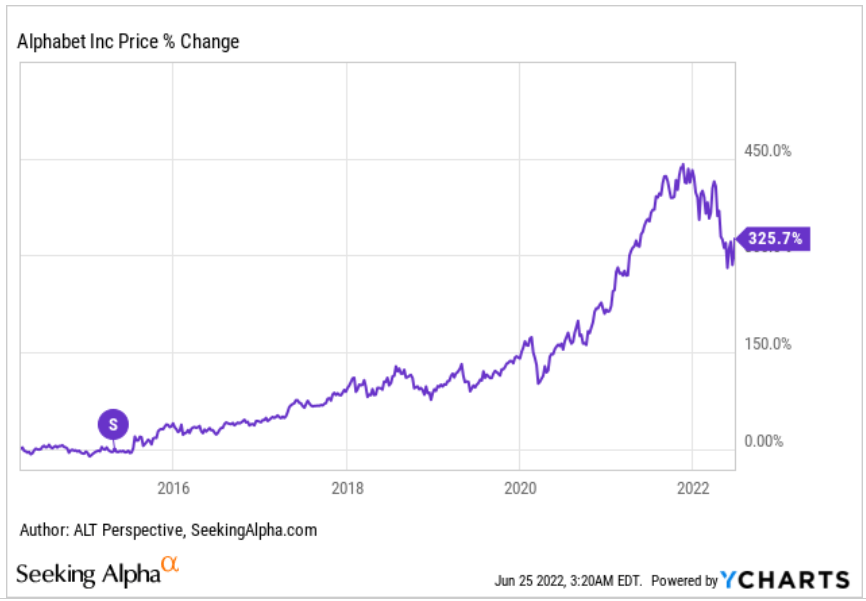

Since the last (and the first) stock split in April 2014, GOOG stock has appreciated 326%. The main purpose of the stock split was to issue Class C shares that don’t come with voting rights, enabling Alphabet to create C-shares to finance acquisitions and reward employees without diluting the voting control of the company’s founders. Hence, the share gains from this particular stock split cannot be attributed to the typical stock split to bring down the share price.

YCharts

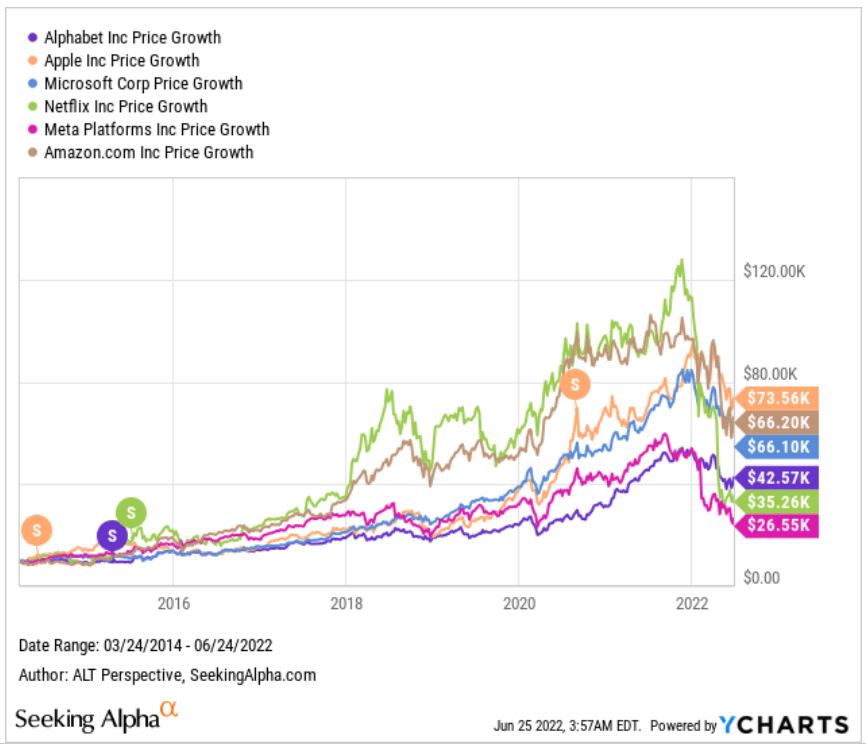

Comparing the share price chart of Alphabet Inc and the other mega-cap stocks affectionately called the MAFANG or MAMANA (based on the new names), it becomes obvious that the stock split in 2014 cannot explain the rise of GOOG. In fact, GOOG had underperformed this grouping until earlier this year when Facebook parent Meta Platforms Inc (META) and streaming titan Netflix Inc (NFLX) tumbled, enabling GOOG to post better returns in the timeframe.

Since March 2014, $10,000 invested in GOOG stock would have appreciated to become $42.6K, while $10,000 invested in AAPL would have become $73.6K on paper, excluding the dividends. $10,000 invested in Microsoft Corp (MSFT) and Amazon.com Inc (AMZN) would have seen a similar appreciation to around $66K, though note that the former has been paying a dividend that would have improved the returns. Apple Inc has had two stock splits since early 2014 and Netflix did one in 2015. Again, in both cases, it wasn’t apparent that the stock splits helped drive the huge rise in the market cap of the duo.

YCharts

GOOG/GOOGL Stock Key Metrics

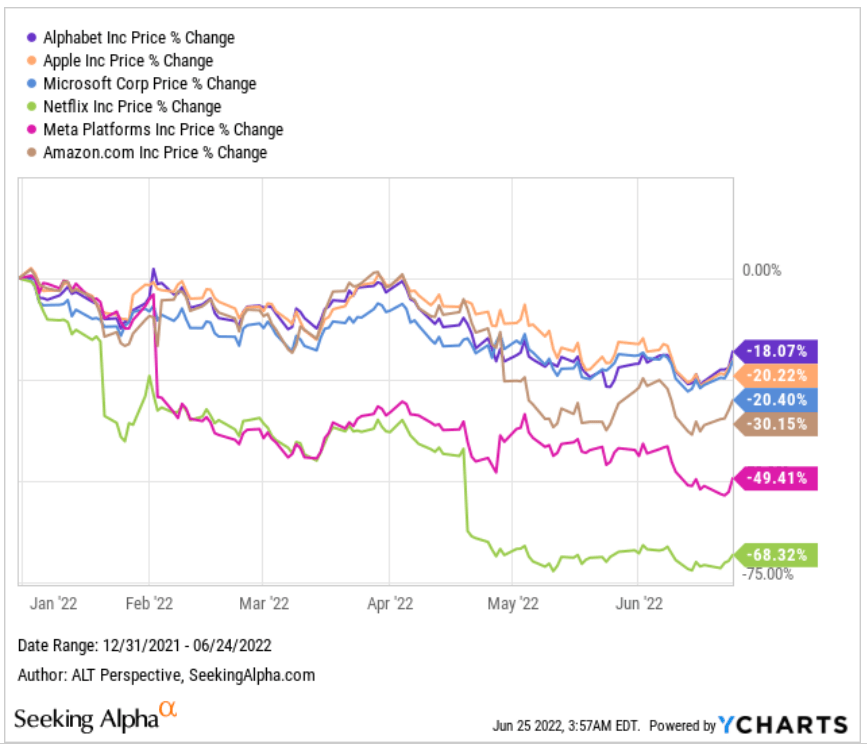

Year-to-date, GOOG has fallen together with the broader market, but it managed to decline the least among the mega caps MAFANG/MAMANA, dropping 18%, compared with the others which fell 20% to 68%.

YCharts

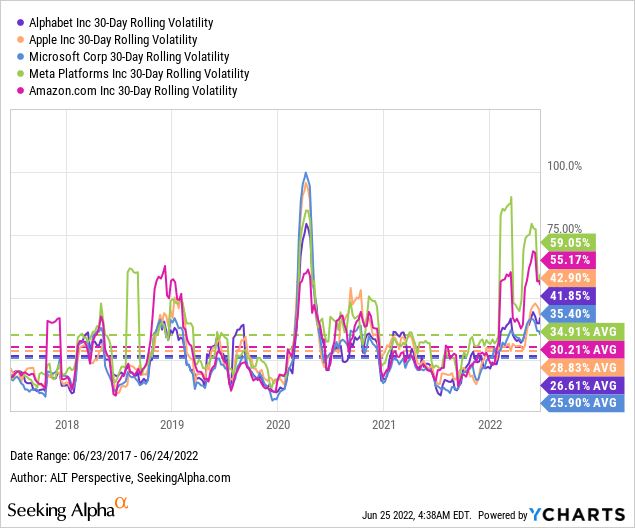

GOOG shareholders also benefit from its lower volatility, allowing them to sleep well at night. GOOG stock’s 30-day rolling volatility stands at 41.9% currently, higher than MSFT but lower than AAPL, AMZN, NFLX, and META. The same is true when we take the historical averages from June 2017 to date. GOOG has 30-day rolling volatility averaging 26.6%, just above MSFT’s 25.9% and below that of AAPL, AMZN, NFLX, and META.

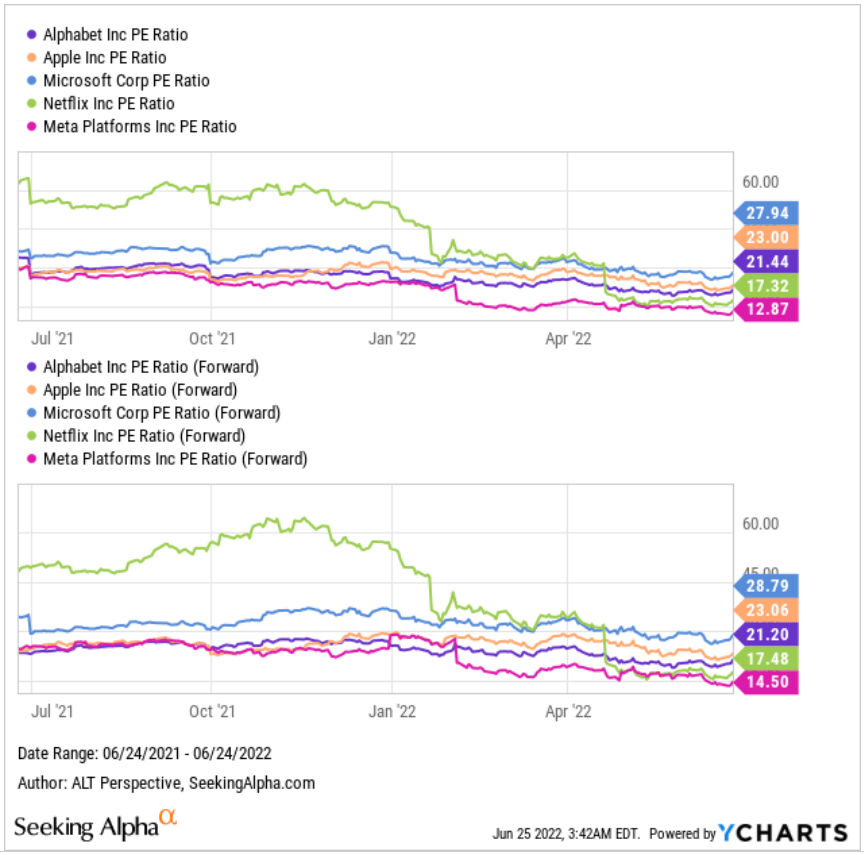

In terms of price-to-earnings ratio, GOOG stock demonstrates a Goldilocks scenario. At a P/E ratio of 21.4 times, GOOG’s multiple comes in the middle – higher than Netflix and Meta Platforms but lower than Apple and Microsoft. Based on the forward estimates, the P/E relationship will remain the same.

YCharts

The same is true for the price-to-sales ratio as well, with Google stock right smack in the middle of the grouping again.

YCharts

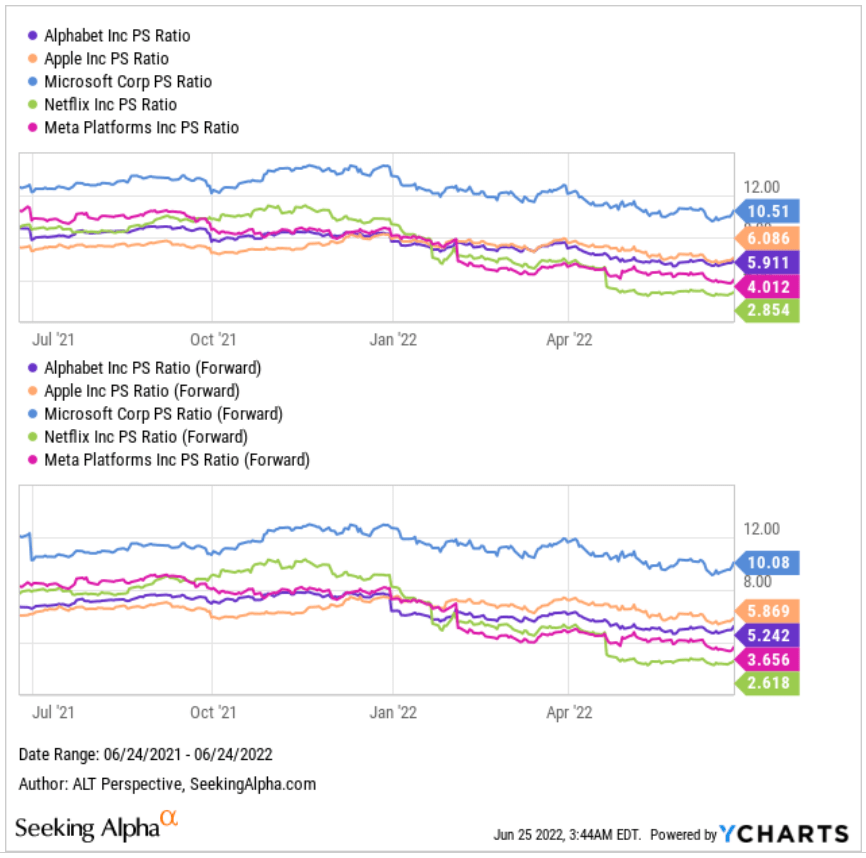

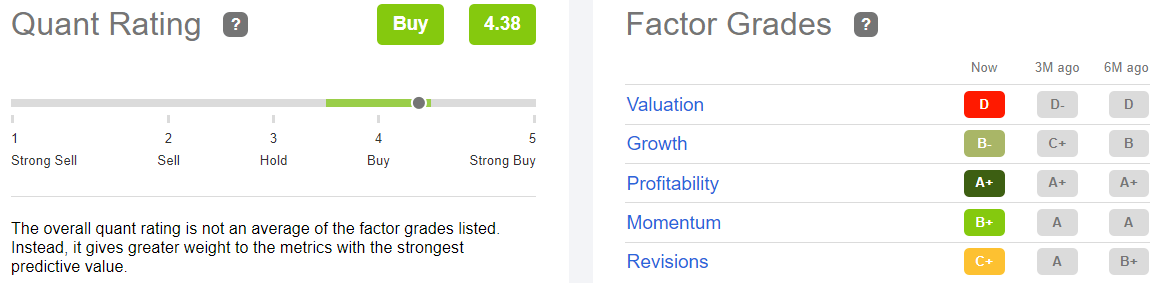

The message is consistent when we compare the price-to-free cash flow [P/FCF] – with AMZN and NFLX taken out of the chart due to their irregular ratio on fluctuating FCF trends – where GOOG’s P/FCF ratio of 23 times is sandwiched between MSFT’s 32 times and META’s 12 times.

YCharts

Google Stock Ratings

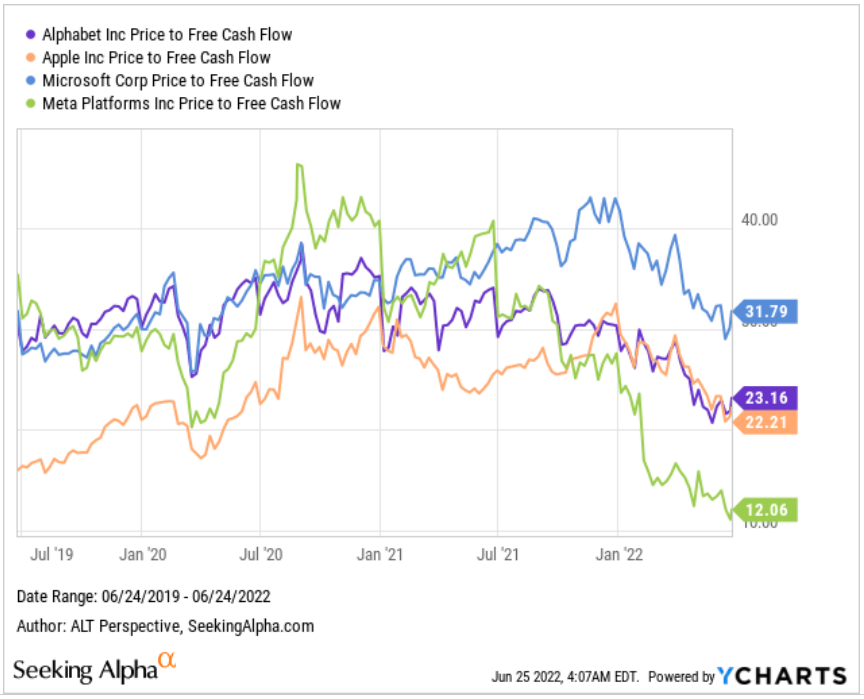

Seeking Alpha’s quant system is rating GOOG a “Buy” with a score of 4.38, i.e., it’s within inches of being rated a “Strong Buy”. Looking at the factor grades contributing to the overall quant rating, we see that GOOG has a poor score of D for valuation, improving slightly from the D- three months ago, despite the swoon in the past few months. However, it should be noted that the entire sector has corrected and the factor grading of a stock is relative to its sector.

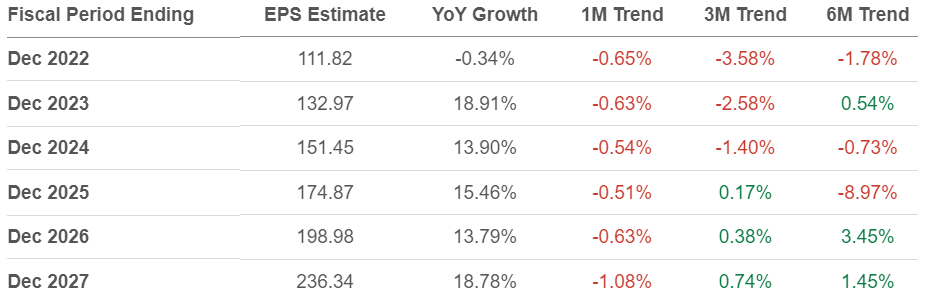

GOOG’s growth factor grade of B- is respectable and is an improvement over the C+ three months ago. Profitability is A+, the highest score. Momentum has deteriorated to B+ but as mentioned earlier, to the credit of GOOG stock, it has lower volatility than most other tech mega caps. Revisions is a weak C+ but I will show the revision trend is very mild in a later section.

Seeking Alpha Premium

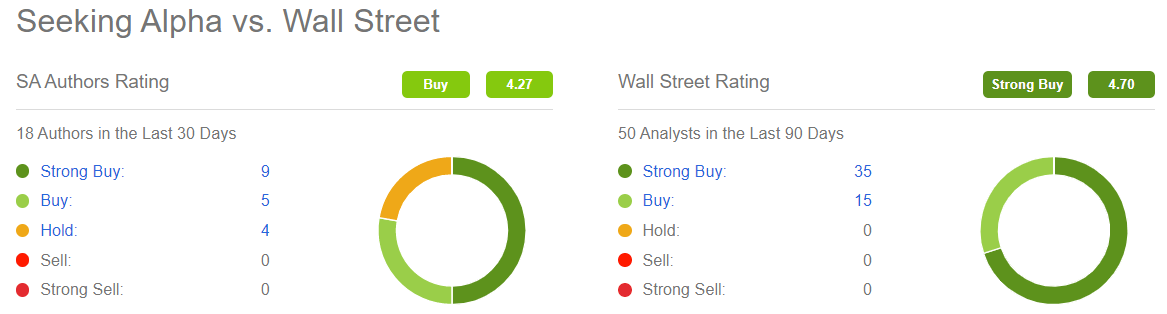

The consensus rating among Seeking Alpha authors is a “Buy” with a score of 4.27. Wall Street analysts are more bullish on Google stock, with a consensus rating of “Strong Buy” and a score of 4.7. All Wall Street calls are either “Buy” or “Strong Buy”, not a single “Hold”, “Sell”, or “Strong Sell”, seemingly a demonstration of their confidence in the advertising giant.

Seeking Alpha Premium

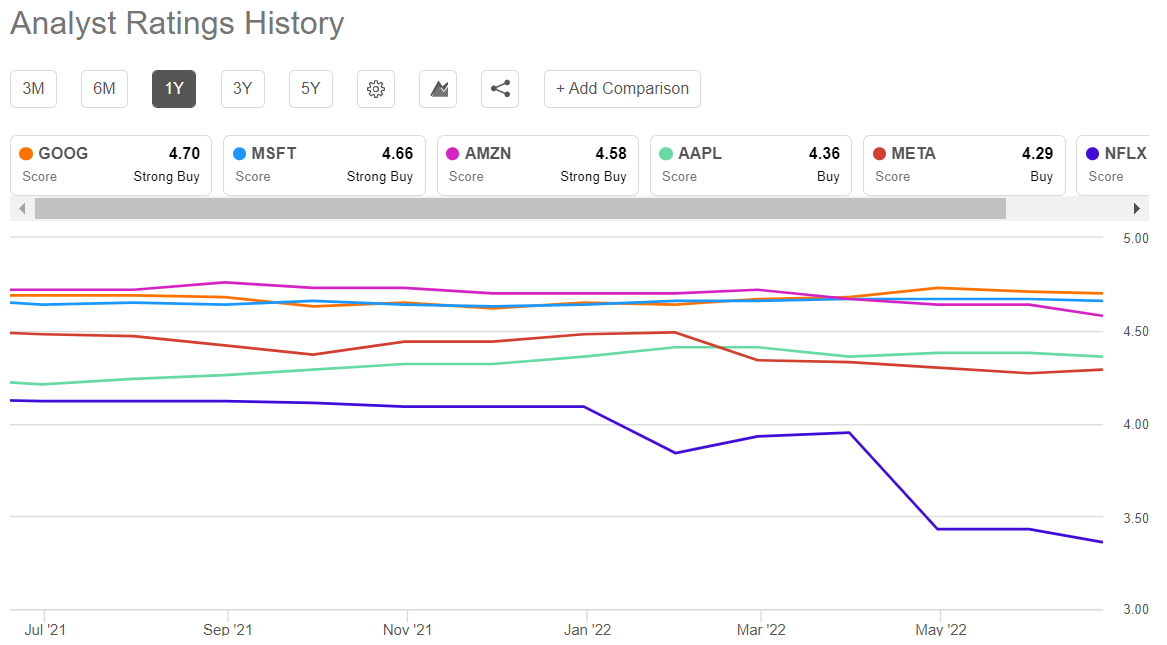

Seeking Alpha has a neat tool to compare the analyst ratings history on each stock’s profile page. I pulled the following comparison chart which showed the rating on GOOG stock surpassing MSFT’s sometime in late March to lead the MAFANG/MAMANA.

Seeking Alpha Premium

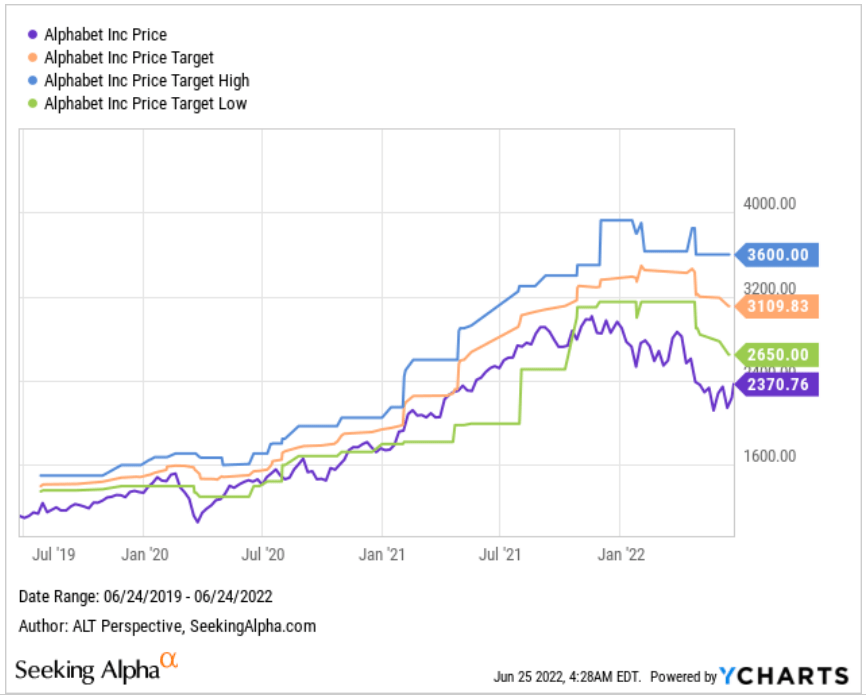

Yet, the share price of Alphabet Inc. ($2370.76) is trading below even the least optimistic price target, $2650, on its stock. This is a reversal of the phenomenon in much of 2021.

YCharts

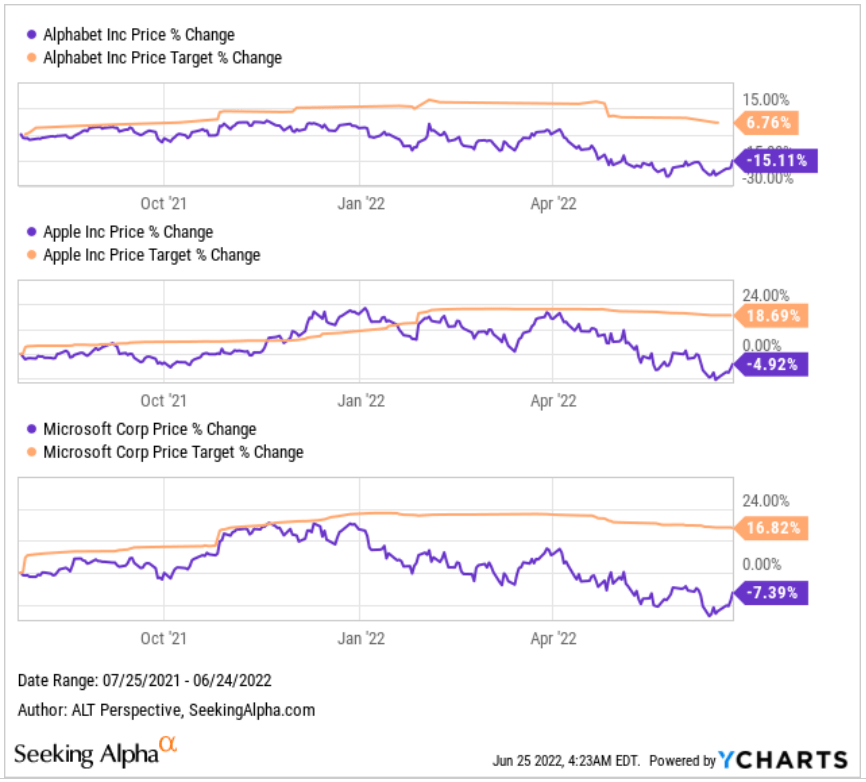

Looking deeper, we see that the price target change has risen 6.8% over the past year, even as the share price dipped 15.1%. AAPL and MSFT have seen their share price targets rising higher at 18.7% and 16.8% respectively but their stocks have fallen less than GOOG.

YCharts

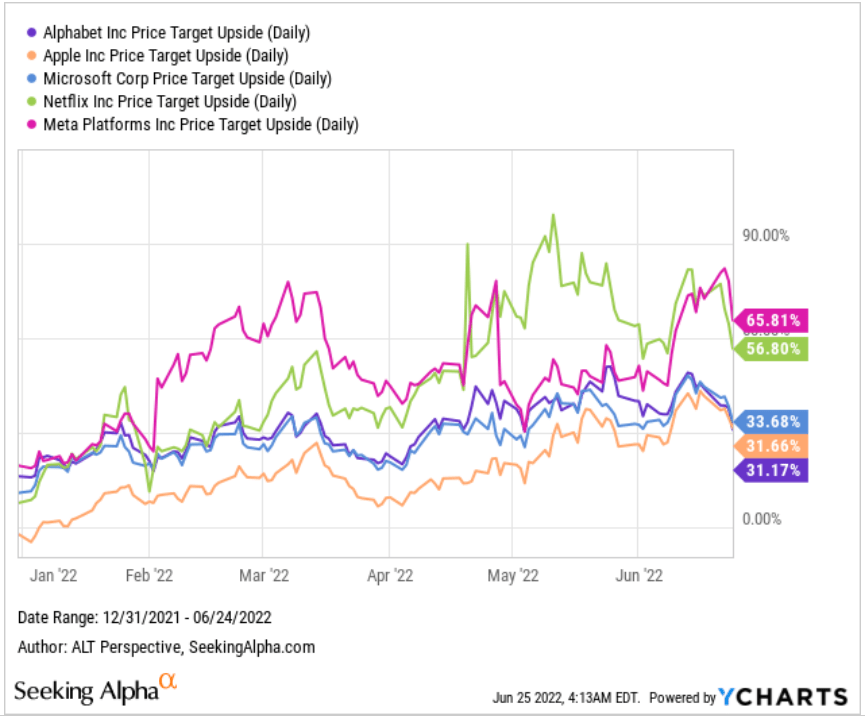

Consequently, GOOG stock now has the lowest price target upside (31.2%) as compared to AAPL, MSFT, NFLX, and META.

YCharts

Is Google Stock A Buy, Sell, or Hold?

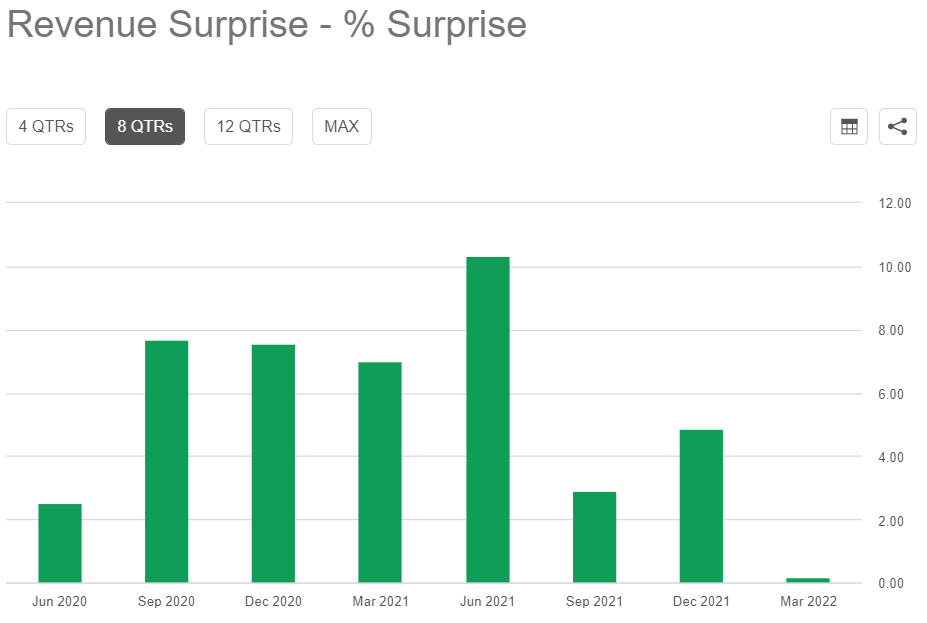

For the March 2022 quarter, Alphabet Inc delivered the smallest revenue surprise in two years. With shareholders jittery over whether their companies can perform amid the weak macroeconomy, a miss can trigger massive selloffs.

Seeking Alpha Premium

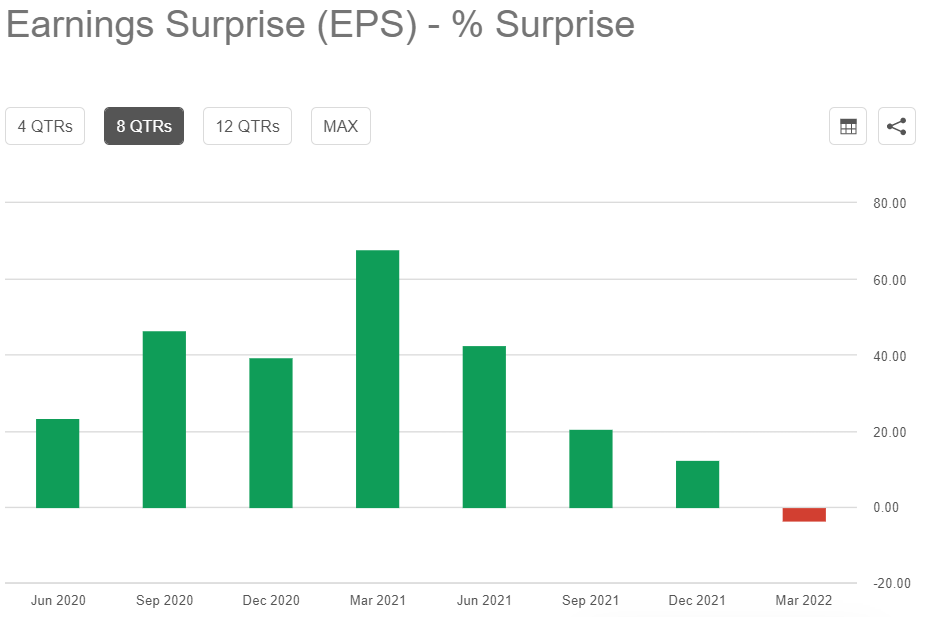

To make matters worse, as market players focus more on profitability than sales growth, Alphabet Inc missed, albeit narrowly, on its first quarter 2022 EPS. Alphabet stock sank post-market after the earnings release (GOOG -6.6%, and GOOGL -6.3% as the company started its Q1 earnings conference call).

Seeking Alpha Premium

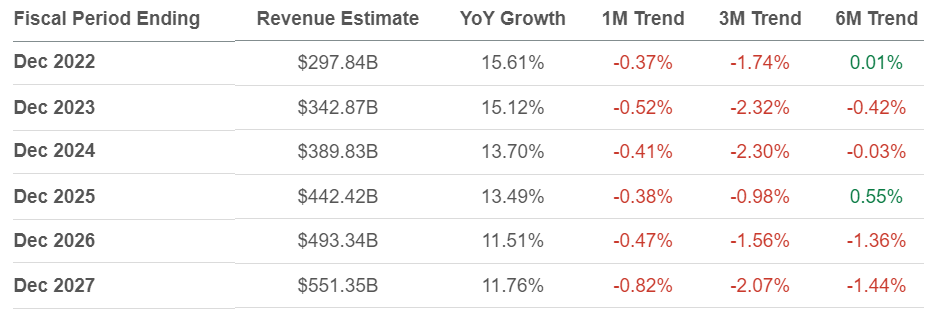

Yet, analysts have only reduced their revenue estimate (on a consensus basis) for Alphabet Inc by 1.7% from three months ago, before the Q1 2022 earnings release and call. The consensus revenue estimates for 2023 and 2024 were shaved by around 2.3%. Nonetheless, this still leaves Alphabet Inc with projected year-on-year revenue growth of 15.6%, 15.1%, and 13.7% in 2022-2024. If the forecast materializes, the company would have increased its revenue by 52% from 2021. A significant increase for a behemoth.

Seeking Alpha Premium

Analysts have cut the 2022 EPS estimate for Alphabet Inc more deeply than for its revenue. This is, however, not a bad thing if they turn up to be too conservative, as it can provide a boost to the share price if the company can beat the estimates.

Seeking Alpha Premium

During the Q1 2022 earnings conference call, Sundar Pichai, Chief Executive Officer of Alphabet Inc, highlighted several key product highlights (not an exhaustive list):

- The launch of “multisearch” in Google Search enables users to find what they need using both images and words.

- New features in Search help users find health care providers who take their insurance and book appointments online.

- YouTube Shorts is now averaging over 30 billion daily views, four times higher than a year ago.

- On average, viewers are watching over 700 million hours of YouTube content on television every day. In the year ahead, YouTube’s connected TV viewers will have new smartphone control navigation and interactivity features, allowing people to comment and share content they are watching on television directly from their devices.

- Over the coming years, Alphabet Inc will continue to invest in new form factors, seamless multi-device experiences and raising the bar for user privacy while giving developers the tools they need to succeed on mobile.

- Pixel 6 is the fastest-selling Pixel mobile phone ever.

- Google Cloud’s Q1 2022 revenue grew 44% year-over-year with continued strong performance across Google Cloud Platform and Workspace.

- The acquisition of Mandiant (MNDT), a leader in dynamic cyber defense and response, to help protect customers from the most advanced threats.

- Mahindra, one of the largest conglomerates in India, has chosen Google for their large-scale IT transformations and migrating their data centers to Google Cloud, while Sony’s Crunchyroll uses Google infrastructure and networking capabilities to power the largest anime streaming service in the world.

- Google’s scalability enables Ninja Van, the leading logistics provider in Southeast Asia, to handle more than 10 times their normal traffic during peak times.

As a recent Google Workspace user, I initially had plenty of adjustment challenges from Microsoft Office. However, I have since discovered the functionalities of Google Workspace that can help me deliver my work in a refreshing manner, and when I started to better appreciate the different ways the platform makes it easier for me in data and word processing. It’s very much the same way a long-time Maserati driver shouldn’t expect a Ferrari car to work the same but he has to appreciate the good of each.

In sharing this anecdote, I wish to convey the hidden opportunities that Google can capture beyond its core products of Search, Gmail, and YouTube. As retail investors, we may be more familiar with the consumer-facing aspects of Alphabet and the other tech mega caps like Apple and Meta Platforms. In the office, we are also more acquainted with Microsoft. However, Google seems to be firing on the right engines to propel growth in new areas.

Not to forget, Alphabet’s Other Bets division is also showing bright prospects. In April, Waymo became the first company to run fully autonomous ride-hailing operations in multiple locations simultaneously. While Other Bets and Google Cloud are currently loss-making, something frowned upon in this tightening liquidity environment, Alphabet continues to earn hefty operating income from Google Services to nurture the new areas, providing the opportunity for a transformational upside surprise to the company. In Q1 2022, the combined operating losses from the two divisions amounted to $2.1 billion, a fraction of the $22.9 billion in operating income that Google Services brought in.

With myriad uncertainties in the broader economy contributing to the ongoing volatility in the stock markets, it is hard to determine a bottom for GOOG stock. Nevertheless, as discussed above, Alphabet Inc is a steady and quiet performer. While it has middling performance, its stock is less volatile and offers decent appreciation over the long term. Hence, I am rating GOOG/GOOGL as a Buy, but I suggest interested investors to size their entries appropriately over the following months given that it will be easier to do so after the stock split.

Be the first to comment