da-kuk/E+ via Getty Images

It’s been about 33 months since I published my cautionary note about Everbridge, Inc. (NASDAQ:EVBG), and in that time, the shares are down about 45% against a gain of about 48% for the S&P 500. I thought I’d check on this company again for a couple of reasons. First, there are a few things better for someone as petty as myself as writing an “I told you so” article. Second, in the previous article, I actually acknowledged that there was a good chance that the crowd would drive the shares higher. Given that, I recommended that people who insisted on staying long here switch to calls in lieu of shares. These offered most of the returns at a fraction of the risk of stock ownership. I absolutely can’t wait to write about how this worked out for people who took my advice. Third, a stock trading at $52 is by definition less risky than the same stock when it was trading at $93.50, so it might be worth changing my tune and buying. I’ll make that determination by looking at the financial history here, and by looking at the stock as a thing distinct from the underlying business.

It’s that time again. Welcome to the “thesis statement” paragraph. The target audience for this paragraph consists of people who want the “gist” of an article, and can’t get that from the title and bullet points above. If you’re such a person, this may be the single best paragraph of this article. If you’re someone who hates spoilers and wants to be surprised as the drama unfolds, you may want to skip this spoiler-laden paragraph. I’m of the view that these shares remain not worthy of consideration until the company demonstrates the capacity to earn a profit. The shares are at record low valuations, which I like a great deal, but I can’t get past the ongoing dilution and continued losses. I also acknowledge that the share price is driven by the crowd, though, and the crowd can be optimistic on occasion. For that reason, I can imagine that there’s a very real chance that the stock will rise in price from here. Given all of that, I would recommend that people who insist on remaining bullish here would be wise to switch to call options. These give most of the upside at far less risk than the actual stock. Given that we’re pursuing superior risk-adjusted returns (as opposed to simple “returns”), I consider this to be a superior trade.

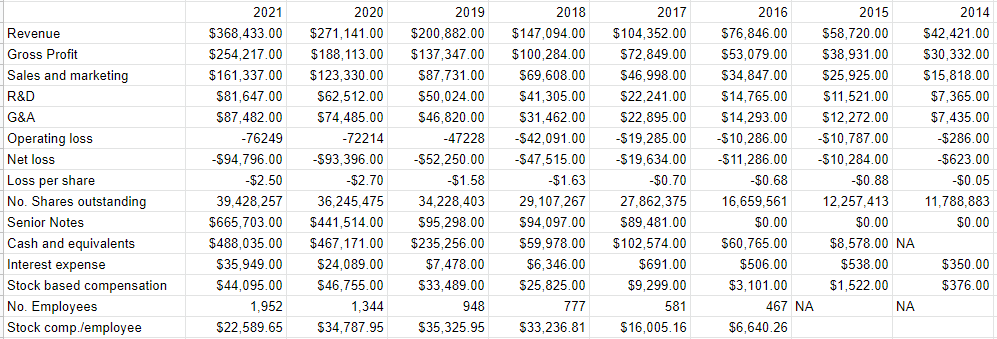

Financial Snapshot

In one way, the financial performance in 2021 was quite good relative to the same periods in both 2020 and 2019. In particular, revenue in 2021 was about 36% higher than it was in 2020, and about 83% higher than it was in 2019. I characterized this as a “growth” company, and in regard to sales growth, I still agree with that characterization. The problem is that that’s where the good news ends. While revenue is much higher, so too are expenses like R&D, G&A, sales and marketing, etc. In my previous article, I pointed out the disconnect between revenue and net income, and it seems that nothing has improved on that front. It seems that the more this company sells, the greater are its losses. For the stats nerds out there, I ran a correlation between revenue and net income and found a very strong (r=-.968) relationship between revenue and net income from 2014 to the present. So, the company can obviously sell, but it continues to do so at a loss.

While it’s not selling services at a profit, the company generated cash by selling more convertible notes. Specifically, in March of 2021, the company issued another $375 million of 0% convertible notes due in March of 2026. These convert at an initial rate of 5.5341 shares per $1,000 principal amount. For more on this fascinating tale, check out page F-44 of the latest 10-K. It’s a real page-turner.

In my view, this is another example of the company diluting shareholders, which is evidenced by the fact that share count has grown at a CAGR of ~16.3% since 2014. Finally, on the topic of the dilution here, I think we should take some time to remember the employees of this company for their recent sufferings. In 2019, they were earning over $35,000 per head on average in stock-based compensation. By 2021, that figure had fallen to just over $22,500 per employee.

In my view, not much has changed, and the financial history here remains poor. The question I ask of companies like this remains unanswered: if growing sales won’t lead to growing profits, what will? That said, the crowd has obviously gone through periods of loving the stock, so I think it deserves some consideration. I’d be willing to buy this if the shares were sufficiently cheap.

Everbridge Financials (Everbridge investor relations)

The Stock

If you thought I was a “downer” to this point in the article, get ready for some “downer on steroids”, because I’m about to write about the stock as a thing distinct from the business. When I talk about or write about stocks, I usually remind investors how interesting companies can be terrible investments at the wrong price. This is because this business is an organization that sells stuff, hopefully for a profit. The stock is a proxy whose changing prices reflect things like the mood of the crowd, alternating perceptions of the long-term prospects for the firm. In other words, we can easily measure the company’s situation. Since the stock is about the crowd’s view of the distant future, it’s a bit more unpredictable than forecasting next year’s profit (or loss in this case).

At the risk of boring you even more than I usually do, I’ll drive the distinction between stock and company further by using Everbridge itself as an example. The company released its annual results on February 25th. If you bought this stock that day, you’re up about 68% since then. If you waited a month, you’re up “only” about 14%. Obviously, not much changed at the firm over this exceedingly short span of time to warrant a 54% variance in returns. The differences in return came down entirely to the price paid. The investors who bought virtually identical shares more cheaply did better than those who bought the shares at a higher price. This is why I try to avoid overpaying for stocks.

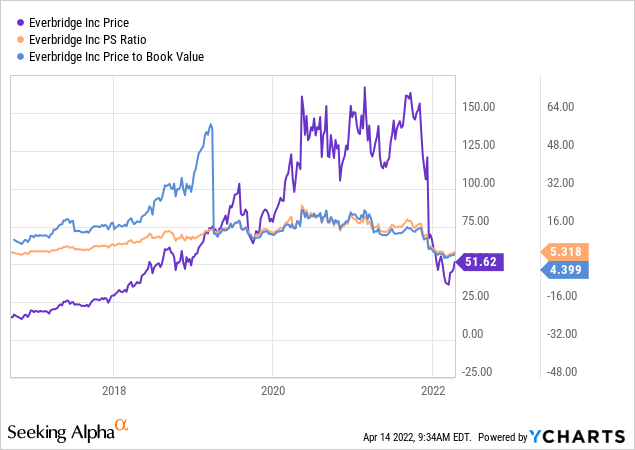

I measure the cheapness (or not) of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the ratio of price to some measure of economic value like sales, earnings, free cash flow, and the like. Ideally, I want to see a stock trading at a discount to both its own history and the overall market. The last time I looked at Everbridge, I moaned that the price to sales and price to book ratios were 17.58 and 16.3, respectively. We see from the below that these valuations have dropped massively.

Relative to their history, the shares are now objectively inexpensive and may be worth considering, especially for people who are more hopeful about the business than I am. Before rushing off and clicking “buy”, though, please consider an alternative path.

Options As Alternative

In my previous missive on this name, I suggested that investors who insist on staying long this company would be wise to eschew the shares and instead express their bullish perspective with February calls with a strike of $90. These were trading at ~$14.20 per share at that time. At the time the calls expired, the stock closed at $101.04. In the two months before they expired, though, the calls got up to a price of $19.40, suggesting that the trade was a reasonably good one. This performance, though not perfect, was certainly better than what happened to stock investors over the past few years.

I like to try to recommend alternative, risk-reducing strategies when I can, so I’m going to repeat the “switch to calls” advice yet again. At the moment, the ask price for the November calls with a strike of $50 is currently priced at $10.20-$12. While some might refer to a call trading for 24% of the value of the stock as a “spicy meatball”, I think it’s still a better trade than the alternative. If the shares continue to rise in price from here, the call owner will enjoy much of the upside. If the shares fall in price, the call owner will suffer, along with the stock owner, but the pain will be less because the call owner employs 76% less capital than does the stock owner.

I’m of the view that the stock is near record-low valuations, and that’s a positive. The problem that I can’t get past is the ongoing poor financial performance here. I can understand why many investors might be bullish here, but I think they would be wise to buy calls instead of shares. If the shares rise dramatically in price between now and the third Friday of November, both the call owner and the stock owner will benefit. If the shares languish, each will suffer, but I believe the pain will be less for the call buyer.

Conclusion

Until this company demonstrates the capacity to generate profits, I continue to think it’s not worthy of investment. The shares are certainly cheaper than they were, but there’s nothing stopping them from getting cheaper. In fact, I’m of the view that the longer this company remains free of earnings, the more investors will lose hope and abandon the name. At the same time, though, I understand the power of the crowd to become hopeful and drive shares higher. Given all of this, I think call options are the “least bad” option for people who insist on staying long here. For that reason, I think the trade I recommended above, or similar, would be the best alternative available to people.

Be the first to comment