Araya Doheny/Getty Images Entertainment

In its recently released third quarter (Q3 2022) shareholder letter, the online event booking platform company Eventbrite (NYSE:EB) says, “Across the breadth of our platform, we see a healthy live events landscape and our scaled marketplace becoming more relevant than ever…”. That in a nutshell seems to be the consensus on the future of the events industry. Consider the following data:

- 83% rise in corporate spending on events and brand experiences is expected in 2023 as per a recent ICE report.

- 77% of the respondents surveyed by American Express Meeting & Events are optimistic about the events industry in 2023.

- 13.5% compounded annual growth rate [CAGR] is expected in the events industry between 2021-28, to reach a size of $2.2 trillion by the end of the forecast period.

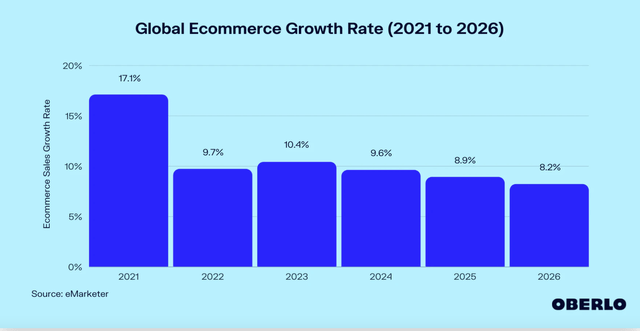

If we consider, in addition, the expected growth in digital sales is at least 8% annual rates until 2026, the potential for Eventbrite begins to surface.

Double-digit revenue growth

And indeed, in three of the last five years, it has shown at least 40% year-on-year (YoY) revenue growth. The pandemic did do quite a number on its sales, but it is recovering from that. In Q3 2022, its revenues grew by 26.4% YoY. It’s notable that the company’s revenues have also risen consistently quarter-on-quarter (QoQ) with the normalisation of global health conditions in 2021.

The volume of paid tickets has also risen by 15% YoY during the quarter. While this is slower growth in both metrics compared to the two preceding quarters, I reckon that it has to do with the wearing-off of the post-pandemic spurt in events’ growth. Compared to the same quarter in 2019, the numbers actually look better, where revenues grew by 11% and paid ticket volumes by 13%.

Weak profit picture, good liquidity

The company’s gross profit margin has also improved substantially over the years and continues to do so in 2022 as well. At 65.2%, it’s higher than the 62.4% seen for 2021 and even higher than the 60.5% level for 2019. It’s still loss-making on both an operating and net basis, but focuses on adjusted EBITDA numbers. The figure of $4.2 million however was down ~29% from Q3 2021. Even without the litigation expense of $0.7 million that it points to for reducing the number, it would still be 17% lower than last year.

Coming to Eventbrite’s liquidity, its position is largely good, with a current ratio of 1.7x and cash and cash equivalents of ~$676 million at the end of Q2 2022. After deducting payables to creators, it still has available liquidity of $348 million.

Using debt for product development

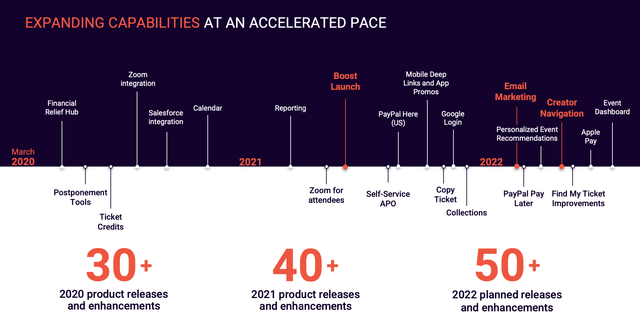

Its debt ratio at 0.4x is also good, however, its debt-to-equity ratio at 2.4x is high. Comfort can be drawn from the fact that it’s using its leverage for investments in building what it calls its “long-term product roadmap”. Product development and engineering is its biggest investment area. It has also added a range of functionalities over the past few years (see chart below) that have likely enhanced the Eventbrite experience.

Risk of price decline

The company does look overvalued, though, compared to the communication services sector, with a price-to-sales (P/S) ratio of 2.8x. The sector’s P/S is 1.27x. However, compared to companies closer in operations to Eventbrite, that’s not so. For example, Momentive Global (MNTV), which enables companies to get customer feedback with platforms like Survey Monkey, has a P/S of 2.4x. Or Zuora (ZUO), which supports businesses in launching and managing subscription-based businesses, has a P/S of 2.6x.

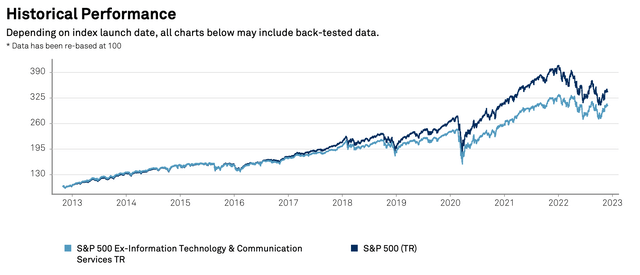

Comparing EB to its closest peers might suggest that it’s fairly valued, but that’s not the full story. It’s worth highlighting that this hasn’t exactly been the year for communication or technology-related stocks. The S&P 500 Communication Services Index is down by almost 39% over the past year, while the S&P 500 IT index is down by 24%. To contextualise this, the S&P 500 (SP500) as a whole is down by just 13.3% in comparison now. Alternatively, the S&P 500 ex-communication services and IT index is down by just 5.8%, showing the drag because of these two sectors.

Additionally, it hasn’t been a year for growth stocks either. In each of the preceding the past five years, growth stocks performed far better than value stocks. Even up to October 31, 2022, the five-year annualised price return on the S&P 500 Pure Growth Index is at 8.6% compared to 5.6% for the S&P 500 Value Index. But there’s clearly a rotation to value stocks now. Over the past month, when the stock markets have in general performed better, the value index (11.35%) has outstripped the pure growth index (7.8%).

According to one definition, a company qualifies as a growth stock if it has seen an average of at least 15% revenue growth over the past five years. A simple average of Eventbrite’s sales growth over the past five years is at over 23% indicating that it makes the cut, even if does not in CAGR terms. Seen through this lens, the wind is currently not blowing in its favour. Compared to the S&P 500, which is down by 17.5% year-to-date, EB has lost over 60% of its value.

What next?

The stock has risen by 7% in the past month, though, which is encouraging. But I’m not holding my breath. Communication services, IT and growth stocks are unpopular this year and EB’s relatively elevated P/S compared to the sector doesn’t go in its favour either. But the market picture is really the only reason I’m holding back from buying it right now. Its revenue growth looks good, and while its profits are wanting, its liquidity looks good too. It also appears to be using its leverage wisely as well. I’d keep a close watch on it and Buy it as it gains momentum.

Be the first to comment