Ca-ssis/iStock via Getty Images

Bank of Japan lets yen go to heck, trade deficit blows out, costs surge for manufacturers, prices surge for consumers.

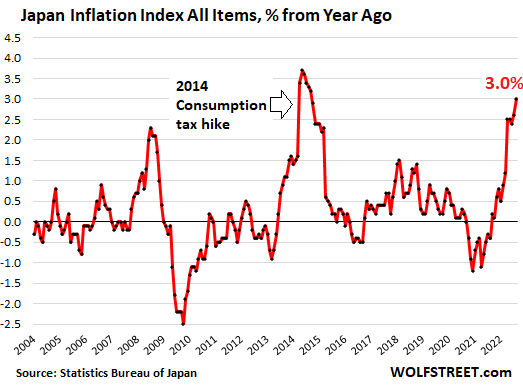

Japan has been lagging behind a little in the global surge of inflation that started early last year. But it’s now coming along nicely. The overall consumer price index for all items in Japan jumped by 0.4% in August from July, and by 3.0% from a year ago, according to Japan’s Statistics Bureau. The measure that excludes rent jumped by 3.5%. The measure for food jumped by 4.7%. A year ago, inflation was still negative.

Some of the major categories.

- Food inflation: +4.7% year-over-year. This includes fresh food (+8.1%), fresh fish and seafood, a crucial item in Japan (+13.7%), and fresh fruit (+9.4%).

- Fuel, light, water charges: +15.6% year-over-year, including: Electricity (+21.5%), gas for the home (+20.1%), and “other fuel and light” (+18.0%).

- Household durable goods, such as furnishings and appliances: +6.3%.

- Clothing: +2.1%

On the positive side:

Communications, where there had been a price war between wireless carriers, prices fell year-over-year: -3.1%.

Government pushes down healthcare inflation: In Japan’s system of universal healthcare, funded by taxes and individual contributions, the government largely decides the prices consumers have to pay for co-pays, insurance, medicines, etc. For Japanese consumers, healthcare costs are small, by US standards. And the government is using the lever of healthcare costs to push down overall inflation.

Three of the four healthcare categories show price declines year-over-year:

- Medical care: -0.7%

- Medicines: +1.2%

- Medical supplies and appliances: -0.6%

- Medical services: -1.7%

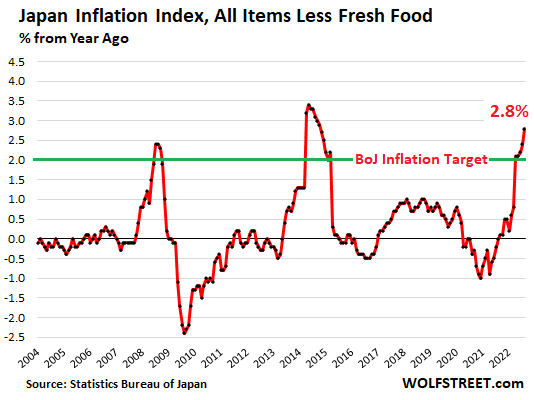

The core inflation index.

The index for “all items less fresh food” in Japan is what the Bank of Japan uses for its 2% “price stability target.” This index rose by 0.3% in August from July and by 2.8% year-over-year, have shot through the BoJ’s inflation target in April:

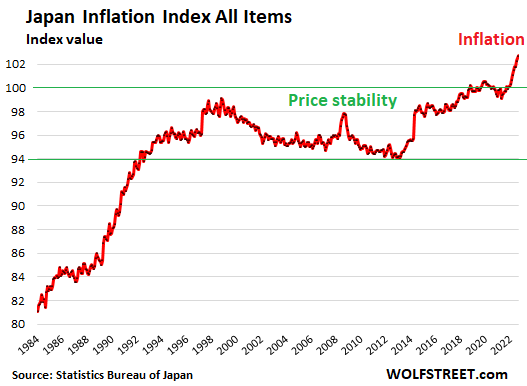

After 23 years of price stability, inflation takes off.

There was no “deflation spiral” in Japan; but there were roughly 23 years of relative price stability, with periods of mild deflation followed by periods of mild inflation, and the whole thing sort of evened out over the long term.

Japan’s all-items inflation index, when seen as an index rather than a percent change of the index, shows this.

In 1997, the index was about 99. Over the next 13 years, the index then declined by a total of 5% all combined, unwinding in 13 years the amount of inflation of five years (1992 through 1997). Then the index rose again, hitting 100 in 2018, so up about 1% from 1997, and roughly remained there until late 2021.

Over those 23 years, the index increased by about 1%; in other words, actual price stability, where the yen maintained its purchasing power within Japan. I wish we could say the same thing of the USD, whose purchasing power within the US has plunged over the same period by 42%.

But now, price stability is over in Japan. And inflation has taken off:

Instead of hiking rates to battle inflation, the Bank of Japan watches yen go to heck.

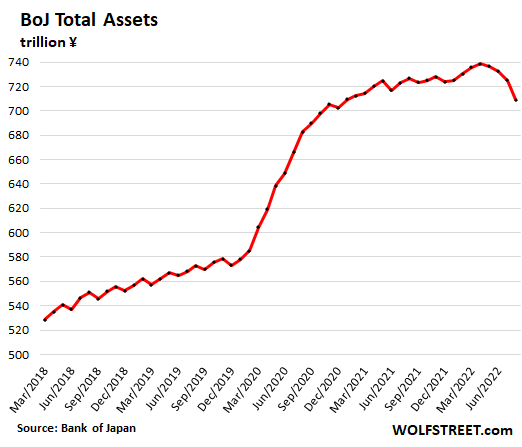

The “All items less fresh food” index – the measure the Bank of Japan uses for its inflation target of 2.0% – is up by 2.8% year-over-year and surging, and the BoJ is still blowing it off. Governor Kuroda will be out next April, and until then, he, the architect of Japan’s money-printing orgy and negative interest rate policy, will likely dig in his heels, keeping the policy rate at -0.1%.

But Japan’s balance sheet has started to decline as some of the pandemic loan programs are being unwound.

Now the BoJ is up against the Fed, which has been hiking rates since March, and against the ECB, which has hiked its policy rate twice in a row, and more aggressively than expected, and it’s up against most other central banks that have been hiking their policy rates, some of them aggressively since mid-2021.

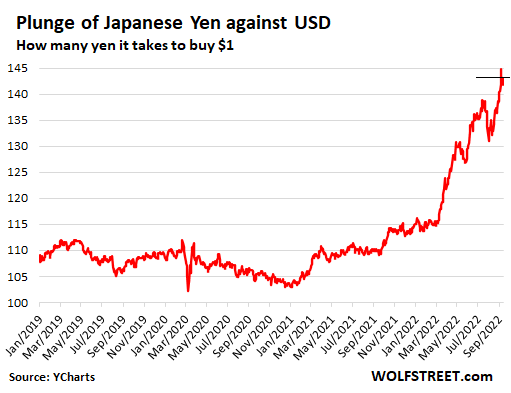

The yen started dropping against the dollar in January 2021. At the time it took about ¥104 to buy $1. In March 2022, when the Fed started hiking its policy rates, the yen began to plunge. Today, it takes ¥143.8 yet to buy $1.

The plunging exchange rate of the yen makes imported commodities and raw materials, including food and energy commodities, a lot more expensive in Japan.

But Japan also imports a lot of consumer goods. And Japanese manufacturers import a lot of manufactured components, and all that is getting more expensive. As a result, Japan’s producer price index jumped by 9.0% in August year-over-year. And since late last year, Japan’s trade surplus turned into a massive trade deficit.

But the weak yen doesn’t offer a lot of advantages to Japan’s global manufacturers because they have factories around the world. For example, all Japanese automakers have factories in the US and Mexico where they produce many of the vehicles they sell in the US. So a weaker yen doesn’t help these manufacturers at all.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment