bjdlzx

(Note: This article appeared in the newsletter July 31, 2022. This is a Canadian company that reports in Canadian dollars).

Paramount Resources Ltd. (OTCPK:PRMRF) is basically a family-run company that has a long-term outlook. It appears that long-term outlook is finally rewarded. This is one of few managements I have covered that went out on a financial limb and then climbed right back out with a great deal for shareholders. They then followed that up with the purchase of Apache Canada for a dirt-cheap price. It has been five very trying years of whipping that purchase into shape. But that process appears to be paying off in a big way in the current environment for shareholders.

Management recently announced a normal course issuer bid to repurchase up to 10% of the company stock. This is easily one of the largest repurchases of any company I follow. The process points to a lot of anticipated free cash flow that the market supposedly prioritizes. If that is the case, the free cash flow and the repurchase of shares should push the stock a lot higher than the current price.

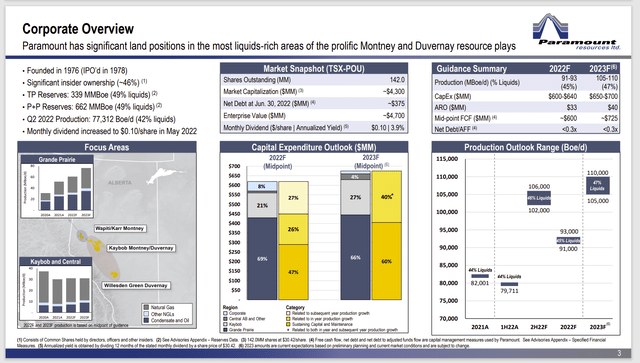

Paramount Resources Insider Ownership And Corporate Guidance (Paramount Resources Corporate Presentation August 2022.)

There are only a few companies that will materially grow production in the current fiscal year. This is one of them. Management has long been working on increasing profitability since they purchased these properties. There was criticism of the strategy to whip properties into shape and then sell them. The proceeds were reinvested back in the remaining properties, which then produced more sales. An asset strategy like that has risks, as 2020 showed, because property sales and purchases can dry up. In the meantime, the debt must be serviced until the properties that were fixed up can be sold. Now, finally the remaining properties are going to generate tremendous cash flow.

This company recently initiated and now is increasing the dividend. Management has announced a relatively large share repurchase project. The long-term debt ratio is extremely low by just about any measure. On top of that, there will be cash for significant production growth. This company is one of the best deals that I follow in an industry with a lot of good investment ideas. The ability to do all those things at once demonstrates above-average profitability and hints at long-term stock outperformance.

Meanwhile, the stock price action is affected by past memories. The market is really reacting to the past strategy of whipping leases into shape and then selling them. That was largely an asset story which led to a lot of market fears in the covid-19 demand destruction year of 2020. The difference going forward is the amount of cash flow achieved will likely fund continued improvements for the very large project of continuing to optimize what was Apache Canada. That is a change from the previous “build and sell” strategy which was closer to an asset strategy that the market came to distrust in fiscal year 2020.

The other strategic evolution was from one of a dry gas producer that optioned into rich gas to a rich gas producer that options into more rich gas as market conditions permit. The market has yet to give management credit for being able to take advantage of robust selling prices by increasing production. That process likely adds far more long-term value to the business than repaying debt.

This management is similar to Exxon Mobil (XOM) in that both companies worked through a very challenging five years to considerably benefit shareholders for when the good times arrived. Both companies earned a lot of negative feedback for investing at a time when “clearly it was not worth it.” But then it turns out that it was worth it. Those of us that earned an MBA know that the best time to expand a cyclical business is at market bottoms when prices are at rock bottom. Yet the market and investor pressure is nearly always in the opposite direction.

Exxon Mobil was able to resist that pressure because it had low debt levels and was integrated. Even though the company reported losses during some of that five-year period, the benefits now surely outweigh the costs.

Paramount Resources management resisted the outside pressure because insiders own so much of the common stock. The market reacted to the strategy by sending the stock to levels that would normally forecast a bankruptcy. But with insider holdings so large, management was able to resist the pressure while firmly heading towards the current situation.

Now the stock price has improved tremendously. But the cash flow has improved far more so. Therefore, the stock remains a bargain even if one does not consider the good growth prospects ahead.

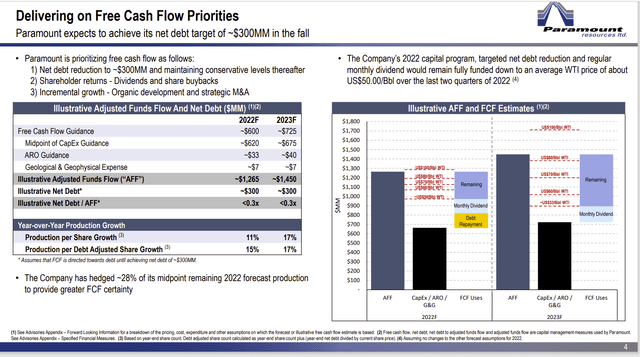

Paramount Resources Free Cash Flow And Maintenance Budget Guidance (Paramount Resources August 2022, Investor Presentation)

Management has long been very strict about low costs. The result is shown above that points to a very low corporate breakeven point. This is a management that tried hard to keep those dry gas costs where possible while drilling for liquids rich resources. The result is a lot of the increased value headed straight to the net income line.

In market terms, it has been a fairly long wait to execute the strategy back when the purchase of Apache Canada was made in 2017. But now that wait appears to have been more than worth it. The kind of management that can successfully engage in a long-term strategy like this rare. ExxonMobil is one of the few other companies I follow that was able to do this.

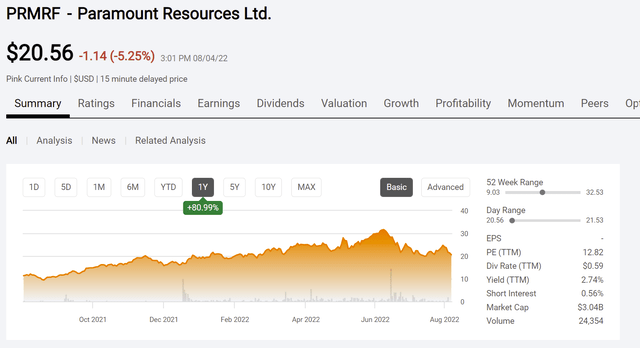

Paramount Resources Common Stock Price History And Key Valuation Measures. (Seeking Alpha Website August 4, 2022.)

Since the purchase (of Apache Canada) in 2017, the stock price has managed to double (roughly) from that level. Production levels are largely intact since the acquisition, but the profitability is far greater than it was back when the purchase was made. Some of that is due to the far higher selling prices. But management gets credit for the increases in natural gas liquids production (including condensate which often sells for a premium price to WTI pricing in Canada). Oil production is also a higher percentage of the production mix.

The increase in cash flow combined with the low debt levels will allow for a significant increase in production for years to come on the acreage. This is now a far more traditional growth stock that will live within cash flow. The market will of course wait for evidence before revaluing the stock. But management will not have to do anything extraordinary going forward to accomplish that desired track record along with a few years of low debt.

Purchasing and then optimizing Apache Canada has been a huge project for this company. But that project is now at the point where the market will begin to reward the efforts of management.

This is not a management that typically does “road shows.” So, the lack of company promotion is likely to slow market recognition. Still, this management has done an outstanding (if unconventional) job of taking a corporate division that many did not think much of and making it far more profitable. Any management that does that is worth consideration by even risk-averse investors.

Be the first to comment