peepo

Published on the Value Lab 12/7/22

Eve Mobility Acquisition Corp. (EVE)(NYSE:EVEX), soon to be called just ‘Eve’, has gone public with the approved merger with the Zanite SPAC. The long-story short is that Embraer (ERJ) has been working on the Eve business for a while now, and decided to put it up for a SPAC opening onto markets in order to separate it out from its own traditional and somewhat languishing tier 2 aviation business. The concept is aggressively VC as well as industrial, which means a lot of cash will be burning on development but also fixed investment and inventory. While the idea is to revolutionize urban travel with eVTOLs, a very cool concept, it might not work and will depend on a lot of regulatory hurdles. It is a convincing future for urban mobility, but with the state of capital markets, the cost and risks for current investors might outweigh the benefits. We’ll pass on it.

On The Concept

The concept is that Eve should become a service and maintenance company for eVTOLs (vertical electric take off vehicles) it produces and sells to partners that today would be lessors or owners of urban mobility fleets like helicopters etc. Longer distance airline-style companies might also be interested given the range capabilities, but also defense companies might be interested in employing eVTOLs as part of a ‘swarm’ concept, especially for naval defense. Eve would also provide the management system for urban traffic of eVTOLs to deal with safe taxi of these things in urban skies.

BAE Partnership (Investor Presentation)

The idea is that with the backing of Embraer, which is a Brazilian company and therefore has been certifying aircraft models in several jurisdictions for the last 40 years, should be able to help get eVTOLs approved by the FAA, EASA and Brazilian authorities as well as others on budget and on time. While Embraer certainly would be able to help, this very new concept has no precedent and will likely be very complicated to safely implement, so we’d be cautious.

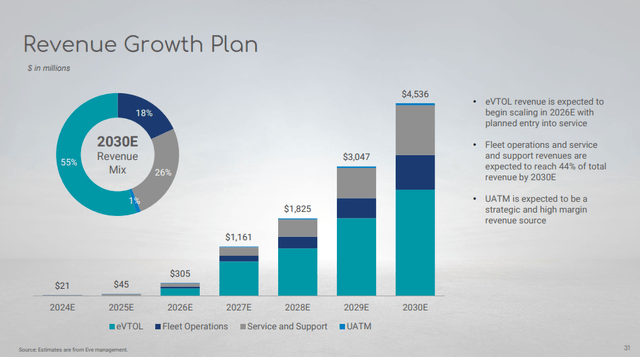

Theoretically, assuming that these things can be adopted by fleet managers and are cost-effective for customers in urban areas, the economics of Eve would be good. They wouldn’t own any of their own eVTOLs after they’re finished, since they are out to produce and sell them, and a large installed base would mean a lot of high margin service and support revenue. Moreover, for urban markets which will require traffic management, and where most of these eVTOLs would be concentrated, fleet operation contracts would be another major cash flow. Finally, while more capitally intensive in terms of revenue, the size of the market for producing these eVTOLs would also be quite large.

Revenue Mix in 2030 (Investor Presentation)

Currently, they are in non-binding agreements for almost 2000 of these aircraft, each priced at $2.75 million and a total contract of $5.5 billion, with partners in these various markets, many of which are marquis partners. It’s impressive, but of course these are non-binding agreements, and will of course depend on jumping the legal hurdles.

The Investment Case

Let’s hop on to the investment case now. There are lots of things to consider in addition to the concept. Let’s start with the pros.

- The Embraer relationship is not irrelevant. Eve will have royalty free access to the full portfolio of Embraer IPs. With Embraer being the leading company in small regional aircraft and light jets, these IPs are both relevant and free. This is a structural benefit to the company. Moreover, Eve will have access to Embraer engineers, where Embraer as the majority holder of the company is still going to be backing the project with all its industrial might. This will include at a minimum 1600 engineers and resources provided at a fixed cost-base. With the labor shortage, it will be good to have these people on tap.

- The economics are somewhat capital light for a manufacturing business, and with the possibility for larger working capital funding from upfront customer commitments, the ball can get rolling on financing manufacturing facilities, which will not be provided by Embraer since Eve will need their own for eVTOLs.

- Theoretical profitability is there, and with urban economics for maintenance and service, the efficiency only gets higher. With the price of these eVTOLs not being all that much less than a typical light jet (about 30% less), we can be sure that profitability will eventually be there once the adoption phase is over, which is of course the most contentious point.

We can agree on the pros, but the issues are in the cons:

- It’s a pie-in-the-sky that might never come to fruition. With 7-sigma being the standard for factories, imagine how difficult it would be to convince politicians that these things flying over our heads all day are safe. Since the concept is for traffic of these things to be more dense than helicopter traffic, the risks are higher. It will be difficult to prove that this is safe, even after certifying the aircraft which depend on electric mobility, which is another new engineering challenge already and comes with its own set of safety concerns (volatility in battery life). Safety is not the only concern, will these things be annoying, and float in front of your windows and terraces in your apartments? Drones are already running into some issues in certain places, so we’d be concerned about this aspect too.

- While working capital commitments are said to be able to fund manufacturing expense, whereby required funds for the Eve ramp-up are only $540 million, with lead times being what they are for company CAPEX nowadays, we are not confident in this CAPEX plan coming to fruition. Moreover, it will depend on a smooth process of approvals across geographies covering their current slated partner base. Given their figures, there is at least a big margin before any more dilution in addition to that associated with the SPAC.

- SPACs dilute public shareholders. Be aware that while some proceeds come from these exercised options, Eve shareholders as of today could be diluted as much as 25% even without capital requirements demanding further dilution through more stock issuances.

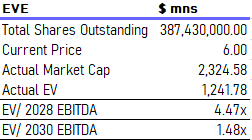

- While the SPAC price is staying strong now, the multiples on very forward income implied by the price are worrying given the state of VC markets right now. The 2030 EV/EBITDA multiple is 3.29x assuming full dilution. Yes, it’s low, but you can buy extremely profitable and safe companies that offer the same today thanks to the market correction without waiting 8 years to get the EBITDA yield implied by that multiple.

Fully Diluted Multiple (VTS)

Conclusions

There are some structural advantages here, but stocks that have the promise of long-term customer commitments and an innovative product have also suffered from the market corrections we find from these EV style issuances. Consider Arqit (ARQQ) which is an interesting company with somewhat similar forecast horizons that has had its price decimated. The multiples aren’t that low on very forward EBITDA, especially when the possibility that the company doesn’t move forward with its original concept is certainly there. There are a lot of things that need to go right for Eve to succeed, and we just don’t see the point of risking money at the SPAC price of $10 when it could drop to $1 very easily with a change of sentiment. Yes, Embraer is a stable holder and owns the vast majority of shares, and the majority of the shares are still subject to lock-up, but why play a game of options with this stock, where the economic outlook could be worse by the time lock-ups expire. Even if you are saved from volatility in the price, it is still a binary play. While very cool, we pass on it and keep watch from afar.

Be the first to comment