shaunl

Thesis

Container shipping stocks like Global Ship Lease, Inc. (NYSE:GSL) have been decimated recently as global macroeconomic headwinds have worsened significantly.

Despite the earnings visibility provided by GSL’s multi-year fixed charter rates with its container shipping companies, the market has de-rated the industry as a whole. We think the battering is justified, as a much weaker macro environment could put further pressure on renewal rates moving ahead. Notwithstanding, the company remains confident that the order book dynamics within its target market (sub-10K TEU) are well below the industry’s average. Coupled with regulatory tailwinds supporting slower voyage speed moving forward, it would continue to underpin robust charter rates over the next few years.

However, the steep correction in global freight rates from their 2021 highs has alarmed shipping investors. Furthermore, the global supply chain pressure has fallen to levels last seen in late 2020 as port congestions eased further. Hence, we concur with the market’s assessment that even GSL’s gains need to be digested to de-risk its execution risks in the face of a looming recession.

We also noted that GSL’s valuation has fallen from its highs in early 2022. We think the market was right in not re-rating the stock despite its seemingly “low valuations.” However, we also noted that GSL is closing in on its fledgling long-term support, which could help undergird its recovery cadence if the underlying shipping dynamics don’t worsen significantly.

As such, we rate GSL as a Buy, with a medium-term price target (PT) of $20.

Shipping Headwinds Are Getting Worse

The panic in shipping stocks is understandable, as investors rushed for the exit to mitigate the impact on their portfolios. As a result, the selling pressure forced GSL down more than 50% to its June lows, taking out lows all the way back to May 2021.

Furthermore, headwinds seen in the shipping industry have worsened further in recent months. Global freight rates have continued to fall through October, down nearly 67% from their September 2021 highs. Notwithstanding, they remain well above their pre-COVID lows, mitigating the profitability impact on shipping companies.

Notwithstanding, global trade flows could also weaken further through 2023. The World Trade Organization (WTO) slashed its previous forecast of 3.4% in trade growth for 2023 to 1% recently, given the macroeconomic fallout, worsened by the Fed’s increasingly hawkish posture. The WTO articulated:

Global merchandise trade will slow next year as multiple shocks ranging from Russia’s war in Ukraine, high energy costs in Europe and US monetary policy tightening raise manufacturing costs and squeeze households. – Bloomberg

Furthermore, Moody’s also turned increasingly negative on the order book outlook through 2024, suggesting an oversupply under the hood. It revised its outlook for the industry to negative, indicating further pain for shipping investors ahead as global demand worsens. It articulated:

New ships launching in 2023 and 2024 may hasten the industry’s reversal of fortunes. The order-book-to-fleet ratio of 28% is the highest since 2010, and that increase in capacity will exceed projections for global trade volumes. Although service reliability issues and elevated freight rates will likely persist into 2023 as the transportation ecosystem continues to right itself, we believe that carriers’ earnings have now peaked as an increased supply of vessels meets weakening demand. – Bloomberg

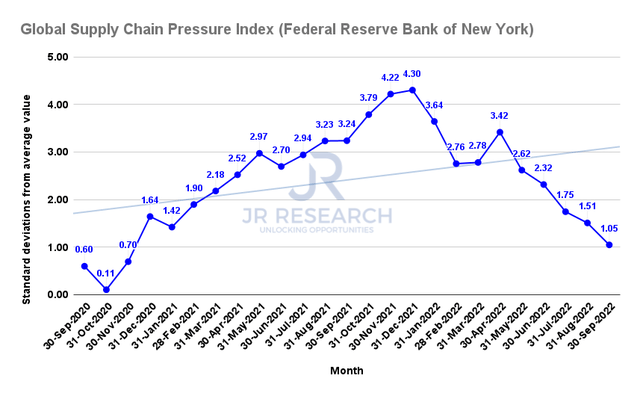

GSCPI (Federal Reserve Bank of New York)

Does it make sense? We believe it does. As seen above, the global supply chain pressure index (GSCPI) has moderated tremendously from the highs seen in late 2021, which is also broadly in line with the highs seen in global freight rates.

Notably, the latest reading from the GSCPI suggests that it has fallen to levels last seen in late 2020. However, it remains elevated (relative to pre-COVID averages) but could continue to fall as global shipping demand worsens due to the global macroeconomic downturn. Hence, we believe the headwinds against the shipping industry seem far from over.

But GSL’s Estimates Have Factored In Tepid Growth

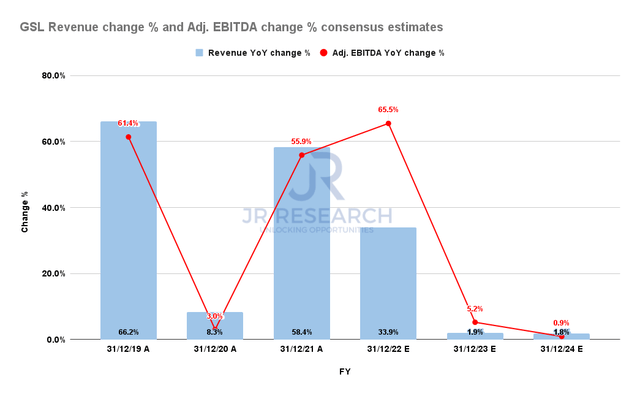

GSL Revenue change % and Adjusted EBITDA change % consensus estimates (S&P Cap IQ)

However, as seen above, we gleaned that GSL’s estimates have already been revised markedly downward to reflect the worsening macroeconomic climate through 2024.

Therefore, we postulate the de-rating in GSL has reflected a significant level of downside risks on its revenue and earnings growth through FY24.

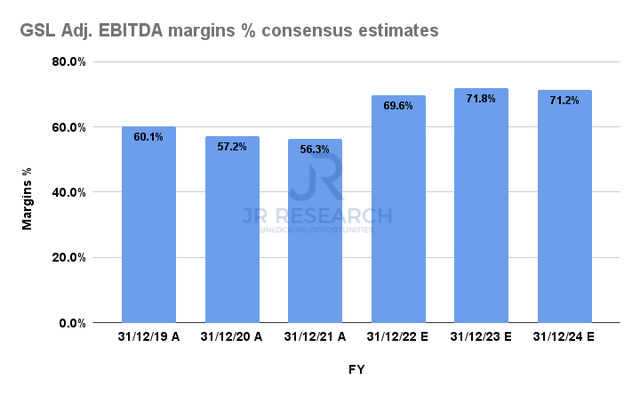

GSL’s Adjusted EBITDA margins % consensus estimates (S&P Cap IQ)

Furthermore, the earnings visibility provided through its fixed rate charters is expected to maintain its robust profitability through the cycle, sustaining its current dividend payouts.

But, we believe the market is looking further ahead post-FY24 to assess whether the demand/supply dynamics could normalize further for GSL and its peers. If it does, it could cause its profitability to slip further to reflect charter rates headwinds, causing more value compression. We believe that is the main risk to our thesis that investors must consider carefully.

Is GSL Stock A Buy, Sell, Or Hold?

With an NTM dividend yield of 9.3%, we believe its reasonable yields reflect management’s prudence through the cycle. In addition, its relatively low TTM dividend payout ratio of 19.46% (based on GAAP EPS) underscores our conviction that it could be sustained through FY24.

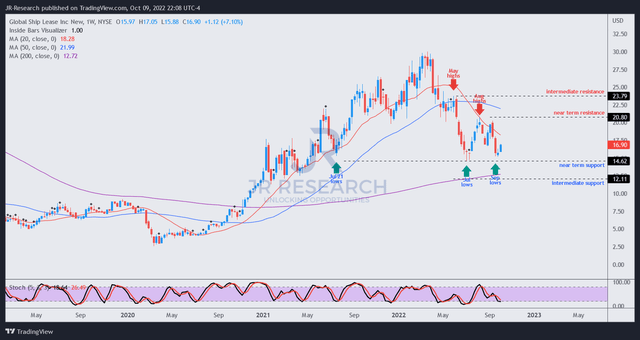

GSL price chart (weekly) (TradingView)

We gleaned that GSL has moved decisively into a medium-term bearish bias on its medium-term chart. However, it remains in a long-term uptrend and has reversed from its long-term decline since its bottom in March 2020.

Therefore, we postulate that GSL is at a critical juncture now. The bear trap price action in July 2022 seems to have stanched further selling downside. In addition, buyers have stepped in robustly to support GSL’s near-term support ($14.5) in the recent pullback from its August/September highs.

Hence, we urge investors to watch this level closely, as it could unveil clues on the market’s directional bias moving ahead. However, we see further downside risks to re-test its intermediate support of $12 if the headwinds worsen.

That would effectively wipe out nearly two years of gains, which could cause a capitulation move in GSL, and de-risking its entry zones. Hence, we urge investors to consider layering in their exposure over time to capitalize on potential downside volatility.

We rate GSL as a Buy, with a medium-term PT of $20.

Be the first to comment