Amax Photo/E+ via Getty Images

Columbia Care Inc.’s (OTCQX:CCHWF) earnings results (Q3 results scheduled for release on 14 November) could not have come at a worse time. Between inflation and sector-wide price compression, this show-me story suddenly faces great difficulty in its efforts to ramp up margins. While the stock continues to trade at cheap multiples based on 2023 estimates, there remain questions as to whether the company can really scale up margins as expected. The best case scenario for CCHWF is for its merger with Cresco Labs (OTCQX:CRLBF) to be completed as soon as possible – but there are better options in the sector.

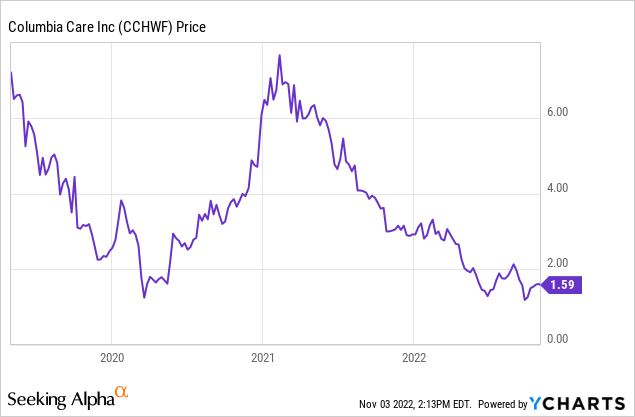

CCHWF Stock Price

Some may forget that CCHWF came public via SPAC in late 2018 at $10 per share.

It has been a tough ride for shareholders, as in spite of strong top-line growth, CCHWF is down over 80% from SPAC prices.

CCHWF Stock Key Metrics

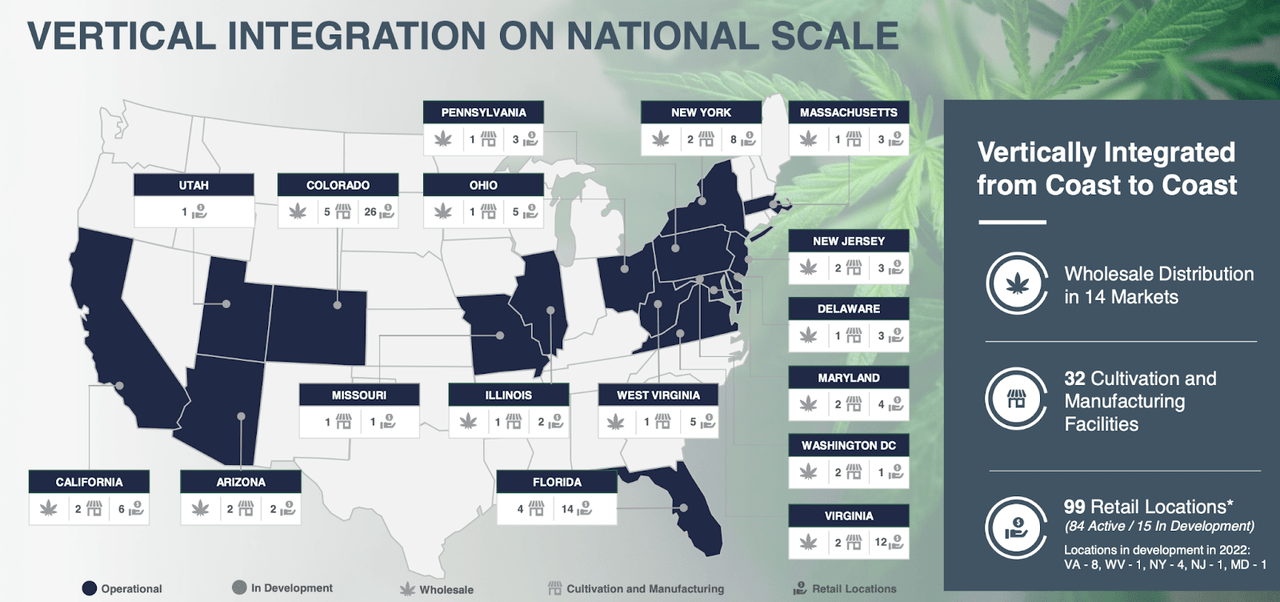

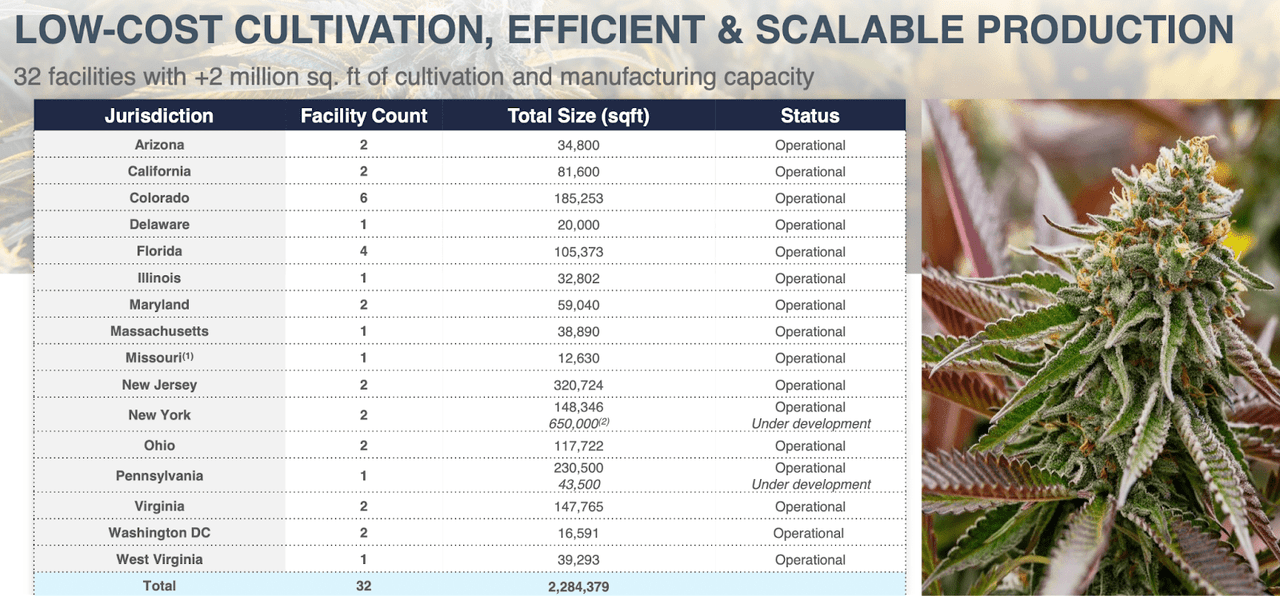

I have previously referred to CCHWF as a cheaper Curaleaf Holdings (OTCPK:CURLF), and I think that comparison still stands today. The company has a wide footprint with 99 retail locations spread across 16 states (plus Washington DC).

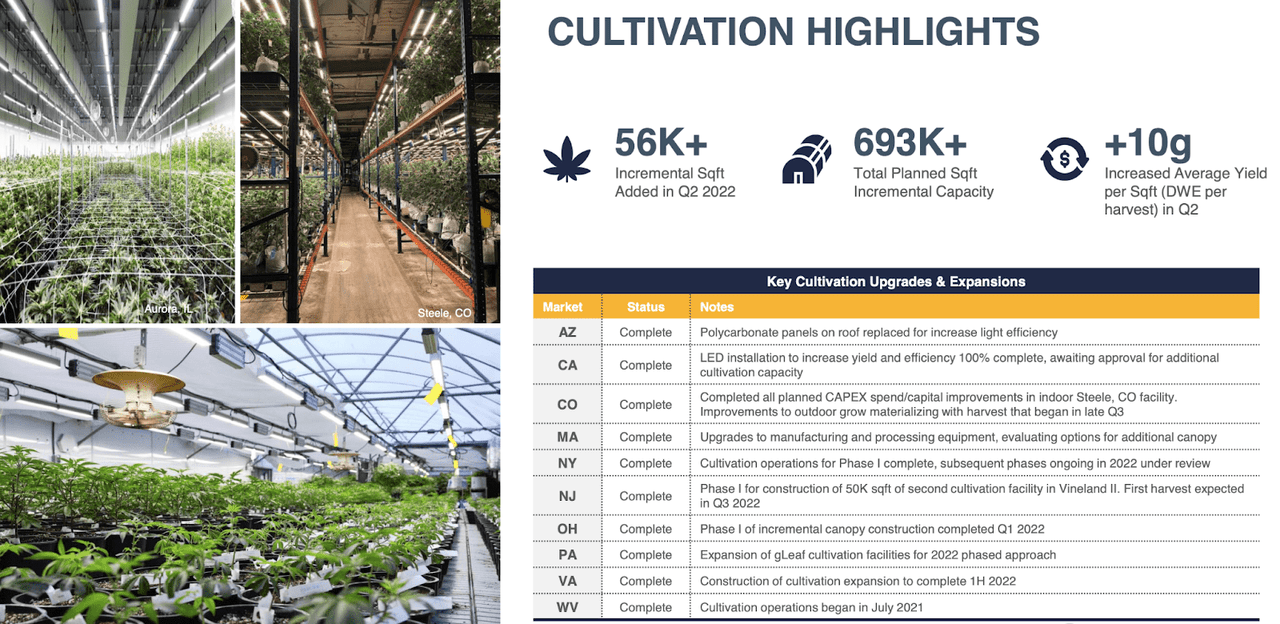

2022 Q2 Presentation

The company is vertically integrated in most of those states, but, like CURLF, the company has a sizable presence in unlimited license states. In particular, California and Colorado rank among its top 5 markets by revenue.

2022 Q2 Presentation

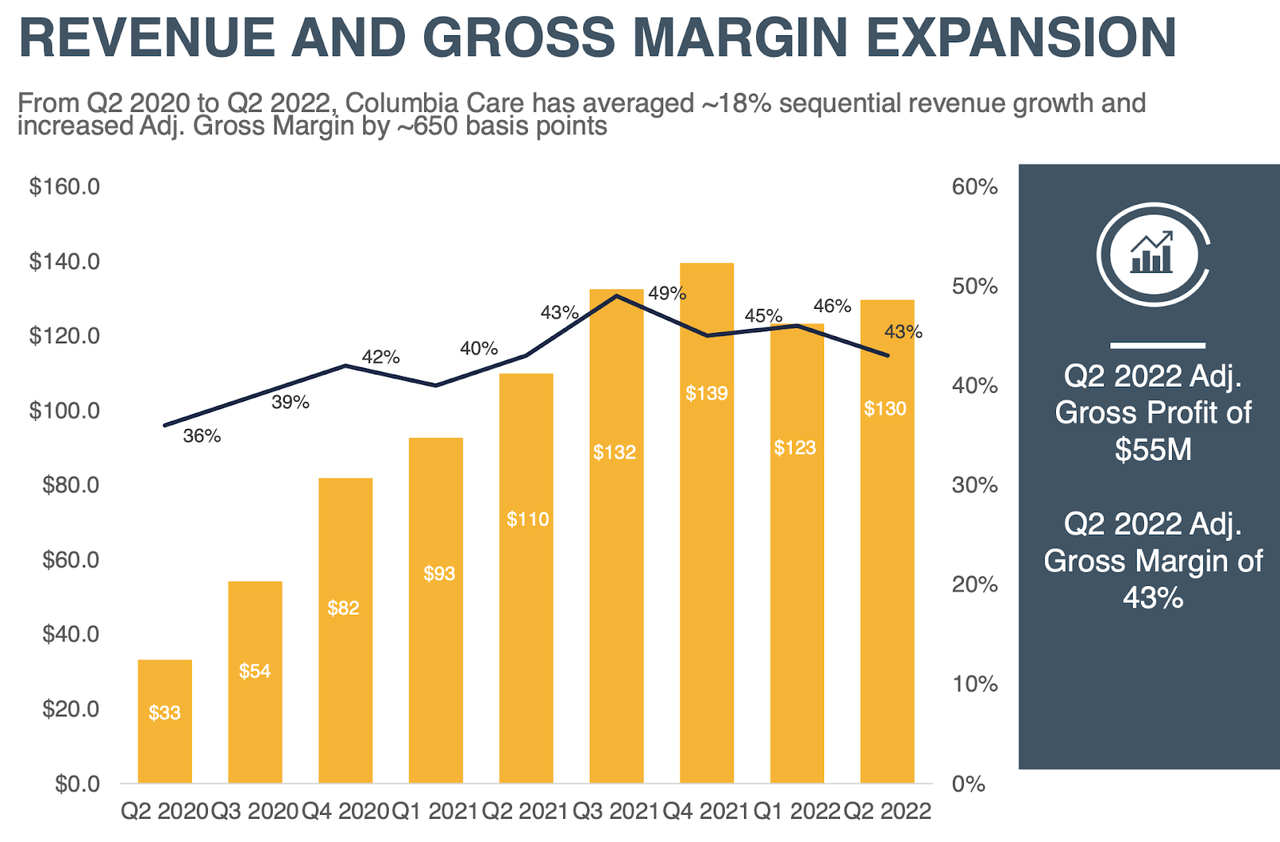

CCHWF reported 18% year-over-year revenue growth in the quarter, with gross margins hovering at 43%.

2022 Q2 Presentation

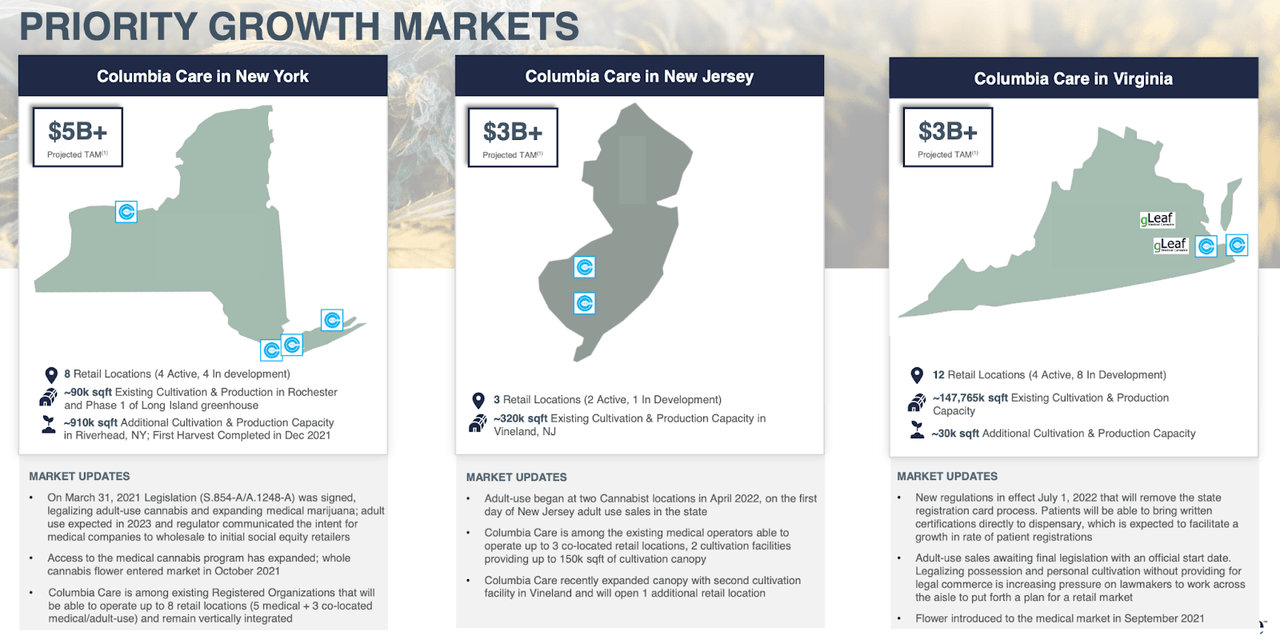

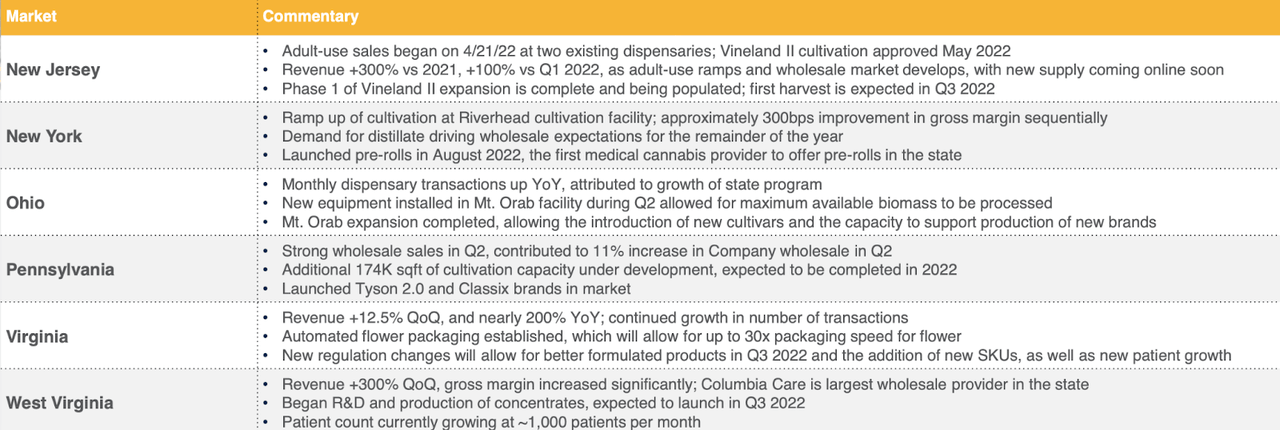

Adjusted EBITDA margins, however, dipped to 9.2%. The company has shown no indication that it will exit its unlimited license markets in spite of the tough macro-environment. This is an example of a “growth at all costs” strategy. CCHWF has identified New York, New Jersey, and Virginia as its priority growth markets.

2022 Q2 Presentation

To its credit, CCHWF has successfully completed many cultivation upgrades and expansions, which is expected to lead to stronger yields.

2022 Q2 Presentation

Looking ahead, CCHWF is still working on expansions in New York and Pennsylvania.

2022 Q2 Presentation

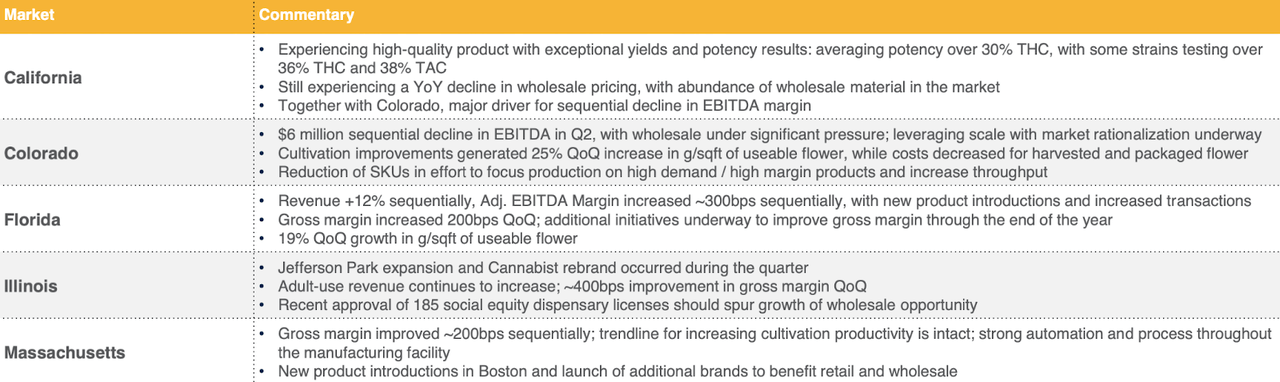

One thing I do like about CCHWF’s disclosures is that it gives commentary on market conditions on a market-by-market basis. I am of the opinion that all MSOs should be taking it a notch further by releasing state-by-state financials, but my hopes fall on deaf ears.

2022 Q2 Presentation

2022 Q2 Presentation

CCHWF ended the second quarter with $81.4 million of cash versus $325.7 million of debt (not including $357.6 million of lease liabilities and deferred debt). While that debt load is comparable with peers, the leverage ratio is stretched because CCHWF’s EBITDA margins are so slim.

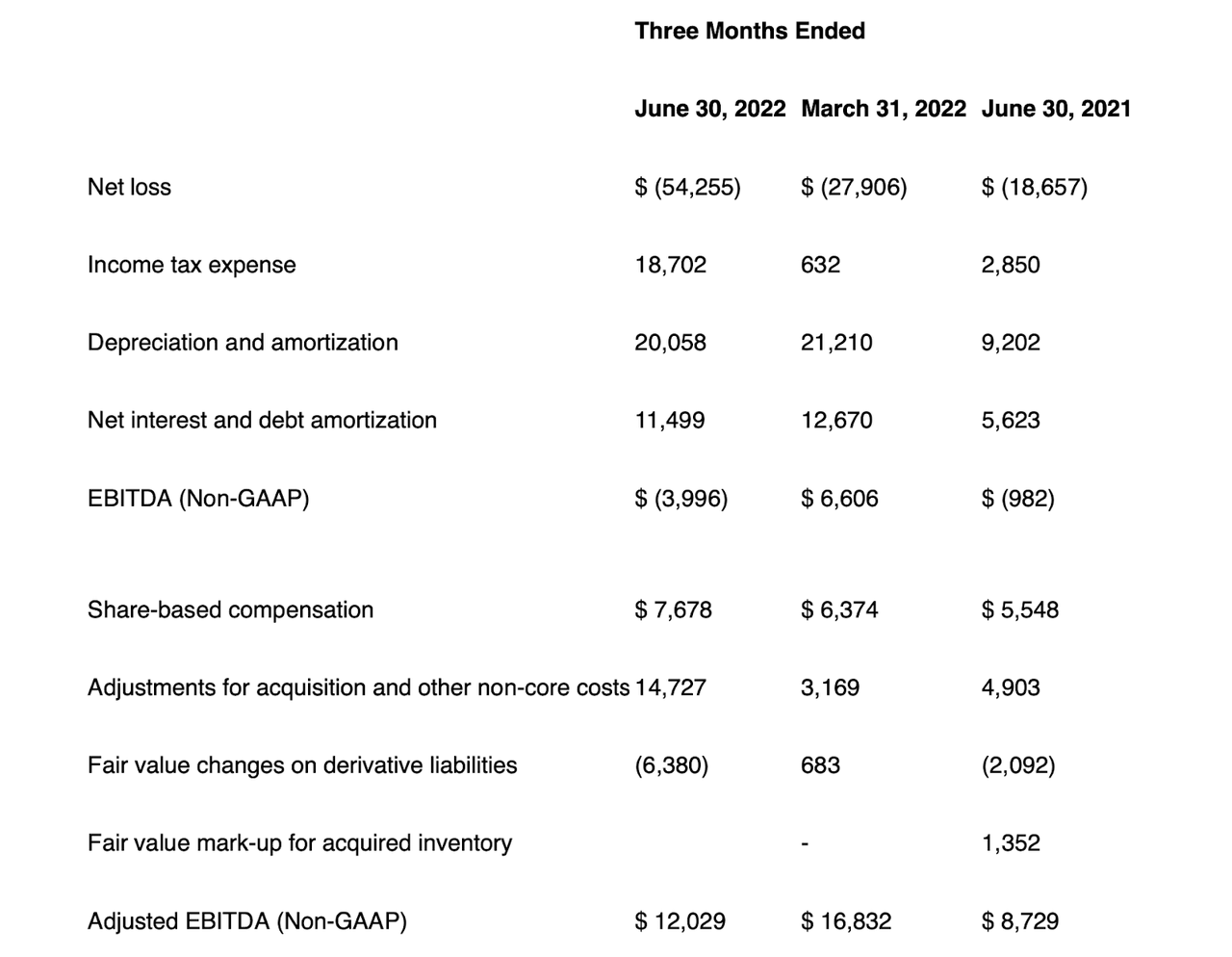

I have previously discussed my view that legislative reform will not happen for many years. I am focused on MSOs which can generate strong cash flows right now, even with 280e taxes and high costs of capital. CCHWF, unfortunately, is not one of those operators. We can see a reconciliation of net loss to adjusted EBITDA below for the company.

2022 Q2 Press Release

I have defined operational free cash flow as being adjusted EBITDA minus interest and tax expenses (maintenance capex tends to be minimal for cannabis operators). CCHWF’s free cash flow stood at negative $18.2 million in the quarter and was not positive even after adjusting for a higher than usual tax expense. Between CCHWF’s high debt load and sizable cash burn, the company presents great financial risk amidst an environment in which liquidity is drying up.

Management has guided for mid-single digit revenue growth and 150-250 bps of adjusted EBITDA margin expansion each quarter this year, but guidance in the cannabis sector has been better left ignored as of late.

Management expects less than $20 million of CapEx for the remainder of this year, with that amount being spent on store openings in Virginia and the aforementioned cultivation expansion projects.

While many investors seem to be ignoring the financial risks at CCHWF, they are instead focused on its upcoming merger with CRLBF. On the conference call, management stated that:

In every market with planned divestitures, perspective bidders have completed initial due diligence. We have evaluated bidders have signed LOIs in advance of executing definitive agreements for every asset being sold, awarded exclusivity to certain lead bidders and are now moving through the final negotiations to sign definitive purchase and sale agreements, which we expect to announce in the next 30 to 45 days.

The state regulatory approval process continues to move forward on a similar rapid path. We have already submitted license transfer applications, for over half of the licenses that require approval.

Management continues to expect the merger to close by the end of 2022.

Is CCHWF Stock A Buy, Sell, or Hold?

As of recent prices, CCHWF is trading at 2x 2023e sales, lower than Tier 1 peers and high than Ayr Wellness (OTCQX:AYRWF) or Ascend Wellness (OTCQX:AAWH). However the stock trades at a premium 9x 2023e adjusted EBITDA and 19x 2022e adjusted EBITDA – a premium to higher quality Tier 1 peers Verano (OTCQX:VRNOF) and Trulieve (OTCQX:TCNNF). While both AYRWF and AAWH 2023 estimates imply sizable growth in adjusted EBITDA, I have more confidence in those estimates, largely due to their focus on limited license states. CCHWF, by contrast, will likely continue to see EBITDA margins pressured by its sizable presence in California and Colorado.

Given that CCHWF does not trade cheaply relative to either Tier 1 or Tier 2 operators, I see little reason to buy the stock here. There is little reason to be buying this name for diversification because it does not offer either greater value or lower risk than the names already in our portfolio. Just expanding on that a bit, I could see the argument for owning Green Thumb (OTCQX:GTBIF) due to the lower risk balance sheet and stronger margins, but similarly see little reason to own CURLF, as that stock trades richly with worse fundamentals.

Perhaps the main reason to own CCHWF might be due to the arbitrage potential with CRLBF. I had previously sold CCHWF in March due to the deal. Recall that each share of CCHWF will be exchanged for 0.5579 shares of CRLBF. As of recent prices, there is an approximate 14% arbitrage opportunity, meaning that if one were to sell CRLBF and buy CCHWF, they could potentially earn 14% more shares by the time of closing.

I have seen many retail investors show great interest in that arbitrage spread but, speaking frankly, my view is that they have greatly overestimated the value of that arbitrage spread. For one, there is great risk that this deal does not go through – it would represent one of the more messy deals in cannabis history. Second, does one really want to own the resulting entity? The combined company would have over $1 billion in net debt (including lease liabilities). Sure, they’ll be able to pay off some of that through asset sales, but I am doubtful that they will get attractive prices on those sales considering that public company valuations are so low. CRLBF itself is not generating envious margins, and I expect margins to only deteriorate when it tacks on CCHWF. I wouldn’t be surprised if CRLBF sees its stock tank in the months following any completion of the merger deal.

Those looking for cannabis arbitrage might better prefer the situation at Goodness Growth Holdings (OTCQX:GDNSF), which I have discussed with Cannabis Growth Portfolio subscribers. My rating on CCHWF is buy due to overall undervaluation, but I remain on the sidelines as there are far better opportunities in the cannabis sector.

Be the first to comment