da-kuk

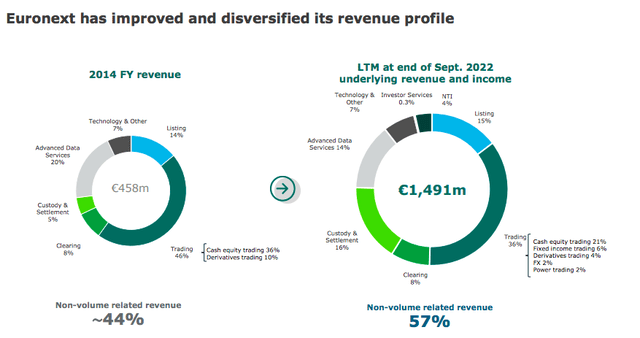

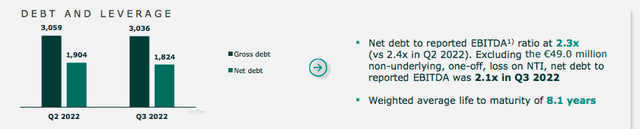

Here at the Lab, we have a long-standing buy rating on Euronext (OTCPK:EUXTF). Despite the fact that our thesis is not (yet) realized due to 1) lower volumes in equity markets and government bond trading, 2) market share loss, and 3) no significant update on synergies, we still believe that the company offers an interesting upside. Aside from our buy case recap, we believe that IPO simplification and new regulation will simplify the process and speed up future companies listing. This will translate into a higher revenue line, in addition, looking at the latest results, the company is diversifying its revenue line (and increasing its non-volume related turnover – fig. 1) and deleveraging (fig 2). We are not forecasting new acquisitions and this will help Euronext to lower its cost of debt and improve its credit rating.

Euronext sales diversification

Fig. 1

Source: Euronext Q3 results presentation (Fig. 2)

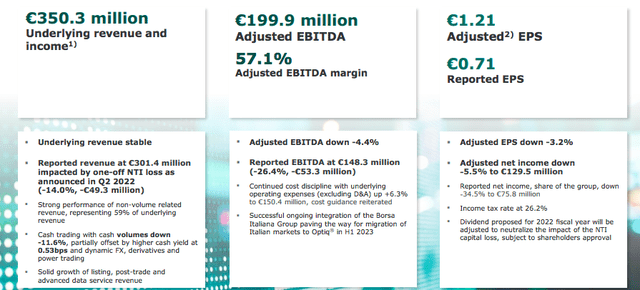

Q3 results

Speaking of numbers, the equity trading slowdown linked to market turbulence had an impact on Euronext’s business; however, as already mentioned, this was partially offset thanks to non-volume-related activities, which are now accounting for 59% of the company’s total turnover. In detail, the company achieved top-line sales of €301.4 million in Q3, signing a minus 14% on a yearly basis. Non-volume revenues recorded robust performance in particular in advanced data services, listing, post-trade, and technology, including the full first quarter of the new Datacenter contribution; excellent performances were also achieved in the trading activities not related to equity markets, with derivatives on FX and commodities, which recorded double-digit growth. Going down to the P&L analysis, operating cost (excluding D&A and write-off) reached €150.4 million in line with management guidance, and adjusted EBITDA decreased by 4.4% to €199.9 million with a margin of 57.1%. Despite lower results, Euronext once again has shown the solidity of the company’s “diversified business model in an increasingly challenging trading context” and the ability to “navigate the macro-economic challenges of 2022“. Adjusted net profit decreased 5.5% to €129.5 million, while adjusted EPS fell 3.2% to €1.21.

Source: Euronext Q3 results presentation

After having carried out the migration to the new data center and achieving a cumulative annual run-rate synergy of €24.4 million, Euronext confirmed:

- Borsa Italiana migration to Optiq by March 2023;

- Cost savings target based on last year’s plan called “Growth for Impact 2024“;

- Integration of one-off costs for a total consideration of €37.9 million;

- A new expansion plan for its European clearing house.

After Euronext’s Q3 accounts, we decide to make minor adjustments to our forecast number and raise our EPS by 1.5% in the 2023/2024 period. According to our calculation, 2023 cost savings are estimated to be around €60 million to reach €100 million in cumulative savings by 2024.

Conclusion and Valuation

Euronext is currently trading at a 13x EV/EBITDA level and a 16x price-earnings ratio in our forecasted number in 2023, with a significant discount (more than 20%) compared to Deutsche Börse and the London Stock Exchange. Following the half-year results, we lowered our target price to €98 per share; however, we continue to overweight Euronext and see no justification for such a discount. Positive catalysts to our target price are: earning upgrades, higher synergies, more business diversification, and higher volumes on monthly trading data.

Be the first to comment