Torsten Asmus/iStock via Getty Images

One of the most rapidly growing REITs on the market today is a company called Power REIT (PW). Over just the past few months, the company has demonstrated significant expansion on both its top and bottom lines, fueled largely through the acquisition of various properties. The company is still small in the grand scheme of things, and as it grows it will find further growth to be challenging. On top of that, shares are looking rather pricey. But if we factor in the added benefit the company should receive on an ongoing basis from its recent acquisitions, shares are trading at levels that might not be unreasonable for long term investors. At worst, I would make the case that shares are probably more or less fairly valued at this time. But it is possible they might warrant even further upside than what they have received as of late.

Great developments for Power REIT

Power REIT has been a true growth machine. But before we delve into the recent performance the company has achieved, we should discuss another matter. And that is my own history with the company. The last time I wrote an article about Power REIT was in October of 2021. In that article, I highlighted how pricey shares of the business looked, but also pointed out how cheap they come to be if we rely on annualizing revenue captured by recent acquisitions. Ultimately, I rated the company a bullish prospect, saying that, despite upside the company had achieved in the months leading up to the article, that further upside might be warranted. Since the publication of that article, shares have generated a return for investors of 36.9%. That compares to the 3.8% achieved by the S&P 500 over the same window of time. But that’s not all, my first bullish article on the company came out in July of last year. Shares are up 90.3% since its publication, dwarfing the 6.7% return achieved by the broader market over the same period of time.

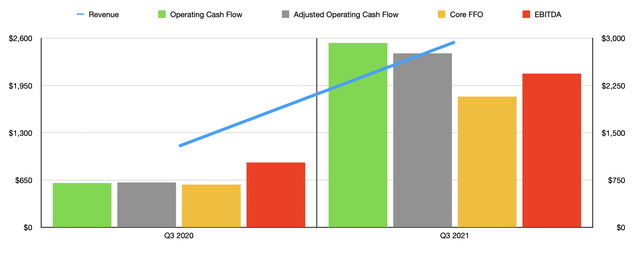

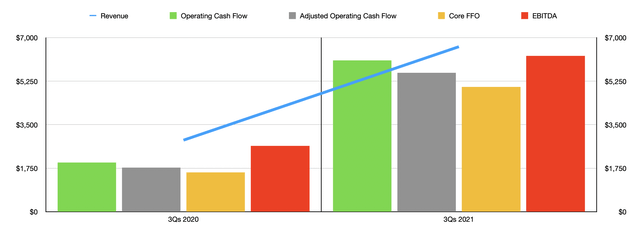

After seeing such significant upside, it might be tempting to say that further upside cannot be possible. But I would make the case that that is not true. Consider recent performance reported by management. Namely, we are talking about performance achieved in the third quarter of the company’s 2021 fiscal year. Revenue for that quarter came in at $2.55 million. That is over double the $1.12 million achieved the same quarter one year earlier. As a result of this strong increase in sales, total revenue for the first nine months of 2021 was $6.64 million, up from the $2.88 million generated in the same nine-month window of 2020. Management attributed this year over year expansion to the acquisition of additional properties. For instance, in the first nine months of 2021, the company purchased nine different properties. As a result of these purchases, the company now owns 172 acres of land on which 22 greenhouses, representing 1.09 million square feet, have either been built or are being built. These are all dedicated to the cannabis space. The company also owns 601 acres of land that at least is out for solar power generation and 112 miles of railroad infrastructure. But the bulk of the business is focused on the cannabis category.

With revenue rising, profitability has been on the rise as well. Due to strong performance in the latest quarter, operating cash flow in the first nine months of 2021 came out to $6.08 million. That is over triple the $1.98 million generated the same time one year earlier. Even if we strip out preferred distributions, operating cash flow would have risen from $1.77 million to $5.59 million. FFO, or funds from operations, expanded from $1.59 million to $5.03 million. And EBITDA jumped from $2.65 million to $6.27 million.

Pricing is a real challenge

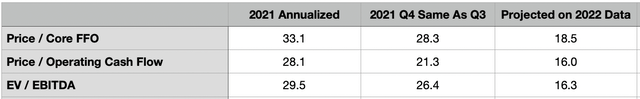

When it comes to pricing the enterprise, the picture gets rather difficult. For instance, if we annualize cash flow figures from the latest quarter, we would get FFO of $7.10 million, adjusted operating cash flow of $8.35 million, and EBITDA of $8.71 million. These would imply a price to FFO trading multiple of 33.1, a price to adjusted operating cash flow multiple of 28.1, and an EV to EBITDA multiple of 29.5. This looks awfully pricey, but there are other ways to look at the company. For instance, instead of simply analyzing financial performance seen so far, we could assume that the fourth quarter of 2021 will look essentially like what the third quarter did. This gives us a different measure of cash flows such as FFO of $8.29 million, adjusted operating cash flow of $11.04 million, and EBITDA of $9.76 million. The end result here is a decrease in the company’s multiples to 28.3, 21.3, and 26.4, respectively.

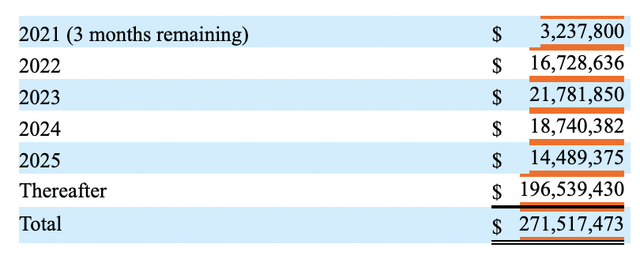

This is all still a pricey proposition, especially if we assume an eventual slowdown in growth. However, neither approach does the company justice. Fortunately for investors, management reveals in their financial statements just how much in leasing revenue is supposed to come to the company over the next few years assuming no other acquisitions are made. This can be seen in the image below.

Taking these figures and applying the same cash flow margins the company achieved in the first nine months of 2021, we can get some expected cash flow estimates for the enterprise. Based on my calculations, for instance, the company is FFO should be around $12.67 million next year. Adjusted operating cash flow should be around $14.68 million, while EBITDA should be around $15.81 million. Taking these, we end up with a price to FFO multiple of 18.5, a price to adjusted operating cash flow multiple of 16, and an EV to EBITDA multiple of 16.3.

Takeaway

Based on the data provided, Power REIT initially looks like an expensive proposition. This is especially true after you factor in the appreciation in share price the company has achieved over the past several months. However, when you consider the cash flows the company should generate just from its recent property acquisitions, shares are looking to be perhaps around fair value territory. If anything, they might even be undervalued if the company can continue to expand at an attractive rate. For this reason, I believe that the company could still offer some additional upside, though I do suspect that upside would be far more limited than what we saw over the past few months.

Be the first to comment