andresr

The global health crisis of 2020 led to unseen social developments and financial turmoil. As in any economical shock on such a scale, there were winners and losers. One of the beneficiaries of the stay-at-home policies introduced in many countries, stimulus checks, and online activity boom was PayPal (NASDAQ:PYPL). Its stock price soared from the pandemic lows of $85.26 to an all-time high of $308.53 on July 23, 2021. From then on, PayPal investors experienced a tough ride downhill seeing the company’s market cap slashed by 73.9% by now.

Despite the negative press and the ongoing global slowdown, PayPal may have a unique chance to adapt, monetize emerging opportunities, and return to the stellar growth it once had. On the other hand, there are risks related to the seemingly unavoidable global recession, reduced consumer spending, or competition. PayPal management became a victim of the broad pandemic-related euphoria by projecting unsustainable growth into the future. In a short period of time, reality hit the business hard which resulted in missing expectations, lowering projections followed by falling the stock price. Will the management succeed in successfully navigating the company in difficult times without falling further behind its previous outlook?

The article provides insight into PayPal’s road from the peak of euphoria to a current bottom of pessimism in terms of both – the outlook and the share price. It also gives a perspective on how inefficient the market can be. Thus, a value investor should always concentrate on business fundamentals and remain conservative when valuing a company.

Growing Bubble

PayPal’s story is a great example of a bubble in the financial market which influenced the company’s management judgment. It started just like for many other companies, also called “pandemic winners” when the central banks and governments intervened in response to the deepening health crisis of March 2020. Stimulus checks and money printing accelerated online spending and the growth of the digital payments space. That led to an unprecedented stock price appreciation of companies such as PayPal, Block (SQ), and Affirm Holdings (AFRM).

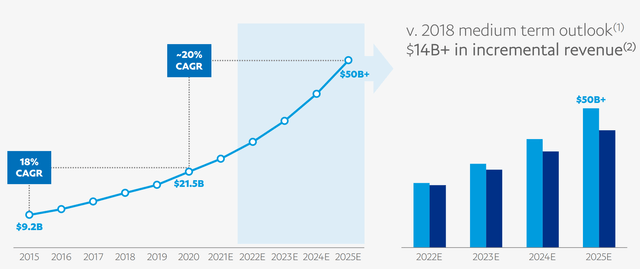

February 1st, 2021 – PayPal Investor Day

In February 2021, the company held its Investor Day, where it gave a rosy outlook to its shareholders. The projections included a $110 trillion total addressable market (TAM), $50.0+ billion in revenue by 2025, US digital market penetration of around 24%, 750 million active accounts, $2.8 trillion in total payment volume (TPV), or 22% EPS growth CAGR by the same year. This outlook just propelled the ongoing euphoria and kept buyers acquiring stakes in the business.

November 8th, 2021 – FY2021 Q3 Earnings Call

On November 8th, 2021, PayPal announced its FY2021 Q3 earnings which were in line with the company’s expectations. There was still a notable amount of time on the call spent on subjects such as Buy Now, Pay Later (BNPL), cryptocurrencies, and strong uninterrupted growth. The CEO – Dan Schulman touched on the growth subject during the call:

Our MS business is going from strength to strength. We have seen a leap forward in digital, and that is continuing, if you look at it in our MS and John will talk about it in Q4, and as we look next year. Same thing on TPV. TPV in Q3 of 2018. MS, I’m talking about MS, was 27%, it jumped up to 29%. Then in Q3, 2020 it jumped to 40% and over that 40%, we’re growing this quarter at 31%, and so these are all really, really strong numbers…

The CFO – John Rainey even indicated that that was a great time to invest in the business whose margins should expand.

So I’ll start by saying that, I would hope that people appreciate and agree with this, but I don’t think there’s ever been a more important time to invest in our business than right now. This is a precious opportunity that we have with some of the secular tailwinds. We’re fortunate in that the margins on our business want to go up.

However, there were the first signs of management’s retreat from the optimistic guidance. Dan Schulman mentioned weakening consumer confidence, and lower travel volumes in the months of August and September. Nevertheless, PayPal kept the mid-term and the long-term projections unchanged.

Our plans are for revenue growth to then accelerate through the year, and to exit 2022 at a revenue growth rate in line with or ahead of our medium-term guidance.

Failed acquisition of Pinterest (PINS), a few stock downgrades by analyst firms, and a pending steady but slow selloff of the pandemic hot stocks and cryptocurrencies, brought PayPal’s share price to $188.58 by the end of December. This was the biggest annual decline in the company’s history.

February 1st, 2022 – FY2021 Q4 Earnings Call

With the start of the year 2022, an overall market sentiment worsened, the situation in Ukraine became tenser and tenser and finally, PayPal announced its FY2021 Q4 earnings on February 1st. The management didn’t sound nearly as confident as one year before. Revenue grew 18% YoY and the outlook for 2022 was significantly lowered.

Based on our more conservative stance today, we are starting the year with an expectation for revenue growth in the range of 15% to 17%.

John Rainey was later confronted by Jason Kupferberg from Bank of America who asked how the revenue growth of 20% CAGR for the period 2020 – 2026 can be possible. The 18% increase in sales in 2021 and the forecast for 2022 at 15-17% were damaging to the projections from the 2021 Investor Day. The CFO still didn’t deny that the mid-term assumptions wouldn’t be met.

… but we are certainly seeing some macroeconomic pressures on our business that were not contemplated at the time that we did our guidance. So, you are correct in that we have confidence that we can achieve those growth rates of 20% revenue and 22% earnings growth in the out years beyond 2022. But because we have not done that in the first 2 years of that, you are correct, mathematically, that CAGR is much more – that compounded annual growth rate is much more challenging.

Dan Schulman also expressed hopes that PayPal will reach its medium-term financial goals.

We continue to believe that our revenue and earnings growth rates as well as our free cash flow objectives are achievable in the out years of the period contemplated in our medium-term guidance.

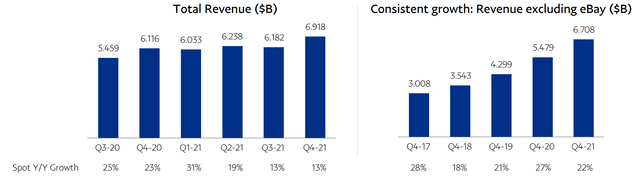

Total Revenue and Revenue Growth (PayPal FY2021 Q4 Report )

However, as shown in the picture above, the revenues in the latest quarters slowed down in a major way.

April 27th, 2022 – FY2022 Q1 Earnings Call

War in Ukraine, rising inflation across the globe, the first Fed rate hike, and the announcement of further tightening left little to no hope that the rosy outlook from early 2021 can be met.

And more specific to PayPal, forecasting normalized consumer e-commerce spending, as we come out of the pandemic, is exceedingly complex. As a result, we believe it is prudent to lower our 2022 guidance and reevaluate our medium-term outlook.

Dan Schulman later continued by determining the increase in sales for 2022.

For the year, we now expect 11% to 13% revenue growth and non-GAAP EPS to be in the range of $3.81 to $3.93. Ex eBay, this represents revenue growth of approximately 15% to 17%.

Several days later PayPal stock hit a new 52-week-low of $74.29 per share.

Outlook

From then on, PayPal shares have been trading in the range of $69.55 – $102.08 which is far from the peak of the pandemic-driven market euphoria. There have been no catalysts that could encourage investors to heavily bet on PayPal. Besides that, regular Fed rate hikes continue shaking up financial markets. Inflation didn’t slow down and the war keeps on weighing on the health of the global economy. On top of that, the sentiment around tech stocks has been bad with a broad range of stocks hitting their 52-week-lows week after week. In this environment, it’s hard to expect PayPal to miraculously outperform.

However, compressed valuation and several new initiatives PayPal is involved in can mean that the return to growth is coming back. Just a few new strategies were listed below.

- Partnerships and expansions with notable businesses worldwide such as Roku (ROKU), Adobe (ADBE), and Salesforce (CRM).

- Partnering with Amazon by introducing Venmo as a payment option for Amazon customers.

- Happy Returns – an initiative that provides customers with returns software and reverse logistics. Returning online purchases is made easy for clients, and merchants.

- Full-service merchant support for Revolve (RVLV) – an online fashion retailer.

- Launch of the PayPal Business Cashback Mastercard Credit Card for merchants with a PayPal business account.

- Strengthening its competitive position against the Block’s Square device by the roll-out of contactless payments with the Zettle Go app. It’s been introduced in the Netherlands, Sweden, and the UK. Zettle Go lets individual sellers and small businesses receive money by tapping a customer’s card or payment device to the back of an Android phone.

- Expanding PayPal Funding to France and the Netherlands by providing small and medium-sized businesses (SMBs) with loans in a very short period of time in an uncomplicated manner.

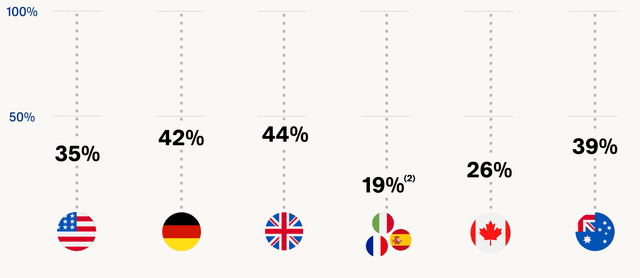

All these initiatives are potential growth drivers for PayPal. The management remains opportunistic. It can be seen in their proactive and innovative approach toward the expansion of PayPal’s market share. One of the areas of focus is to increase PayPal’s presence in the most developed countries, where the platform’s consumer penetration is still below 50%.

PayPal consumer penetration in core developed markets (PayPal)

PayPal consumer penetration calculation is based on the number of unique PayPal consumers and refers to the PayPal platform only. It does not include other products/services (e.g., Venmo).

Apart from that, the company aims to transform PayPal into a super app that can give users all the services they need within one package. Super apps such as WeChat and Alipay have been very successful and engaging allowing businesses to monetize in many different ways.

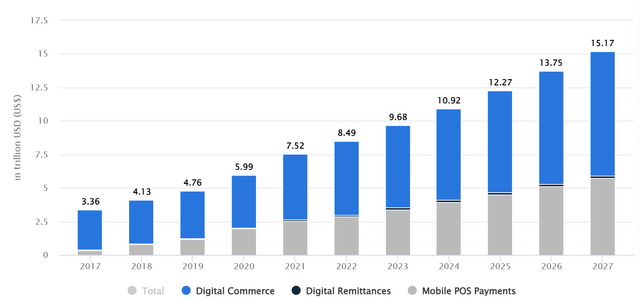

PayPal’s management pointed out that the company’s total addressable market (TAM) is oscillating around $110 trillion. At the same time, total transaction volume will be rising by 12.41% CAGR by 2027 hitting $15.15 trillion according to Statista. This means that the total transaction volume in 2027 would constitute only around 1/7 of the projected TAM. Although the management outlook can be too optimistic, it’s worth noting that PayPal hasn’t built its presence in areas such as:

- In-Store Retail

- Bill Pay

- In-Person Services

- Business to Consumer

- Emerging Market Payments

- Government Payments

- Asset Trading

- Business to Business

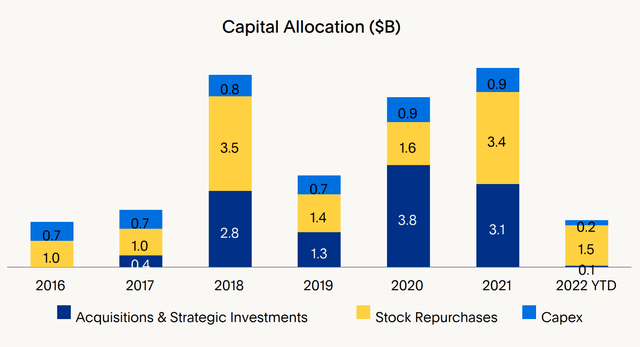

The opportunity remains enormous. Based on the company’s leadership strategy that has always prioritized acquisitions, share buybacks, strong cash position, and meaningful partnerships, there is a high chance that PayPal will continue delivering strong performance. If it materializes, earnings and investor returns will follow.

PayPal’s Capital Allocation (PayPal)

Valuation

In the article from December 4th, 2021, I inserted PayPal’s management projections to the TAM valuation model. It quickly turned out to be one of the most important lessons of investing in 2021 which was to not apply companies’ own outlook to valuation models. Even CFOs can overshoot and be caught off guard by unexpected events affecting their businesses. And this is exactly what happened in the case of PayPal.

Now, with a more conservative viewpoint, the model was updated. According to it, the fair value of PayPal stock in 2023 is $75.97 per share after applying a P/E ratio of 24. It means that theoretically, the stock has still room to fall. However, when the assumed level of growth continues, from 2024 EPS should get back to the levels from 2021 and increase in the following years.

The following projections were used as a baseline for the TAM valuation model:

- Global Total Payment Volume (TPV) will grow as shown in the diagram below.

Global Total Payment Volume Forecast (Statista)

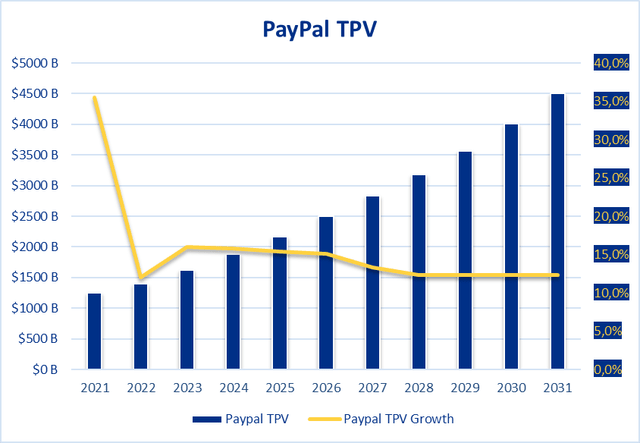

- PayPal’s TPV will grow by 12% in 2022 and later in the range between 12% and 16%

PayPal TPV Projection (Author)

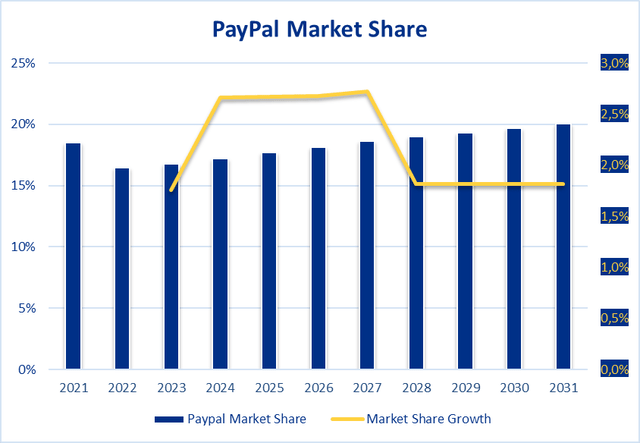

- Previous PayPal’s US market share penetration of 24% was neglected. Instead, the model assumes that the company reaches 20% market share by 2031

PayPal Market Share Projection (Author)

- The Total Take Rate (Revenue/TPV) remains at 1.99%

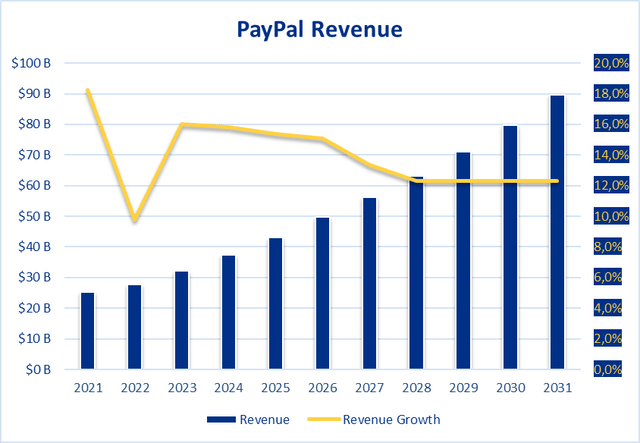

- Revenue of $50 billion + should be generated by 2027 instead 2025.

PayPal Revenue Projection (Author)

- Revenue growth gets back to the mid-teens and slowly declines over time reaching 12% growth in the year 2031.

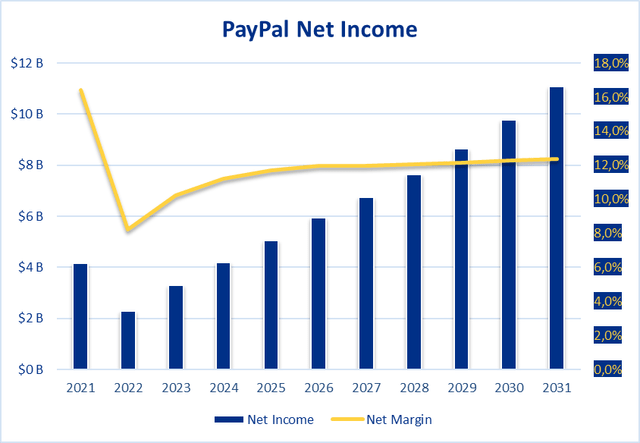

- Profit margins steadily improve to achieve 12.4% by the end of the analyzed period.

PayPal Net Income Projection (Author)

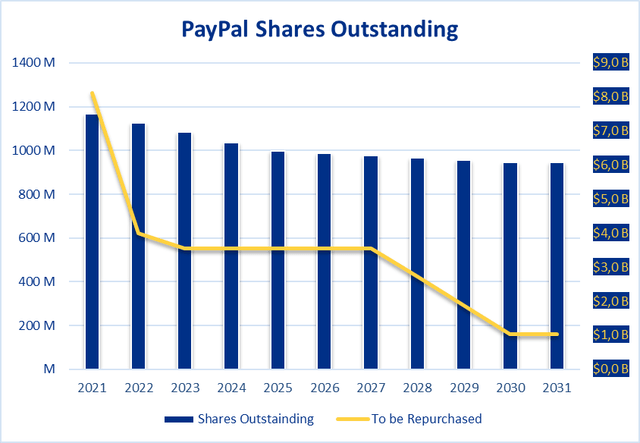

- The number of shares outstanding declines evenly over the next five years where newly confirmed $15 billion, as well as the remaining $2.8 billion worth of shares, will be repurchased.

PayPal Shares Outstanding Projection (Author)

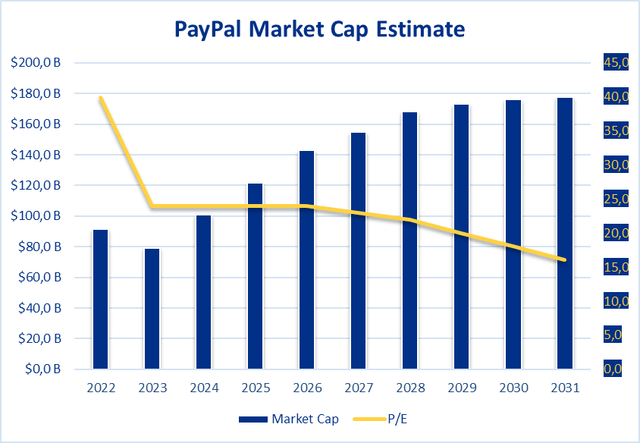

- P/E = 24 till 2026. From then on, it decreases.

- Fair Value Per Share in the table doesn’t apply to the year 2022 where the current share price was inserted.

Being a trillion-dollar market cap company has been apparently wishful thinking, at least for the foreseeable future. With revenue exceeding $50 billion in 2026 and possibly doubling from there by 2032, PayPal’s market cap is to be around $177.5 billion by the end of 2031. However, these are very long-term projections that can carry a substantial margin of error. The outlook for the next 3-4 years should give a more accurate picture of the company’s valuation. If believing the assumptions, the company’s market cap should almost double by 2031, which would be a great return if invested today.

PayPal Market Capitalization Projection (Author)

PayPal might be still overvalued by ~10% but it doesn’t mean that the price will hit the exact fair value calculated with the use of the valuation model.

Conclusion

PayPal became a victim of its own success and the broad bubble that expanded in certain segments of the market. The euphoria blinded not only investors bidding prices of the stock higher and higher, but also the management that at some point lost common sense and the ability of rational judgment. It all led to a substantial cut in the company’s valuation. Investors fled to assets considered safer leaving PayPal unwanted.

On the other hand, the company is in a strong financial position and steadily growing its business despite all the negativity around it. It has undoubtedly a bright future ahead. The valuation declined substantially being in the interesting range for a value investor, where the risk has come down and the possible reward materially increased.

Be the first to comment