HeliRy/E+ via Getty Images

Introduction

Energy stocks were showing impressive performance amidst consistently increasing inflation, supply chain bottlenecks, and the Russian invasion of Ukraine. Euronav (NYSE:EURN), one of the largest listed tanker ship owners, was among the companies that showed positive performance since the beginning of the year. The stock is currently trading above $12.20 per share, a 37% increase in 2022, compared to a 21% decline for the S&P 500 (SPY).

Despite a weak fiscal year in 2021, Euronav is well-positioned to create additional value for shareholders, driven by the market consolidation and the announced merger with Frontline, another oil tanker shipping company. The merged entity will be the global leader in the oil tanker industry and have the world’s largest oil tanker fleet by capacity.

The company was added to our International Equity portfolio last May. As we will explain in this article, Euronav has strong quality, value, and momentum factors, which resulted in a high grade in our factor-based ranking system. We believe it provides an appealing investment opportunity.

Business Segments

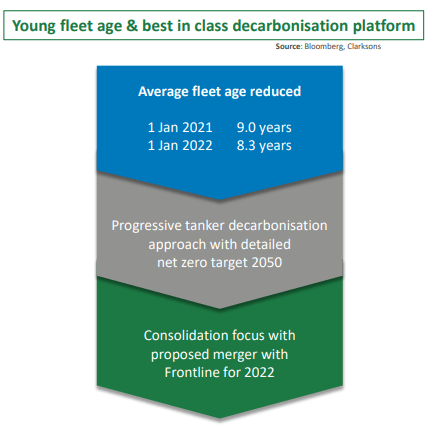

Euronav engages in the international transportation and storage of crude oil and petroleum products, in addition to floating, storage, and offloading services (FSO). The company manages a fleet of 74 vessels with an average age of 8.3 years.

Source: 2022 Annual General Meeting

Euronav operates in two business segments, each having a completely different market:

Tankers (89.4% of 2021 revenues): The segment includes the operation of crude oil tankers in the international markets. The tanker market is volatile and contract durations are often less than two years as they are affected by business cycles and oil demand.

Floating production, Storage and Offloading operations (10.6% of 2021 revenues): Euronav has two contracts, FSO Asia and FSO Africa, expiring in 2032 with North Oil Company.

Euronav-Frontline merger

Euronav and Frontline announced their agreement on the principal conditions of a proposed stock-for-stock combination on April 7, 2022. Since then, Euronav’s stock price has increased 11.50% as investors positively received this information. This merger will create a leading oil tanker operator with 140 vessels consisting of 65 VLCC, 55 Suezmax, and 20 LR2/Aframax vessels. Significant cost synergies related to SG&A, improved utilization rates, and a stronger balance sheet are all benefits expected to arise from this merger. Moreover, the company will be more attractive to institutional investors. Thus, Euronav is on track to return additional value to its shareholders in the upcoming periods.

As per Hugo De Stoop, Euronav CEO, timing is always the key; he thinks that it is the right time to enter into this merger:

“Eight years ago with the acquisition of the Maersk crude tanker fleet and four years ago when we merged with Gener8. We know proposing to merge with frontline and to offer a material consolidation transaction in order to deliver further shareholder value as we enter into the next stage of the tanker market. This exciting development and merger of two leading companies in the space with a — is a strong signal of our confidence in the sector.”

Outlook

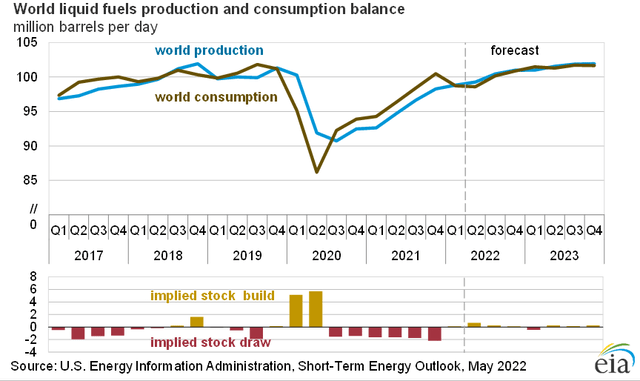

The second half of 2022 could be favorable for the oil tanker industry and drive Euronav back to growth and profitability. Based on the EIA projection, oil production and demand are expected to grow by 4.5% and 2.3%, respectively. Also, OPEC+ is expected to increase its output to be an alternative for traditional importers of Russian oil. All these factors might help propel tanker rates higher than their levels during the last year, particularly now that the upside momentum is already there.

US Energy Information Administration

Competitive Advantage

Euronav is working to become an innovative front-runner and is well-positioned in the tanker oil industry despite operating in a cyclical business environment and the fierce competition in the market. We will evaluate the company’s competitive edge by analyzing the five forces of Michael Porter, which helps in identifying the company’s current positioning and what impacts its profitability and outlook.

Threat of new entrants (Low)

Euronav faces a low threat from new entrants as regulatory frameworks related to maritime shipping and the oil industry impose certain challenges to new players. Additionally, tanker oil industries require substantial capital investment in fleet acquisition and maintenance, which may deter prospective competitors from entering the market.

Bargaining Power of Suppliers (Medium)

Currently, Euronav has 3 VLCC and 3 Suezmax under construction, which are due for delivery in 2023 and 2024. On the fleet management side, the company entered into ship management agreements where it transferred direct control (technical, crew, and commercial management) of 20% of its fleet responsibilities to third parties. The failure of any service provider to meet their commitments could lead to reputation damage or legal liability.

Bargaining Power of Buyers (High)

A significant amount of Euronav’s revenue is generated from a few customers in both operational segments. Valero (VLO) accounted for 11% of total revenues generated from the tankers segment and North Oil Company is the only customer in the FSO segment. Accordingly, the bargaining power of buyers is high since the loss of any customer could result in a considerable loss of revenue and cash flow.

Rivalry among the existing players (Low)

Many companies operate in the oil and petroleum products transportation industry. However, various factors influence the activity of each one, such as the location, size, age, and condition of the fleet they manage. Accordingly, there is no major player in the industry that is able to influence charter rates. Moreover, currently, companies are more concerned with geopolitical threats than the rivalry among existing firms.

Threat from Substitute Products (Medium)

As companies are looking into eco-friendly partners, substitute products and services offered by other companies with more fuel-efficient vessels represent a real threat to the future operations of Euronav. In particular, new tanker carriers that reduce the risk of pollution (like oil spills) will likely be preferred despite being more costly for consumers.

Ranking

Euronav is considered an attractive investment opportunity based on our multi-factor ranking system. The company’s rank is 99.4, among the top-ranked stocks in our Factor-Based International Equity Strategy, and it is spread across quality, momentum, and value factors.

|

Ranking (%) |

Quality (20%) |

Value (30%) |

Momentum (50%) |

|

99.4 |

92.6 |

47.8 |

99.4 |

Source: Factor-Based, FactSet

We assign a certain weight to each factor, reaching the final rank by normalizing it to a certain percentile. A detailed explanation and further presentations are available on our website. We will now discuss some of the factors contributing to Euronav’s high rank.

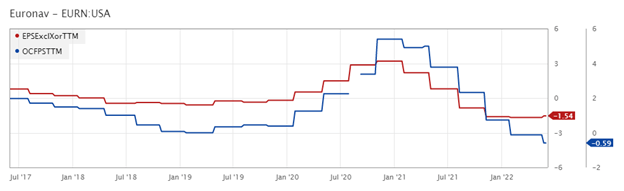

Quality

Euronav has a high-quality ranking of 92.6, which considers the profitability of the firm. The earnings quality component (EPSQ) is among those quality factors and is used to evaluate the quality of the company’s accruals; it divides the difference between operating cash flow and earnings by the average total assets of the company. Despite a decline in operating cash flow over the previous year, Euronav expects an increase in operating cash flow in the following period.

Source: Factor-Based, FactSet

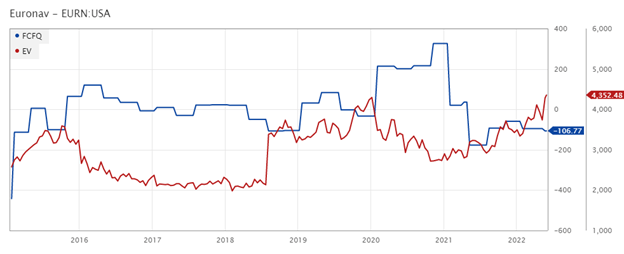

Value

The free cash flow to Enterprise Value (EV) is among our value factors. It estimates the amount of free cash flow generated for each EV unit.

Factor-Based, FactSet

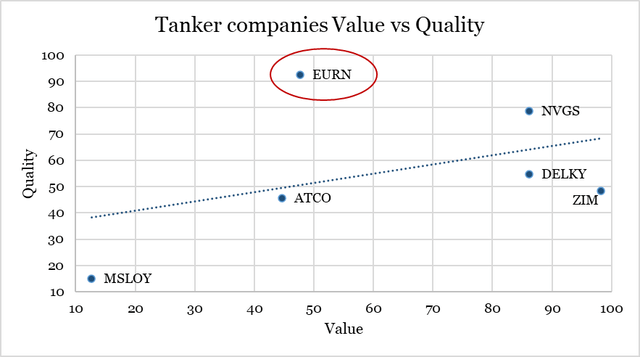

As shown in the chart below, Euronav has a better position when plotting value against the quality ranks of the major tanker companies.

Factor-Based

Momentum

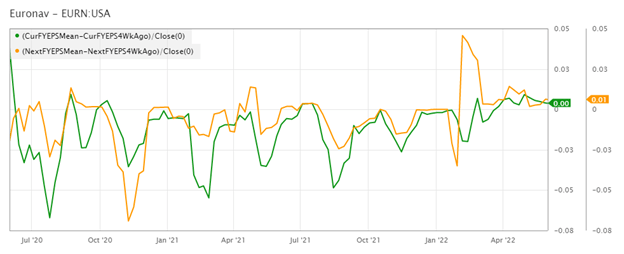

As for momentum, we use an analyst revision factor that compares the current fiscal year’s estimated EPS mean to its value four weeks ago. Additionally, we use a similar factor to assess next year’s estimates. As shown below, Euronav’s factor increased for both fiscal years implying that analysts expect higher growth in the future, and the stock will likely gain momentum.

Factor-Based, FactSet

Investment Risks

Although Euronav has a high rank in our factor-based system, its business is exposed to various challenges that might threaten its profitability:

Highly impacted by geopolitical risks

Increased geopolitical weigh on Euronav as the company’s vessels navigate various routes subject to attacks like the Russian-Ukraine war or the Strait of Hormuz. Vessels taking those routes are subject to higher insurance premiums which might pressure profitability margins.

Highly concentrated customer base

As mentioned earlier, a limited number of customers derive a substantial part of Euronav’s revenues. One customer represents 11% of the tanker’s segment revenues, while a single client generates the whole revenue of FSO. Hence, Euronav’s revenue is highly concentrated and might present a risk for the business continuation in the long run if one of those clients terminates its contract with the company.

Cyclical and volatile business

The tanker industry is cyclical due to the periodic adjustments to supply and demand by oil producers. Additionally, the shipments of crude oil depend on the economies of the world’s industrial countries. Any decrease in shipments of crude oil may adversely affect financial performance.

Conclusion

In conclusion, many factors support a bullish thesis on Euronav. Oil shipping demand is predicted to grow further in the upcoming period due to geopolitical unrest and the rising demand in developing countries. On the other hand, Euronav is well equipped to deal with the current stage of the cycle. It is working on expansion strategies through the Frontline merger and has a strong balance sheet and high liquidity levels.

Moreover, Euronav was among the top decile companies in our ranking system, backed by strong quality, value, and momentum factors. We consider it suitable for investors looking for exposure to the energy sector while benefiting from the potential growth in the tanker industry. Thus, it was one of the new additions to our Factor-Based International Equity Strategy.

Be the first to comment