imaginima

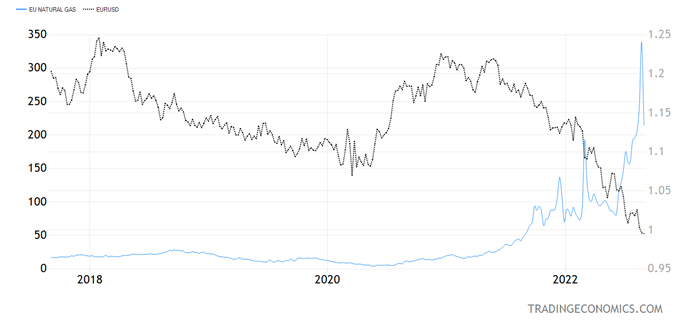

Late last Friday, the Russians turned off the gas to Germany and other EU countries that rely on Nord Stream 1. They blamed an oil leak in a compressor station, but this development came just a few hours after the G7 agreed to try a scheme to cap the price of Russian crude oil, so this was clearly a retaliation.

Trading Economics

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

TTF EU natural gas futures had closed for trading on Friday when the Nordsteam1 news came, but on Monday they were up as much as 30%. I am finishing this article before the close of trading in TTF on Monday but suffice it to say that the German stock market’s -2.2% move down on Monday is not the end of the decline for German stocks, and neither is the new low for the euro below 99 U.S. cents.

Trading Economics

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The reason why EU natural gas futures were down last week was the news that Germany was ahead of its schedule for winter storage. The question that needs to be asked is: Can Germany still operate if gas flows are stopped indefinitely, from now through winter? I was under the impression that storage was there for any excess demand, but it needed the pipelines to operate for there to be enough natural gas for everyone.

Also, there is another pipeline that goes through Ukraine that is still carrying gas to Germany, although not at full capacity. As I was finishing this piece, Bloomberg ran a breaking news headline that the EU will also cap the price of Russian pipeline gas. How do they plan to do this unilaterally? Given the ultimatum to “take a price or leave it,” I give very high odds that the Russians will completely shut it off.

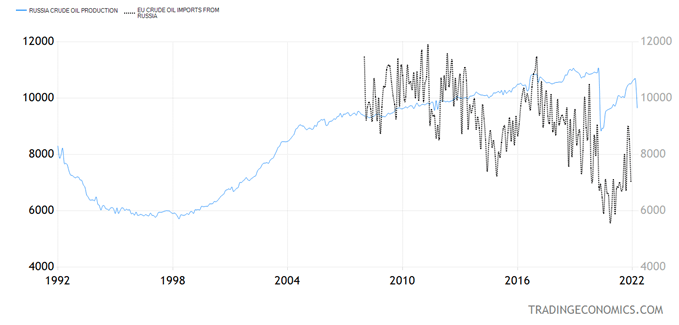

I am not sure how the G7 can cap the price of Russian oil. In theory, the Russians can shut off half of their crude oil production, which totals over 10 million barrels per day, which will cause a spike in the price of crude oil globally. At the onset of the Ukrainian conflict, JP Morgan came up with an estimate of $380 per barrel of oil if there is a big disruption in Russian production. If the Russians cut their production in half, and the price more than doubles globally, would that reduce the flow of dollars to the Russian Federation? It seems to me that the G7 is acting recklessly, like an economic suicide bomber, via this crude oil price gambit. In this case, the G7 may take down quite a few more countries than just seven.

It is Dangerous to be Shorting Treasuries

Treasury bonds have been selling off because of the Fed’s newfound Volcker-like attitude. As the Fed funds rate goes up, so will Treasury yields, or so the theory goes. It is clear to me that the Fed is behind the curve on inflation and trying to make up with too many rate hikes, which may backfire.

Trading Economics

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Neither the Fed nor the ECB has ever experienced hiking interest rates aggressively into highly volatile financial markets, which this natural gas shutoff promises to deliver. Historically when financial markets are turbulent, the Fed has acted more restrained.

In my view, the recent Fed rate hikes are not reflected in the economic numbers yet, so the Fed may very well run the risk of over-tightening monetary policy. The Fed is hiking into an inverted yield curve, which, in and of itself, offers rather poor historical probabilities of generating a benign outcome. If the natural gas situation blows up EU financial markets, the first thing that will rally are German bunds and Treasuries, so all those shorts in government bonds (based on stated Fed and ECB policy moves) may be reversed.

Disclosure: *Navellier may hold securities in one or more investment strategies offered to its clients.

Disclaimer: Please click here for important disclosures located in the “About” section of the Navellier & Associates profile that accompany this article.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment