wildpixel/iStock via Getty Images

How can you govern a country which has 246 varieties of cheese?”― Charles de Gaulle

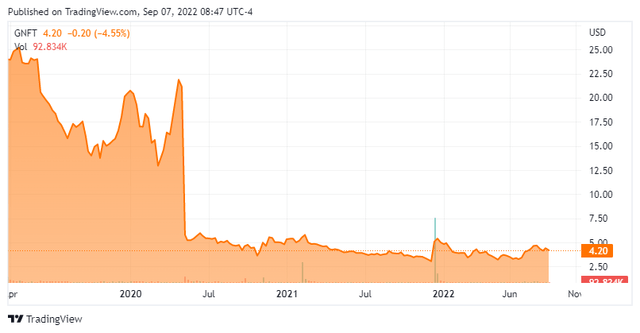

We last posted a piece on small biotech outfit Genfit S.A. (NASDAQ:GNFT) in March of 2021. We concluded saying the company has some interesting attributes, but it was probably too early to take a stake in its pending further development. The stock trades almost exactly where it did 18 months ago. No one else on Seeking Alpha has covered the company since then. Therefore, we will circle back on this name today.

Company Overview:

This France-based clinical stage biotech concern is focused on developing treatments primarily to treat disease of the liver and from gastroenterology. The shares currently trade just above four bucks a share and sports a market capitalization just north of $200 million.

April Company Presentation

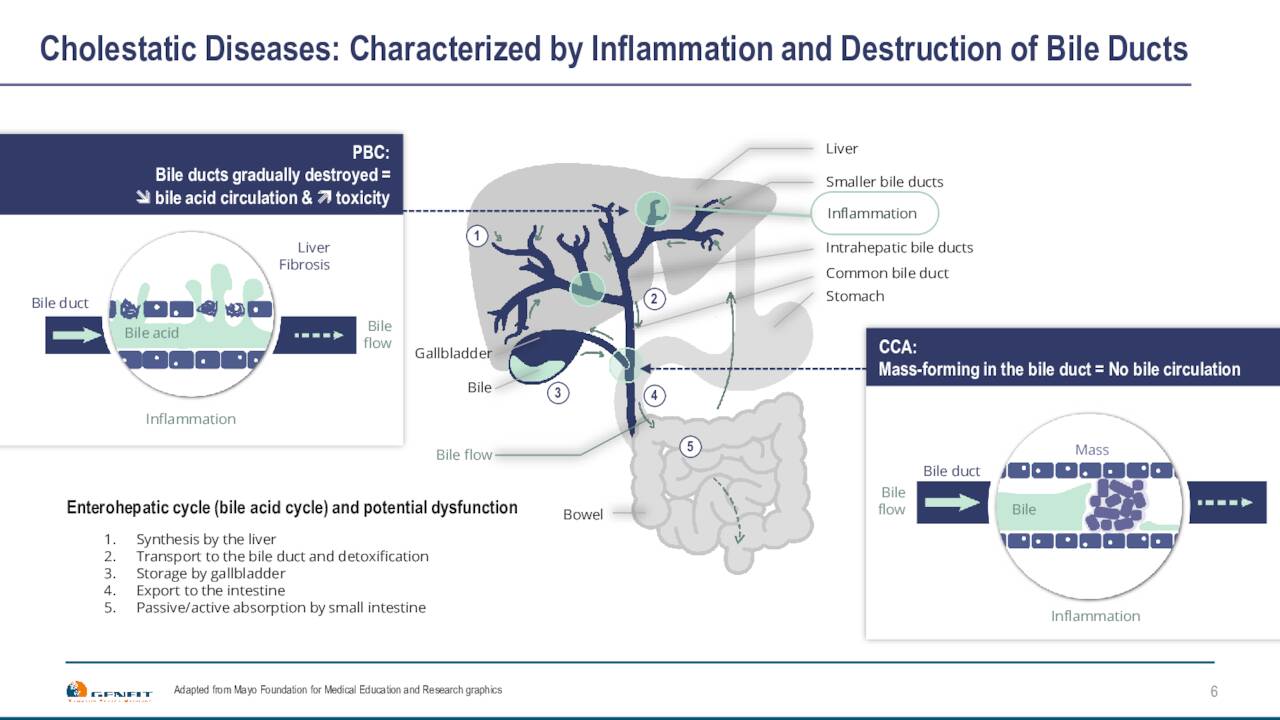

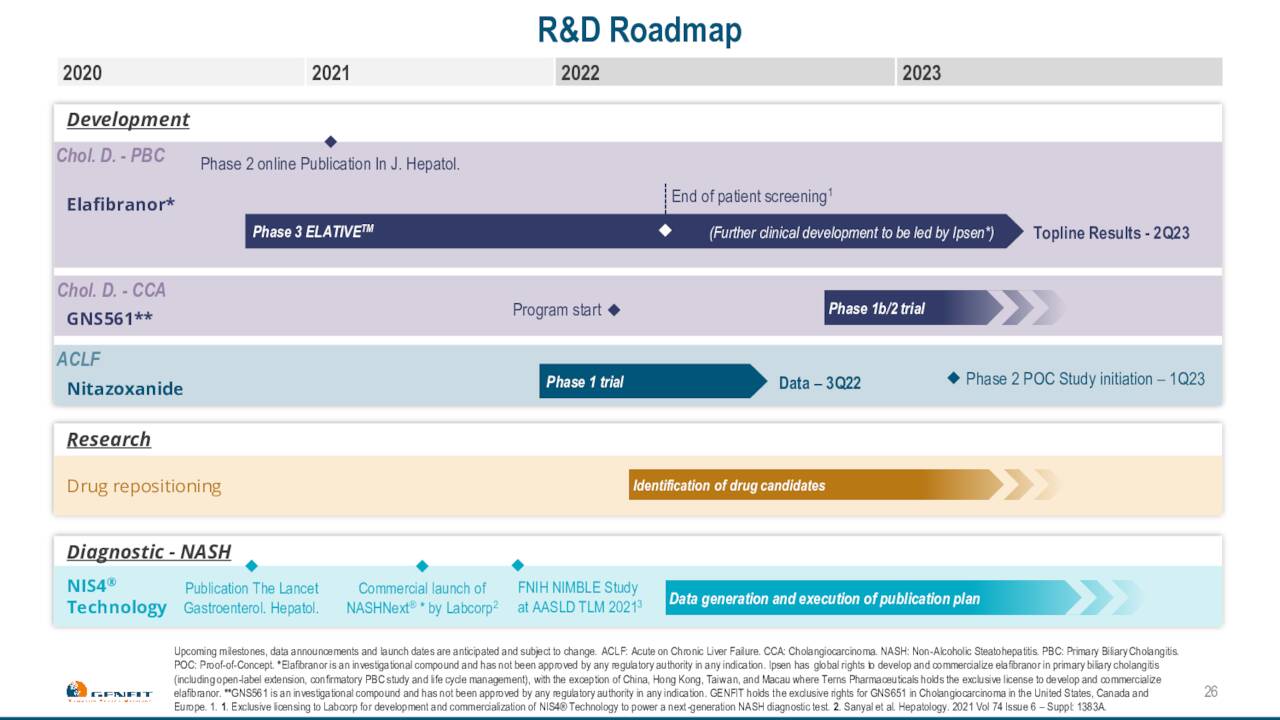

Genfit is developing several compounds within its pipeline. Elafibranor, a dual agonist of PPARα and PPARδ, has shown encouraging results in mid-stage studies evaluating it to treat Primary Biliary Cholangitis or PBC. Elafibranor has Breakthrough Therapy and Orphan Drug status for PBC it should be noted. In late 2021, the company announced that it entered into an arrangement with Ipsen that will give that drug maker exclusive worldwide license to develop, manufacture and commercialize Elafibranor.

April Company Presentation

Genfit received a €120 million upfront payment for this license agreement and also can garner milestone payments up to €360 million (roughly 50% of this is for developmental milestones), plus tiered double-digit royalties of up to 20% on any commercialized sales. €80 million of the upfront payment was recognized as revenue in 2021, and €40 million was booked as deferred revenue and will be recognized as revenue in subsequent years following the completion of the ELATIVE double-blind study. Top-line results from that Phase 3 study evaluating Elafibranor to treat PBC should be out in the second quarter of next year.

April Company Presentation

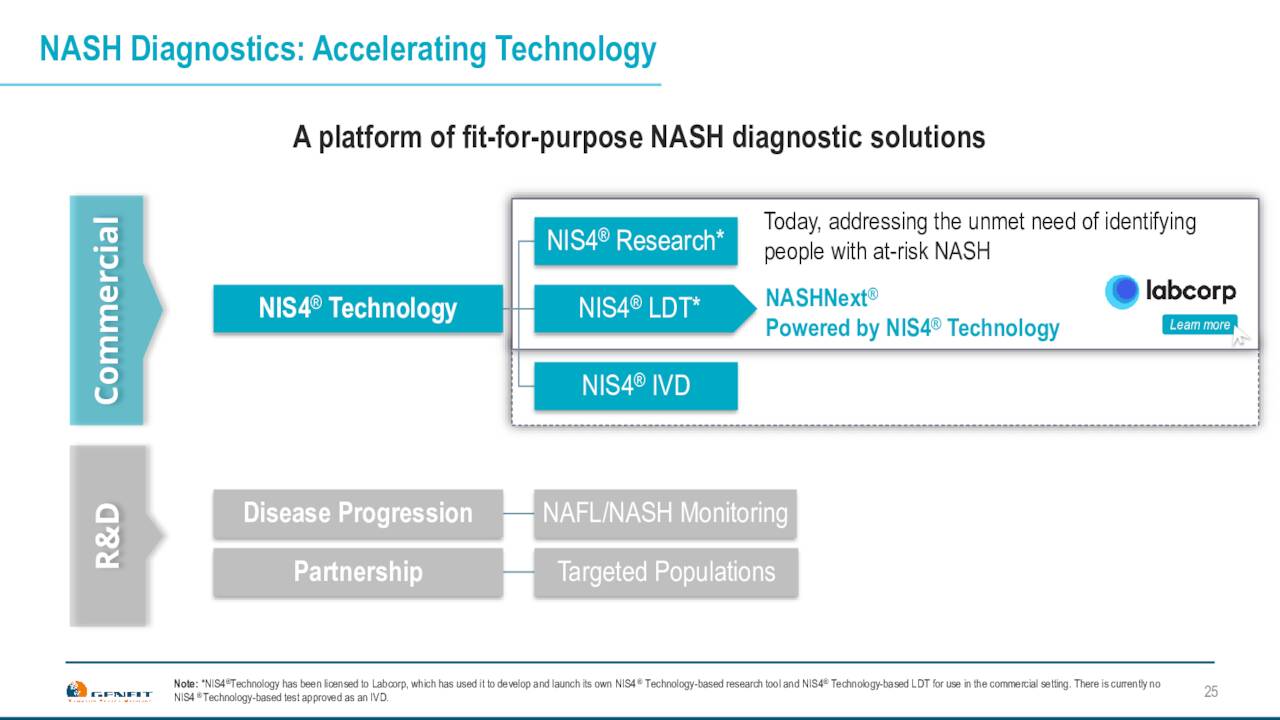

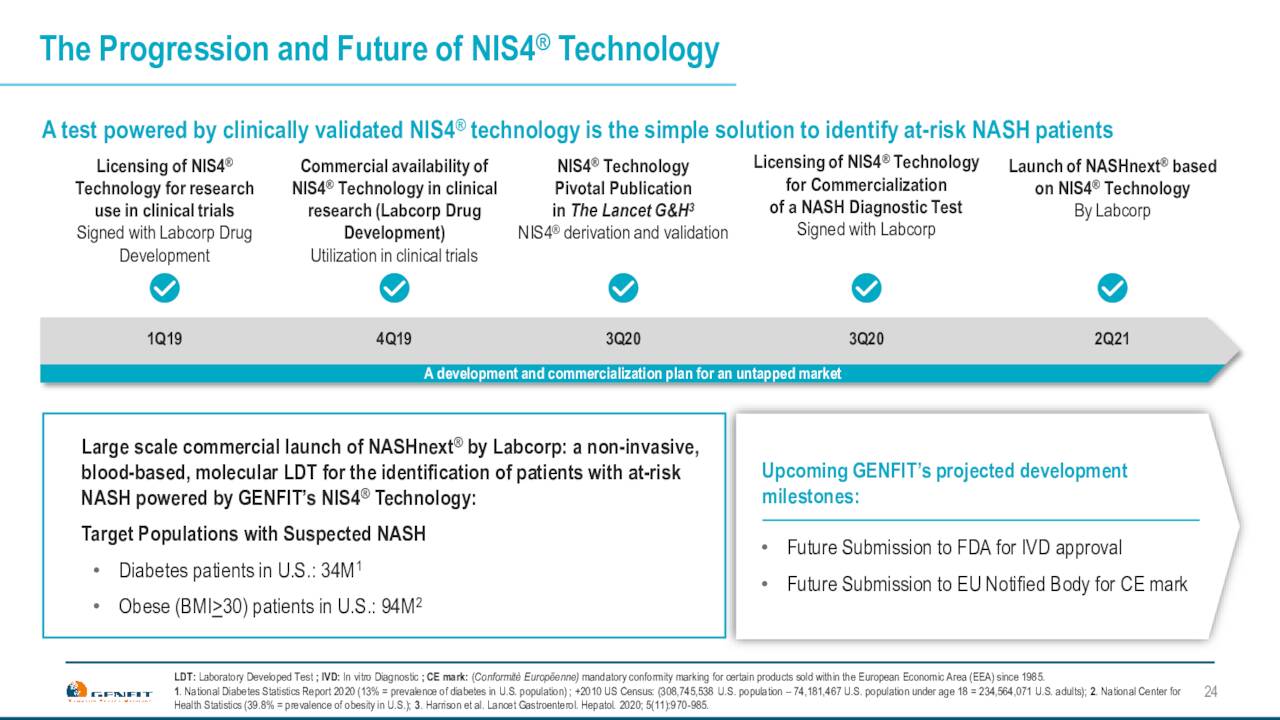

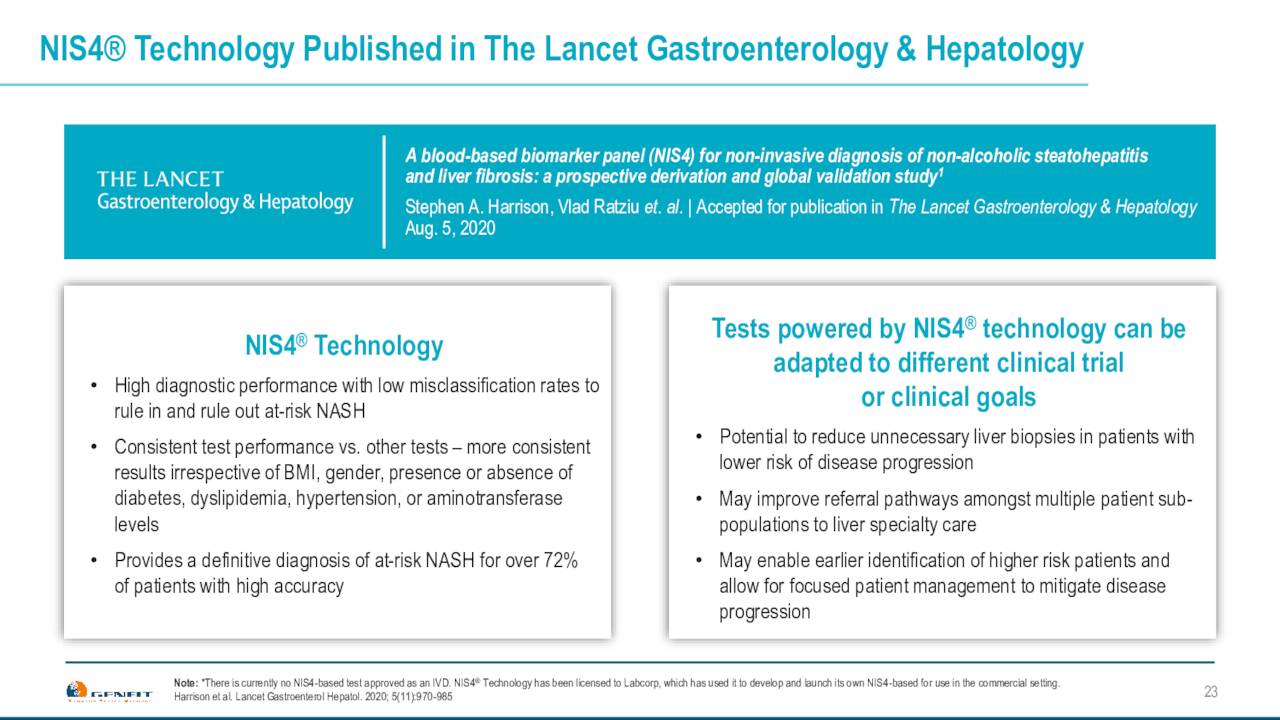

The company is also working on a simple non-invasive test with Labcorp to identify at risk patients for NASH. This will be important if/when a drug is eventually approved for NASH. The company already has a significant database of patients from the work it did with its own NASH development which ended with the failure of the RESOLVE-IT trial in 2020. More data will be added with Ipsen’s work on PBC.

April Company Presentation

The company is also working with other NASH development trials to ensure they knew steroids in their clinical trials, so that they can generate data with it. They also would naturally allow clients to use this test built on Genfit’s NIS4 technology out of five blood based biomarker panels called NASHNext. That will launch from Labcorp if it is eventually approved. Genfit has an exclusive license agreement with LabCorp around this test. Genfit hopes this becomes the standard to identify at-risk NASH patients, provided a drug or drugs is approved for this widespread affliction.

April Company Presentation

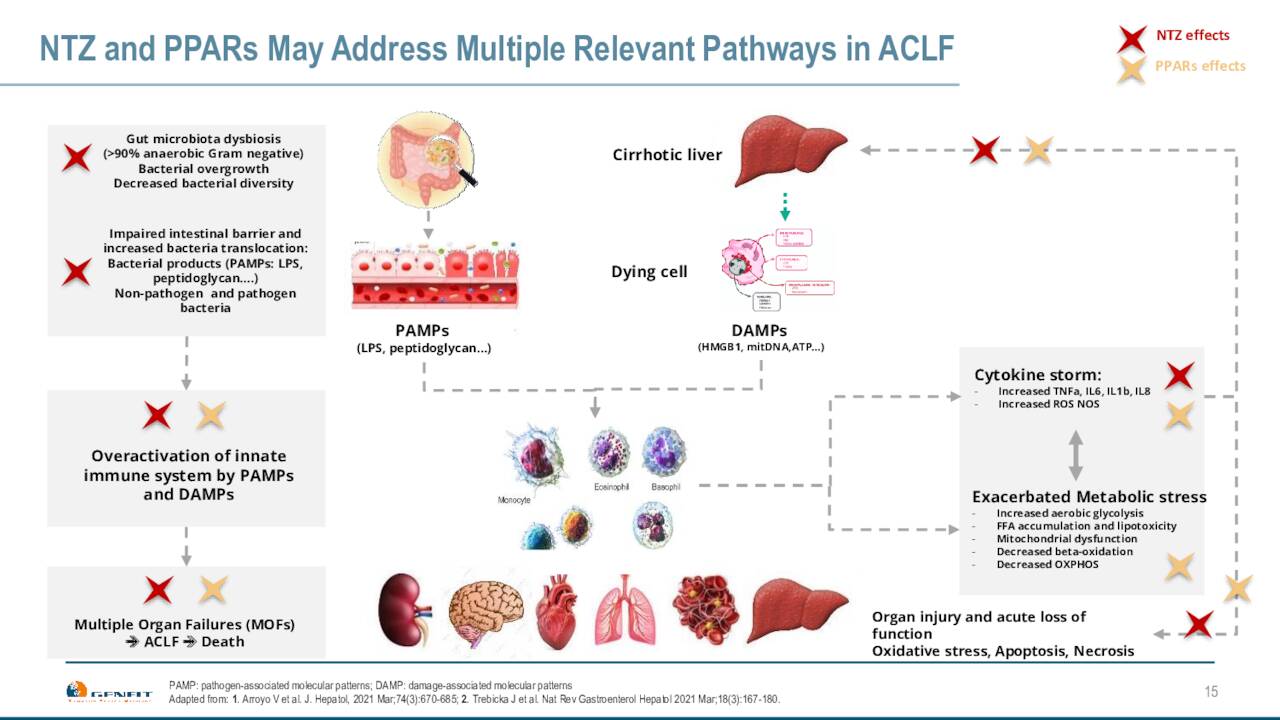

The company also has two Phase 1 studies evaluating a candidate called NTZ, which they identified through phenotypic screening. The first Phase 1 study is focused on hepatic impairment, results from that study should be out shortly. The other Phase 1 study is focused on renal impairment. Data for this trial expected to be available in the fourth quarter of 2022.

April Company Presentation

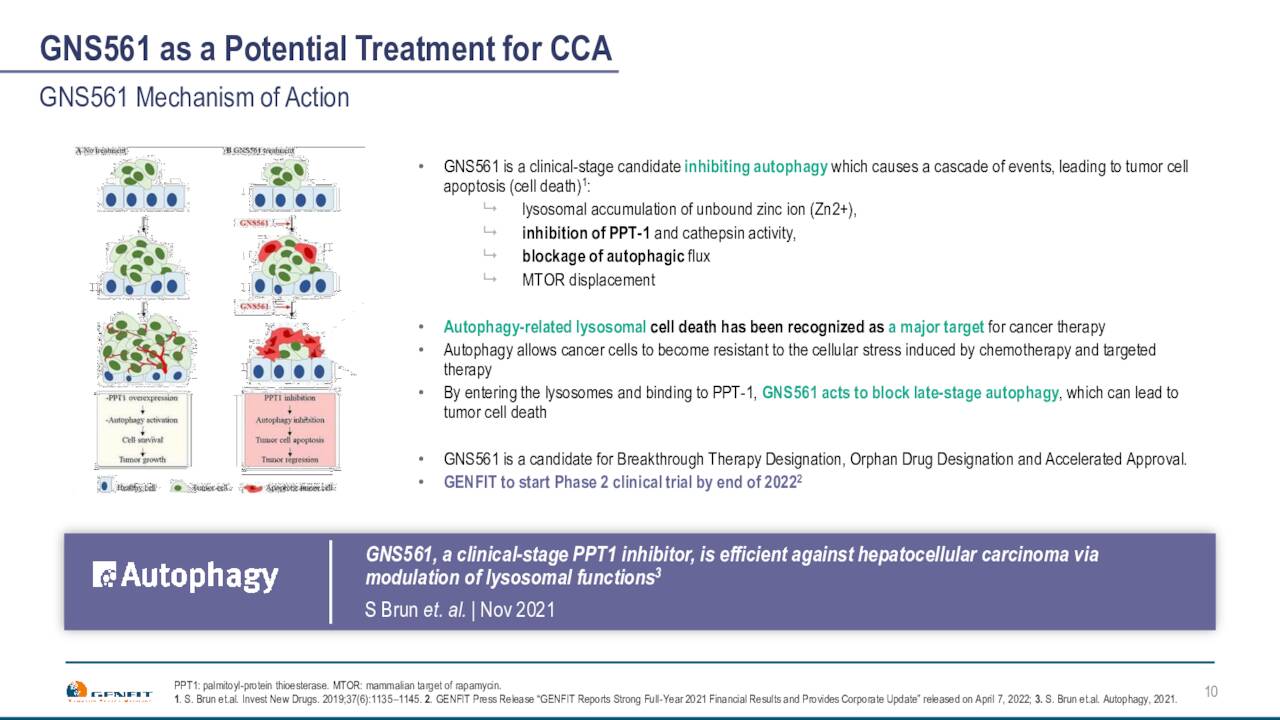

Finally, late last year Genfit licensed an investigational compound from Genoscience Pharma called GNS5611. Genfit hopes to launch a Phase 1b/2 study towards the end of this year to evaluate this candidate for treating Cholangiocarcinoma (Bile Duct Cancer) which could be eligible for Orphan Drug status. Study data from this trial should be out in the first half of 2024.

April Company Presentation

Analyst Commentary & Balance Sheet:

Not being based in the United States means the company gets little coverage from Wall Street. On April 11th, Leerink Partners maintained a Buy rating with a $10 price target on the stock. Two days later, H.C. Wainwright did the same with a $8 price target. That is the only analyst firm activity I can find on Genfit so far in 2022. Cash and cash equivalents totaled €222.2 million at the end of the first quarter. Management expects to use €$65 million to fund all operating activities in 2022. The company ended FY2021 with approximately €$75 million, most of this is convertible debt that expiration runs into the fourth quarter of 2025. Given this, the balance sheet currently looks solid.

Verdict On Genfit:

Genfit is one of the hardest small biotech companies to analyze. There is little to no analyst coverage on this name. The company seems to only post results and earning call transcripts twice a year. There are also a lot of moving parts here to evaluate. Elafibranor development is moving forward and the licensing deal with Ipsen brought in much needed funding and also could provide lucrative milestone payouts as well as potential royalties.

NashNext also would seem to have potential once a candidate is approved for NASH. The company also has a couple of other much earlier stage “shots on goal.” Subtracting net cash on the balance sheet, the stock has less than a $100 million market cap. Given that, this “sum of the parts” story probably merits a small “watch item” holding pending further developments at this time.

If your arteries are good, eat more ice cream. If they are bad, drink more red wine. Proceed thusly.”― Sandra Byrd, Bon Appetit

Be the first to comment