proxyminder/iStock Unreleased via Getty Images

Bloomberg’s US Edition ran an interesting piece last week highlighting crypto’s notable outperformance in the third quarter. Cross Asset Markets Editor Joanna Ossinger pointed out Bitcoin’s (BTC-USD) relative stability and Ethereum’s (ETH-USD) reversal compared to the retreat in both the MSCI’s (ACWI) all-county stock index and Bloomberg’s total-return global bond index.

| Bitcoin | Ethereum | ACWI (all-country stocks) |

LEGATRUU (global bonds) |

|

| Q3 Change | 3.7% | 32% | -7.0% | -7.0% |

Sourced from: Crypto Notable Quarterly Performer With Bitcoin Edging Higher, bloomberg.com, 9/29/2022

Two takeaways from the article are the key role Treasury yields are playing in the crypto space and how Ethereum is providing leadership to the sector. The article below expands on these two points with an eye toward the fourth quarter ahead.

Ethereum: Now The Surge and The Verge

Looking back, The Merge on the Ethereum platform was implemented frictionlessly. The Merge took Ethereum from its energy-intensive proof-of-work consensus mechanism to an ESG-friendly proof-of-stake method for securing and propagating its blockchain. This change likely allows additional institutional investment. Darius Sit of QCP Capital gave the following color to Bloomberg:

The Ethereum merge was a strong Q3 2022 narrative…. Although we saw a post-merge dip in prices, the success of this watershed event bodes well for the space.

Crypto Notable Quarterly Performer With Bitcoin Edging Higher, bloomberg.com, 9/29/2022 (link above)

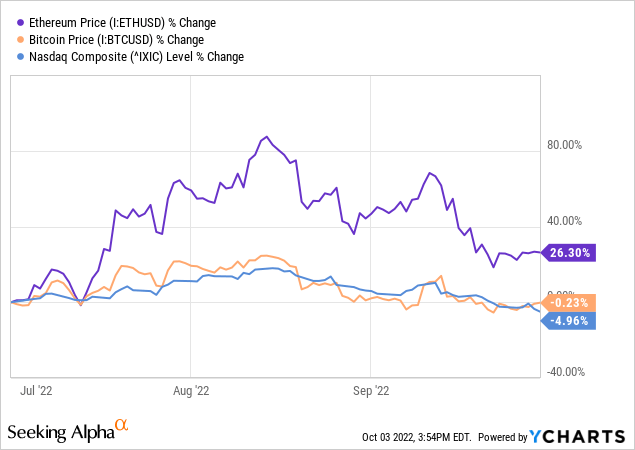

Consider Ethereum’s price moves over the third quarter in the graph below. They appear correlated to Bitcoin and the interest rate sensitive Nasdaq Composite, but substantially more positive during the period of the successful practice merges on the major testnets in July and August. Note also that the oft-predicted “sell the news effect” of The Merge did seem to play out in mid-September.

But where from here? First, the importance of Ethereum’s move away from proof-of-work can’t be overstated from a regulatory point of view. The recent White House mandated digital asset report from the executive branch agencies called for the minimization of GHG emissions from crypto-assets. It went further and even suggested a proof-of-work ban if actions through DOE efficiency requirements are not sufficient.

… the Administration should explore executive actions, and Congress might consider legislation, to limit or eliminate the use of high energy intensity consensus mechanisms for crypto-asset mining.

Climate and Energy Implications of Crypto-Assets in the United States, whitehouse.gov, 9/2022

Consider how regulation may directly affect the two largest digital assets. Bitcoin has a small but differentiating advantage over Ethereum as it is less directly assailable from securities regulation. This is because Bitcoin does not have well-known, central promoters that benefited from the initial distribution coins.

But Ethereum is much more resilient from an ESG perspective as its energy usage is minimal. Increasingly Bitcoin mining uses renewables, lends to grid stability and encourages new wind and solar projects. But numerous U.S. lawmakers and regulators have indicated Bitcoin’s growing energy usage is problematic more broadly and questioned the relative societal good of the network. And any regulatory action against the miners will likely negatively impact the underlying coin price as was seen during the mining crackdown last year in China.

Ethereum may also benefit from the next step in its development. In the coming six months the platform should see a clean-up upgrade that includes one of the last key elements of The Merge, which is the enabling of withdrawals from the newly implemented staking mechanism. While there are workarounds and derivatives, any Ethereum that is staked cannot currently be withdrawn from the mechanism until this date-uncertain upgrade is implemented.

Enabling withdrawals removes a current talking point of rivals like Cardano (ADA-USD) that have longer standing, fully functional staking protocols. But more importantly, enabling withdrawals should eventually lead to somewhat of a staking renaissance. Once institutions are guaranteed liquidity terms there will be increased interest in Ethereum. The platform will then be somewhat regulatory moated and provide the option to safely capture meaningful yield through staking.

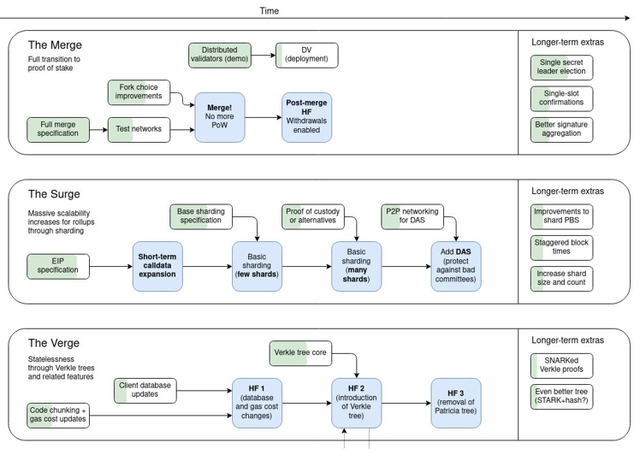

twitter.com/vitalikbuterin

While implementing a merge on the various testnets wasn’t without difficulty, The Merge on Ethereum’s mainnet was basically without issues. This lends credence to the notion that the next two major milestones, The Surge and The Verge, can be efficiently implemented as well. This is not to say the process will be quick and there is some indication from developers that the process will slow for both practical and technical reasons.

But every six months or so we could see a number of improvement proposals implemented representing steps toward the milestones. The Surge is of particular importance as it brings sharding, which increases the scalability of the platform and the capacity of transactions per second. The Verge will reduce the cumbersomeness of the proof-of-stake mechanism and likely leads to increased decentralization, a pillar of digital asset value.

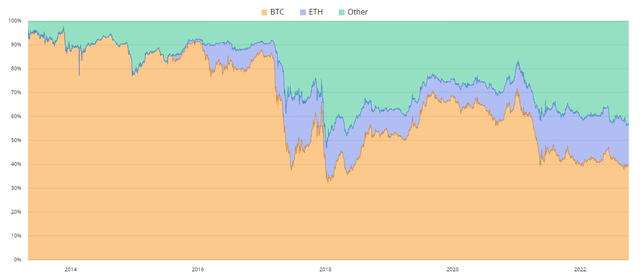

Bitcoin Dominance Over Time (btctools.io)

The graphic above shows percent of the total market capitalization of the crypto space over time for Bitcoin (orange), Ethereum (blue) and the altcoins combined (green). Though not without volatility, Ethereum should continue to capture share and provide leadership for the sector. The paddlewheel of development upgrades and tests provide a constructive price environment over the next year. Cici Lu of Venn Link Partners Pte explained in the Bloomberg article:

While prices are depressed, the crypto ecosystem is actually thriving… Developers are focusing on building the technologies.

Crypto Notable Quarterly Performer With Bitcoin Edging Higher, bloomberg.com, 9/29/2022 (link above)

Interest Rates: The Great Reset

Working contrary to this paddlewheel of developments are interest rates and inflation focused U.S. momentary policy tightening. This was especially true during the second quarter of this year. And recall that higher rates make longer-term bets less attractive and that the prior loose monetary policy supported asset pricing, including for the digital ones.

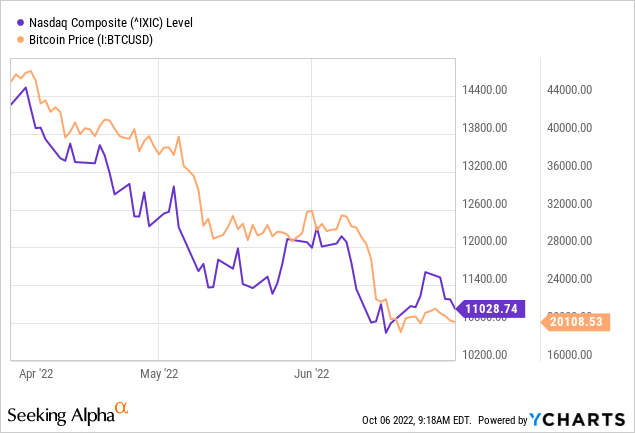

The main pain to the broader technology market and crypto space came specifically during the second quarter this year as interest rate expectations were substantially reset. Consider the 3000 point drop in the Nasdaq and Bitcoin’s fall to present levels from $44k over just three months.

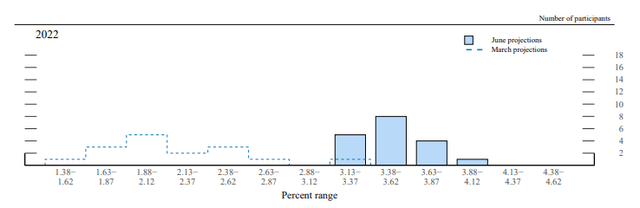

One can see the largest part of this year’s shift in interest rate expectations in the FOMC’s Summary of Economic Projections released with its June meeting. The median participant substantially adjusted their outlook from a year-end 2022 target rate near 2%, to one over 3.5%.

The dotted line below represents the projections from the March meeting and the shaded area is the projections at the time of the June meeting; the scale on the right is the number of members making that particular projection, i.e. a chart view of two meeting’s dot plots. Most importantly, during the quarter the stock, bond and crypto markets were observing, accepting and pricing this new rate paradigm.

FOMC Participants’ Target Ranges – Fed Funds (federalreserve.gov)

Digital Assets Going Forward

Edward Moya of Oanda Corp. described the current short-term thinking on rates and crypto assets in the Bloomberg piece.

It appears Wall Street believes crypto is close to the bottom and will become an attractive diversification strategy once the peak in Treasury yields is in place.

Crypto Notable Quarterly Performer With Bitcoin Edging Higher, bloomberg.com, 9/29/2022 (link above)

A growing perception across market participants is that the once flatfooted Fed has now caught up in the inflation fight. The FOMC’s historic actions at the past three meetings may now actually prove overly hawkish, as there is some lag in policy effects. With the federal funds rate set to exceed 4% by year-end and well above the longer-run neutral rate, the market has some hope that the worst of the hikes are now priced into risk-on assets. Put differently, the current and foreseen rate increases are judged sufficient to reduce demand across the economy and thereby reverse the entrenched growth in prices.

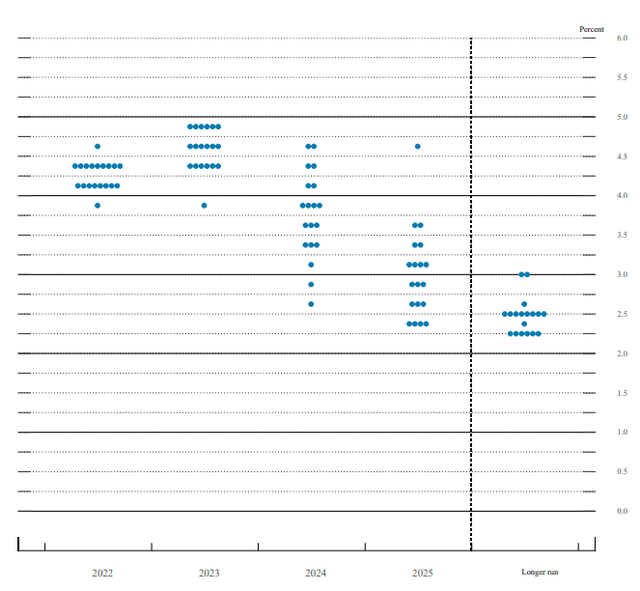

Note the topping of member expectations below 5% for the federal funds rate next year in their most recent FOMC dot plot.

Sept. Fed Funds Dot Plot (federalreserve.gov)

However, both recent CPI and PCE reports show elevated, entrenched energy prices, continued acceleration in the growth of food prices and a now surprisingly high core inflation. Falling U.S. gas prices likely reverse with this week’s OPEC decision to cut production. And there remains large uncertainty where energy prices will settle over the next six months given the U.S. policy on Russian natural gas and oil exports. A brief but detailed piece from the International Energy Agency on projected tight 2023 natural gas supplies can be found here.

If inflation does not retreat, continued negative real rates would likely force additional tightening beyond what is currently anticipated, which could cause another meaningful correction in tech and crypto assets. Further, I have admittedly been wrong this year on inflation and surprised by the Fed’s forcefully talk and repeated meaningful actions. All this said, there is a solid argument we are reaching the peak in Treasury yields soon, as the Fed’s large dose of prior hikes likely reverses inflation trends. Coupling that outlook with the overblown second quarter correction, I am maintaining my buy rating on Bitcoin and Ethereum.

My new marketplace service is coming soon. Complete Crypto Analytics is launching in the near future and will have in-depth analysis of the Ethereum development process. Please keep reading my articles here for updates so you can reserve your spot as a Legacy Discount Member. There will be a generous introductory price for early subscribers. Thank you for following my work.

Be the first to comment