jeffbergen/E+ via Getty Images

After our Kering follow-up with their latest Maui Jim acquisition in which they did not disclose the value of the transaction that was carried out through Kering Eyewear, today we are looking at EssilorLuxottica (OTCPK:ESLOF). At a global level, the company designs, produces and distributes ophthalmic lenses, frames, and sunglasses. The group is not only engaged in the fashion & luxury industry but also in sporting eyewear. EssilorLuxottica operates with two divisions – Professional Solutions and Direct To Consumer; and thanks to four geographical areas – North America, EMEA, APAC, and Latam – in order of revenue size. The company is now the home of the widely-recognized eyewear brands across the globe.

EssilorLuxottica brands EssilorLuxottica brands

Looking forward to the Q1 Results

Turnover had already returned to the pre-pandemic levels of 2019. E-commerce is also growing thanks to the positive performance of Oakley.com and SunglassHut.com. Having listened to the Q1 call, we understood that the company was not affected by the raw materials crisis. Guidance was confirmed and our internal team believes that after the recent stock price sell-off, EssilorLuxottica is back to being a good buy opportunity and is the perfect match between value (thanks to a progressive dividend yield) & growth (thanks to organic and inorganic growth).

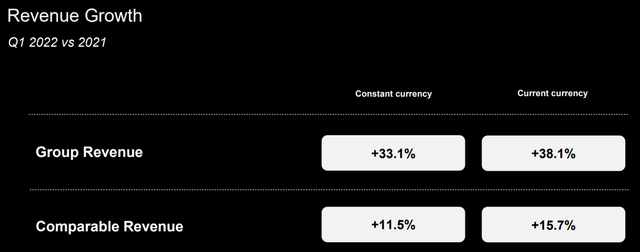

EssilorLuxottica Revenue Results

For a few months, our internal team has overweight luxury companies and we believe brand power is a good protection shield against the ongoing inflationary pressure. So, why are we positive?

- Supportive growth thanks to secular trends uses either contact lenses or eyeglasses;

- Travel recovery will support the next sunglasses season;

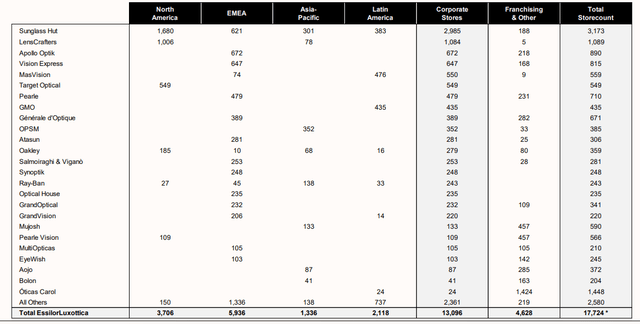

- Proprietary brands and stores (more than 17thousands on the latest quarter release);

- The company is very well vertically integrated at the R&D but also in the supply chain;

- New collaboration with Meta for the glass of the future as well as new product launches such as Stellest;

- Inorganic growth thanks to supportive M&A – here is the latest Italian acquisition;

- Positive FX thanks to the US exposure;

- Regarding point 3), we should also note that GrandVision’s integration is paying off and will create further synergies. New top management was also recently announced. This is also a key pillar of the company’s strategy to build a strong network.

Aside from the financial consideration, we should also underline the group’s commitment to social support actions.

Our estimates, conclusion, and supportive buyback

Our internal team is forecasting a long period of market volatility. Moreover, this is not an easy market to interpret because it is not guided by fundamentals as a reference point, and therefore stock picking can be pretty challenging. Thus, instead of looking at fundamentals, we run a screen based on FCF surplus, earnings growth metrics relative to the market, and balance sheet solidity. Interestingly enough, we discovered that EssilorLuxottica’s stock price decline was not matched by a fall in earnings expectations. Despite the prolonged crisis, we firmly believe that EssilorLuxottica will use M&A operations as a strategic tool of competitive advantage. This is not priced by the market, but it has always been a company’s characteristic.

After these positive insights and the supportive positive long-term developments, we confirm our buy target with a price of €196 per share. Looking at the Wall Street consensus, we recognized that we are beyond analysts’ expectations. We acknowledged that North America for the second quarter will have a more challenging comparison to Q2 2021. More in detail, we see positive development in all geographic areas but in particular in the region of EMEA and Latin America. We are more worried about China, the group posted positive sales until February, with deteriorating performance in March due to COVID-19 restrictions. The group has announced the launch of a plan to purchase a maximum of 2.5 million shares until next August 31 at a unit price of up to €200. This is very supportive of what’s can be EssilorLuxottica implied stock price (it currently trades at €140 per share). This announcement reflects also the company’s confidence in its ability to create value and in its long-term economic prospects. More in detail, buyback could not exceed 10% of the share capital and the shares are intended to be assigned or transferred to EssilorLuxottica’s employees & managers in the context of the profit-sharing plans and share-based bonuses.

Be the first to comment