f11photo/iStock via Getty Images

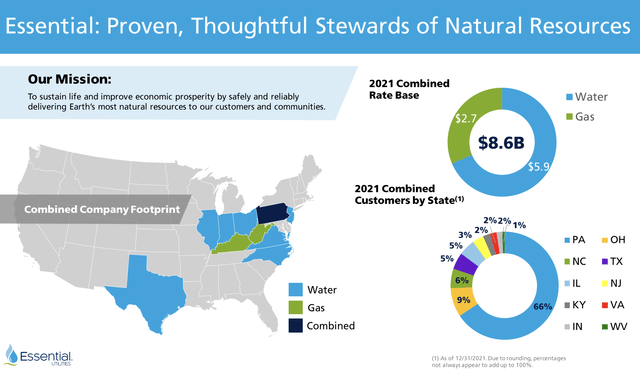

Pennsylvania-based Essential Utilities (NYSE:WTRG), formerly trading as Aqua America, is the second largest and highest-yielding publicly traded U.S. water utility, which now also offers diversification in the form of a growing natural gas business acquired in 2020. Aqua, its water division, serves over three million people in eight states (IL, IN, NC, NJ, OH, PA, TX, VA) and Peoples, its gas arm, serves over two million people in three Rust Belt states (PA, WV, KY).

(Still) A Safe Haven In Uncertain Times

While the utility sector has taken a hit and become quite volatile lately due to rapidly rising interest rates and shifting Fed projections, I think it’s important to zoom out and take stock of the underlying fundamentals and long-term stability of companies like Essential Utilities in order to see this moment as an opportunity to add to your defensive holdings at a historical discount.

Similar to some of my other favourite utilities like Casella Waste Systems (CWST) and American Water Works (AWK), Essential Utilities employs a business model of slow growth by acquisition, having gradually expanded west and south from its major metro market of Philadelphia over the decades by acquiring hundreds of smaller local utilities.

Its recent $4.3 billion acquisition of Peoples Natural Gas – Pennsylvania’s largest natural gas distribution company – brought it into Pittsburgh as well, but most of the company’s expanding geographic footprint covers smaller suburban and rural areas with favourable regulatory environments and FMV (Fair Market Value) legislation, which allows municipalities to sell water and wastewater systems to larger utility operators like Essential for lower prices.

Notably, three other states that have enacted FMV legislation (IA, MO, TN) border Essential’s current footprint and might allow them to expand further to the west and south in future years. Still, investors should be aware that they are mainly buying a Pennsylvania utility, with over 75% of WTRG’s rate base located in the state.

Water With A Gas Kicker, And A Risk

Perhaps one of the most attractive features of WTRG is that unlike other water utilities, it made a prescient move into natural gas distribution at a near 20-year low in natural gas prices. In retrospect, the timing of the Peoples deal couldn’t have been better, and it marked a new era for the company with natural gas now comprising over 30% of the company’s revenue mix and infrastructure investment.

Essential Utilities Business Overview (Sept 2022 Investor Presentation Slide)

With the world now competing for natural gas resources and increasing domestic investment in and political support for natural gas infrastructure, I believe that management can achieve its goal of a higher 8-10% annual growth rate for its natural gas segment through 2024 versus its 6-7% CAGR target for its water business. Given Essential’s projected EPS growth of 5-7%, higher gas growth should enable the company to maintain its 7% dividend growth rate while remaining below its 65% max payout ratio cap (currently at 63%), especially since their wastewater expansion efforts in PA have faced some setbacks in the past few years.

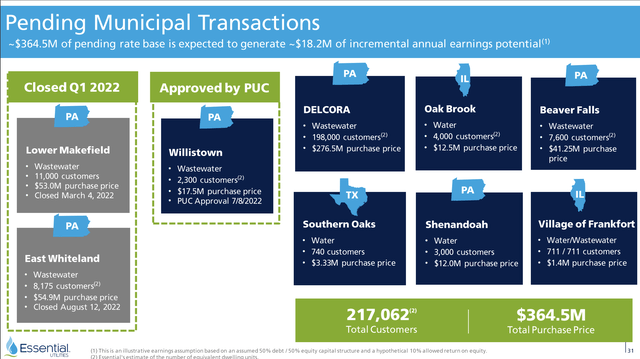

This brings us to the main investment risk, which in my view is the difficulty Essential has had in closing two major wastewater acquisitions in counties around Philadelphia, especially because wastewater in particular is the company’s main focus for expansion. While 2021 marked a lower-than-average year of new water customer additions at only 7.7k (note that “customers” refers to households, not people), Essential has already added over 20k new customers in 2022 and has signed deals for nearly 200k more, the vast majority of which are supposed to come from the DELCORA plant, which provides wastewater treatment for Delaware Country, PA. The problem is that closing the DELCORA deal, originally signed in 2019, is by no means a certainty and looks murkier by the day.

Pending Aqua Acquisitions (Sept 2022 Investor Presentation Slide)

County-level politics in Pennsylvania is convoluted to put it mildly, but the deal remains in limbo between the local county council, which has voted to terminate the plant entirely, and Aqua, which has an enforceable purchase contract. Without getting too deep in the weeds, I personally think a financial settlement in Essential’s favour is most likely, with a smaller chance that the original deal will be honoured. Either way, I think investors would be wise to discount the 200k DELCORA customers from Essential’s projections to avoid disappointment should the deal fall through, although they may see some cash in the event of a settlement.

At $276.5 million, the DELCORA deal isn’t going to make or break the company’s fortunes, but it does raise questions about their ability to expand further within the greater Philadelphia area. This situation echoes Aqua’s last failed $1.1 billion bid for neighbouring Bucks County’s wastewater assets, which was eventually rejected largely due to local constituents’ animosity over what they viewed as exorbitant wastewater rate hikes granted to Aqua by PA’s Public Utility Commission. Luckily the Bucks County customers were never included in Essential’s projections, so it didn’t result in any revisions to their outlook in the way that a negative outcome for the DELCORA assets might.

Looking Back, Looking Forward

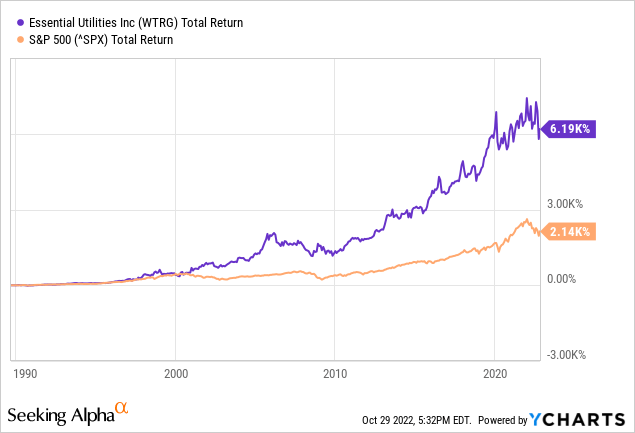

While not indicative of future performance, WTRG’s historical chart is extremely impressive. Founded in 1886, it has paid a rising dividend since 1981, making it a dividend aristocrat and very likely a future dividend king. Since 1988, WTRG has generated a total return CAGR of 12.85% versus 10.25% for the S&P 500, more than doubling the S&P’s total return over the past 35 years with far less volatility and rock-solid dividend growth.

Likewise, WTRG’s historical yield chart might look concerning at first in a rising rate environment since the stock has yielded as much as 8% in the past, but much like my recent analysis of AWK we can see that the reason for its steadily declining yield has been robust share price appreciation that has outpaced its dividend CAGR by nearly double — in other words, this is a problem we want to have.

As the table from that article shows, WTRG is still trading at a significant discount to its 5-year average PE ratio (25.9x versus 35.1x) while offering the highest yield among water utilities. In addition, WTRG sports one of the sub-sector’s higher dividend CAGRs at 7% over the past 5 years. If the company can maintain this rate, investing at today’s current yield of 2.64% would produce a 10-year yield-on-cost of 5.19%. This is in line with the current projected terminal fed funds rate and should insulate the stock from further rate-driven drawdowns should those projections hold.

Conclusion

To me, this shows that the company has done an excellent job of maintaining both overall growth and dividend growth through a diversity of challenging market conditions such as those we are now facing. Higher projected growth from its new gas distribution business should help it meet its revenue, EPS, and dividend growth targets over the next few years even if its planned DELCORA acquisition falls through or results in a financial settlement, and management is pursuing many other deals that should help keep their customer base growing at the targeted 2-3% per year despite recent setbacks in wastewater expansion.

Without downplaying these risks, in terms of defensive SWAN stocks, I’d argue that Essential belongs alongside the best blue chip names like McDonald’s (MCD) and PepsiCo (PEP) in any DGI portfolio. While it may be prudent for cautious investors to wait until the DELCORA sale is resolved, I think the company’s current valuation is compelling enough to recommend cost averaging in at these prices and adding on any further weakness.

Be the first to comment