Nikada/iStock via Getty Images

Investment Thesis

Vertiv (NYSE:NYSE:VRT) went public in 2019 through a SPAC merger with GS Acquisition Holdings Corp. Unlike most other SPACs, this is a rare high-quality SPAC co-sponsored by Goldman Sachs (GS) and David Cote, the former CEO of Honeywell (HON). The company has performed exceptionally well since going public, up almost 200% in less than two years. However, the company got caught in an unprecedented supply chain disruption earlier this year. This along with the broad market sell-off caused to stock to plummet by over 50% from its all-time high, now trading at around $12.7.

Vertiv has a large TAM and is poised to benefit from the growth of data centers thanks to its leading position in the digital infrastructure space. While the macro environment remains unstable, the company’s outlook mentioned in the recent earnings suggests a significant improvement in financial performance over the coming year, as demand continues to increase. Therefore I rate the company as a buy.

Overview

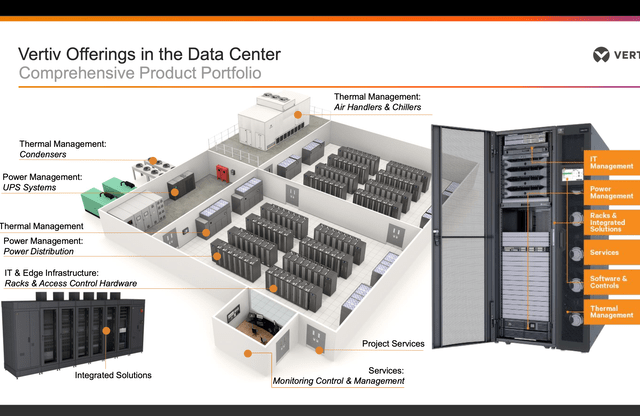

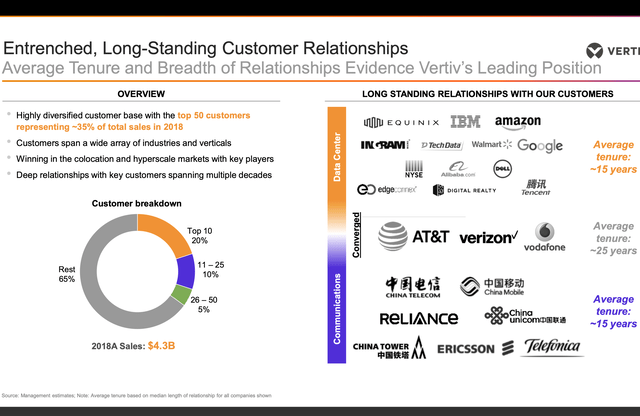

Most people think of Nvidia (NVDA), Equinix (EQIX), or Digital Realty (DLR) when investing in the data center space. However, I believe Vertiv is another pick and shovel data center play that investors can consider. Vertiv can be considered the backbone of data centers. It provides comprehensive digital infrastructure solutions to data centers and communication and industrial companies, which include thermal management, power management, infrastructure hardware, services, etc. The company has a presence in 130+ countries with over 270 service centers. Approximately 70% of total revenue is currently generated from data centers. The company’s client list is very impressive, including some of the biggest companies in the world, such as Amazon (AMZN), Google (GOOG), Walmart (WMT), Verizon (VZ), and more.

Why Vertiv?

Vertiv is benefiting from the growth of data centers. Thanks to strong secular trends like cloud computing, IoT (internet of things), video streaming, and gaming, the number of data circulating exploded in the past few years. The increased adoption of digitization and higher requirements for connectivity caused a significant increase in demand for data centers. According to the company, the TAM (total addressable market) for its data segment alone is around $20 billion and is forecasted to grow at a CAGR of 5% moving forward. The total TAM is currently $29.5 billion when accounting also the communication and industrial segment.

Rob Johnson, CEO, on market tailwinds:

Cloud and colocation remain robust. You have seen this in the cloud growth rates reported by all major cloud providers. AWS reported last week that their cloud business increased 33% in the second quarter and believes that we are still in the early stages of enterprise and public sector cloud adoption. Certainly, the growth in cloud market supports this view; data growth is not slowing down. Our view on the enterprise and small to medium business remain consistent from Q1 and we believe edge applications will continue to provide growth and lift for these markets.

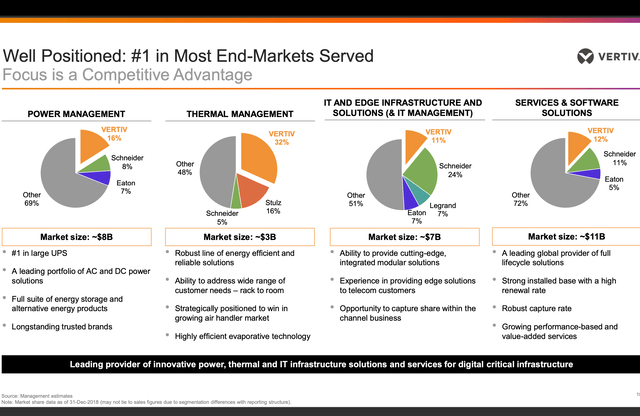

The company also has a leading market position with strong competitive advantages. It is currently the leader in 3 out of the 4 markets it operates in, as shown in the slide below. This is especially important in an inflationary environment as it gives the company strong pricing power compared to its peers. Vertiv’s business model is also a lot more resilient than its peers. While around 40% of revenue is contributed by project-based sales such as initial deployment and services, the remaining 60% of revenue is flow and recurring-based. Which includes revenue from ongoing maintenance and replacement. These expenses are non-discretionary for customers as they need their data center to be up and running at all times. The large portion of recurring revenue is able to provide the company with a lot more stability.

Financials

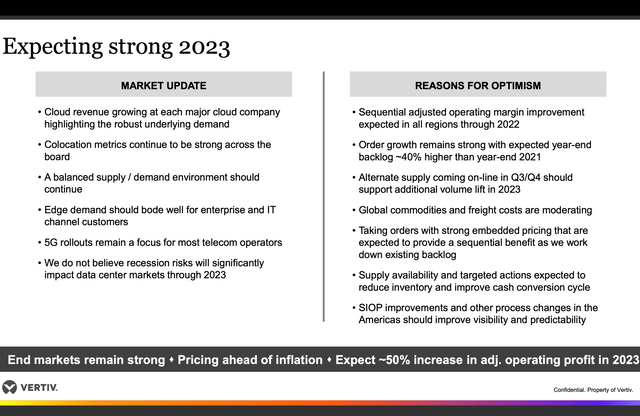

Vertiv recently reported its second-quarter earnings and the results remain mixed as it continues to face significant pressure from the macro environment. The company reported net sales of $1.4 billion, up 11% YoY (year over year) from $1.26 billion. The growth is largely driven by strong demand, with quarterly orders up 17% YoY (pricing contributed a 10% increase). Revenue from the US and EMEA continue to show resilience, up 14.6% and 16% respectively. While the revenue from APAC trailed behind with an increase of only 2.3%, largely caused by the lockdown in China. The company also ended the quarter with a record high backlog of $4.4 billion, up 39% from the end of 2021.

While sales growth was decent, the bottom line continues to suffer due to macro pressures. Adjusted operating profit decreased 38.8% from $134 million to $82 million. This is due to a significant increase in material and freight costs caused by inflation, as well as FX headwinds. This resulted in adjusted operating margins dropping from 10.6% to 5.9%. Adjusted diluted EPS also decreased from $0.31 to $0.1, largely attributed to the drop in operating profit. Free cash flow was negative $(232) million compared to $41 million a year ago. The drop was due to increased inventories to address the volatile supply chain dynamics and increased backlog.

Rob Johnson, CEO, on the company’s outlook

In summary, our demand remains strong. We are currently filling our backlog for the second half of the – for next year and we expect these favorable conditions to continue.

Fortunately, thanks to strong demand and supply chain initiatives, the outlook appears to be very encouraging. The company expects Q3 results to improve significantly both YoY and sequentially. Net sales growth is forecasted to be 20%, up from 11% this quarter. Adjusted operating profit to be around $140 million compared to $82 million, with adjusted operating profit margin increasing from 5.9% to 9.4%. Diluted EPS is also expected to increase from $0.1 this quarter to $0.23 in Q3. The management team expects a very strong FY23 citing strong secular tailwinds and increasing demand. They now expect adjusted operating profit for FY23 to increase by approximately 50%.

Risks

I believe the biggest risks in regard to Vertiv are currency headwinds and ongoing supply chain disruption. Currently, approximately 50% of the company’s total revenue is generated from EMEA and Asia Pacific. Due to its global presence, Vertiv is now facing strong currency headwinds as the dollar continues to grind higher. The company already took a $45 million profit hit due to FX in the latest quarter, or 4% of sales. If the dollar continues to persist at high levels, FX headwinds are likely to put further pressure on the company’s bottom line. While the supply chain disruption seems to be easing and the company has been actively taking initiatives to improve inventory management, the situation remains very unstable. The volatility may continue to post unprecedented risks on Vertiv if the situation were to worsen again.

Conclusion

In conclusion, the current sell-off appears to be an overreaction. Vertiv is operating in a large TAM and is facing substantial tailwinds as the demand for data centers continues to increase. It also has a market leading position with a blue-chip client base, giving it strong pricing power compared to peers. While the latest quarterly earnings appear to be mixed, the outlook is very encouraging with major improvement across all metrics. As demand continues to ramp up and supply chain disruption eases, I believe the company will rebound significantly. Therefore I rate Vertiv as a buy at the current price.

Be the first to comment