4kodiak

Price Action Thesis

We present a detailed price action analysis on VICI Properties Inc. (NYSE:VICI) stock as we noticed significant price action developments over the past month.

VICI is a popular REIT with retail investors focusing on casino assets. Therefore, it also helps investors with underlying gambling stock exposure diversify their risks with the relative stability of a REIT.

However, we noticed that VICI formed a bull trap in June (significant rejection of buying momentum). In addition, its price structure suggests investors need to be wary of adding at the current levels. Notwithstanding, some investors could point to its robust NTM dividend yield of 4.82% to justify adding exposure.

Still, we believe that investors should bide their time for a more attractive buy point (and even better yields!), as VICI’s revenue and AFFO/share growth are projected to slow markedly. Coupled with its less constructive price action, we believe caution is warranted.

Accordingly, we rate VICI as a Hold now.

VICI – Don’t Ignore June’s Bull Trap

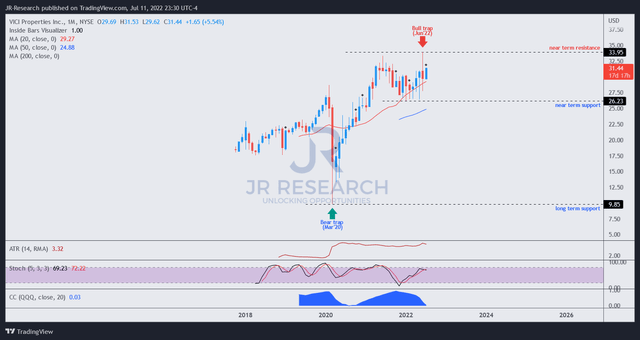

VICI price chart (monthly) (TradingView)

VICI has been a massive winner for investors since its March 2020 COVID bear trap (significant rejection of selling momentum). Furthermore, despite the downtrend seen in the SPDR S&P 500 ETF (SPY), VICI has outperformed the market significantly. VICI delivered a YTD total return of 6.69% against the SPY’s -17.56% return. Therefore, it has provided its investors with an excellent hedge against the general market’s poor performance in 2022.

Despite that, we noticed a noteworthy bull trap in June 2022, as seen above. As a result, we believe the market could be setting up a steeper fall in VICI, as it looks to deny further buying upside.

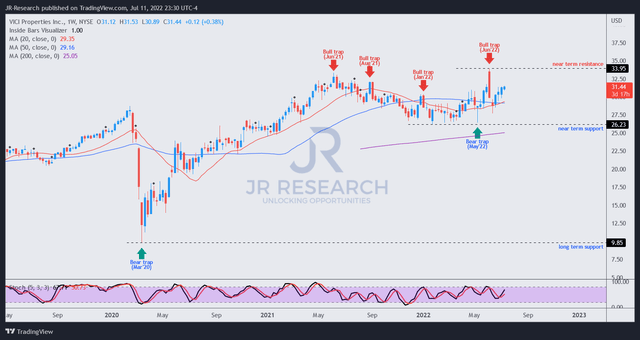

VICI price chart (weekly) (TradingView)

Moving into its weekly chart, we can glean the series of bull traps over the past year. VICI also seems to have lost its bullish bias (since March 2020’s bottom) since its bull trap in January 2022, which was a significant development.

However, a remarkable bear trap in May 2022 helped stanch its initial decline and attempted to reverse its bearish momentum. But, we believe June’s massive bull trap has resolved its attempted reversal.

As a result, we believe that investors should be cautious when deciding to add exposure at the current levels. In addition, VICI has a potential upside of slightly more than 6% before reaching its bull trap resistance level ($33). Therefore, we don’t think it looks attractive at the current levels.

Furthermore, we don’t believe May’s bottom could hold eventually, as the price structures from the medium- and long-term charts look menacing. Hence, the risk of breaking down its near-term support ($26) could increase.

Notwithstanding, the current momentum seems positive as it attempts to retake its near-term resistance. Therefore, we don’t encourage investors to execute directionally bearish set-ups until they observe another lower-high bull trap.

Accordingly, we are not convinced that the current risk/reward profile is attractive.

VICI’s Growth Is Expected To Slow

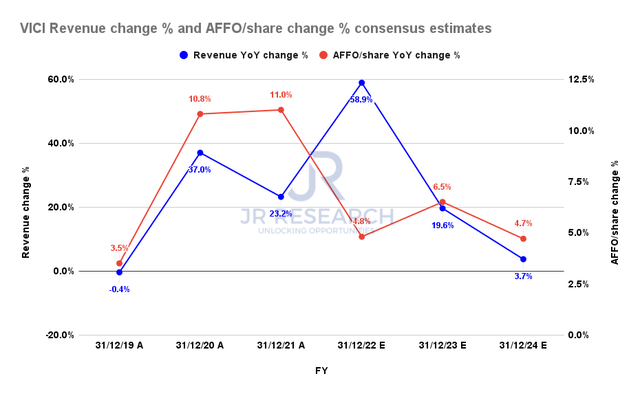

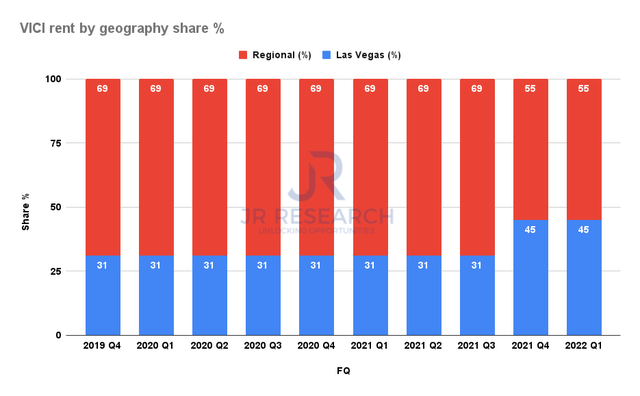

VICI revenue change % and AFFO/share change % consensus estimates (S&P Cap IQ) VICI rent diversification by geography share % (Company filings)

The REIT has a sizeable exposure to Las Vegas assets, with a 45% share of rent in FQ1’22. Accordingly, investors should keep a close watch on the developments in Las Vegas, given its revenue concentration. VICI also cautioned in its 10-Q (edited):

Our business may be significantly affected by risks common to the Las Vegas tourism industry. For example, the cost and availability of air services and the impact of any events that disrupt air travel to and from Las Vegas can adversely affect the business of our tenants. (VICI’s FQ1’22 10-Q)

The consensus estimates (very bullish) suggest that VICI’s growth is projected to slow markedly from FY22. Notably, it’s expected to slow through FY24, reaching 3.7%. Consequently, it’s also likely to impact its AFFO/share growth, falling to 4.7% in FY24.

Is VICI Stock A Buy, Sell, Or Hold?

We rate VICI as a Hold for now.

VICI last traded at an NTM dividend yield of 4.82% (Vs. 3Y mean of 5.33%) and an NTM P/AFFO per share of 15.98x (Vs. 3Y mean of 14.53x). Therefore, the market could use some meaningful value compression.

Our price action analysis indicates that VICI’s price structures are less constructive to maintaining its bullish bias, given its June bull trap. As a result, we urge investors to be patient with VICI and let the price action play out first.

Be the first to comment