Nirian

With nearly 8 billion people in the world today, physical infrastructure is something that the world cannot be without. There are many companies that are focused on providing the various goods and services necessary to facilitate the creation and maintenance of the world that we see today. And one of the firms that investors should be aware of that operates in this space is Carlisle Companies (NYSE:NYSE:CSL). Over the past few years, financial performance achieved by the company has been a bit lumpy. However, recent financial performance has been impressive and a continuance of that trend has the potential to yield attractive upside. Although shares of the company may not be the cheapest on the market, they do offer some upside potential if management can continue expanding as they have recently.

A play on engineering

To best understand Carlisle Companies and its operations, we should delve into each of the four key segments that the company has. First and foremost, we have the Carlisle Construction Materials segment. Through this, the company produces a line of premium single-ply roofing products and warranted roof systems. It also produces and sells accessories related to these other goods. Examples include PVC membrane, polyiso insulation, and engineered metal roofing and wall panel systems. Although this segment largely focuses on catering to the commercial building industry, some of its products are also made available for residential buildings as well. The latest data available suggests that this particular segment is responsible for 60.3% of the company’s revenue. It’s also responsible for nearly all of its profits. In the latest quarter, this segment was responsible for 82.9% of the company’s overall profits.

Next in line, we have the Carlisle Weatherproofing Technologies segment. This particular unit produces building envelope solutions that help to drive energy efficiency and sustainability. Products under this unit include waterproofing and moisture protection offerings, protective roofing underlayments, roof coatings and mastics, block-molded expanded polystyrene insulation, and more. This particular unit was, in the latest quarter, responsible for 24.3% of the company’s revenue and for 13.6% of its profits. The third segment worth paying attention to is called Carlisle Interconnect Technologies. Through this unit, the company produces high-performance wire and cable, including optical fiber. End uses include the commercial aerospace, military, medical device, industrial, and other sectors. The segment is also responsible for the sale of a variety of other products like sensors, installation kits, and more. It was recently responsible for 11.5% of the company’s revenue and for just 1.8% of profits. And finally, we have the Carlisle Fluid Technologies segment. This unit produces highly engineered liquid, powder, sealants, and adhesive finishing equipment and integrated systems solutions for a variety of activities. Examples include pumping, mixing, spraying, metering, and curing coatings that are used in the automotive space, general industrial markets, and more. This is the smallest of the company’s segments, generating just 3.9% of the firm’s revenue and a paltry 1.6% of profits.

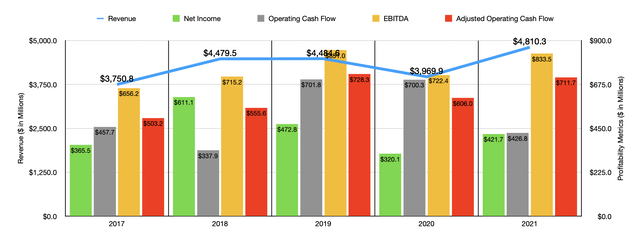

Over the past few years, the financial picture for Carlisle Companies has been a bit lumpy. Consider revenue. Between 2017 and 2019, sales rose consistently, rising from $3.75 billion to $4.48 billion. In 2020, the COVID-19 pandemic was responsible for sales dropping to 3.9 $7 billion. But this decline was short-lived. In 2021, sales totaled $4.81 billion. The significant increase in revenue for the company between 2020 and 2021 was driven largely by higher volumes and price realizations across its major operating segments. For instance, the Carlisle Construction Materials segment of the company saw revenue expand by 28.1% thanks to strong demand for US commercial roofing and other building-related products. This is not to say that every segment performed well. The Carlisle Interconnect Technologies Segment, for instance, saw revenue drop by 6% because of lower volume caused by a downturn in the commercial aerospace market that was, in turn, driven by a slow recovery in build rates on certain types of aircraft.

The company has seen similar volatility when it comes to profits. Net income, for instance, rose from $365.5 million in 2017 to $611.1 million in 2018. It then fell over the next two years, bottoming out at $320.1 million in 2020 before rebounding some to $421.7 million last year. Of course, we should also pay attention to other profitability metrics. Operating cash flow has been volatile as well. This much can be seen in the first chart of this article. But if we were to adjust for changes in working capital, the picture would look better. In that case, the metric would have risen from $503.2 million in 2017 to $728.3 million in 2019. In 2020, it would have fallen to $606 million before rebounding mostly to $711.7 million in 2021. The trend experienced by EBITDA closely mirrored this, with the metric ultimately rising between 2017 and 2019 before dropping in 2020. But in 2021, it shot back up, hitting $833.5 million.

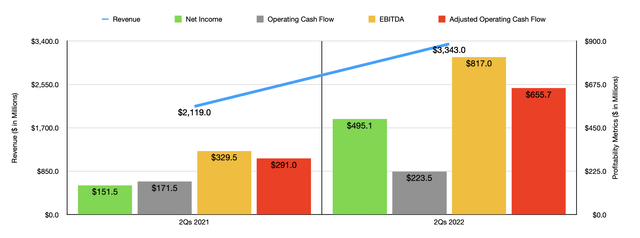

When it comes to the 2022 fiscal year, performance for the company has been even more impressive. Sales in the first half of the year came in strong at $3.34 billion. That’s 57.8% higher than the $2.12 billion generated the same time one year earlier. Once again, this rise in revenue was driven largely by strength in both pricing and volume. However, the company also did benefit some from an acquisition that it made. For the first half of the year, price and volume changes pushed sales up to the tune of 43.4%. Its aforementioned acquisition contributed 15.1% to the company’s growth. Meanwhile, foreign currency fluctuations impaired revenue growth modestly.

This surge in revenue brought with it a significant improvement in net income. For the first half of the year, the company generated a profit of $495.1 million. That dwarfs the $151.5 million in profits generated the same time one year earlier. Operating cash flow rose from $171.5 million to $223.5 million. Meanwhile, if we adjust for changes in working capital, the metric would have risen even more from $291 million to $655.7 million. And finally, we arrive at EBITDA. In the first half of 2022, this metric came in at $817 million. That stacks up favorably against the $329.5 million generated the same time one year earlier.

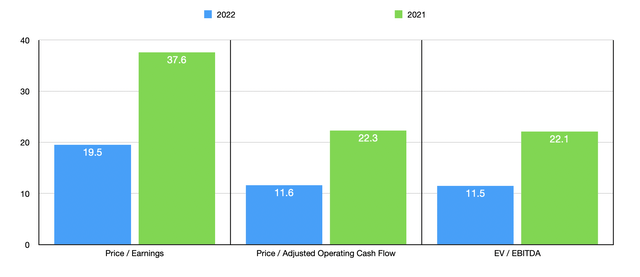

Truth be told, we don’t really know what to expect from the company from a profitability perspective for the rest of the year. However, management has said that revenue should rise by around 40% year over year while the EBITDA margin of the company should expand by roughly 6.5%. Running the math here, we would get a rough estimate for EBITDA of $1.61 billion. Applying that same year-over-year growth rate to other profitability metrics, we would get net income of $812 million and adjusted operating cash flow of $1.37 billion. Using these numbers, we can easily value the firm. On a price-to-earnings basis, the company is trading at a multiple of 19.5 if we use results that are forecasted for 2022. The price to adjusted operating cash flow multiple of the company should be 11.6, while the EV to EBITDA multiple of the firm should be 11.5. These numbers stack up favorably against the results that we get when we use profitability figures from 2021. In that case, these multiples should be 37.6, 22.3, and 22.1, respectively. As part of my analysis, I did compare the company to five similar firms. On a price-to-earnings basis, these companies range from a low of 4.3 to a high of 32.8. And when it comes to the EV to EBITDA approach, the range is between 3.4 and 14.8. In both cases, three of the five companies were cheaper than Carlisle Companies. Using the price to operating cash flow approach, the range is between 5.1 and 32.4, with only one of the five companies being cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Carlisle Companies | 19.5 | 11.6 | 11.5 |

| Advanced Drainage Systems (WMS) | 21.1 | 16.8 | 13.2 |

| Masco (MAS) | 12.4 | 11.7 | 9.1 |

| Builders FirstSource (BLDR) | 4.3 | 5.1 | 3.4 |

| Lennox International (LII) | 18.2 | 16.8 | 14.8 |

| A. O. Smith (AOS) | 32.8 | 32.4 | 10.8 |

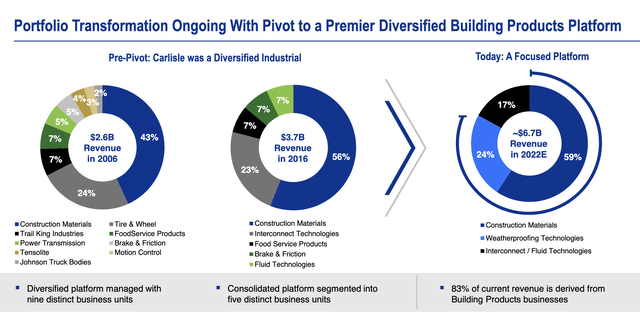

From a pricing perspective, the picture of the company, on a forward basis, looks fine. I would make the case that it probably does have some additional upside. Having said that, these are difficult times for this space and uncertainty exists around how long robust strength will continue. Long term, it’s worth noting that management does have a plan in place. Their current goal is to grow the company enough to generate $15 in earnings per share by 2025. Given the company’s current share count, this would translate to net income of $787.5 million. That’s roughly 29.7% above what the company generated in profits last year. The company has already undergone a number of changes in order to achieve this. As you can see in the image below, the company once was far more diverse in terms of its revenue stream than it is today. Consolidating like it has will be instrumental because having too many diverse revenue streams brings with it the risk that none of them or few of them Will be managed optimally. While this is a great step, it alone would not be enough for management to reach their targets.

To get where it wants to be, management must prioritize growth above all else. In the past few years, the company has undergone several acquisitions, including 15 that have been completed since the launch of its 2025 objective. The combined purchase price of all of these acquisitions has been $3.2 billion. Having said that, of the $3.1 billion in additional revenue the company has brought onto its books between 2012 and 2022, assuming forecasts for 2022 will be accurate, only $700 million of the rise has come, on a net basis, from mergers and acquisitions, as well as foreign currency fluctuations. most of the growth, then, that the company has brought on has related to organic means. And as we have seen recently, this organic growth is rather opaque in the sense that we don’t know how much can be chalked up to higher volume because of strong demand and how much can be attributed to rising prices that may be temporary because of supply chain problems.

Takeaway

At this moment, I do find Carlisle Companies to be an interesting business. Prior to the pandemic, and since the pandemic came to an end, the overall trajectory of the company has been mostly positive. From a pricing perspective, shares are cheap enough to warrant some upside should we see continued strength in profitability moving forward. But I do worry about broader economic issues when it comes to an enterprise like this. If shares were significantly cheaper than they are today, then this might not be an issue since going from very cheap to cheap still implies upside potential. But in the event that financial performance reverts back to what we saw in 2020, the company would go from being attractively priced to being overvalued rather quickly. Management does currently have a plan in place aimed at continuing to grow the firm’s bottom line. And so far, that picture is looking up as well. But because of all the uncertainty and the absence of a margin of safety from a valuation perspective, I cannot help but to rate the business a ‘hold’ for now.

Be the first to comment