Ekaterina79/iStock Editorial via Getty Images

What a difference 5 ½ months make. Since I wrote my cautious piece about Mattel Inc. (NASDAQ:MAT), the shares are down about 20% against a loss of about 2% for the S&P 500. The company has reported earnings since, and they’re on the eve of doing so again, so I thought I’d review the name again to see if it makes sense to buy at current prices. After all, a stock trading at $19.70 is, by definition, a less risky investment than when that same stock is trading at $24.70. I’ll review the financials, and will look at the stock as a thing distinct from the underlying business. Additionally, the short puts I wrote earlier have just expired worthless, highlighting, once again, the fact that deep out of the money put options are a great tool to generate superior risk adjusted returns. If you’re not yet familiar with these, I strongly recommend you learn about them.

I feel a small need to write a bit about my process, because, not to brag or anything, but it seems that my results put me in the top 10% of my peers in the “financial blogger” community. Also, not to nitpick, but I feel compelled to point out that tipranks doesn’t have the capacity to calculate returns earned from selling put options. If we include these, my results would be considerably higher. Although I have a well deserved reputation as a braggart, I’m actually not bragging in this case. I point this out to demonstrate that it’s possible to enjoy pretty decent results by focusing entirely on profitability and valuation. I’ve returned to this approach after learning from painful experiences that more complex models are not helpful. It’s hard to maintain the discipline of only ever buying profits at reasonable valuations, but if we can do it, I think we’ll be well compensated. With that sermonizing out of the way, it’s time to review Mattel.

My regular readers know that every one of my articles comes with a “thesis statement” paragraph that I hope is simultaneously “handy” and “dandy.” In these thesis statement paragraphs, I offer the “gist” of my argument so you won’t have to wade through the entire thing. I know that my writing can be “a bit much” for some people, so right up front I offer 90% of the flavor at 10% of the calories. You’re welcome. I think Mattel is now a buy, and will be picking up a few hundred shares prior to its earnings release tonight. The company’s turnaround goes apace in my view, and the financials reflect this. Revenue and net income are up dramatically, while the capital structure is much less risky now than it was only a year ago. Additionally, the shares are cheap enough that investors are reasonably well insulated against massive capital loss in my view. Although I did reasonably well on the short puts that just expired, I think the stock represents better risk adjusted value at the moment, so I’ll buy the shares and eschew the puts. If you’re paying attention, you’ll know that this is the polar opposite of what I did just under 6 months ago.

Financial Snapshot of Mattel

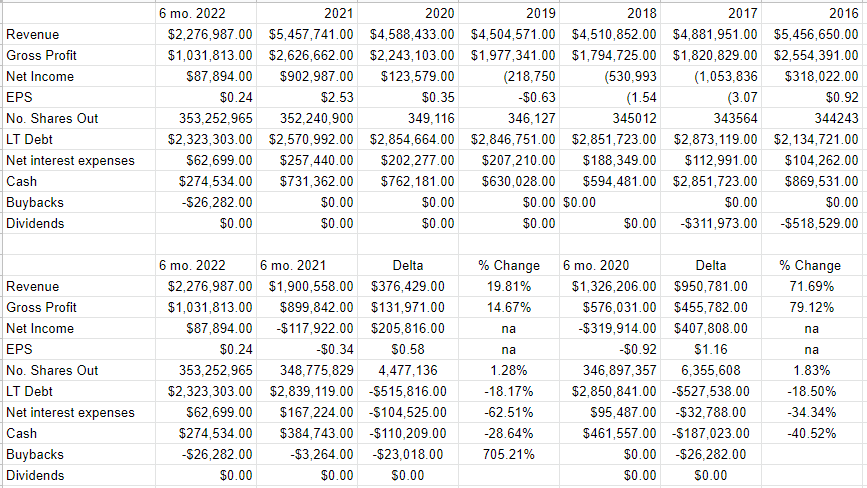

The financial results this year have been quite good in my estimation. Relative to the same period in 2021, revenue is up by about 19.8%, and net income has swung from a loss of about $118 million to $87.9 million. At the same time, net interest expenses have collapsed by $104 million as the company has cleaned up the balance sheet. Long term debt has declined by over $515 million over the past year.

In case you’re worried that a comparison to 2021 is exceptionally easy because 2021 was a soft year for the firm, fret no further. The results look just as impressive in my view when we compare the latest results to 2020 also. Specifically, revenue, and gross profit were higher by 72% and 79% respectively. Additionally, net income has moved from a loss of about $320 million in 2020 to the $87.9 million we’ve seen so far this year. Additionally, the capital structure was much worse in 2020, and is much cleaner now.

Although the business is volatile, I’d be very comfortable buying at the right price.

Mattel Financials (Mattel investor relations)

The Stock

One of the most important, and most painful, lessons I ever learned is that a company is different from the stock that supposedly represents it. The stock is, in fact, often a poor proxy for the underlying business. It was the late 1990s, I had bought an irresponsibly large amount of Nokia (NOK) because I knew the company was going to report rapid growth. They did as I expected, and the stock dropped about 9% in early trading hours. The company delivered very good results, but the market expected very, very good results. Since the company didn’t meet the market’s expectations, the stock was punished. Ever since, I’ve drawn a distinction between “stock” and “company”, and have realized that a great company can be a terrible investment if you buy it for the wrong price. This is why I insist on only ever buying cheap stocks. When a stock is cheap, that’s a clear sign that the market’s not too optimistic about its future, so the stock is far less likely to hit the painful air pocket that Nokia did many, many years ago.

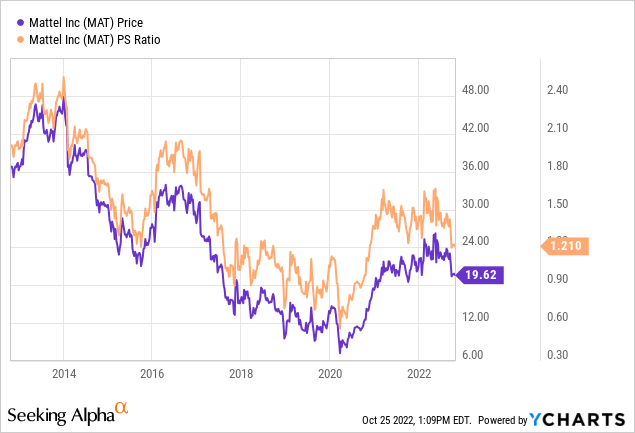

My regular readers know that I measure whether or not a stock is cheap in a few ways, ranging from the simple to the more complex. On the simple side, I look at the ratio of stock price to some measure of economic value, like earnings, free cash flow, and the like. Ideally, I want to see a stock trading at a discount to both the overall market and its own history.

When I last reviewed Mattel stock, the market was paying $1.58 for $1 of sales. Now that new sales figures have come in, and the stock has dropped, the shares are about 24% cheaper on that basis, per the following:

While I like to review ratios of this type, I also want to try to work out what the market is currently “assuming” about the future growth in profitability. Again, the more gloomy the forecast, the better. In order to do this, I turn to the work of Professor Stephen Penman and his great book “Accounting for Value.” In this book, Penman walks investors through how they might isolate the “g” (growth) variable in a standard finance formula to work out what the market must be assuming about the future growth of profits. At the moment, the market is only assuming a growth rate of about 1.5% for Mattel, which I consider to be wonderfully pessimistic. Given the above, I’m happy to buy a few hundred shares on the eve of their earnings release, and may add more depending upon how things shake up after Q3 results are posted.

Options Update

In case you don’t happen to have your “Almanac of Doyle’s Trades” open on your desk, I’ll remind you that I generated a (small) options premium last May when I sold deep out of the money puts on this stock. I sold these because, although I liked the company in May, I didn’t like the price. Thus, selling puts at a strike price that I did like would either get me into the stock at a very attractive price, or would put some options premia in my account. The puts have just expired, which is gratifying enough, though I would have really liked to have been exercised at $17 per share.

Although I like to repeat success when I can, I think the best risk adjusted returns from this point can be earned from the stock itself. For that reason, I’m not going to be selling any puts at the moment. This may change if the stock drops precipitously after earnings are announced tonight.

Be the first to comment