Arthurpreston/iStock via Getty Images

We just crossed the halfway point in 2022, and broader markets have had a rough year. The major indices are all down double-digits, and many sectors have had an even rougher time this year. The only major exception is the energy sector, but one of the sectors I have been adding to lately is the real estate sector. One of the companies that I don’t own yet but plan to buy in the coming months is Essential Properties Realty Trust (NYSE:EPRT). Shares of Essential Properties Realty Trust have also had a rough start to 2022. They have sold off nearly 25% YTD, and I think it offers a solid entry point for long-term investors.

Investment Thesis

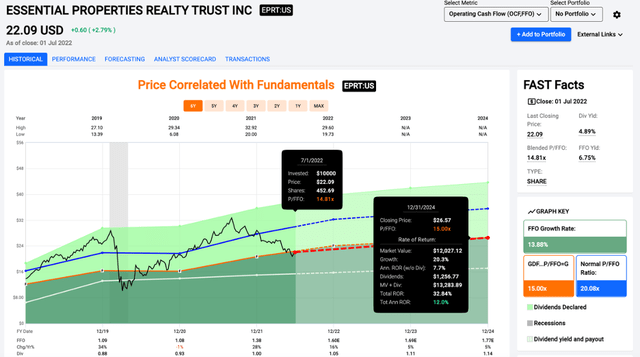

EPRT is a relatively new net lease REIT that has only been publicly traded since 2018. As such, they don’t have a long track record, but after doing some digging, there is a lot to like about this young REIT. The company has a diversified tenant portfolio and obtains unit level reporting on nearly all its properties. Shares are down almost 25% YTD, offering new investors a good entry point. At 14.8x price/FFO, shares are trading at an attractive valuation relative to the projected growth and offer a growing 4.9% dividend to boot. I will be looking to add shares of EPRT to my Roth IRA as I make contributions later in the year.

Business Overview

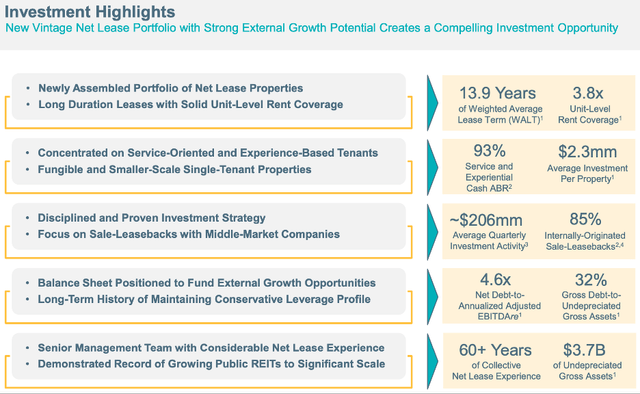

EPRT is a net lease REIT with a diversified real estate portfolio. The company went public in 2018, and they have grown rapidly since then. It focuses on smaller businesses and properties, as its average investment is just over $2M per property. Below is a picture from an investor presentation that summarizes EPRT.

EPRT Summary (essentialproperties.com)

The portfolio is diversified across many businesses and the top 10 tenants make up approximately 19% of overall rents. EPRT also has no debt due until 2024 and has a very low weighted interest rate of 2.8%. With inflation running hot and interest rates rising, that is very attractive for investors. The company might have to issue future debt at higher rates, but the existing debt maturities have a significant difference from the average cap rates of the portfolio. With a weighted average lease term of nearly 14 years and less than 5% of leases expiring before 2026, EPRT has an attractive portfolio that is locked in for a long time.

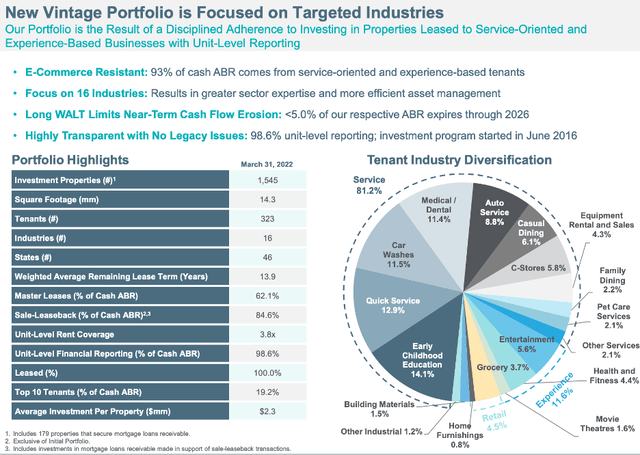

EPRT Portfolio (essentialproperties.com)

One of the other things that I like about EPRT is that it has unit level reporting for almost all its tenants (98.6%). That is similar to another net lease REIT that I own, STORE Capital (STOR). Most of the tenants have solid rent coverage ratios and cap rates have consistently been above 7% since 2020 and the portfolio has a weighted rent escalation rate of 1.5%. Like STOR, the valuation has only become more attractive in 2022.

Valuation

Shares of EPRT peaked last September above $32, which carried a price/FFO over 25x. Shares are much more attractive today at $22 and a price/FFO of 14.8x. Even if there isn’t any multiple expansion, shares are projected to return over 10% if we see 15x price/FFO. If the market eventually assigns a higher multiple to shares, returns will be even better.

While continued broader market weakness could lead to further share price weakness and a cheaper multiple, I think the risk/reward is skewed to the upside for long-term investors. I think shares could easily command a 16-18 price/FFO multiple in the coming years, but even if shares stay around 15x, returns should still be solid. While the valuation is attractive today, one of the main reasons to get excited about a smaller REIT like EPRT is the potential for future dividend growth.

Dividend Growth

EPRT has typically hiked its dividend every other quarter, and the most recent dividend was no exception. The company hiked the dividend by another penny, for a 3.8% raise from $0.26 to $0.27 per quarter. I think that this pattern should continue for a while as EPRT continues to grow its real estate portfolio. The dividend growth might not light the world on fire, but the consistent raises on a 4.9% yield should be enough to drive attractive returns for long-term investors.

Conclusion

EPRT is one of the REITs that I look forward to adding to my portfolio in the coming months. The company has an impressive, diversified portfolio serving smaller businesses, and the cap rates near 7% with 1.5% escalators provide attractive spreads on investment. Shares trade just under 15x price/FFO and have a yield just under 5% at current prices. I think we will eventually see shares trade at a slightly higher multiple, and FFO/share is likely to continue to grow for the foreseeable future. Investors will likely see dividend hikes every other quarter with continued growth, and with a market cap of $2.9B, EPRT has a long runway for sustainable growth ahead. Shares are a buy today near $22, and I am expecting double-digit returns for years to come. If shares drop below $20, I will look to start buying more aggressively as the yield near 5.5% would likely limit further downside for long-term investors.

Be the first to comment