dimid_86/iStock via Getty Images

European Wax Center, Inc. (NASDAQ:EWCZ) is a silent giant in a specialized market that has continuously proved the strength of its business model. Having just IPO’ed in August of 2021, EWCZ stock is still in its early stages of finding its footing in the public market, however, EWCZ seems to have not only found its footing but is already sprinting. As a little-discussed stock, I believe there is massive potential to be an early entrant into a serial compounder of growth.

About European Wax Center

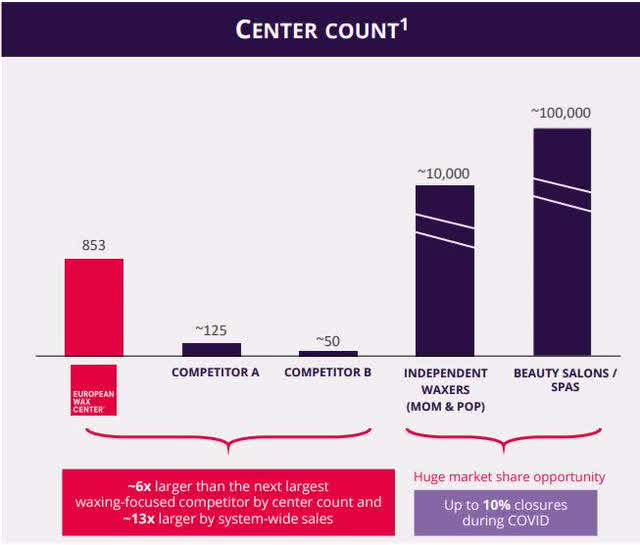

EWCZ is a highly specialized provider of personal services that has established itself as a runaway market leader for the out-of-home waxing space. With 900 locations and counting, this waxy company has successfully begun to consolidate a historically fragmented industry that is personal care and services. Until the EWCZ IPO, there was no way to invest in personal care companies in the public market such as hairdressers and nail salons. Now that has all changed, and European Wax Center has wasted no time in accelerating its market dominance. As you can see from the most recent investor presentation below, European Wax is miles ahead of the next biggest competitor. Using economies of scale, they have a large runway for growth on both the top and bottom lines.

Market Dominance (EWCZ Investor Presentation)

The company has not only focused on location growth, but also on expansion of product offerings, and the integration of digital technology. This three-pronged approach has already begun to show its rewards as free cash flow has been accelerating. The potential to be a long-term compounder of wealth is high due to the high margin nature of its business and multiple avenues for growth.

Growth

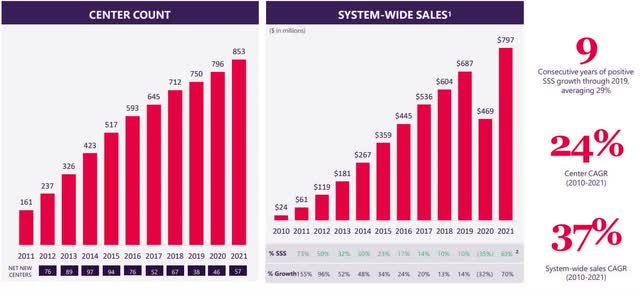

Historically, the company has enjoyed substantial, sustained growth as they began the quest to consolidate an industry. As depicted in the graphic below, the CAGR that has been achieved in both store location (center) count and gross sales is nothing short of astounding. Not only that, but EWCZ also employs a mixed center ownership model with both franchised and company-owned stores, reducing the cost to open new locations and reducing the asset depreciation burden on the balance sheet. The company has stated their goal is to achieve a more balanced mix of franchised to company-owned centers; currently only 239 of the 853 centers are franchised.

Store Count and Sales Growth (EWCZ Investor Presentation)

For the first prong of the triple-pronged growth strategy we look at the growth in center count. Just recently, European Wax announced they opened their 900th location. Opening the 47th new location just halfway through the year puts them on pace to far exceed the 57 net add in centers during 2021. Along with store count increasing, a substantial increase in average unit volume sales has been observed as same store stacked growth is 52%. Per the most recently filed S-1, the average unit volume per store averaged roughly $1mm. The company looks to target a center count of 3000 in their 15-year plan. This goal may seem lofty, but after looking at the fragmentation of the market and the still-small market share experienced by European Wax, it’s not unreasonable to believe they could achieve it.

For the second prong, we look at expansion of product offerings. For starters, they rebranded and introduced their retail product line to ensure that EWC’s services and care don’t end when customers complete their appointment. An expansion into new body services and a focus to attract male customers has also been at the forefront of the company’s desired goals.

Lastly, digital integration. Retail products are available on-site and online via their eCommerce site and mobile app. I believe the mobile app for the retention of user data and behaviors will be a key catalyst in the growth story of this company as a user-targeted app experience begins to take shape. The ease of use to schedule and cancel appointments will allow for the company to increase booking efficiency as well. Lastly, the introduction of both the EWC Rewards Program and the Healthy Wax Pass will transform the business and create even further distance from competition. Introducing a recurring revenue stream and an increased user retention rate, EWCZ will have an enhanced ability to forecast sales and smooth out revenues across the fiscal year.

Valuation

Next, let’s look at the valuation. First, we will look at the Price/Free Cash Flow metric, sitting at 14.67. Like the free cash flow (“FCF”), the EBITDA of EWCZ has grown substantially year-over-year to $64mm in 2021 from $34mm in 2019 (roughly 37% CAGR). It is a little tricky to determine the average multiple for a niche company such as this, but comparing to other specialized consumer services it appears a 14x multiple would be appropriate, in line with the average of the S&P500.

To predict the fair value of EWCZ in five fiscal years from now we will look to model the EBITDA and free cash flow growth based on company estimates and recent performance.

European Wax forecasts low-to-mid teens long term growth (15 yrs) in adjusted EBITDA. The past three years have brought 29% CAGR so let’s use 17.5% to model the next 5 years. Based on annualized growth we can estimate for nearly $144 million of EBITDA by end of FY2026, predicting a conservative 90% free cash flow conversion rate we arrive at a projected $130 million in FCF. If EWCZ maintains minimal growth in outstanding shares to 44 million in 2026 this will equate to $2.95 in FCF/ share. With a 14x multiple, I arrive at a price target of $41.30, or a 113% increase from today’s prices.

| FY2021A | FY2022E | FY2023E | FY2024E | FY2025E | FY2026E | |

| EBITDA | 64 million |

75.2 |

88.4 | 103.8 | 122 | 144 |

| FCF | 64 million | 67.7 | 79.6 | 93.4 | 109.8 | 130 |

| Share Count | 37 million | 39 | 41 | 42 | 43 | 44 |

| FCF/Share | $1.73 | $1.74 | $1.94 | $2.22 | $2.55 | $2.95 |

| P/FCF | 14.67 | 14.00 | 14.00 | 14.00 | 14.00 | 14.00 |

| Tgt. Price | $19.36 | $24.36 | $27.16 | $31.08 | $35.70 | $41.30 |

| Price Appreciation (Cumulative) | 0% | 25.8% | 40.3% | 60.5% | 84.4% | 113.3% |

Secondly, we can look P/E ratios. For a conservative target, we will target a 20.0 exit P/E ratio in FY2026 for this fast-growing stock. Mid-point net income estimates from company statements are $26.25 million for FY2022 or $0.68 per share. Using data provided in forward-looking statements and current ownership structure, we can estimate net income from the $144 million EBITDA projection. Assuming a $24 million annual interest rate from the recent S-1, a 15% estimated tax rate, plus depreciation and amortization of roughly $20 million per year, we can estimate a net income of $78.4 million in FY2026. Adhering to the guess of 44 million shares, this would translate to $1.78 EPS. If we assume an exit P/E of 20.0, we wind up with a share price of $35.60.

Averaging between the two valuations, I have a price target of $38.45 in FY2026, representing a 99% gain from the current price.

Balance Sheet

I am more than pleased with the balance sheet EWC is able to boast. Currently on the balance sheet, we see a cash and short-term investment balance of roughly $44 million and total debt of roughly $179 million, thus totaling a net debt of $135 million. Looking at the cash flow statement, we see that EWCZ is producing roughly $41 million in free cash flow and is growing. With this snapshot, it appears debt is easily manageable with a 3-4 year time horizon to pay off full debt with cash flows.

However, the company has recently made a move to further improve the balance sheet with a whole business securitization deal to refinance its debt. They have successfully improved the interest rate of their debt with a fixed rate versus the previous fixed rate loan term and given itself more freedom in payment structure. Netting roughly $374 million from the securitization sale, proceeds were spent on paying down all previous indebtedness of $180 million and the issuance of a special dividend to shareholders at a value of $3.30/share working out to $122 million in total. This leaves $72 million in remaining cash to be used for growing the business or to hold as a cash reserve for future debt payments. More details on the new debt structure are to be shared in the next earnings report.

Short Interest Concerns

The item that jumps out most readily when researching EWCZ is most likely the high level of short interest, at around 22%. At first glance, this appears to be a showstopper, but upon sifting through the most recent Form S-1 and previous Prospectus documents, it appears this may be more manageable than you think.

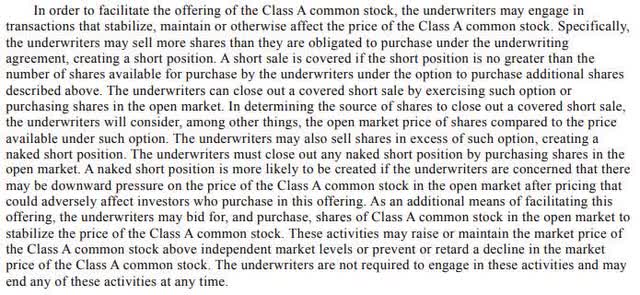

Per company prospectus filings and other forms, the treatment of shares purchased by the underwriters is defined clearly in the statement below.

Short Sale Initiation (Recent S-1 Filing)

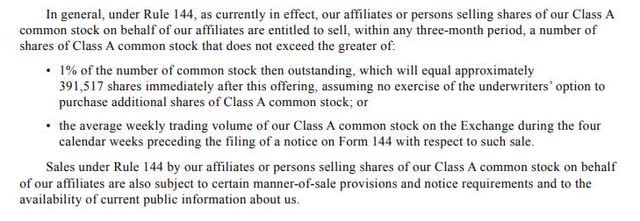

This means that all shares sold beyond the obligated number of shares purchased by the underwriters during offerings (i.e., over-allotments and purchases from selling stockholders) will initiate a short sale until the shares are distributed through their network or purchased via the open market or exercising the option defined in the filing. Due to the large household names of the underwriters, there is little to be concerned about in regards to the completed sales of these shares. Stated below, we see that the number of shares that are able to be sold by underwriters to complete the short sale in a three month time window are actually limited to the greater of two conditions.

Share sale rules (Recently Filed S-1)

Based on current outstanding shares, option 1 equates to 390,000 shares every 3 months. Option 2, based on the average daily volume of ~400,000 would leave them with the ability to sell 2 million shares every three months. Total possible short sells from underwriters across all of the offerings from EWCZ since the IPO:

- IPO over-allotment max of 1,590,000 shares

- Secondary offering in November 2021 with over-allotment max of 782,547 shares

- Filed agreement to the purchase of 4,500,000 shares from selling stock holders.

With the initial six month IPO lockup period and the 60 day lockup period from the secondary offering both ending in January of 2022, we see that about 3,420,000 shares are shorted just before lockups expire with 2,372,547 of those shares likely to be underwriter over-allotments. Due to the substantial upward price movement during this time it is likely over-allotment exercises were not exercised to avoid a significant decline in stock price due to the purchasing of much cheaper shares. Lastly, we have seen an additional 1,000,000 shorts enter the scene immediately following the offering of 4,500,000 shares from selling shareholders, of which roughly 2,000,000 are newly converted Class A shares bought by underwriters. As of today there are 5,380,000 shares shorted with a possible 4,400,000 shares accounted for by underwriters.

I suspect the short interest will raise slightly over the next few months then begin to decline quickly as expirations approach for exercising. It is possible that the true short interest from other outside parties may be as little as 1,000,000 out of 26,500,000 as underwriters close out, an interest level of just 3.8% in the best case scenario.

Risk

There is, of course, risk involved with stock that has recently become public. The majority of the short interest may be explainable, but regardless there are still a large number of short shares that may drag on the stock price for an extended period of time. Secondly, there is the risk that inflation pressures and supply chain issues cause the expansion of the company to be stunted. Lastly, there is a risk that the digital integration efforts do not yield the results expected and lead to a reduction in growth rates. While all of these risks are warranted, I believe EWCZ will weather the storm and continue their rapid expansion.

Summary

I believe European Wax Center provides a rare opportunity for the common investor to reap the benefits of a highly profitable and simple business and enter into a position that could become a wonderful compounder of wealth. The company also clearly has an initiative to return value to shareholders, as witnessed in the large special dividend paid earlier this year. At a targeted 99% percent return by FY2026, I believe EWCZ has the potential to be an excellent mid-term and long-term position. I believe in long term buy & hold strategies and I am more than happy to be patient and see the returns grow.

Be the first to comment