ArtistGNDphotography/E+ via Getty Images

The iShares ESG Aware MSCI USA ETF (NASDAQ:ESGU) demonstrates a problem that lots of ETFs have – they aren’t unique enough. With more than 8,500 ETFs in existence, it’s no surprise that instruments that are usually passive cannot create more than 8,500 unique themes. The ESGU is built based on MSCI ESG scores, but ends up being almost identical to the iShares Core S&P 500 ETF (IVV), which is the most stock standard ETF. In other words, ESG ratings do nothing to discriminate between large-cap stocks, apparently they all have great ESG ratings, even Exxon Mobil (XOM)!

MSCI ESG Ratings

The index provider MSCI is the one that provides the benchmarks for ESG ratings, so how are they calculated? Well here’s the kicker:

ESG Ratings Methodology (MSCI)

They’re relative to peers. In other words: in my opinion, they’re useless to the investor. ESG risks are a pretty valid concern for profit oriented investors because when there’s political incentive to clamp down on things, regardless of whether it actually makes or not, investors are rather likely to get hurt and it usually happens suddenly and dramatically. But the serious ESG risks that are associated to powerful and well capitalised agendas usually affect whole industries. Oil is an obvious example, where the entire enterprise stands against one of the most popular dimensions of ESG, which is reducing carbon footprint. Yes, some companies may implement more sophisticated carbon mitigation, or maybe their rigs run on hydropower or offshore wind like Equinor (EQNR), but they’re oil producers.

MSCI claims that in setting the ESG rating they take into account quality of risk management systems on top of the degree of financial risk associated with the ESG issue. The financial risk of shutting down city centers to ICEs or banning ICE cars is very large to oil price-levered oil companies, and cannot be mitigated, yet a 5% energy exposure is present in this ETF which is almost exclusive to dirty oil companies in the US. Ironically, none have been removed by the threshold of ‘favourable ESG ratings’ for this ETF, because there’s actually less energy exposure in the IVV.

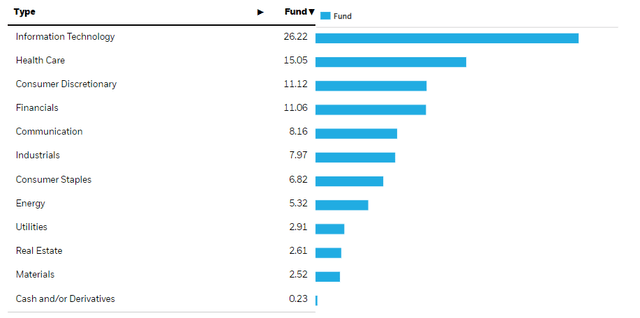

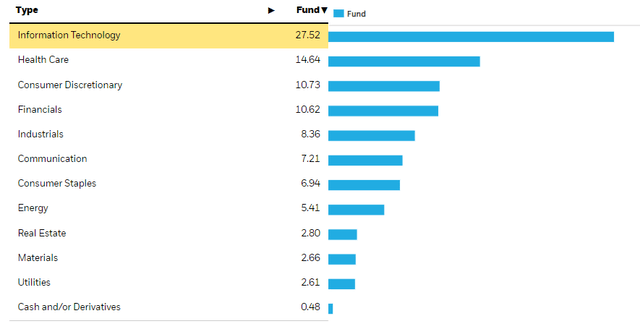

ESGU Breakdown

Indeed, there is virtually no difference between the sectoral allocations between the ESGU and the IVV.

IVV Sectors (iShares.com) ESGU Sectors (iShares.com)

The top holdings really are much the same. After ‘filtering’ through the ESG rating requirements, the ESGU is value weighted, so megacap exposures like Apple (AAPL) and Microsoft (MSFT) dominate the top holdings. The order of the allocations is almost identical and so is the exact quantum of exposure to each item, Apple at 7%, Microsoft at 6% and so on.

Remarks

In return for the research into ESG ratings that is being provided by MSCI to this index, you have to pay an expense ratio of 0.15%, instead of the 0.03% you’d be paying on the IVV. Since the ESG ratings don’t alter the holdings relative to the stock-standard S&P 500, you should not be paying more for being indexed with them, because they really don’t contribute anything – and this is before you even discuss the merits of the current regime of environmentalist thinking.

Thanks to our global coverage we’ve ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment