HJBC

Thesis

Amazon (NASDAQ:AMZN) is set to publish Q3 results will on October 27, post-market. And in my opinion, the e-commerce giant will very likely disappoint against earnings. According to data compiled by Seeking Alpha, analyst consensus expects a 15.4% year over year and 5% quarter over quarter revenue growth. I simply do not see that as likely. Given how sharply the macro-economic environment has deteriorated, and reflecting on various announcements from the e-commerce giant (here, here), I believe quarter over quarter revenue growth may struggle to even be positive QoQ.

If my thesis is correct, and Amazon will indeed disappoint, then AMZN stock may face a sharp sell-off — because many analysts still hold on to the believe that Amazon’s business is somewhat recession-proof.

Earnings Preview

According to data compiled by Seeking Alpha, as of October 20th, 33 analysts have submitted their estimates for Amazon’s Q3 results, which are expected to be announced on October 27th post-market.

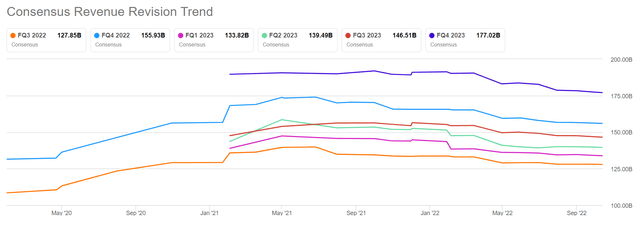

Total sales are estimated to be between $124.96 billion and $130.62 billion, with the average estimate being $127.85 billion (versus Amazon’s guidance range of $125.0 billion and $130.0 billion). PS: note how analyst consensus perfectly aligns with Amazon’s guidance range.

If an investor would assume the consensus average as the anchor, Amazon’s Q3 sales are estimated to grow by about 15% as compared to the same quarter in 2021, and grow 5% as compared to Q2 2022.

Amazon’s Q3 EPS estimates are between $-0.05 and $0.39. The average is $0.2.

Although analyst’s revenue estimates have clearly flattened versus the same estimates from a year ago, in fact they have somewhat decreased, I believe consensus is excessively optimistic – as I argue in the following section.

Additional Prime Day Is A Warning Signal

To get things into the correct perspective, I would like to point out that Amazon’s e-commerce sales, which account for more than 50% of the conglomerate’s revenues, have stealthy declined for the past 2 quarters. In the latest June quarter, e-commerce sales were down by about 4.3% year over year.

In my opinion, it is very likely that with Q3 Amazon will add a third consecutive quarter of falling revenues – simply as a function of a sharply deteriorating macro environment and falling consumer sentiment.

The thesis is surely supported by Amazon’s unexpected announcement to push an unprecedented second Prime Shopping Day into Q4. As for any company – and Amazon should be no different – a sales promotion is highly likely a warning signal that a company is fighting against disappointing analyst’s and investor’s revenue expectations.

But the additional Prime Day promotion, which should add about $4 billion of additional revenues will only materialize in Q4 results, not Q3.

Cost Pressures Are Real

While Amazon’s topline is likely challenged by an economic slowdown, the company’s cost pressures are real. In Q2, Amazon’ operating expenses have jumped already by 11.9% year over year, to $117.9 billion. But the inflationary trend has very likely continued throughout Q3.

Amazon’s recently announced hiring freeze may highlight that the days of super-charged growth may be over. Admittedly, many companies – including the FAANG’s – have announced hiring freezes, employee lay offs and more HR discipline. But Amazon’s 1.5 million employee strong business model stands out as particularly human resource intensive. Any smaller wage inflation will translate into material margin pressure. Moreover, a capital-intensive logistic network certainly does not help to alleviate inflationary cost pressures. Notably, according to analyst Marc Wulfraat, Amazon has already scaled back on operations and/or expansion for 66 U.S. logistic facilities.

The key question for Q3 is: what has materialized faster – Amazon’s inflationary pressures or the company’s (successful) restructuring efforts? I would argue the former prevails, given that the latter is a ‘response’ action of the former (with an uncertain success rate).

Valuation Still Stretched

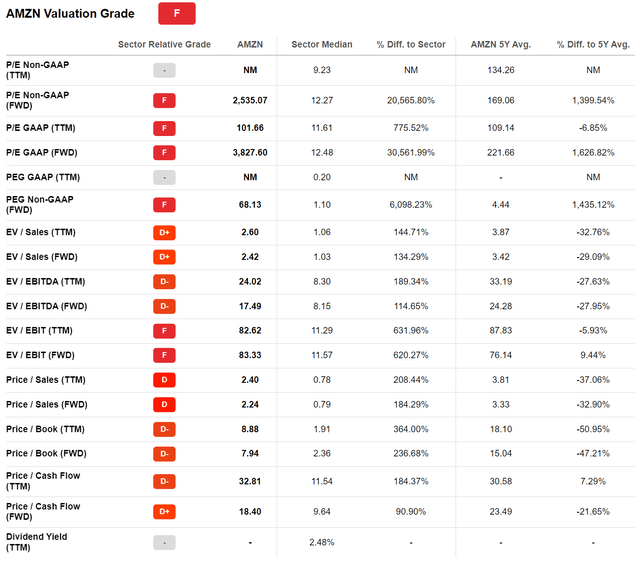

So, analyst consensus estimates are bullish, while various data indicates the contrary. This makes an earnings disappointment very likely. The next question now is: is Amazon stock vulnerable to the disappointment? Yes, in my opinion.

Investors should consider that, despite a 30% sell-off YTD, Amazon stock is still valued at a one-year forward EV/EBIT of x83, and EV/Sales of x2.4. As compared to Walmart being priced at x17.7 EV/EBIT and x0.7 EV/Sales respectively.

As I understand that multiples might not provide an accurate valuation reference, here is what I have previously calculated for Amazon’s relative multiple analysis, sum-of-the-parts-valuation and residual earnings framework.

According to the relative multiple comparison, Amazon’s fair valuation should be approximately $90/share. My residual earnings framework returns a base-case target price of $84.55/share. The sum-of-the-parts valuation boils down to a key question, namely, if Amazon’s retail business is worth more than Walmart’s?

Risks

There are two risks to point out. First, betting against Amazon is hardly ever a smart move – or at least it has not been in the past. Despite the shot-term headwinds Amazon remains one of the best managed companies in the world, and the long-term outlook for the e-commerce giant remains bright. Second, investors should consider that Amazon frequently misses earnings estimates (less so revenues) and the market does not very much care. Arguably, Amazon has taught its investors to look past short-term accounting and profitability targets. And accordingly, the (expected) earnings miss may fail to materialize a stock sell-off.

Conclusion

I am worried about Amazon’s Q3 quarter. I think the e-commerce giant is facing unreasonably high expectations. And accordingly, a disappointment is likely – which could come in form of a missed Q3 revenue or earnings target, and/or in form of a disappointing full year outlook.

Given Amazon’s stretched valuation, I believe an earnings disappointment will not be taken ‘nicely’ by the investor community. As a consequence, I recommend to reduce exposure to AMZN stock going into Q3 results.

Be the first to comment