Leonid Ikan/iStock via Getty Images

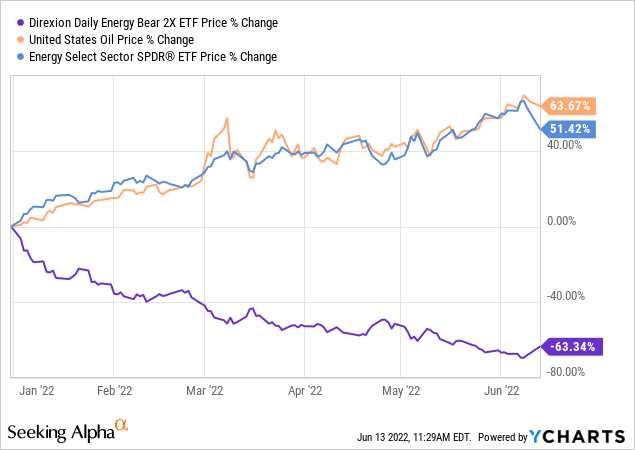

The Direxion Daily Energy Bear 2x Shares ETF (NYSEARCA:ERY) provides leveraged exposure against a basket of major oil and gas stocks. This is a tactical trading instrument that represents a “short bet” on the energy sector, a strategy that has been a disaster on the wrong side of the trade, with ERY down by more than 55% year-to-date. Indeed, energy stocks have benefited with the price of oil near $120 per barrel amid record inflation, global supply chain disruptions, and the Russia-Ukraine crisis.

That being said, we see several scenarios that can result in a correction lower to the price of oil from current levels, opening the door for a sustained rally in ERY. The bearish case here is that a deteriorating macro growth outlook can end up hitting energy demand and force a reset of expectations for oil & gas stocks. By this measure, ERY is an interesting contrarian trade idea and can also work for investors to hedge existing energy sector exposure.

What Is The ERY ETF?

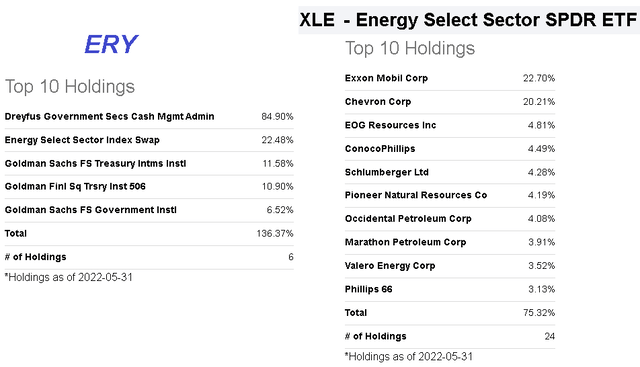

ERY is designed to generate 200% of the inverse daily performance of the “Energy Select Sector Index” which is comprised of the energy sector constituents of the S&P 500 Index (SPY). ERY can also be seen as the leveraged opposite of the Energy Select Sector SPDR ETF (XLE) which works as a benchmark. It’s worth mentioning that ERY has a “sister fund” with the Direxion Daily Energy Bull 2x Shares ETF (ERX) which is the long version.

ERY technically holds a combination of the cash secured swap derivatives against the underlying stocks in XLE. The underlying companies ERY is betting against include the U.S. oil & gas majors like Exxon Mobil Corp. (XOM) and Chevron Corp. (CVX) as the two largest holdings.

As mentioned, there are several ways to incorporate ERY within a trading portfolio. First, ERY can be used to make a speculative directional bet that oil stocks will go down. Investors that hold a large portfolio of energy sector stocks can also consider adding ERY to balance losses from the downside in the long exposure. The fact that it’s 2x leveraged means that the capital outlay required to place the trade is only half the corresponding notional value of the exposure which provides some portfolio management flexibility.

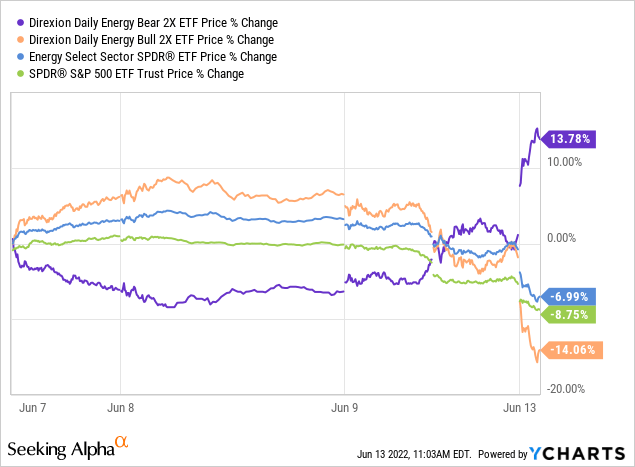

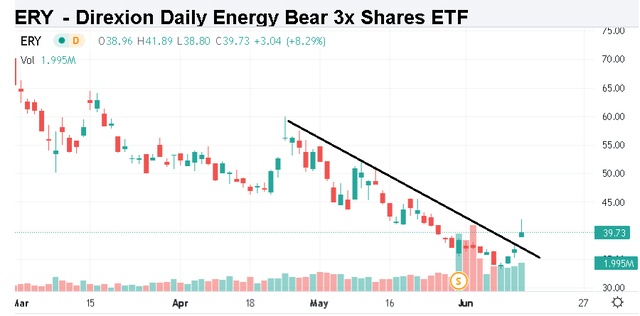

The recent trading action helps put everything together with ERY up 14% over the past 5 trading days compared to a 7% decline in the non-leveraged long XLE. ERX has consequentially declined by 14% over the same period. The leveraged structure can both amplify gains while also adding to risk with higher volatility.

The Bearish Case For Oil

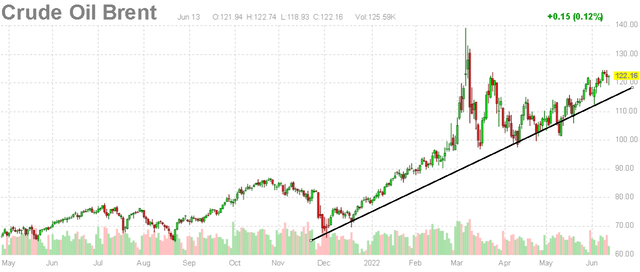

When thinking about investing and market expectations, the big question is always – what comes next? Bullish bets on oil and the broader energy sector have been massive winners but we get a sense that the trade has become crowded. It’s almost as if the outlook for more upside is too obvious. The reality is that calls for the price of oil to keep climbing with targets like $140 or +$200 per barrel are far from certain.

Our insight is that while the tight supply-side conditions have been a large part of the bullish case over the past year, a weakening outlook on the demand side now opens the door for oil to reset lower. The global economy is facing several major headwinds between persistent inflation that squeezes both consumer spending and trade activity all in the context of rising interest rates and a strong dollar. With concerns being raised about a potential recession, oil prices would not be immune to a hard landing scenario.

In the U.S. and many parts of the world seeing record gas and fuel prices, the challenge is that it gets to a point where energy demand destruction begins to take hold with the current level of economic activity simply unsustainable. To be clear, this scenario has not yet played out, but our view is that the risks to demand estimates are tilted to the downside.

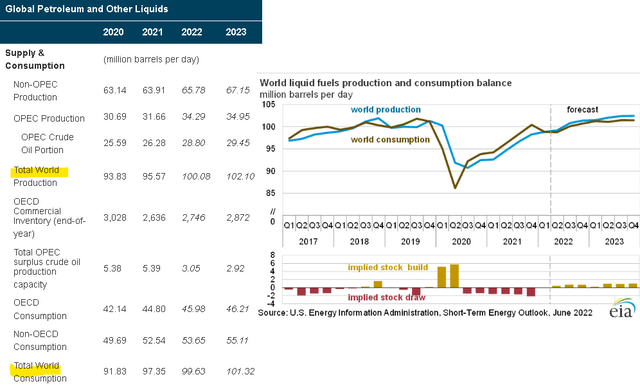

According to the U.S. Energy Information Administration (EIA), total world production of petroleum is expected to climb 4.7% this year compared to 2.3% in total world consumption. The takeaway here is that from a supply deficit in 2020 and 2021, the market is moving towards a surplus as producers rush to take advantage of high prices and normalize compared to pandemic stoppages. Notably, these forecasts incorporate the disruption from Russian supplies including a ban in the European Union set to go into effect. In other words, the actual fundamentals for oil point to some downside in pricing which could accelerate if the demand comes in weaker than expected.

The other side to the discussion, and key risk for any bearish bet on oil, are the scenarios where the price of crude oil and gas can take another leg higher. Here we would point to the uncertainties with the Russia-Ukraine crisis that has entered a sort of quagmire stage with no real end in sight. An escalation of the crisis that would spill over into neighboring NATO countries would likely add a new way of momentum to the energy sector. There is also the potential that demand simply keeps surprising to the upside, with the world economy staying resilient beyond the current rough patch.

ERY Stock Price Forecast

A key point here is that ERY is not a direct bet against oil, but specifically, the energy stocks within the S&P 500. Our thinking is that a correction lower in crude benchmarks like WTI and Brent towards $110 or even down to $100, would directly hit sentiment towards energy stocks even if their own operating and earnings environment is still positive.

Another scenario that could play out is a rotation out of energy and natural resources into growth and technology sector stock. This could happen over the next few months with some indication that inflationary trends are peaking, adding a new wave of bullish momentum towards risk assets. Finally, market themes like the push toward clean energy alternatives and even electric vehicles gaining market penetration support a bearish view on crude oil over the long run.

Putting it all together, we believe there’s a good chance ERY may be trading higher over the next several weeks and a few months ahead. If the underlying benchmark index the XLE ETF falls towards $70.00, a level seen in late April, ERY can rally towards $55.00 per share representing upwards of a 40% upside. On the downside, the recent low of around $33.00 can be used as a stop level for any trade.

Final Thoughts

Leveraged ETFs can be high risk but should have a place in every trader’s toolbox. We are bullish on ERY at the current level with a view that its reward-to-risk setup here is attractive.

Keep in mind that there are some alternative ETFs that can also express a similar bearish view on the sector. In contrast to the ProShares UltraShort Oil & Gas ETF (DUG), our pick is ERY as the fund is larger and has higher liquidity for trading. There is also the ProShares UltraShort Bloomberg Crude Oil ETF (SCO) that has inverse leveraged exposure to an index tracking the price of oil (USO).

Note that our call on ERY has a time component because the leveraged fund is expected to suffer a gradual volatility decay. This means that over time, even if the underlying benchmark being the XLE ETF falls by a certain percentage, the corresponding move in ERY will face some slippage in percentage terms. For this reason, we do not recommend holding the fund for an extended period.

Be the first to comment