bjdlzx/E+ via Getty Images

Being hungry changes your perspective. Nothing matters when stomach howls.”― Sarvesh Jain

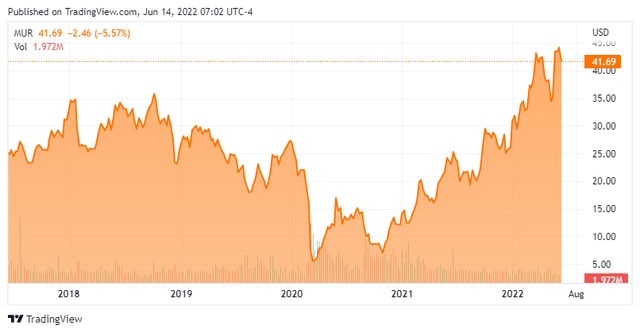

Today, we put Murphy Oil (NYSE:MUR) in the spotlight for the first time. This energy producer has seen a huge run-up since the end of the pandemic lockdowns, thanks to soaring prices for natural gas and oil. Recently, there has been some large and notable insider selling in the shares. Sign of a top or nothing to be concerned about? We try to answer that question via the analysis below.

Company Overview

Murphy Oil is headquartered in Houston and operates as a natural gas exploration and production company. The firm explores for and produces crude oil, natural gas, and natural gas liquids. After a large run-up, the stock sells for approximately $42.00 a share and sports an approximate $6.8 billion market capitalization.

May Company Presentation

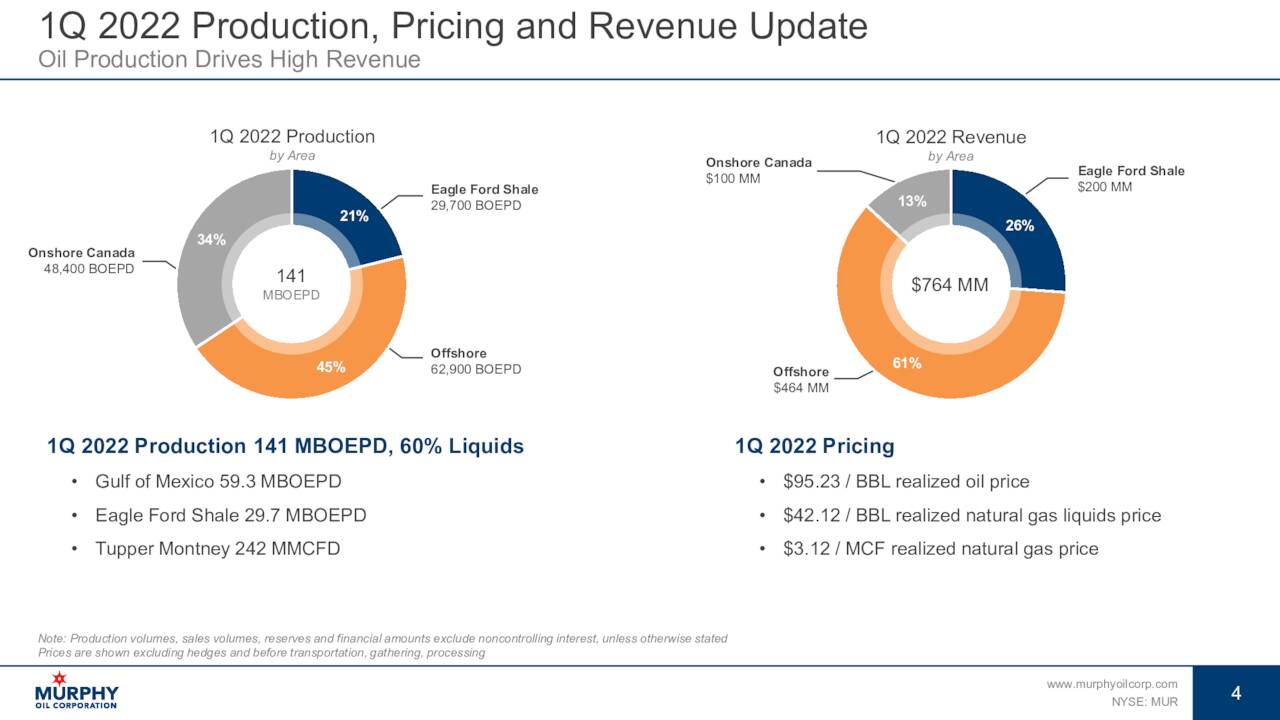

The company has major producing properties in Canada, the Eagle Ford Shale region and in the Gulf of Mexico as well as other opportunities. Here is a breakdown of production in the first quarter of this year.

May Company Presentation

First Quarter Results:

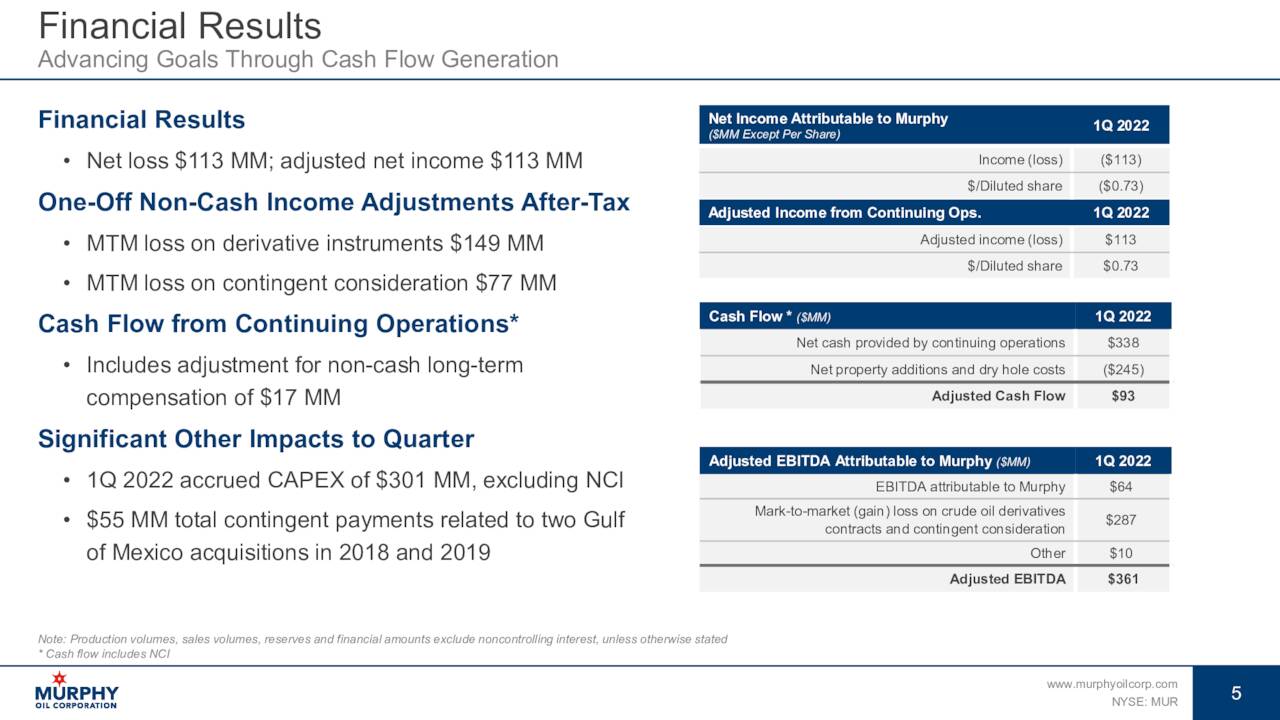

On May 4th, Murphy posted first quarter numbers. Non-GAAP earnings came in at 73 cents a share, more than a dime better than expectations. Revenues rose just over 45% on a year-over-year basis to just north of $550 million, which was more than a $100 million under the consensus.

During the quarter, the company produced 141 thousand barrels of oil equivalent per day (BOED) of which 53% was oil and 60% overall was liquids. During the quarter, Murphy had just under $410 million of adjusted earnings before interest, tax, depreciation, amortization and exploration. This amounts to just north of $32.50 per barrel of oil equivalent sold.

May Company Presentation

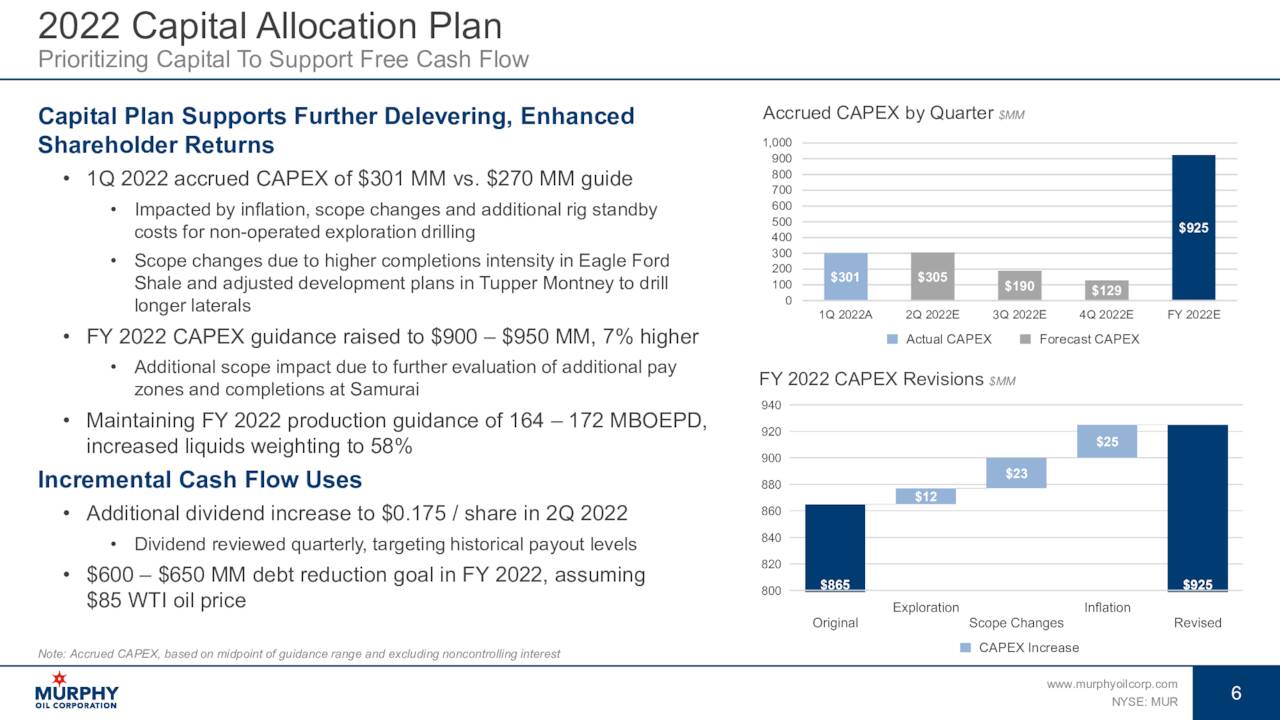

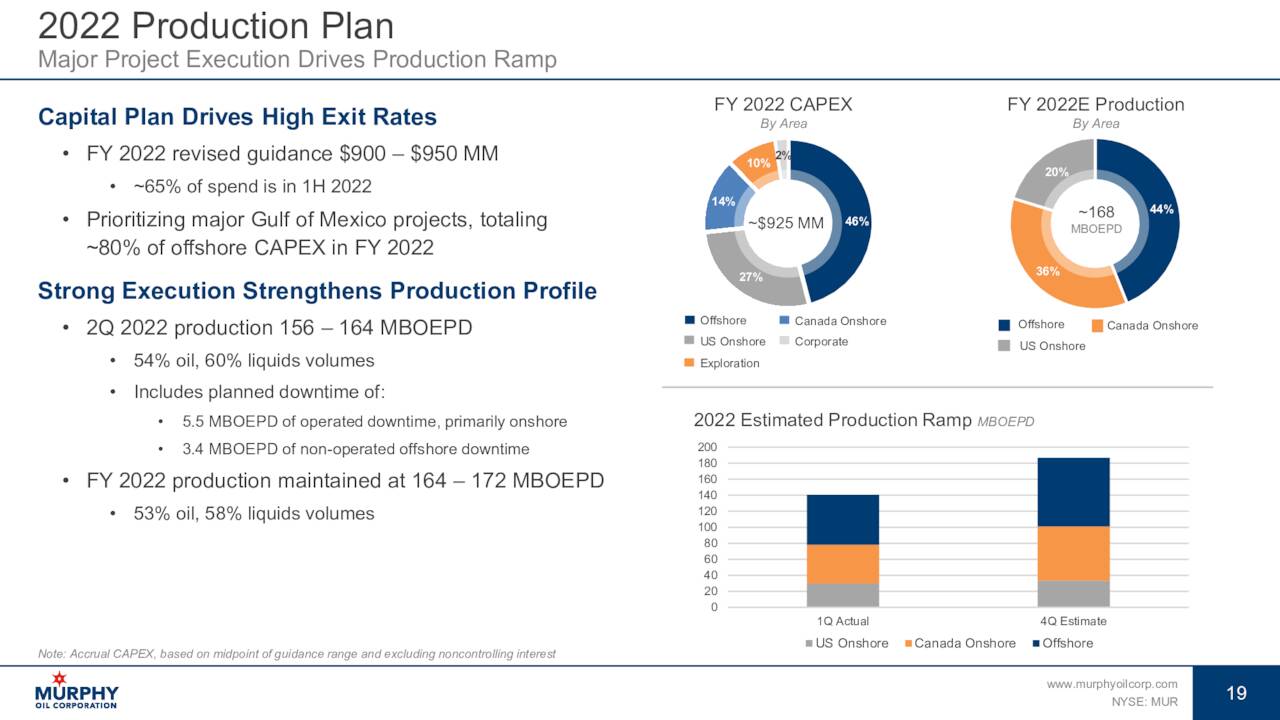

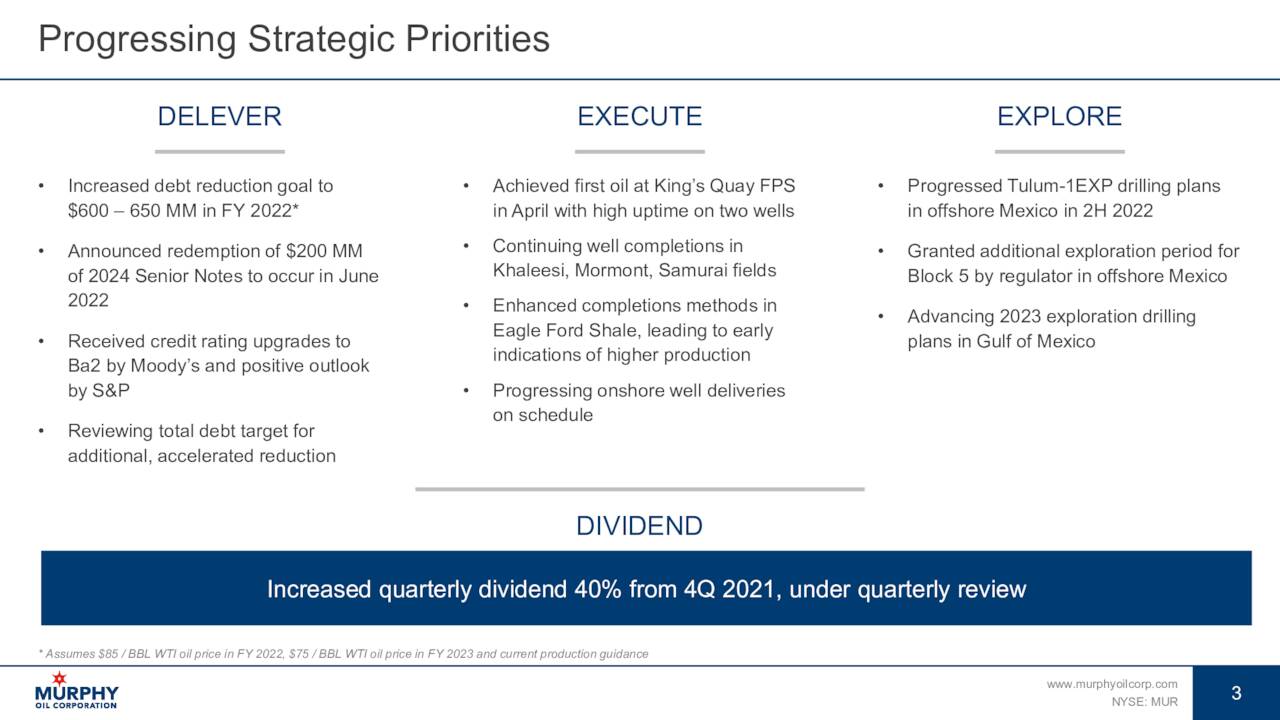

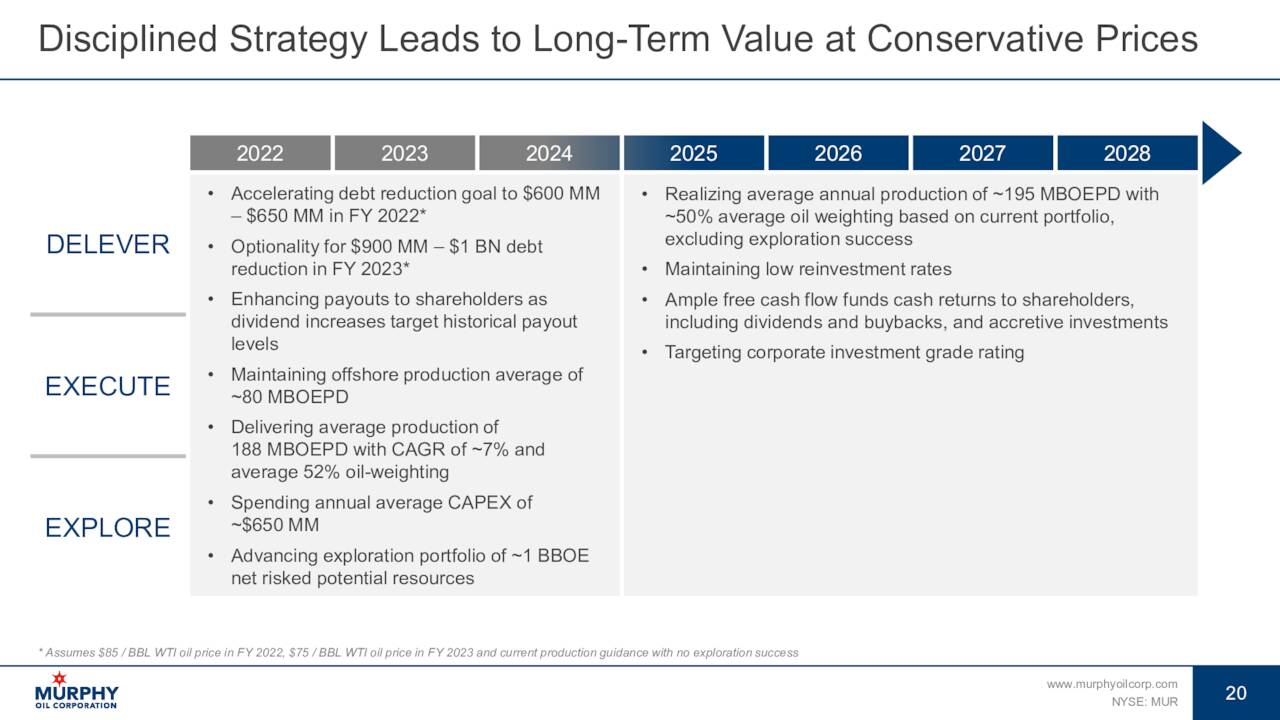

Leadership also bumped up its capex guidance by seven percent to a range of $900 million to $950 million for this fiscal year. The budgeted increase was caused by inflation and scope changes for its drilling plans. Full year production guidance remain unchanged at 164 to 172 MBOEPD.

May Company Presentation

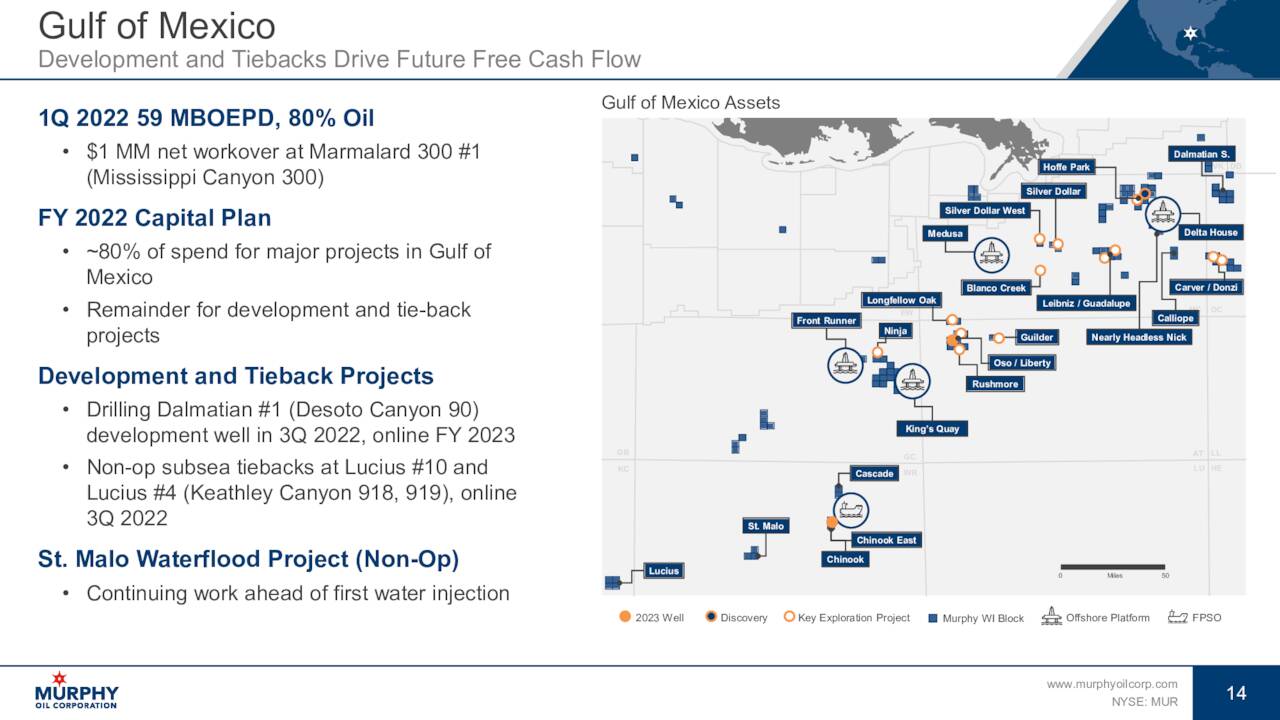

The company is prioritizing its capex towards offshore opportunities in the Gulf of Mexico, which is the most ‘oily‘ part of the company’s production footprint.

May Company Presentation

Analyst Commentary And Balance Sheet

Analysts are not currently sanguine about the stock’s near-/medium-term prospects. Since first quarter results posted, four analyst firms including JPMorgan downgraded and Morgan Stanley reissued Hold ratings on the stock. Price targets proffered range from $40 to $51 a share. Only Mizuho has reiterated a Buy rating on MUR, this one with a $59 price target. Here is the view from JPMorgan’s analyst. The analyst sees:

An important free cash flow inflection point for Murphy at mid-year 2022 given start-up of the Khaleesi, Mormont and Samurai fields, while the 2023 outlook should benefit from restart of the Terra Nova field offshore Canada, which should lift the company’s free cash flow metrics from below average to near the top of the peer group starting mid-year 2022.”

He also notes that Murphy’s ‘cash return yields are below its peers as the company focuses on further deleveraging its balance sheet and the company’s Cutthroat exploration well (off the coast of Brazil) was a dry hole in 2Q22, which has reduced the optionality in the portfolio’.

1st Quarter Cash Flow Details (May Company Presentation)

Approximately six percent of the outstanding shares are currently sold short. Two insiders have sold more than $650,000 in aggregate in shares so far in June. This follows heavy selling in May, where the company’s CEO sold nearly $10 million worth of shares and two directors sold north of $1.8 million in total as well. In February and March, insiders disposed of nearly $3 million worth of shares as well. This easily eclipses all the stock that was sold by insiders in both 2020 and 2021 combined. The last notable insider purchases happened in March 2020 when most of the country was going into pandemic lockdowns.

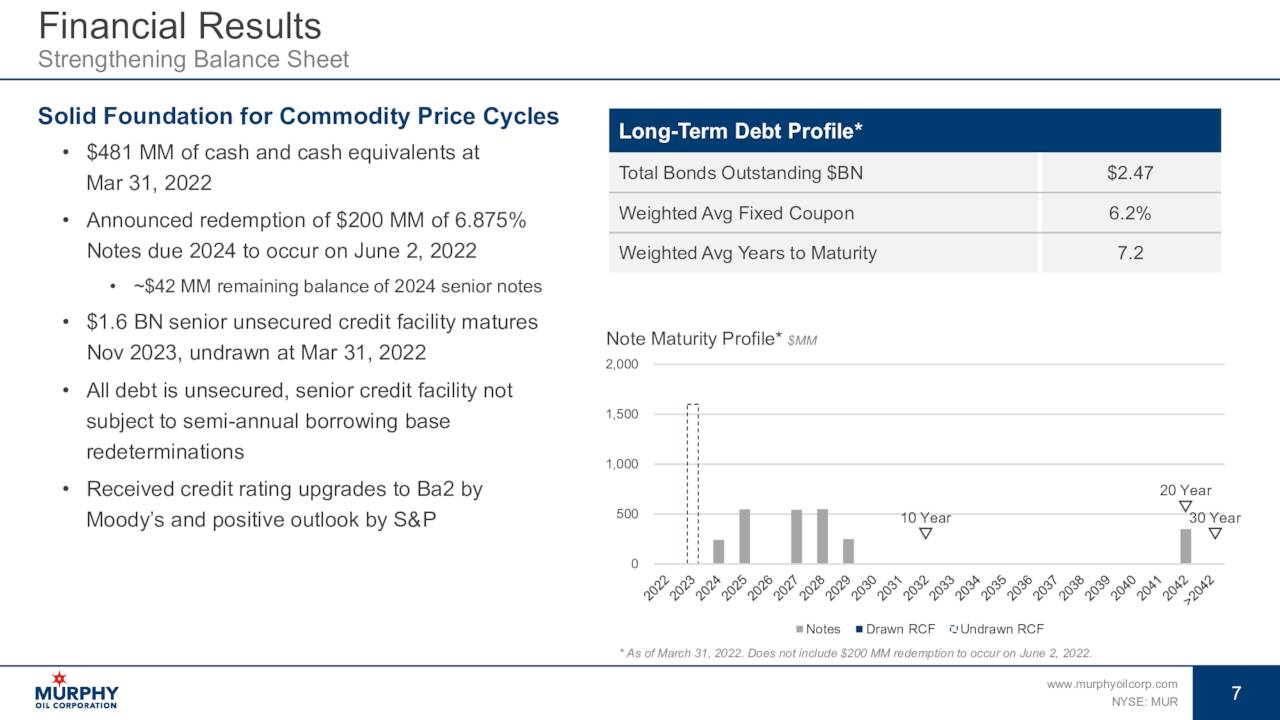

May Company Presentation

The company ended the first quarter with nearly $500 million of cash and marketable securities against just under $2.5 billion in long-term debt. The company plans to use cash flow to pay down $600 million to $650 million in debt in FY2022.

Verdict

The current analyst consensus has the company earning $5.80 a share as revenues rise more than 50% to $3.5 billion. Both earnings and sales have wide ranges as some 10 analyst firms have projections, which are also reliant on pricing for natural gas and crude oil.

May Company Presentation

The company is focused on reducing the leverage on its balance sheet and also boosted its dividend significantly higher in late 2021. The shares now yield 1.7% and go for seven times forward earnings. Its debt reduction plan assumes an oil price of just $85 WTI per barrel, which is currently far below current trading levels.

May Company Presentation

The earnings valuation seems reasonable in a growing economy. Unfortunately, both the country and a good portion of the developed world are likely heading to recession, which will result in energy demand destruction. Oil seems more likely to be trading lower a year from now than higher in this scenario. As JPMorgan noted, Murphy’s cash flow generation is not at this time up to the level of peers. In addition, insiders seem to be taking some money ‘off the table‘ and analyst firms have also withdrawn their support. Therefore, I am passing on any investment recommendation around Murphy. If I owned shares that benefited from the stock’s large rally over the past two years, I would be taking some profits as well.

The only reason the world was a better place during your childhood is because you were a child.”― J.R. Rim

Be the first to comment