Equinox Gold (NYSEMKT:EQX) released its Q4 financial results. It is most probably the last quarter not impacted by the transformative merger with Leagold Mining (OTCQX:LMCNF). Equinox confirmed its positive momentum and reported another quarter of strong production growth. The financial situation of the company improved, too.

In Q4, Equinox produced 80,176 toz gold. It is 28% more than in Q3 and almost 200% more than in Q2. The H2 growth was fuelled not only by the Aurizona mine start-up but also by the Mesquite mine production growth. In Q3, Mesquite produced 33,306 toz gold and Aurizona produced 29,350 toz gold. In Q4, Mesquite produced 40,321 toz gold and Aurizona produced 39,855 toz gold. The production should keep on growing (also without taking into account Leagold’s assets), as the Castle Mountain mine construction is approximately 50% complete and the first gold pour is scheduled for Q3 2020.

Source: Own processing, using data of Equinox Gold

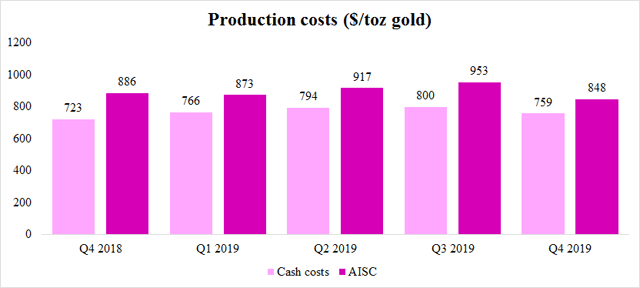

As the production is growing, the unit production costs are declining. In Q4, the cash costs declined to $759/toz, or by 5.1% quarter-over-quarter. The AISC declined to $848/toz, or by 11% quarter-over-quarter. Although the cash costs are slightly higher than in Q4 2018 (Equinox’s first quarter of gold production), the AISC is at its lowest level.

The overall 2019 gold production equaled 201,018 toz gold, which means that Equinox met its 2019 guidance of 200,000-235,000 toz gold. The 2019 AISC equaled $931/toz, which is below the guidance of $940-990/toz.

Source: Own processing, using data of Equinox Gold

Source: Own processing, using data of Equinox Gold

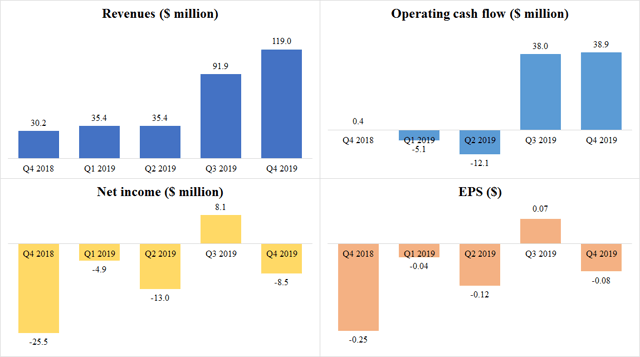

Equinox’s revenues increased to $119 million, or by 29.5% quarter-over-quarter. The operating cash flow improved as well, however, not as impressively. It climbed up to the $38.9 million level, which is Equinox’s new quarterly record high. The net income was negative $8.5 million. It is a significant decline in comparison to net income of $8.1 million recorded in Q3. However, the number was negatively impacted especially by a non-cash loss of $26.8 million, related to change in fair value of its derivative liability. Adjusted Q4 net income equals $20.9 million. The Q4 EPS equals $-0.08 and adjusted EPS equals $0.18.

Source: Own processing, using data of Seeking Alpha and Equinox Gold

Source: Own processing, using data of Seeking Alpha and Equinox Gold

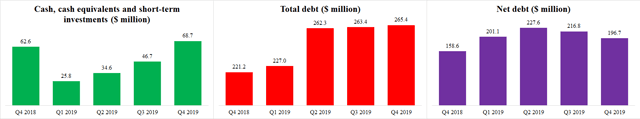

Equinox’s cash position improved notably in Q4. As of December 31, it held cash, cash equivalents and short-term investments of $68.7 million. It means a 47% growth quarter-over-quarter. Although the total debt increased, the increase was only negligible. From $263.4 million to $265.4 million. As a result, Equinox’s net debt declined by more than 9% to $196.7 million. The net debt declined, although Equinox keeps on investing in the development of its assets, especially in the Castle Mountain mine construction.

Source: Own processing, using data of Seeking Alpha and Equinox Gold

Source: Own processing, using data of Seeking Alpha and Equinox Gold

The most important event that occurred during Q4 was the announced merger with Leagold Mining. The newly created company will keep the name Equinox Gold and it will be 55%-owned by the current Equinox shareholders and 45%-owned by the current Leagold shareholders. The Leagold shareholders will receive 0.331 Equinox shares per 1 share of Leagold. The new Equinox should produce 700,000 toz gold in 2020 and more than 1 million toz gold in 2022. The merger has been already approved by shareholders of both companies and also by the authorities. It should be completed next week.

As can be seen in the chart above, last week, Equinox’s share price dived along with the broader stock market and the gold price. However, this week, the gold price recovered from the steep February 28 decline. And Equinox was able to erase the majority of losses achieved last week. The decline helped to cool down the RSI, which needed only several days to move from the overbought nearly to the oversold levels. Right now, it is back in the high 50s. The chart above also shows that the longer-term upwards trend is still valid. The late February share price decline was stopped at the support trend line. Although the share price declined below the 10-day as well as the 50-day moving averages, it managed to return back above them pretty quickly. Moreover, the slower moving average is still situated above the slower one, which is a bullish sign. The overall technical picture looks good right now. However, further stock and gold market volatility may cause some trouble.

As can be seen in the chart above, last week, Equinox’s share price dived along with the broader stock market and the gold price. However, this week, the gold price recovered from the steep February 28 decline. And Equinox was able to erase the majority of losses achieved last week. The decline helped to cool down the RSI, which needed only several days to move from the overbought nearly to the oversold levels. Right now, it is back in the high 50s. The chart above also shows that the longer-term upwards trend is still valid. The late February share price decline was stopped at the support trend line. Although the share price declined below the 10-day as well as the 50-day moving averages, it managed to return back above them pretty quickly. Moreover, the slower moving average is still situated above the slower one, which is a bullish sign. The overall technical picture looks good right now. However, further stock and gold market volatility may cause some trouble.

What I like about Equinox’s Q4:

- Gold production increased significantly, by 28%.

- AISC declined to new record lows of $848/toz.

- Net debt declined by more than 9% to $196.7 million.

- The Castle Mountain mine construction is well underway, with first gold pour expected in Q3.

- The merger with Leagold Mining should help Equinox to become a mid-tier gold producer, with an aim to reach the production rate of 1 million toz per year by the end of 2021.

What I don’t like about Equinox’s Q4:

- Honestly, I don’t know what to write here 🙂

Disclosure: I am/we are long LMCNF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment