Pgiam/iStock via Getty Images

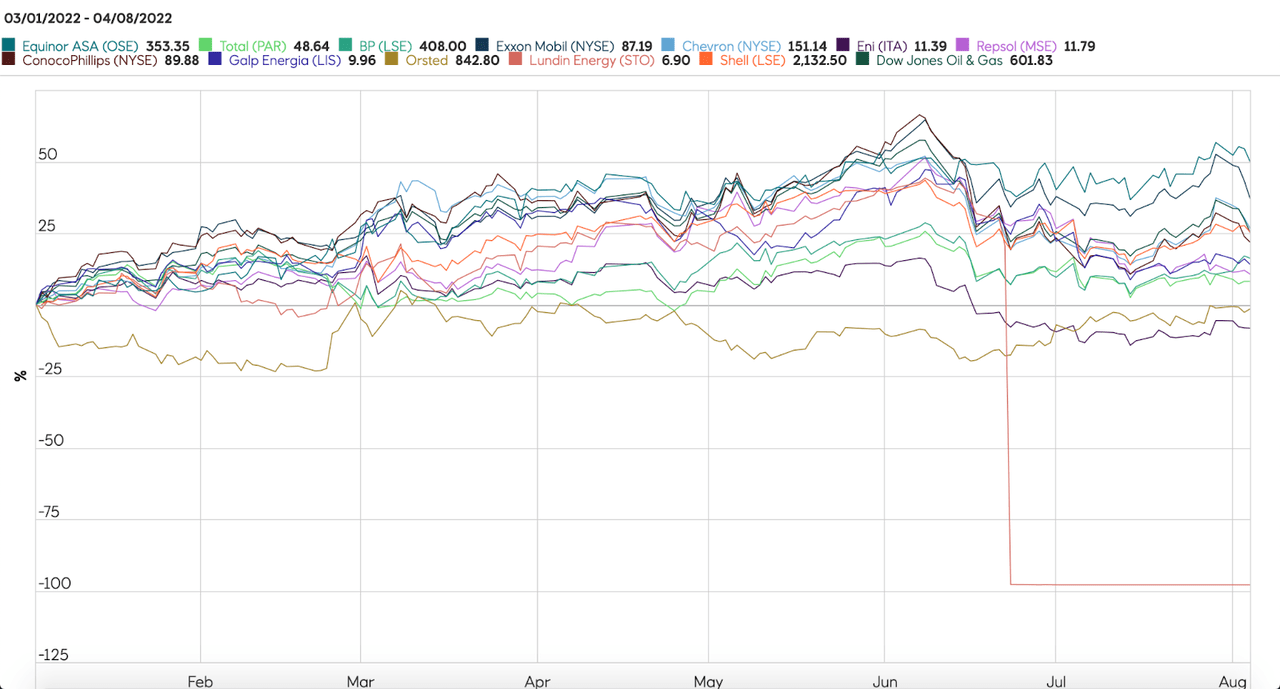

Since we last spoke about the Norwegian energy company Equinor ASA (NYSE:EQNR), the company has risen 6.08% compared to 3.59% for the S&P 500. Year to date, Equinor is up more than 47%, compared to the S&P 500, which has declined by nearly 14% for the year. The company has outperformed its peer group which is composed of BP plc (BP), Chevron (CVX), ConocoPhillips (COP), Eni SpA (E), Exxon Mobil (XOM), Galp Energia, Lundin Energy (OTCPK:LNEGY), Repsol S.A. (OTCQX:REPYY), Shell plc (SHEL), TotalEnergies SE (TTE) and Ørsted A/S. In the last 52 weeks, the company’s shares have appreciated over 75%, with Exxon as its closest competitor, at 50.69% share price appreciation. The company’s second quarter results have been strongly positive and I believe that the company remains a strong buy.

Source: Equinor ASA

EQNR Stock is Still a Buy

Equinor’s price-earnings multiple at the time was 9.53 against a five-year PE multiple of 16.65. Now, the company has a PE multiple of 7.37. Take into consideration that the oil and gas (production and exploration) sector has a PE multiple of 34.66, according to Professor Aswath Damodaran’s data. In addition, the S&P 500 has a PE multiple of 20.98. So, we can see that the company is trading relatively cheaply on a historic basis and compared to its peers and the S&P 500.

The company earned around $20.78 billion in free cash flow in 2021 and has an enterprise value of $117.85 billion. This gives it an FCF yield (FCF/enterprise value) of 17.63%. This compares favorably to the 1.2% FCF yield of the 2000 largest companies in the United States, as measured by New Constructs, and the 4% FCF yield of the energy sector. Although the company’s FCF yield has declined from 19.055 when we first looked at the stock, its FCF yield is still very high, and suggestive of very strong future fundamentals and stock performance.

When I wrote the first analysis, the buy signal for me was that the company appeared in the Financial Crisis Observatory’s Cockpit Global Bubble Status Report for May 2022 as one of several stocks with strong positive bubble signals, based on a calculation of the company’s DS LPPLS Bubble Score, and strong fundamentals. That report showed that the company had been in a positive bubble since June 2021. According to the June 2022 Global Bubble Status Report, the company remains in positive bubble territory. In May 2022, it had a low bubble score of 4.1%, showing not only that it was in positive bubble territory, but also that the bubble was unlikely to correct in the near future. According to the June 2022 report, the company’s bubble score was 6.9%, showing that the bubble is still positive and although more likely to be corrected compared to May, still unlikely to be corrected in the near future.

Equinor’s Second Quarter Results are Impressive

Equinor’s second quarter results are spectacular, driven by the European energy crisis in the wake of Russia’s invasion of Ukraine and the subsequent sanctions Russia faced. Equinor earned revenues of $36,459 in Q2 2022, compared to $17,462 billion in the same period last year. In the first half of the year, they earned revenues of $72,852 compared to $35,052 billion in the same period last year, a rise of nearly 108%.

Equinor earned a net operating income of $17,733 billion in Q2 2022, compared to $5,298 billion in the same period last year, an increase of nearly 235%. In the first half of the year, the company earned $36,125 billion, compared to $10,518 billion in the same period last year, an improvement of over 243%.

The company earned net income of $6,762 billion in Q2 2022, compared to $1,943 billion in Q2 2021, a rise of more than 248%. In the first half of the year, Equinor earned a net income of $11,476 billion, compared to $3,797 billion in the same period last year, a rise of over 200%.

The company grew cash flows from operations from $6,643 in Q2 2021 to $8,520

billion in Q2 2022, a rise of 28%. In the first half of 2022, the company earned cash flows from operations of $24,291 billion, compared to $12,627 billion, a rise of 92%.

The company earned $6,964 in FCF in Q2 2022, compared to $4.511 in the same period last year, a rise of 54%. In the first half of 2022, the company earned $19,653, compared to $9,681 in the same period last year, a rise of over 103%.

Asset growth is negatively correlated with future returns, so it’s interesting that the company recorded a 2% decline in capex and investments, from $$1,747 billion in Q2 2021 to $1,713 billion in Q2 2022. Similarly, capex and investments in the first half of the year was $3,895 billion, which was roughly equivalent to the $3,897 billion spent in the same period of 2021.

A Partnership with Management

As we said in the first piece, going forward, the most attractive thing about the company, a real differentiator, is that management’s interests are aligned with those of shareholders. This has been true since 2016, when shareholders voted to introduce two equally-weighted company performance modifiers in the calculation of variable pay: Relative total shareholder return (TSR) and relative return on average capital employed (ROACE). These metrics have been used since then to also evaluate the business’ performance. This analysis of variable pay and corporate performance is done in relation to how the company’s peer group is performing.

That simple modification to the compensation structure of the company ensures that management is taking the same decisions that owners would take, and working to build the value of the business. The company ranks second among its peers on relative TSR and relative ROACE. With Equinor, shareholders are investing in a quality energy company. This is especially important in an industry that has historically been inclined to capital indiscipline. We have already seen that the company has restrained itself capital-wise during a boom in the energy markets. Although it’s true that energy today is a much more capital disciplined sector than it was several years ago, Equinor still stands out.

Conclusion

Equinor’s fundamentals have of course not changed since the last time we spoke about the company. What we have seen is that the company remains very attractively priced, and that it’s likely to remain in positive bubble territory for some time. This provides a very wide margin of safety for investors. I continue to recommend the stock.

Be the first to comment