filmfoto

Investment Thesis

Equinor’s (NYSE:EQNR) share price is being depressed by investors’ fear that as Equinor makes increasing profits, its future cash flows will be increasingly taxed, perhaps even retrospectively.

As I run through different taxes assumptions, I contend that Equinor is priced at 5x next year’s free cash flows.

Meanwhile, I also estimate that Equinor’s capital return program is somewhere around 12% to 15%.

There’s a lot to like here, so let’s get to it.

What’s Happening Right Now? Effective Tax Rate of 72%

The only thing that investors seem interested in right now is the uncertainty over how much taxes these companies with exposure to Europe’s energy markets will be taxed.

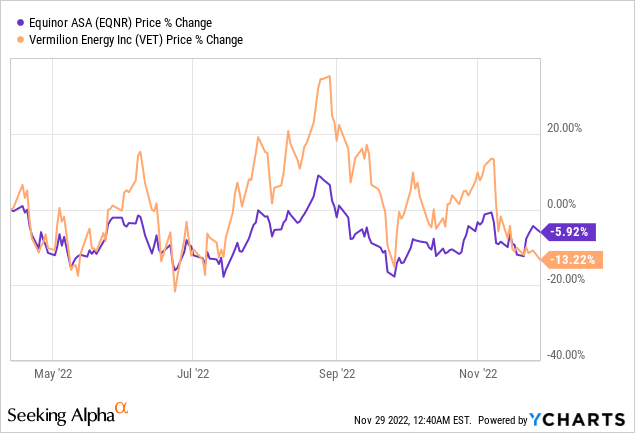

In fact, shown below are two companies that should be making a killing in 2022.

And instead, since April, both companies have been trending directionally negatively. Why? Investors are worried. Not only about how much tax these companies are having to pay in the form of windfall tax right now.

But whether the EU will come back in the future to retrospectively claw back further taxes.

As it stands right now, Q4 will see approximately $10.5 billion in taxes (104NOK). That’s after Equinor paid $17.0 billion in taxes in Q3. However, keep in mind that this $17.0 billion figure also included some portion of earlier 2022 profits that were due for taxation.

Put another way, close to $40 billion of taxes will be paid by Equinor in 2022.

Cash Flows Sizzle, Even After Taxes

Q3 2022 saw $2.4 billion of free cash flow, but this figure included an elevated tax payment. On the other hand, keep in mind that Q3 spanned July to September months, a period where natural gas prices in Europe were extraordinarily high, as governments were forced to buy at any cost.

I don’t believe it’s sensible to assume that prices will return to +EUR250 per megawatt hour.

Thus, here are my estimates for free cash flow looking ahead. We know that for the first 9 months of 2022, cash flows before working capital and taxes were $62.6 billion. However, that figure includes the extraordinary $24.5 billion in cash flows before working capital and taxes in Q3.

- Hence, for 2022 as a whole, I’m inclined to believe that $80 billion of cash flows from operations before working capital and taxes is possible.

- Then, we have to factor in $40 billion in taxes.

- Next, I’ve assumed that working capital is approximately $3 billion for 2022, because there was already $2 billion set aside during the first 9 months of the year.

- On top of that, there’s also approximately $10 to $11 billion of capex expected for 2023.

- Altogether, we are looking at very approximately $27 billion of free cash flows in 2022.

With that in mind, let’s discuss Equinor’s capital allocation.

Capital Allocation Profile, 10% Dividend Annualized

Equinor has a net debt position of approximately $5 billion. This compares with an approximately net debt of $16 billion in Q3 of last year. Put simply, there’s a dramatic improvement in Equinor’s balance sheet.

This improved balance sheet has allowed the company to be more aggressive with its capital return program.

Equinor has a base dividend of 2.2%. On top of that, last quarter it also declared $0.70, bringing the total for Q3 to 10% total dividend if it were to be annualized. Now, here’s where things get complicated and some room for assumptions opens up.

On the one hand, this special dividend was a one-off dividend, and we can’t annualize it. On the other hand, Equinor paid out a special dividend of $0.50 in the previous Q2 period.

So, not only are these two consecutive quarters of special dividends, but the payout is increasing. Will the special dividend remain in place? That’s the ultimate question.

Furthermore, looking ahead to Q4, Equinor has stated its intention to repurchase approximately $1.8 billion worth of stock. If this figure were to be annualized, it would reach 6.2% of the company returning to investors.

This not only increases future earnings per share figures, but it also ensures that the same dividend payout, translates into an approximate 6% increase in yield per share; all else equal.

EQNR Stock Valuation — 5x Free Cash Flows

This is what we know as we eye up 2023. Inflation and cost increases will continue to dampen Equinor’s free cash flow. So, I’ve assumed that this further impacts future free cash flows by approximately $3 billion.

Hence, altogether, I believe that approximately $22 to $24 billion of clean free cash flows are possible in 2023. If we take the midpoint of $23 billion, this puts Equinor at 5x next year’s free cash flows.

The Bottom Line

The other day I saw this headline:

And I thought to myself, 27 years is a long time. Why on earth would China be signing up for natural gas, when we no longer need natural gas, because we are going to be living off renewal energy in a few years’ time? I say this in jest, of course.

The way I think about it is that Equinor is being priced at 5 years’ worth of future cash flows. If one assumes that after 5 years we still need natural gas in Europe and elsewhere, then this strikes me as a good risk-reward.

And then, just to further entice prospective investors, I estimate that Equinor is going to be returning investors somewhere close to 12% to 15% of annualized capital returns.

Be the first to comment