serts/E+ via Getty Images

Investment Thesis

EQT (NYSE:EQT) is a fast-growing natural company that the market isn’t fully pricing in. Why? Because the market has become very jittery of late.

Here, I lay out a bull case that paying approximately 3x next year’s free cash flows is a very attractive valuation.

The one detraction from this bull case is that EQT’s balance sheet remains in the way of its full throttled capital returns program.

But even with that in mind, I believe that EQT is a compelling investment. Here’s why.

A Very Jittery Market

The best time to buy commodity companies? When the multiples are extended. That adage has worked a charm over the previous cycles, particularly in the past decade. Why would it be any different today? Given that line of reasoning, investors are looking for any reason to take profits off the table from their energy stocks.

In fact, we’ve been fully indoctrinated to believe that we can somehow do away with burning fossil fuels. And that alternatives are on the way! And that once we get past the very near-term, namely this winter, our demand for natural gas will tail off and replacements are on the way.

At this line of thinking I take a pause. How in the world are we going to find a clean, reliable, available, and affordable replacement to heat our homes? Well, that takes coal out of the equation since it’s neither clean nor affordable right now.

And what about its use in agriculture? After all, nitrogen fertilizer is made from natural gas, via the production of ammonia. We can hardly produce ammonia from other sources at scale. Unless the need to feed a growing global population isn’t ”a necessity”.

Or what about making plastics? That’s crude oil and natural gas, both as feedstocks and energy. Even for making the hailed wind turbines, that’s made from aluminum, which requires natural gas in its production.

Natural gas usage is a lot more pervasive than Wall Street believes. So, yes, the market is jittery, and investors are looking for any reason to take profits off the table, but I don’t believe that the spot market has got this one right.

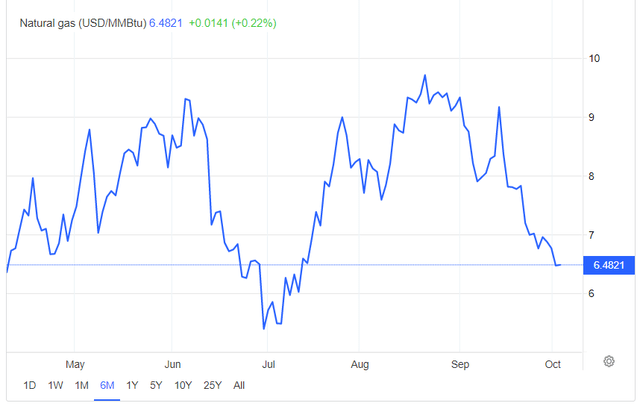

As I write, we can see that natural gas prices have substantially sold off in the past few weeks. Investors believe that since we have enough in storage to overcome this winter, therefore everything is solved. After all, the market right is unwilling to imagine we’ll require natural gas more than 1 year from now.

However, I contend that’s not the right way to think about this investment. But before getting to excited, here is a detraction from the bull case.

Robust Capital Allocation Program

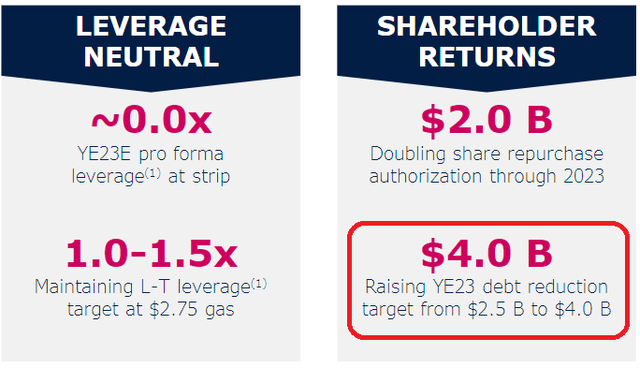

The one aspect that makes me slightly less bullish on EQT is that the business still has a fair amount of debt.

However one seeks to frame it, the fact is that EQT holds approximately $5 billion of net debt as of Q2 2022. Yes, that figure will come down significantly in the coming quarters,

But given that other natural gas players already have their balance sheets in a strong position and are today returning significant sums back to shareholders, EQT is still having to pay favor to its debt holders.

Its net debt balance will change in the coming quarters, but for a market that is constantly asking ”what have you done for me lately”, that’s a minor detraction from the bull case.

EQT Valuation — Priced at Approximately 3x Next Year’s Free Cash Flow

Now, let’s get to the core of the bull case.

EQT Q2 presentation

During EQT’s Q2 earnings call, management stated,

As an illustration of the resiliency of our forward outlook, if NYMEX retraced to approximately $3 per MMBtu in 2023, we would still expect to generate approximately $1.6 billion of free cash flow next year or a 10% free cash flow yield.

Conversely, if natural gas averaged $7 per MMBtu level, we would expect to generate almost $6 billion of free cash flow in 2023 or nearly a 40% free cash flow yield.

Obviously, the risk here is that natural gas prices were to continue sell-off so that natural gas prices would find a bottom around $3 mmbtu. Of course, at that point, this stock trades around 10x free cash flow, and much of the appeal of investment soon becomes unattractive.

But I don’t believe that we’ll see natural gas prices stay below $6 mmbtu in a sustainable fashion in 2023. Not while Europe is having to pay 7x that price. That’s simply not a realistic scenario in my opinion.

The Bottom Line

There’s clearly a lot to like in EQT. For investors that can seriously buy now and close their eyes all the way into the early parts of 2023, for a grand total of around 6 months, then this business will be in very strong shape.

Particularly given its acquisition of THQ will mean that EQT’s breakeven price is now approximately $1.35 mmbtu, a shockingly low price.

I believe that even if one pushes asides any considerations over its capital return programs if one is bullish on natural gas, then EQT is a very viable contender.

Be the first to comment