JHVEPhoto/iStock Editorial via Getty Images

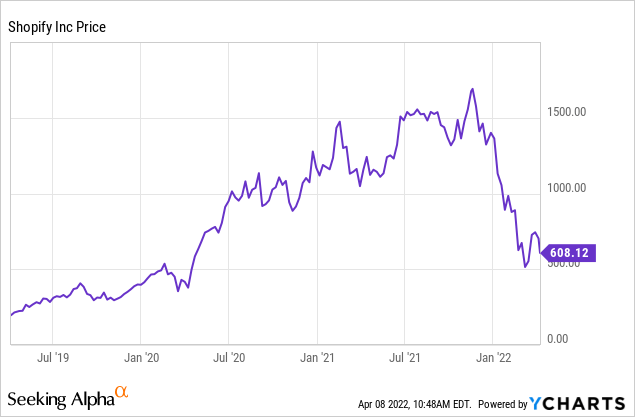

As of this writing, Shopify (NYSE:SHOP) is down more than 65% from its all-time high. Blink, and you missed it. It took only 3 months for the damage to occur.

We are living in what Tom Lee likes to call a treacherous market, and we are far from solving any of the big macro issues of the day. So the natural question relating to a high-risk asset like Shopify shares is how far can they still fall? A fellow Seeking Alpha contributor recently predicted another haircut in Shopify’s share price, suggesting we will see the shares dropify below $400. This is based on a still high valuation multiple, as well as revenue and earnings estimate revisions to the downside. My view is that the recent price drop reduces risk, increases potential future returns, and makes shares look more attractive than they have been for many years. Although I am not in the position to make any predictions as to short-term price movements, I think the current negative environment surrounding “long-duration” assets presents a good buying opportunity in many growth stocks, particularly in Shopify.

Shopify Stock – There Are Concerns In The Short Term

Shopify is a stock that has become a victim of its own success. It’s a classic “pandemic stock”, more than quintupling from the start of the pandemic, only to come back crashing down. What is troubling shareholders right now is that as things are getting back to “normal”, we are seeing a deceleration in Shopify’s growth.

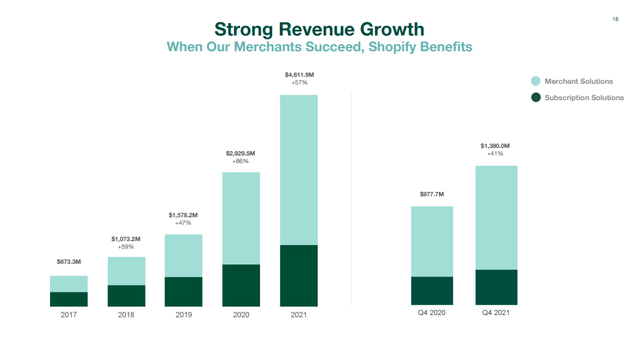

Shopify Investor Presentation Q4 2021

You can clearly see the tailwinds COVID provided to the business in 2020 and 2021 in the chart above. And you can already see the deceleration through 2021. Shopify started the year 2021 with 110% yoy growth and finished it at 41%. Current revenue estimates for 2022 range between $5.7 billion and $6.5 billion, with a consensus estimate of $6.1 billion. This would translate to a growth range between 27% and 41%. While I am usually quite confident to predict SaaS companies easily outperforming analysts’ expectations, in Shopify’s case, I am not so sure, mainly because Shopify makes most of its money nowadays from non-recurring merchant solutions but also because of existing headwinds and tough comparables.

Management itself has not given revenue guidance since the COVID outbreak. However, they did provide a cautionary note on their 2022 outlook in their last earnings release:

For 2022, we expect: Year-over-year revenue growth to be lower in the first quarter of 2022 and highest in the fourth quarter of 2022 due to three factors. First, we do not expect the COVID-triggered acceleration of ecommerce in the first half of 2021 from lockdowns and government stimulus to repeat in the first half of 2022. Second, our new terms with apps and theme developers cause two differences from last year’s first quarter: the elimination of Shopify’s rev share on partners’ first million dollars of revenue annually reset on January 1st, and the shift from gross to net revenue recognition for the sale of themes as a result of revised contract terms with our theme partners. Since these terms didn’t come into play until the second half of last year, these will be a headwind to Subscriptions Solutions revenue in the first half of 2022, particularly in the first quarter.

Add in some caution around inflation and consumer spending near term and you get a quite bleak picture for Shopify’s 2022, especially its first half.

Expanding the scope a bit beyond 2022 top-line growth there are other important factors concerning investors: Shopify’s recent decision to double down on the Shopify Fulfillment Network has been discussed at length in the last earnings call. Management wants to operate more fulfillment centers themselves which should enable Shopify to deliver packages in 2 days or less to more than 90% of the U.S. population. This may sound exciting for merchants, but investors are worried about how this will affect profitability and cash flows in the near term (management noted its plans to invest all of its gross profit dollars back into the business), the margin profile longer-term, and if Shopify is reaching beyond its core competency (execution risk!). Especially in a market that is looking for stability and earnings, this move – while possibly very beneficial to the business – is not well received by the market.

Moreover, a bit less discussed by investors, Apple’s (AAPL) mobile advertising changes have an indirect, and most likely negative, impact on Shopify. In the Q3 2021 earnings call, management noted that “Apple’s changes to IDFA are harder to discern“. One quarter earlier, they admitted that “it will reduce the efficacy of some ads“, but added that it would also further “incentivize merchants to look for new ways and multiple ways to connect with buyers on top of ads getting increasingly expensive“. The key concern here is that reducing the efficacy of merchants’ ads directly impacts Shopify’s GMV and by extension revenue and profits. Stratechery’s Ben Thompson has written extensively about this issue and especially Shopify’s dependence on Facebook (FB) in that regard, suggesting that Shopify might end up offering advertising services itself. In the meantime, these ad changes will pose challenges to Shopify’s business, creating amplified problems for investors, since it will be hard to decipher which part of revenue deceleration comes from COVID normalization (which is totally fine) and if and how much comes from the reduced efficacy of Facebook ads (which would be a bit more concerning).

But Shopify’s Business Is Still Strong

I know many investors who would stop their analysis at this point, and I can’t blame them. An out of favor stock in a tough market, decelerating growth, uncertain outlook, compressing margins, execution risk. Why would you want to be part of this?

The reason is simple: Shopify is a very high-quality business that checks almost all the boxes I look for in a long-term investment; in terms of its potential, there are few companies in the public markets that come close to it in my opinion. Let me just highlight some traits of Shopify that make it a very attractive investment:

- Secular growth tailwinds for entrepreneurship and e-commerce – Shopify should be able to compound revenue growth at 20-30% for the next decade.

- A large and growing addressable market (estimated at $160 billion recently).

- High optionality: Shopify went from a simple e-commerce website provider to adding apps, POS, Payments, Plus, shipping, multi-channel, Capital, international expansion, and now Fulfillment. There are countless opportunities for Shopify to expand its platform.

- Strong competitive advantages from high switching costs, network effects, brand, and counter positioning.

- Founder-Led by Tobi Lütke, insider ownership of almost 10%, and a high Glassdoor rating.

- A strong balance sheet with $7.77 billion in cash and $0.9 billion in debt

- Medium-high gross margins at 54% and a highly scalable business model suggest high profitability in the future.

- Strong past stock performance, beating the market significantly since the IPO.

Following Hamilton Helmer’s Footsteps

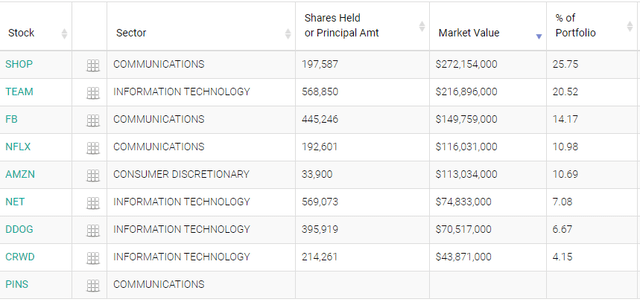

While I have confidence in my own analytical abilities, it always helps to get confirmation from other respected investors. One such investor is Hamilton Helmer, a business strategist, investor, and author of the book 7 Powers. At the end of 2021, his fund STRATEGY CAPITAL LLC held 25.75% of its portfolio in Shopify.

STRATEGY CAPITAL LLC Holdings as of Dec 31, 2021. (whalewisdom.com)

Strategy Capital has a concentrated long-only approach based on fundamental value and extended holding periods. One of their main focuses is to identify businesses with high “power” i.e. durable competitive advantages that drive outsized free cash flow generation. Helmer is a student of competitive advantages and probably one of the most knowledgeable people on the planet on that subject. The fact that Shopify is his largest position tells me that he believes strongly in Shopify’s power and potential future returns. The fund will disclose its updated positions from the end of Q1 2022 until mid-May 2022. I will be watching closely if there are any changes in the Shopify position.

SHOP Stock Valuation Has Come Down To Earth Again

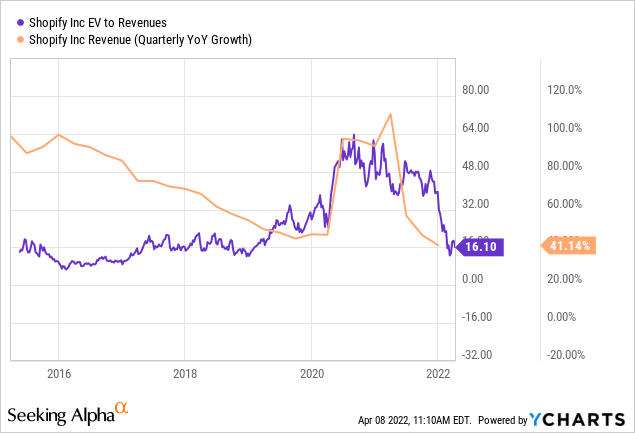

On top of that, Shopify is again trading in its historical EV to revenue multiple range:

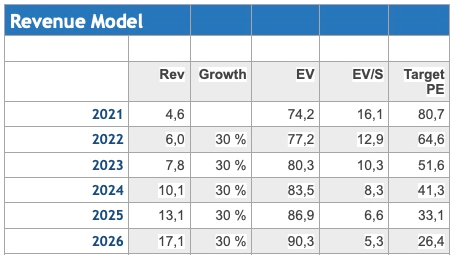

There is no doubt that investors were too sanguine at more than 50 times sales, but now that shares have come down considerably, the stock looks quite attractive to me. Granted, also its growth rate has been falling (and will continue to fall in 2022), which means that relative to its growth, shares are still trading at elevated levels historically. However, I would also argue that shares were undervalued for quite some time after the IPO, so referring to historical multiples can be a bit misleading. Below I have calculated a simplistic forecast, assuming average revenue growth of 30% for the next 5 years, a 4% dilution annually, and a 20% net margin for the target PE (or hypothetical PE).

Author

I assume that Shopify will be far from 20% net margins by 2026, as they will see ample opportunities for investment and growth. Shopify will also be far from done with its growth at $17 billion in revenue. I am not arguing that Shopify is trading at bargain-basement prices (although, if this plays out, it probably is in hindsight). The table above simply illustrates that Shopify’s valuation is not out of this world and certainly does not rule out market-beating returns in the future.

I am quite happy with my roughly 5% position in Shopify and I am considering adding to my position at these levels. I acknowledge that the short-term outlook for the company is far from perfect and that the current market environment could lead to further downside. But I also think the 65% price drop was exaggerated, considering the strong fundamentals of the company. The next earnings report will come out at the end of April, which I expect to be generally underwhelming in terms of growth and outlook. It will be interesting to see how the market reacts since expectations seem to be quite low, as well.

Be the first to comment