Matt Winkelmeyer/Getty Images Entertainment

One of the most exciting and undervalued quality companies on the market today is lifestyle brand business Funko (NASDAQ:FNKO). In recent years, management has succeeded in growing the company at a rapid pace. Although the market has failed to recognize recent growth, as well as expectations from management for the near-term future, the overall picture of the company is undeniably positive. All in all, this should be a top prospect for value-oriented investors who like some growth added to the mix. And for myself, it represents one of the highest conviction opportunities I have come across.

A disconnect exists

Back in early November of 2021, I wrote my most recent article about Funko. At that time, I praised the robust fundamentals that the company had exhibited. I also said that shares are trading at attractive levels that indicated attractive upside potential for long-term, value-oriented investors. At the end of the day, I rated the company a ‘strong buy’ and I have since allocated a sizable portion of my portfolio to it. Since then, shares of the business have not performed all that well. While the S&P 500 has experienced a decline in value of 4.5%, investors in Funko would have experienced a loss of 6.7%.

Given this drop in value, investors would be forgiven for thinking that fundamental performance and the near-term outlook for the company would be, at a minimum, lackluster. The good news for investors, however, is that the picture for the company remains stronger than ever. Today, fundamental performance for the business is available covering all timeframes through the final quarter of its 2021 fiscal year. This represents one additional quarter worth of data compared to when I last wrote about the business. And the data provided since then has been incredibly bullish.

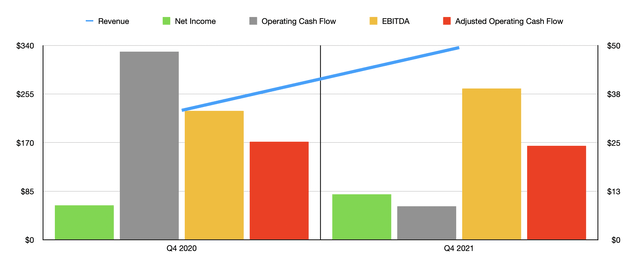

According to management, sales in the final quarter of 2021 came in at $336.27 million. That represents an increase of 48.5% over the $226.51 million in revenue the company reported just one year earlier. The strongest growth for the company came from its Figures product lines, with sales surging by 49.9%. Though the ‘Other’ sources of revenue for the business, while still representing just 24.1% of overall sales, managed to grow a robust 44.1%. When you break up the product data even further, you find that the Pop! Branded Products for the business experienced year-over-year revenue growth of 40.9%. Even more impressive was the Loungefly Branded Products category, which saw sales climb by 57%. The strongest growth for the company, from a geographical perspective, came from Europe, with revenue rising by 58.9% year over year. Though, it is worth mentioning that the rather mature US market still saw revenue climb by 47.5%.

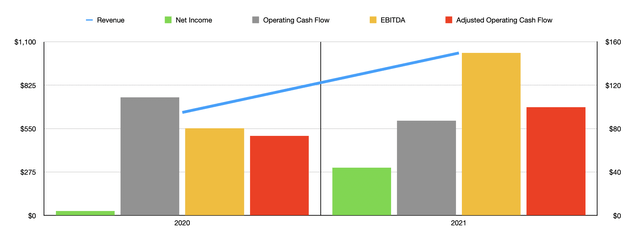

As a result of this strong performance across the board, sales for the entirety of the company’s 2021 fiscal year came in at $1.03 billion. This represents an increase of 57.7% over the $652.54 million generated in 2020. It’s also 29.5% higher than the company’s all-time high revenue prior to that point of $795.12 million that management reported for the 2019 fiscal year. If this were all, investors could possibly reason that this was a one-time surge in revenue caused by a winding down of the pandemic. But this does not appear to be the case. For the company’s 2022 fiscal year, management currently expects revenue to come in at between 20% and 25% above with the company reported last year. At the midpoint, this would imply sales of $1.26 billion.

When it comes to profitability, the picture is also quite impressive. Net income of $11.67 million in the final quarter of the company’s 2021 fiscal year implied a year-over-year increase of 31.5% over the $8.88 million reported one year earlier. This pushed overall profits for the company up to $43.90 million for the year. This compares to the $3.96 million generated in 2020 and it’s almost double the $27.82 million the company reported for its 2019 fiscal year. Other profitability metrics also fared quite well. Operating cash flow did decline, dropping from $108.74 million in 2020 to $87.36 million last year. But if we adjust for changes in working capital, it would have actually risen from $73.25 million to $123.74 million. Meanwhile, EBITDA for the company expanded from $86.22 million to $149.94 million.

This is not to say that everything has been great for the company fundamentally. For instance, due to inflationary pressures, combined with one-time structural costs and its ERP implementation program, Funko’s management team expects the EBITDA margin for the company to remain flat year over year for 2022. Even though the margin will remain flat, that still implies EBITDA of $184.1 million at the midpoint for revenue. If we assume the same growth rate for adjusted operating cash flow that we should see for EBITDA, then that metric should be $123.74 million. After stripping out non-controlling interests, this figure should be closer to $99.79 million. Meanwhile, management expects adjusted net income of between $95.8 million and $104.8 million. At the midpoint, this translates to profits of $100.3 million.

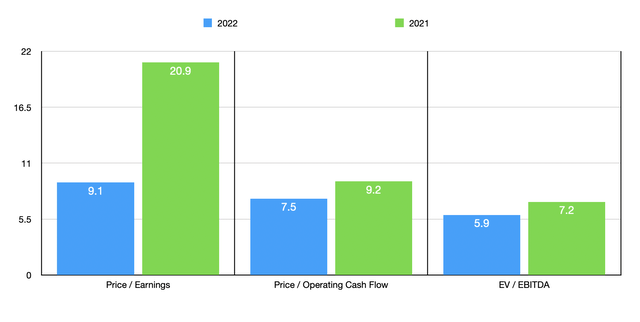

Taking this data, we can easily value the company. If management comes through on its expectations, using the company’s 2022 estimates, it is trading at a price to earnings multiple of 9.1. This compares to the 20.9 the company is trading at if we rely on 2021 figures. Other returns look even better. The price 2 adjusted operating cash flow multiple of the company should come in at 7.5 for 2022. This compares favorably to the 9.2 that we get relying on 2021 results. And the EV to EBITDA multiple for the company should come in at 5.9. This stacks up against the 7.2 figure we get if we rely on 2021 results. Normally, I would like to value Funko against similar firms. But it is difficult to find true comparables for a business like this.

Takeaway

All things considered, Funko strikes me as a fascinating company that is growing at a nice clip and that is trading at rather low multiples. From a cash flow perspective, especially relative to the growth management is achieving, the company is one of the most attractive on the market today. So although the market has pushed shares of the business down recently, I cannot help but to believe that the firm offers significant upside potential moving forward.

Be the first to comment